Be a part of Our Telegram channel to remain updated on breaking information protection

Bitcoin’s (BTC) value has suffered a dreadful final 4 days after a 15% hunch. The decline despatched the flagship cryptocurrency to the mid-June lows of round $25,174. Additionally, the autumn noticed BTC lose a vital assist degree, which had stored the king of crypto bullish from an total outlook. Efforts to revive the above important assist are underway, however on-chain metrics, like volatility and liquidations, counsel a dismal outlook. This might gas a miner-induced sell-off until issues enhance.

Theories To Clarify Current Bitcoin Value Crash

A number of theories have sprouted to elucidate the latest hunch in Bitcoin value, however two stand out. Temporary explanations for the 2 are as follows.

Convoluting Volatility

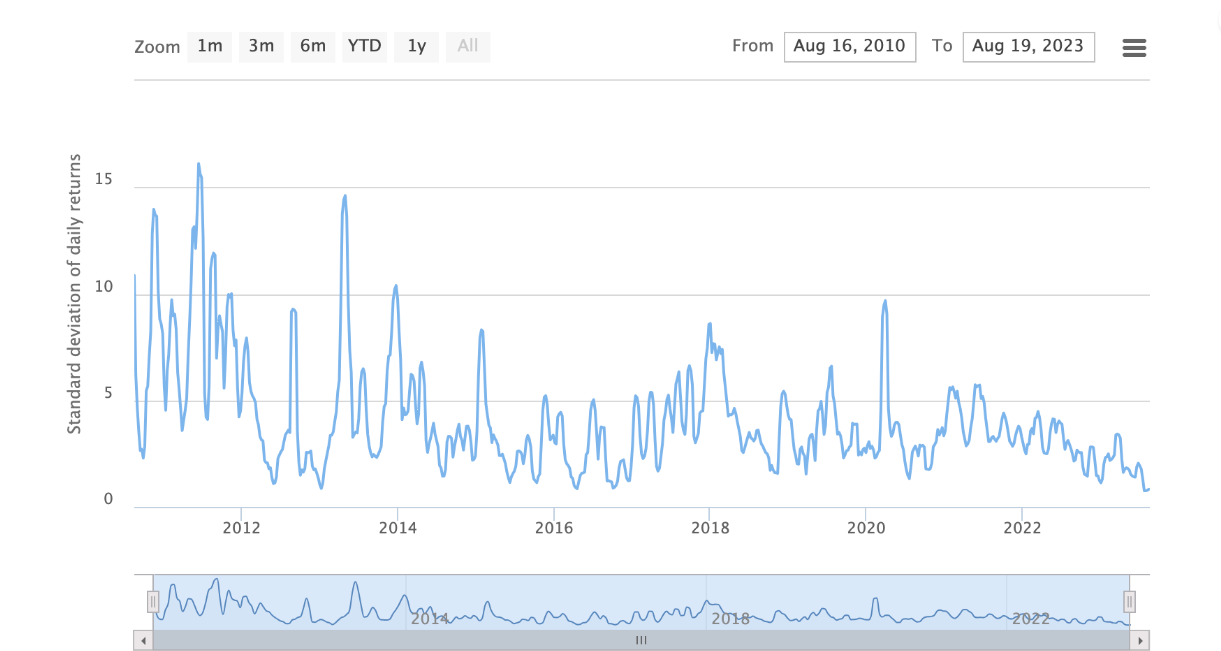

Notably, Bitcoin value has recorded a number of transferring cases in a good consolidation. First, it was earlier than the 2023 rally established a $31,500 peak for BTC. This was made worse by broader macroeconomic circumstances and a range-bound motion, main its volatility rating to an all-time low.

Bitcoin value has recorded many sequences of low volatility over its 13-year tenure. With each breach of every transfer, an explosive motion adopted.

Compelled Liquidations

Compelled liquidations is the second principle to elucidate the latest dip, and it majorly factors to rumors of SpaceX selling its BTC holdings. Citing an excerpt from a QCP Capital publication:

Giant BTC and ETH gamma associated perp liquidations on choices exchanges Deribit and OKX, which collectively accounted for an outsized 50% of all liquidation circulate.

Bitcoin Value Forecast

Bitcoin value reveals efforts by bulks to drag again up, however momentum stays abysmal, or within the easiest phrases, terrible. The Relative Power Index (RSI) is at 19, whereas the histogram bars of the Superior Oscillator present big volumes of pink. This implies the bears nonetheless have a really tight grip on BTC costs.

Due to this fact, until momentum will increase, Bitcoin value may break beneath the instant assist degree at $25,174 and file a brand new vary low. It may slide 25% to the psychological $20,000 degree within the dire case.

Business investigators, traders, and merchants agree that the market wants a optimistic impulse to catalyze an uptrend. If this occurs, Bitcoin value may transfer north, recovering the bottom misplaced within the latest crash. Doubtlessly, it may restore above $28,738.

From the present standpoint, the almost definitely impulse could be the US SEC approving a spot BTC ETF. Nonetheless, probabilities of such an end result stay bleak, with an ETH ETF approval displaying extra promise, the Wall Avenue Journal reported.

In a extremely bullish case, the worth may lengthen larger than the $30,664 resistance degree to file a brand new vary excessive, doubtlessly extra elevated than the $31,804 degree.

BTC Various

Whereas Bitcoin value works out a restoration, contemplate WSM, the ticker for the Wall Avenue Memes ecosystem. The WSM token is an ERC-20 token operating on the Ethereum blockchain with a most provide of two billion. It is likely one of the most important communities within the cryptocurrency ecosystem, with among the highest social engagement. It goals to legitimize loyal supporters of the motion.

WSM token is within the presale stage, provided in alternate for $0.0337 per token.

The fundraiser has already accrued $26.015 million in presale gross sales. traders should purchase WSM utilizing Ethereum (ETH), Tether (USDT), or a card.

Additionally Learn:

Wall Avenue Memes – Subsequent Huge Crypto

- Early Entry Presale Reside Now

- Established Group of Shares & Crypto Merchants

- Featured on BeInCrypto, Bitcoinist, Yahoo Finance

- Rated Greatest Crypto to Purchase Now In Meme Coin Sector

- Group Behind OpenSea NFT Assortment – Wall St Bulls

- Tweets Replied to by Elon Musk

Be a part of Our Telegram channel to remain updated on breaking information protection

More NFT News

XRP Worth On Its Approach To $10 In Solely Three Months If It Follows This Sample

El Salvador Boosts Bitcoin Purchases After IMF Settlement

No, BlackRock Can't Change Bitcoin