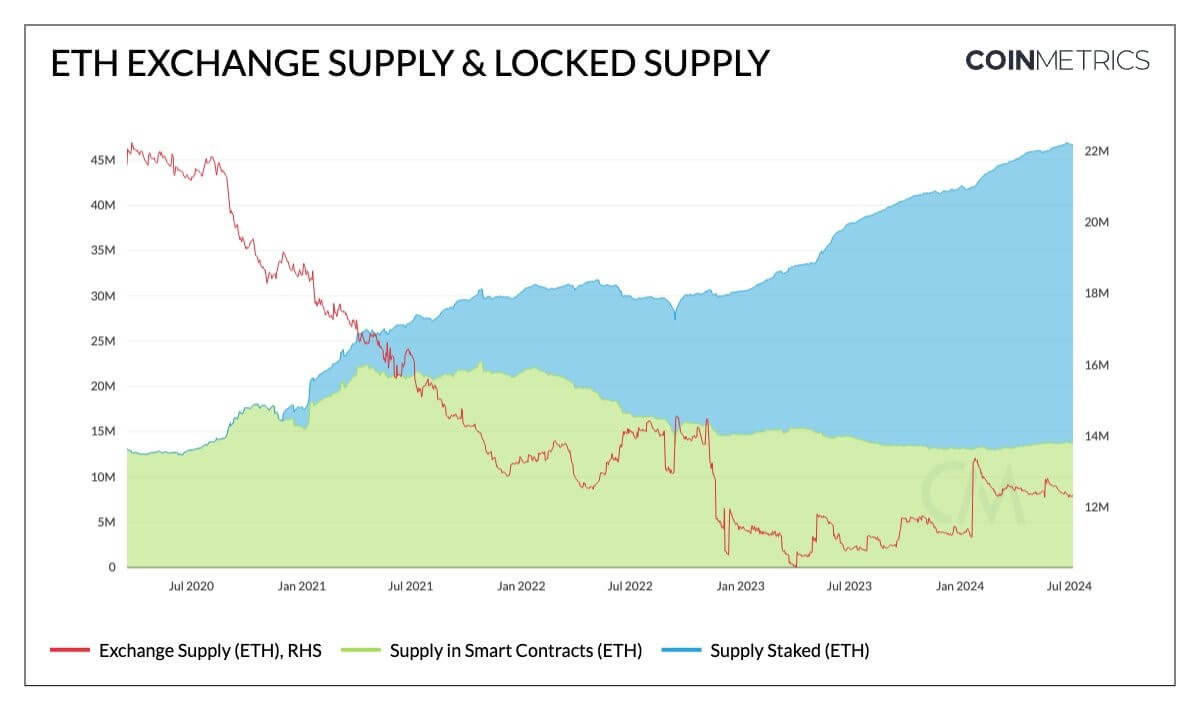

Roughly 40% of Ethereum provide is locked because the market anticipates the ultimate approval for ETH spot-based exchange-traded funds (ETFs).

A breakdown of this “locked provide” exhibits that over 33 million ETH is staked on the community, representing round 28% of Ethereum’s complete provide, in keeping with Dune Analytics data.

Proof-of-stake networks like Ethereum require customers to “lock up” their digital belongings to help its safety and operations, and in return, they earn rewards.

Moreover, 12% of the provision is locked in sensible contracts and bridges, that are seeing excessive adoption recently. For instance, A.J. Warner, Chief Technique Officer at Offchain Labs, noted that ETH within the Arbitrum One bridge has constantly elevated over the previous three years.

Market observers imagine this substantial ETH lockup and the approaching ETF approval will enhance ETH costs. Tom Dunleavy, Managing Companion at MV Capital, identified that the approval of spot Ether ETFs will considerably affect the market. He stated:

“The spot ETH ETF flows are going to quickly transfer this market.”

ETF approval

In the meantime, anticipation continues to develop surrounding the ultimate approvals for a spot Ethereum ETF in the USA.

On July 9, Bitwise’s Chief Industrial Officer, Katherine Dowling, said the ETFs are nearing approval, stating that the Securities and Alternate Fee (SEC) was addressing just a few remaining points.

Dowling steered the merchandise could be permitted over the summer time, a sentiment echoed by Bloomberg ETF analyst James Seyffart.

Seyffart speculated that approval may come by the tip of the month regardless of his low confidence in precise launch date predictions. He said:

“I’ve pretty low confidence in these launch date predictions at this level. There’s no deadline & SEC’s Corp Fin is taking its time right here (I don’t blame them). However these modifications had been very minimal and [i don’t know] why the ETFs wouldn’t be able to go inside a few weeks.”

In the meantime, crypto bettors on Polymarket expect the merchandise to launch earlier than the tip of the month, with an 87% likelihood of being listed for buying and selling by July 26.

More NFT News

Marathon and Hut Eight scoop up $1.6 billion price of Bitcoin throughout market dip

Osprey Funds Launches First US Publicly Quoted BNB Belief

Will Binance's BNB Attain $1000? Worth Prediction Amid Authorized Challenges in Australia