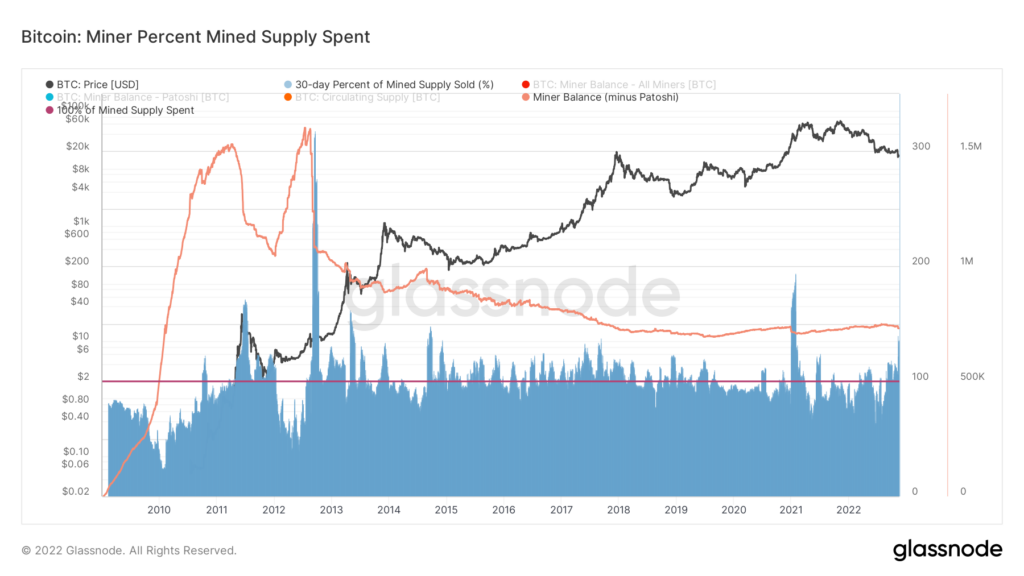

Bitcoin’s mining problem is predicted to regulate Sunday evening/Monday morning (Nov. 20/21.) At the moment, over 100% of the mined Bitcoin provide is being spent on the fifth most vital fee ever.

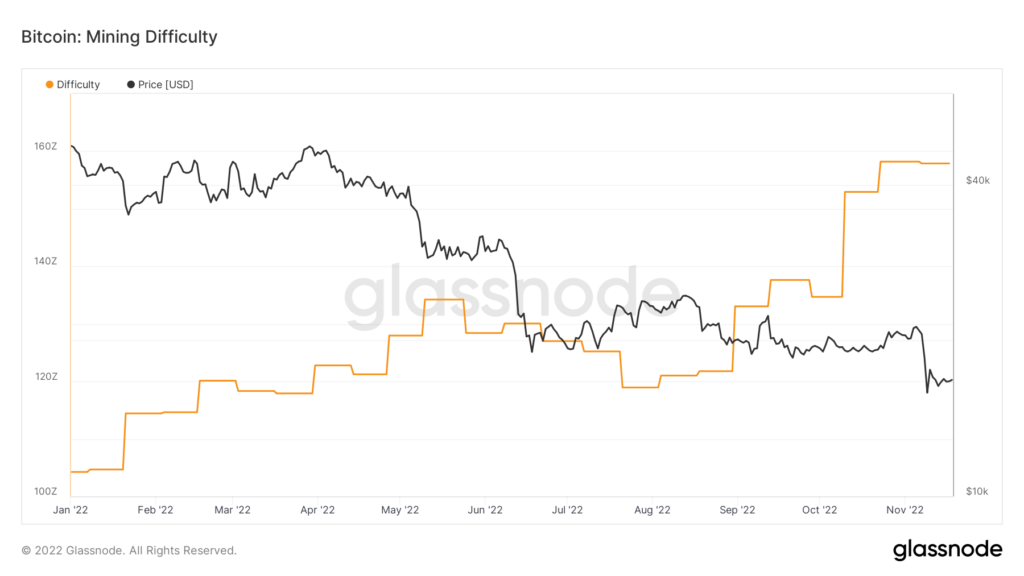

Following back-to-back problem detrimental or impartial changes, it’s doable that Bitcoin hash fee and problem could have topped. Nonetheless, the issue is predicted to regulate down once more over the weekend, bolstering expectations that the hashrate has peaked.

The next highlights the share of spent Bitcoins from miners over a 30-day window. The blue part, which has peaked at its highest stage since 2021, depicts the variety of cash offered by miners. The quantity of Bitcoins offered by miners over the previous 30 days is the fifth-largest outflow in Bitcoin’s historical past.

Miners’ balances are additionally trending downward, nonetheless, not presently at a worrying velocity. The discrepancy between spent Bitcoins and Miner stability suggests mining corporations could also be promoting newly mined cash to cowl prices.

A drastic enhance in world power prices in tandem with the drawdown within the value of Bitcoin is creating an ideal storm for Bitcoin miners.

Nonetheless, because the fallout from the FTX collapse continues to reverberate throughout the trade, Bitcoin continues to commerce under $17,000 for the eighth day straight.

Ought to Bitcoin’s value stay under $18,00, it may proceed to trigger points for miners leading to additional promoting. A cycle of additional downward stress could subsequently be led by miners promoting to cowl the operation value.

More NFT News

Osprey Funds Launches First US Publicly Quoted BNB Belief

Will Binance's BNB Attain $1000? Worth Prediction Amid Authorized Challenges in Australia

What Does Spot Buying and selling Imply in Cryptocurrency and How Is It Accomplished?