The under is an excerpt from a latest version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Final week, I put the huge shopping for stress coming to bitcoin in context, however there’s one other — maybe the biggest — supply of potential demand getting into the scene.

We already know the Bitcoin ETFs, MicroStrategy issuing more shares to purchase extra bitcoin, Tether’s constant buying, and the halving will all be main sources of demand this cycle. For instance, within the first two weeks of buying and selling alone, the “new child 9” amassed 125,000 BTC. That has, to this point, been offset by GBTC outflows, however it’s unlikely that every one GBTC holders are captive sellers who will get out ASAP. This outflow ought to begin to wane within the coming weeks.

A considerably surprising improvement is rising in China of all locations. Readers of my content material right here and on bitcoinandmarkets.com gained’t be strangers to what’s occurring in China over the previous couple of years. They’re experiencing the end-of-an-economic-model transition. The China now we have grown to know was constructed on debt, producing items for over-indebted overseas prospects. They’re closely depending on globalization and a extremely elastic financial surroundings. That period is coming to an finish, and the crash of the Chinese language actual property market, and now their inventory market, are seen indicators of the tip of that paradigm.

On January 24, China Asset Administration Firm (China AMC), a huge fund supervisor and ETF supplier in China, halted buying and selling on their Nasdaq 100 and S&P 500 ETFs to cease the flood of cash out of different funds and into these US-connected funds. On Tuesday, different US-connected ETFs on Chinese language markets opened restrict up, and had a 21% premium over NAV. The flight to security can also be affecting Chinese language-based Japanese ETFs. Tuesday noticed the China AMC’s Nomura Nikkei 225 ETF rise over 6% to a 22% premium.

Chinese language buyers are in full-on panic mode, and the authorities are barring the door. It is just a matter of time till extra Chinese language buyers begin tapping bitcoin for its store-of-value and portability. Many Chinese language are already conversant in bitcoin. China was a dominant supply of demand for bitcoin till the CCP banned it in 2021.

Whereas bitcoin remains to be formally banned in Mainland China, buyers can nonetheless use exchanges like Binance and OKX. They will additionally purchase OTC, person-to-person, or through off-shore financial institution accounts. Final yr, Hong Kong very publicly opened again as much as bitcoin. They’ve been following in lockstep behind US regulators giving Bitcoin the official blessing in Hong Kong. It’s unlikely that Hong Kong authorities would make such a public push for legalizing bitcoin solely to show across the subsequent yr to ban it.

This morning, a piece from Reuters quotes a senior government of a Hong Kong-based bitcoin exchange, who confirms this capital flight story. “Funding on the mainland [is] dangerous, unsure and disappointing, so folks want to allocate belongings offshore. […] Nearly on a regular basis, we see mainland buyers coming into this market.”

The supply added, “In case you are a Chinese language brokerage, going through a sluggish inventory market, weak demand for IPOs, and shrinkage in different companies, you want a progress story to inform your shareholders and the board.”

We’ve got been speaking about Bitcoin offering a parallel world of inexperienced shoots, and now it’s being acknowledged in all places.

The flows from China shall be an enormous supply of demand on this cycle, and the approval of bitcoin spot ETFs within the US will create an ideal synergy through permitting refined overseas buyers to purchase bitcoin and US-based belongings on the identical time.

We can’t neglect concerning the faltering European markets both. Europe is probably going already in recession. By December, EU manufacturing facility exercise had contracted for 18 straight months. Germany barely avoided a technical recession regardless of 2023 GDP being damaging at -0.2%. The relative attractiveness of bitcoin may be very excessive in a world of capital flight and damaging progress. Many bitcoiners are fearful a few recession bringing a inventory market crash, which might drive promoting of bitcoin prefer it did in March 2020, but it surely is likely to be the other this time round. As buyers understand that the previous system is stagnant and decaying, Bitcoin’s distinctive convergence of properties as revolutionary tech, a set provide asset, and financial progress potential shall be the place capital flees into.

Bitcoin Value Replace

Bitcoin’s value efficiency has been disappointing because the ETF launch. Nevertheless, within the context of FTX receivership promoting $1 billion value of GBTC and different massive entities promoting GBTC to rotate into decrease capital charges of the brand new ETFs, value has held up extraordinarily nicely.

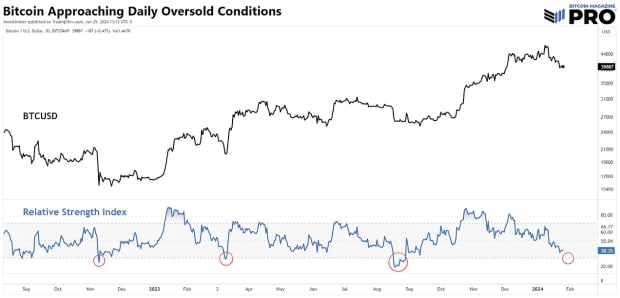

RSI is likely one of the most generally used indicators and, as such, has a Schelling level impact. Folks and bots are waiting for the day by day RSI to hit oversold. Due to this fact, it’s doubtless we gained’t see any vital upside in value till 30 on the RSI is damaged. That may be achieved by yet one more sell-off into help, since we’re so near 30 already. A extra unlikely chance is we may kind a hidden bullish divergence, the place the worth makes barely increased lows, however the RSI makes decrease lows. I don’t anticipate any vital draw back both with the confluence of demand described above:we’re at a brief stalemate.

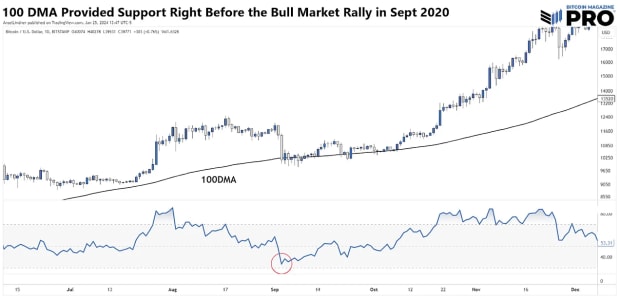

Staying on the day by day chart under however zooming in, we see the 100 DMA is offering help presently. I additionally am watching the $37,877 stage; an vital value from again in November. Any dip that pushes RSI to oversold won’t shut under that.

The 100-day usually doesn’t present a lot help in bitcoin, with the 50- and 200-day shifting averages being probably the most influential. Nevertheless, under I present September 2020, proper earlier than the monster bull rally to finish that yr. The 100-day was the star again then. It’s attainable to carry alongside the 100-day after which rally with a pause in GBTC promoting. One other attention-grabbing be aware from that interval in 2020: the RSI stopped shy of oversold, catching many off guard because it shot to the moon. That’s not my base case, but it surely does have priority.

Backside line, we’re seeing huge and new sources of demand for bitcoin from the ETFs and now China capital flight. The ETF launch dynamics have been sophisticated however value has been comparatively regular all issues thought of. It is just a matter of time till demand turns into obvious in value.

More NFT News

El Salvador Boosts Bitcoin Purchases After IMF Settlement

No, BlackRock Can't Change Bitcoin

Canine Memecoins Rebound as Bitcoin Reaches $98,000