Onchain Highlights

DEFINITION: The share of circulating provide in revenue, i.e. the proportion of present cash whose value on the time they final moved was decrease than the present value.

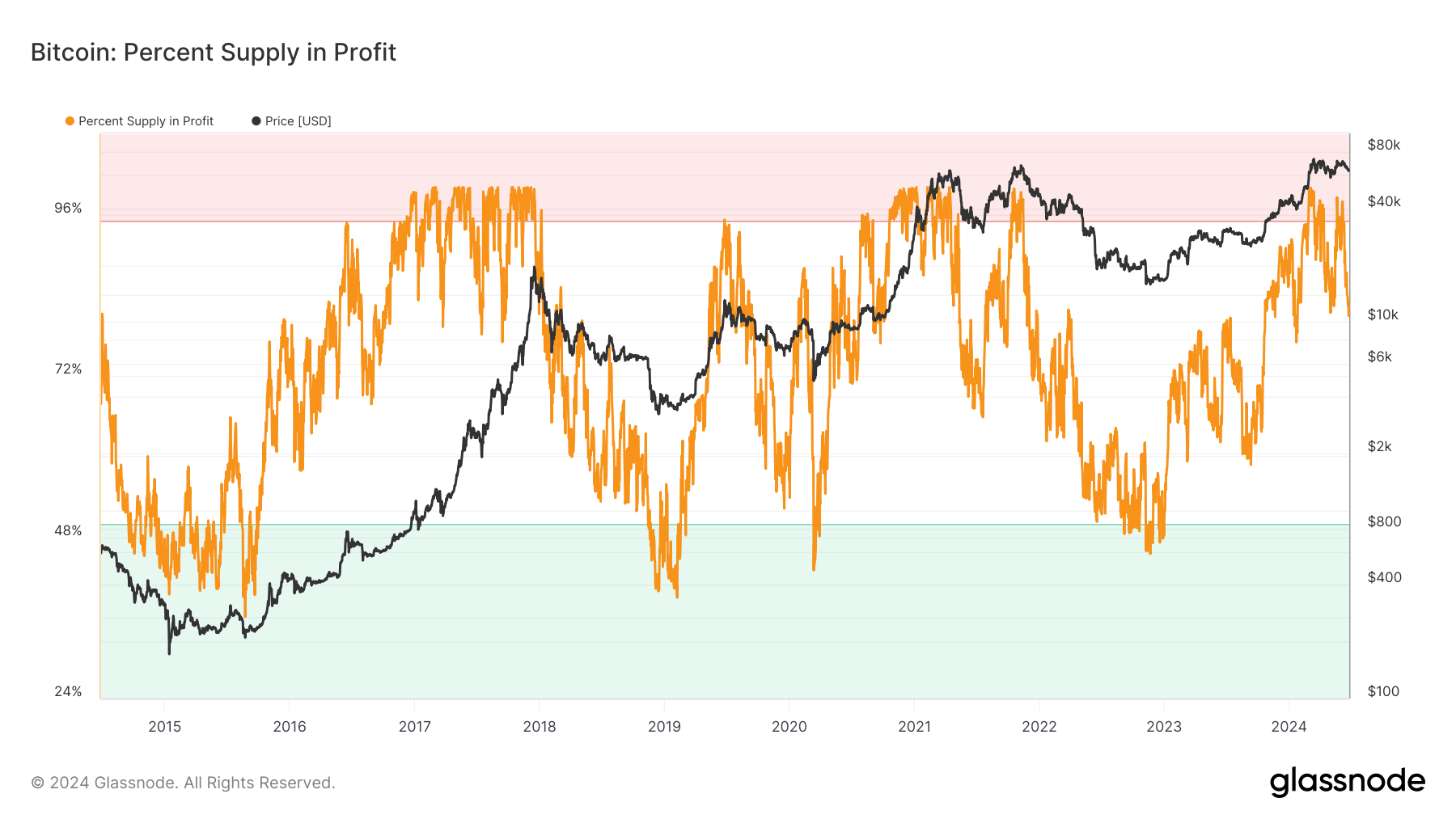

Bitcoin’s proportion provide in revenue displays dynamic market circumstances. The primary chart illustrates historic information from 2013 to 2024, exhibiting durations the place over 90% of the provision was in revenue, notably throughout 2017 and late 2020 to early 2021. This era correlated with important value rallies, highlighting the cyclical nature of Bitcoin’s market.

