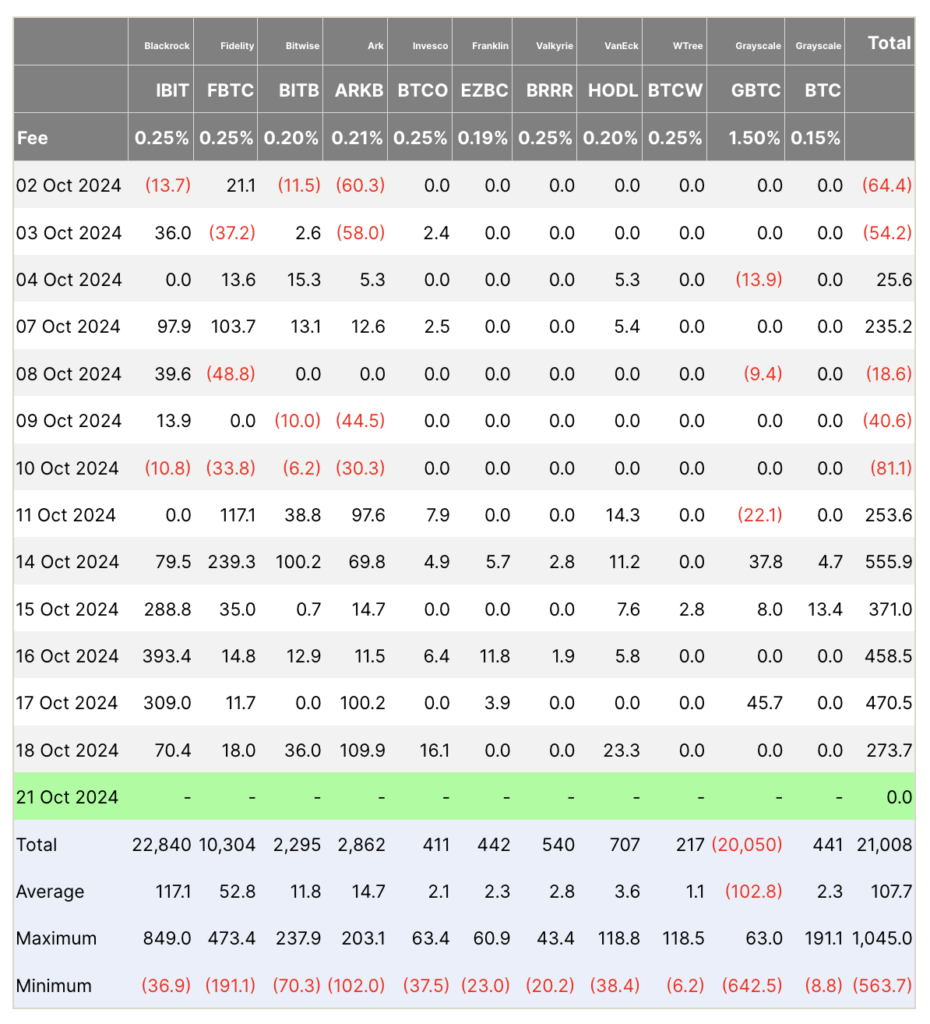

iShares Bitcoin Belief ETF (IBIT) recorded over $1.1 billion in new money inflows final week, marking its strongest efficiency since March 2024. Eric Balchunas, Senior ETF Analyst at Bloomberg Intelligence, shared the information, highlighting IBIT’s speedy ascent within the ETF panorama.

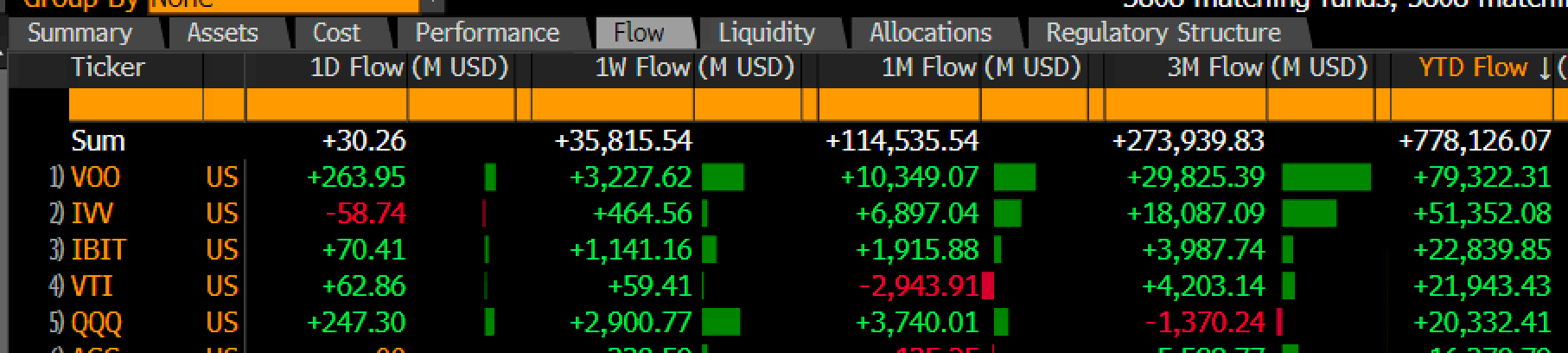

IBIT surpassed Vanguard’s Whole Inventory Market ETF (VTI) to safe the third spot in year-to-date flows. This achievement is notable provided that IBIT launched solely in January 2024, whereas different high ETFs have been established for over twenty years and handle property exceeding $300 billion.

The fund’s whole property beneath administration now stand at $22.eight billion, inserting it within the high 2% of all ETFs by dimension. This progress displays a robust investor urge for food for Bitcoin publicity by means of conventional funding autos. As one of many first spot bitcoin ETFs permitted within the US, IBIT presents a well-recognized construction for traders looking for to enter the crypto market.

A number of elements contribute to IBIT’s success: BlackRock’s repute because the world’s largest asset supervisor, rising mainstream acceptance of Bitcoin, and the comfort of the ETF format. The substantial inflows counsel that crypto-based ETFs are gaining vital traction within the broader funding neighborhood.

Balchunas’ insights emphasize IBIT’s affect throughout your entire ETF trade. The fund’s efficiency denotes a shifting panorama the place digital property have gotten integral to diversified funding portfolios.

More NFT News

Chinese language Auto Supplier Dives Into Bitcoin Mining With $256M Funding

Harnessing idle GPU energy can drive a greener tech revolution

Will Dogecoin Attain $1? Crypto Volatility Returns as Bitcoin and Ethereum Slide