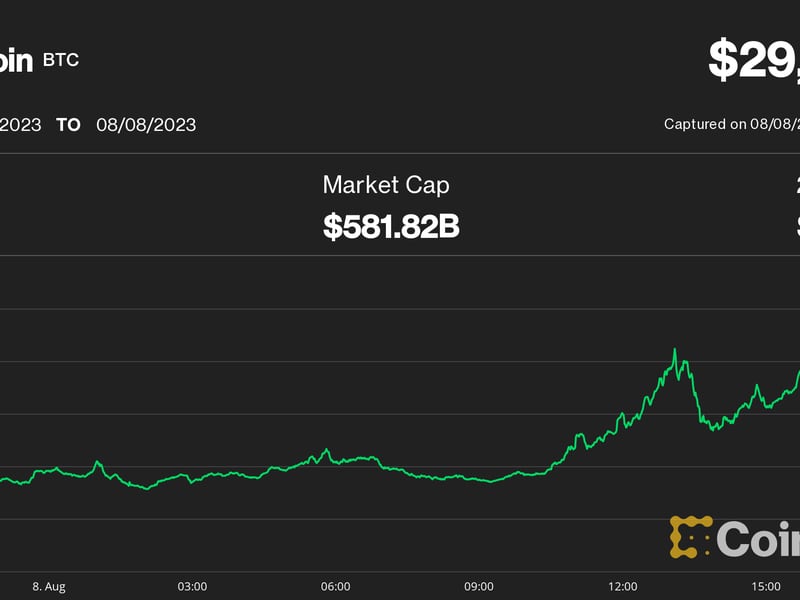

Bitcoin’s price noticed a 3% uptick, climbing to only shy of $30,000 in response to a plunge in world long-dated authorities bond yields. This fall in yields was triggered by China’s far weaker than anticipated commerce numbers for July. The U.S. 10-year Treasury yield tumbled beneath the 4% mark. These macroeconomic shifts have seemingly buoyed the crypto market, with different notable cryptocurrencies like Solana (SOL), Toncoin (TON), and Chainlink (LINK) registering features of over 4% on the time of writing.

More NFT News

El Salvador Boosts Bitcoin Purchases After IMF Settlement

No, BlackRock Can't Change Bitcoin

Canine Memecoins Rebound as Bitcoin Reaches $98,000