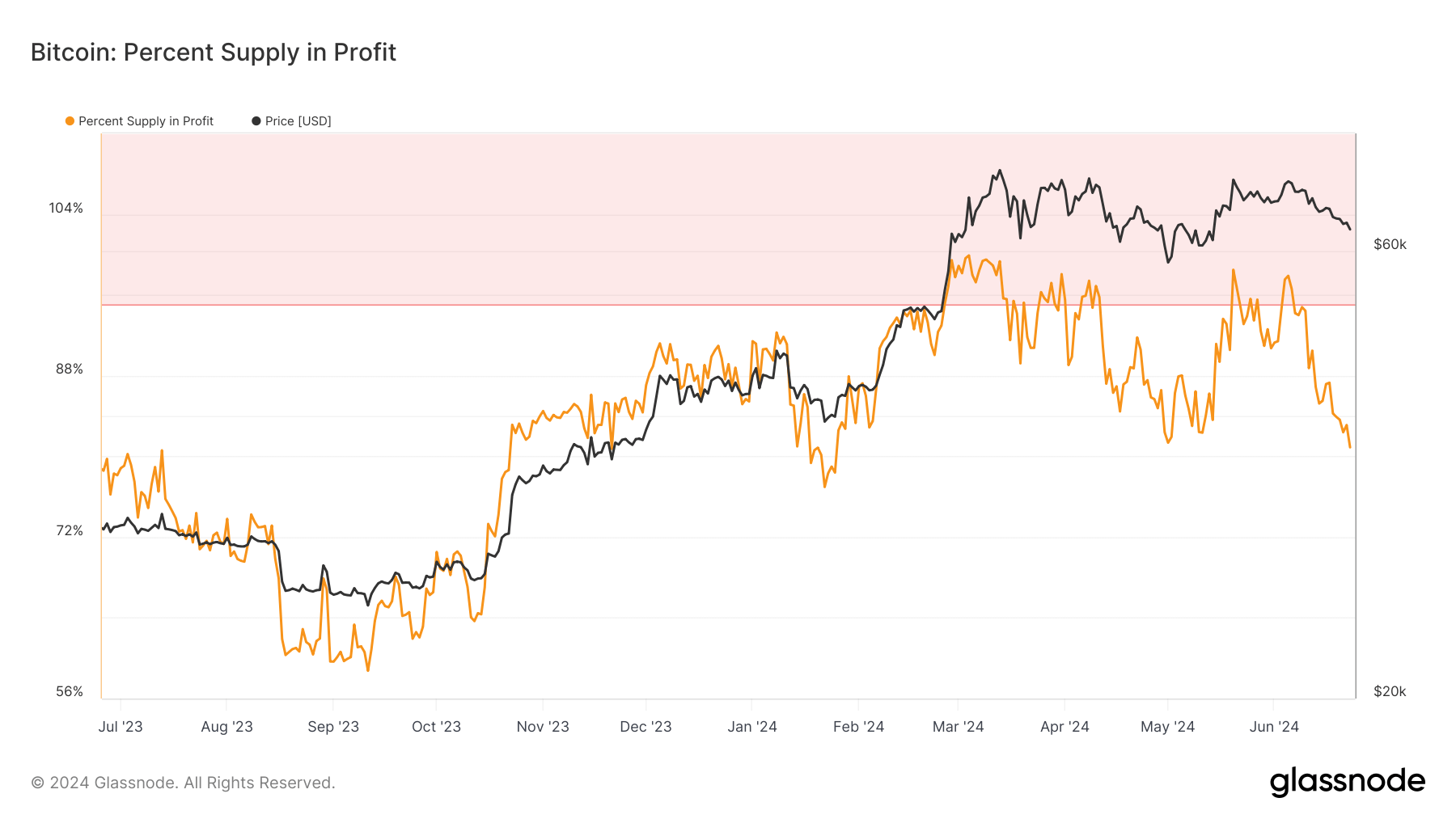

In distinction, the second chart focuses on the previous 12 months, from mid-2023 to mid-2024, exhibiting a big decline within the proportion of provide in revenue. After reaching a peak of roughly 100% in March 2024, simply earlier than the Bitcoin halving occasion, the metric has since dropped to 80% by June 2024. This decline mirrors the worth drop from almost $73,000 to roughly $60,000 inside the identical interval.

These tendencies spotlight the market’s volatility and the affect of key occasions just like the halving on Bitcoin’s profitability metrics. Monitoring the proportion provide in revenue can present insights into market sentiment and potential value actions, as important shifts typically precede or comply with main value modifications.

The publish Bitcoin’s supply in profit drops to 80% as post-halving effects take hold appeared first on CryptoSlate.

More NFT News

Kraken Affords Price Credit for FTX Purchasers to Commerce $50Ok in Crypto

Constancy believes Bitcoin is on the precipice of mass adoption, says traders are usually not ‘too late’

Choose Pauses SEC Lawsuit In opposition to Coinbase