Knowledge reveals the Bitcoin correlation to Nasdaq has plunged lately, suggesting that the cryptocurrency is shifting extra independently now.

Bitcoin 60-Day Correlation With Nasdaq Is Now Underwater

In line with knowledge from the analytics agency Kaiko, BTC has lately develop into much less correlated to conventional property lately. The “correlation” refers to a metric that retains monitor of how tied the costs of any two property are.

When the worth of this metric is optimistic, there exists some optimistic correlation between the given property. What this implies is that the value of 1 asset reacts to actions within the different by shifting in the identical route. The nearer is that this worth to 1, the stronger is the correlation.

However, damaging values indicate that whereas there may be some correlation between the costs, it’s a damaging one. This means that the property have been reacting to one another by shifting within the reverse instructions. On this case, the intense the place this correlation turns into the strongest is -1.

Naturally, when the indicator’s worth is round zero, it implies that there exists no correlation by any means between the 2 costs, as their actions are unbiased of one another.

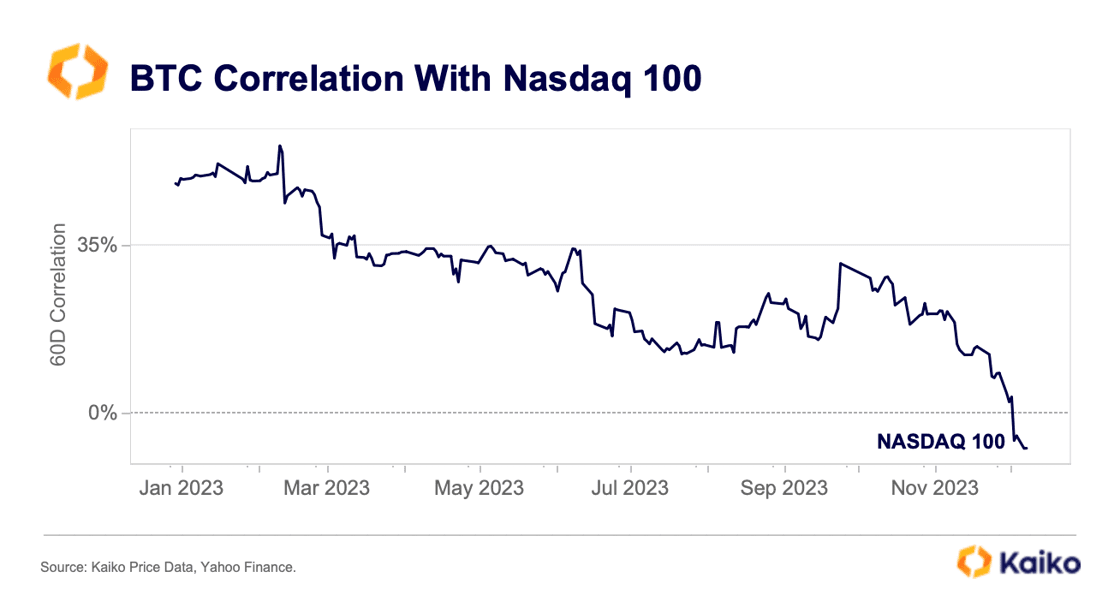

Now, here’s a chart that reveals the development within the 60-day correlation between Bitcoin and Nasdaq over the previous yr:

The worth of the metric appears to have sharply gone down over the previous couple of weeks | Supply: @KaikoData on X

As is obvious from the chart, the correlation between the property is displayed as a share right here (with 100% naturally similar to the intense level of 1).

It might seem that the Bitcoin correlation with Nasdaq had been at notable, however not too excessive ranges all through the remainder of the yr, however lately, the indicator’s worth has seen a plunge.

The metric has entered contained in the damaging territory now, which means that the 2 property have been shifting reverse to one another over the past 60 days. The correlation continues to be fairly near 0, although, so in actuality there may be solely a really slight relationship current between the 2 now.

Bitcoin, which had been shackled to the stock market‘s efficiency for some time, now lastly seems to be travelling independently from the costs of those conventional property.

The correlation is a helpful indicator to look at if the purpose of an investor is to diversify their portfolio. If the investor provides two extremely correlated property to their portfolio, they wouldn’t get any advantages of diversification, as their danger would stay about the identical.

Since Bitcoin is shifting independently to Nasdaq now, it might make up for an excellent diversification possibility for the merchants of the normal asset.

BTC Value

Bitcoin had plunged in the direction of the $40,500 mark only a few days again, however the cryptocurrency seems to have been made some restoration because it’s now buying and selling across the $43,700 stage.

Seems to be like BTC has made some restoration over the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from André François McKenzie on Unsplash.com, charts from TradingView.com, Kaiko.com

More NFT News

El Salvador Boosts Bitcoin Purchases After IMF Settlement

No, BlackRock Can't Change Bitcoin

Canine Memecoins Rebound as Bitcoin Reaches $98,000