Bitcoin is shifting sideways at press time, absorbing the wave of promoting during the last week. Despite the fact that there are some optimists, the candlestick association within the each day chart factors to weak point.

This preview, no less than from a technical angle, stays so long as costs pattern under the spherical variety of $60,000 and the liquidation stage at round $66,000.

Binance Purchased The Bitcoin Dip

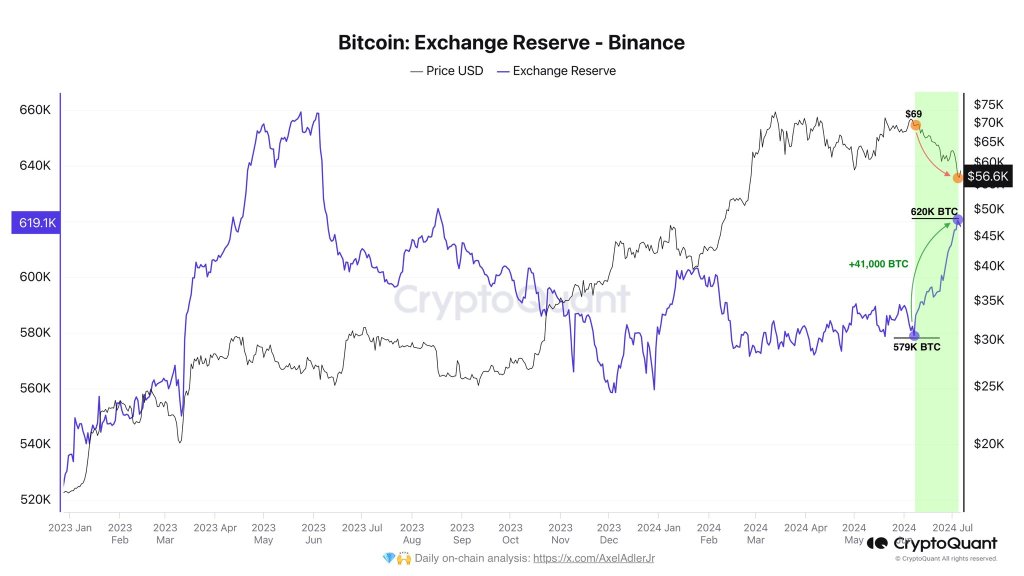

Amid the restoration, one analyst, pointing to attention-grabbing on-chain information, observed that when costs fell final week, some unnamed exchanges have been loading up the dip. It’s now rising that Binance, the world’s largest trade by shopper depend, was actively accumulating.

CryptoQuant information exhibits that Binance elevated its reserves by 41,000 BTC during the last bear run when costs corrected from $72,000. Shopping for on dips is strategic, contemplating the trade’s obligation, particularly for customers searching for to transform different tokens for BTC on the fly instantaneously.

Associated Studying

Throughout this time, Ki Younger Ju additionally noted that “everlasting holders,” entities who are likely to HODL and never transfer cash, have been accumulating. These addresses, excluding spot Bitcoin exchange-traded fund (ETF) issuers, exchanges like Binance and Coinbase, or miners, added 85,000 BTC within the final month. Throughout this time, spot Bitcoin ETF issuers decreased their holding by 16,000 BTC.

Whereas some entities have been scrambling for the exits, others noticed this as a chance to double down, loading on each retracement. Their involvement has helped stabilize costs, enhancing sentiment shredded after final week’s dump to as little as $53,500.

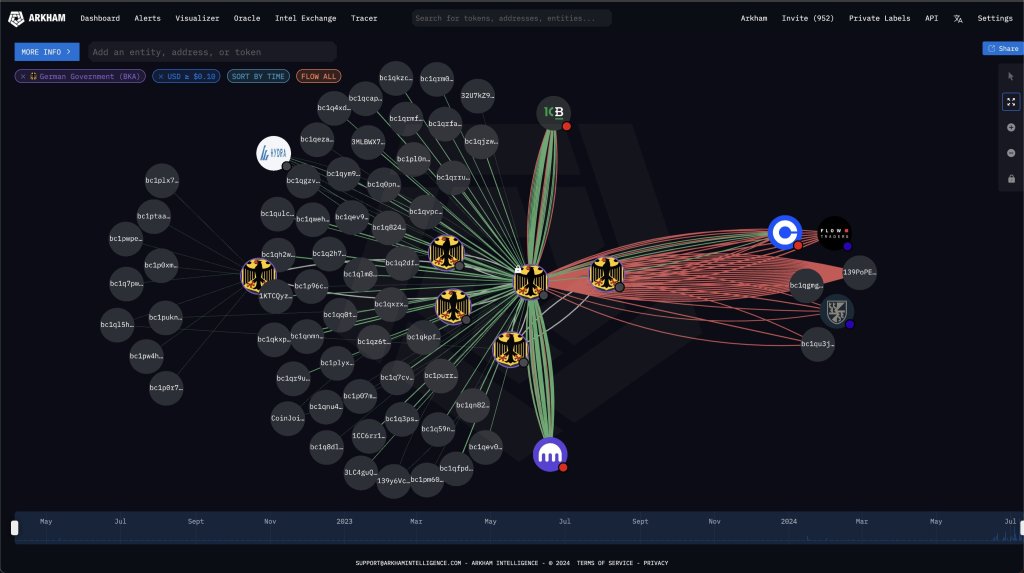

German Authorities Offloading Extra BTC

Even because the “diamond arms” purchase the dip, the German authorities isn’t stopping; Arkham Intelligence data. Right this moment, on July 11, they moved one other 3,250 BTC, on prime of the 5,627 despatched earlier, to a number of market makers and exchanges, together with Bitstamp.

Their determination to promote is heaping extra strain on the coin, slowing down the uptrend. Even amid sustained outflows from the German authorities, a Coingecko survey shows that the majority respondents, particularly buyers, are upbeat.

Associated Studying

In the meantime, merchants and speculators have blended sentiments. Whereas 39% of merchants are upbeat, anticipating costs to get better, one other 33.5% of these surveyed are bearish. Most speculators, or 42.4% of these surveyed, are bearish, anticipating costs to proceed tanking.

Function picture from DALLE, chart from TradingView

More NFT News

Machine Studying in Focus as Chainalysis Acquires Hexagate

Extra Than Half of Crypto Tokens, Memecoins Launched in 2024 Have been Malicious: Blockaid

Hedera Value Prediction for Right now, December 18 – InsideBitcoins