As of Might 3, 2023, the Bitcoin blockchain has witnessed a staggering 3.35 million Ordinal inscriptions, and a brand new experimental token commonplace often known as “Bitcoin Request for Remark,” or BRC20, has garnered substantial consideration previously week. With 10,487 BRC20 tokens constructed utilizing Ordinals and a swelling market capitalization exceeding $95 million, this new improvement has the crypto world buzzing.

Ordinals Protocol Witnesses Three Million Inscriptions Whereas BRC20 Tokens Drive Bitcoin’s Mempool into Overdrive

The Bitcoin neighborhood is abuzz with conversations surrounding the BRC20 token standard after its introduction by a pseudonymous developer named Domo in March. BRC20 tokens leverage the Ordinals protocol, enabling creators to mint fungible crypto belongings onchain with ease. To create a BRC20 coin, people must encode a JSON information object containing vital token info. Like an ERC20 token contract on Ethereum, this information would embody basic particulars such because the token’s title, image, and complete provide.

EVERYTHING Ethereum can do IS BEING performed on BTC w/ blockspace & customized indexers

First Liquidity Pool for DEX on Bitcoin L1 w/ BRC-20

NO ONE thought it attainable

Posting the SAME information that UNISWAP DEX would put up to make a transaction & reconciling it later w/ indexer pic.twitter.com/1IBuQ8e7A4

— trevor.btc @ NYC (@TO) May 3, 2023

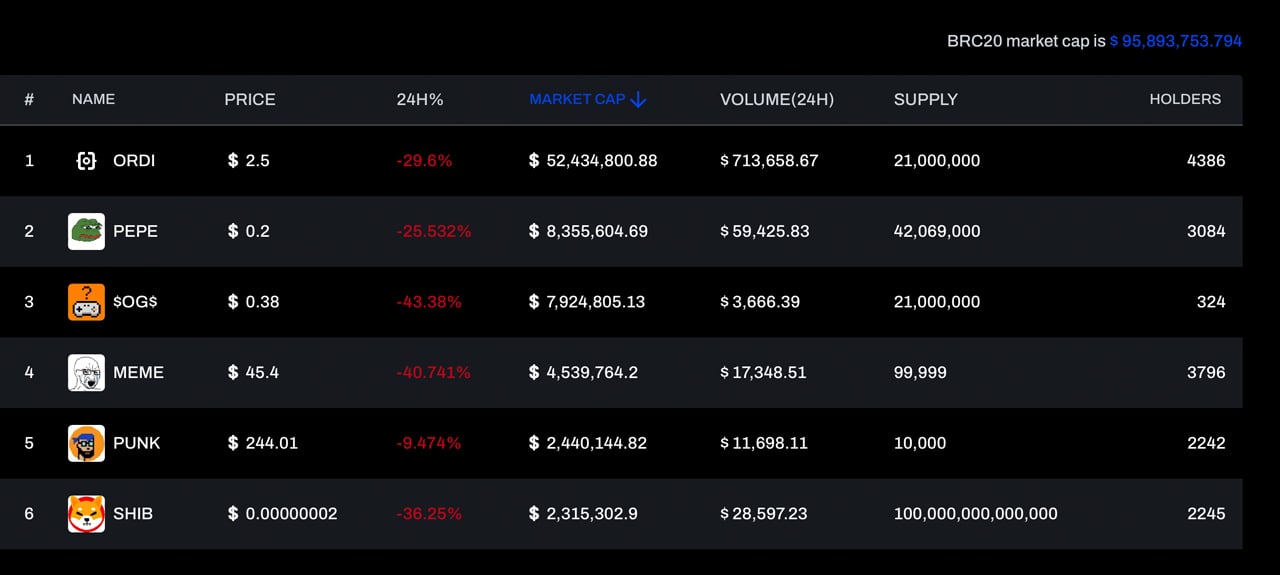

The spectacular issuance of over 10,500 BRC20 tokens — alongside the surge of Ordinal inscriptions surpassing 3 million — has led to a backlog of over 200,000 unconfirmed transactions in Bitcoin’s mempool. A complete record of those 10Okay+ BRC20 cash may be discovered at ordspace.org, displaying every token’s worth in US {dollars}. Presently standing at a outstanding $95 million, the BRC20 token economic system has witnessed tokens skyrocketing with quadruple-digit beneficial properties.

Notable examples of those tokens embrace ordi, $OG$, PEPE, MEME, PUNK, SHIB, and DOMO. The ordi market cap immediately is hovering above $52 million; the $OG$ token market cap sits at $7.9 million, and the PEPE BRC20 coin’s market valuation rests at $8.Three million as of Might 3, 2023. This rise of BRC20 tokens and Ordinal inscriptions, predominantly comprised of textual content, has pushed Bitcoin’s common and median-sized charges to soar.

Knowledge from bitinfocharts.com on Might 3, 2023, reveals that the average onchain Bitcoin transaction fee is 0.00025 BTC or $7.05 per transaction, equating to roughly 0.0000011 BTC per byte. Moreover, the median-sized transfer fee is 0.00012 BTC or $3.46 per transaction, in response to metrics compiled by bitinfocharts.com. The flood of BRC20s and Ordinal inscriptions has reignited a heated debate over whether or not the fungible tokens and non-fungible token (NFT) ideas constructed on BTC justify affirmation alongside monetary transactions.

What are your ideas on the rising development of making fungible tokens on the Bitcoin blockchain utilizing the Ordinals protocol? Do you assume the surge in BRC20 tokens justifies the excessive transaction charges and the backlog of unconfirmed transactions in Bitcoin’s mempool? Share your opinions with us within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any injury or loss triggered or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

More NFT News

El Salvador Boosts Bitcoin Purchases After IMF Settlement

No, BlackRock Can't Change Bitcoin

Canine Memecoins Rebound as Bitcoin Reaches $98,000