In 2022, Ethereum formally adopted Proof of Stake (PoS) as a safer and energy-efficient methodology to validate transactions and add new blocks to the blockchain.

PoS and different consensus mechanisms are integral to the safety of a community. This shift has important implications for the Ethereum ecosystem, notably by way of staking – the method of holding funds in a cryptocurrency pockets to help the operations of a blockchain community.

Associated Studying: Will Listing Of Floki Inu On Brazil’s Largest Exchange Boost Meme Coin’s Price?

Whereas staking has been round for a while, a number of components at the moment are converging to probably drive a big improve in ETH staking. Actually, a number one staking service supplier has predicted a surge in staking exercise and has backed it up with compelling causes.

So, what does this imply for Ethereum, and why is staking turning into such a vital a part of its blockchain infrastructure?

Staked Q2 Report Predicts Vital ETH Staking Price Improve

Staked, a analysis subsidiary of the Kraken change, has launched its Q2 report, projecting that the ETH staking fee may see a big improve of 20% to 35% over the subsequent 12 to 18 months. This forecast was primarily based on a number of components, together with the current improve in common Ethereum staking yield from 5.2% to five.8% on a yr on yr foundation.

Furthermore, the Staked Q2 report’s prediction of a big improve within the ETH staking fee may even have broader implications for the cryptocurrency market as an entire. If extra customers start staking their ETH, the circulating provide of the cryptocurrency will lower, probably resulting in a rise in its value.

This, in flip, may have a ripple impact on all the cryptocurrency market, making it an important pattern to observe within the coming months.

ETH complete market cap at present at $218 billion on the every day chart at TradingView.com

What Elevated ETH Staking Means For Buyers

One of the crucial apparent advantages is {that a} larger staking yield means buyers can earn extra rewards for his or her staked ETH. This could possibly be particularly interesting to long-term buyers who need to maximize their returns.

Moreover, the rise in staking may probably result in a lower within the circulating provide of ETH, which may drive up its value. Which means buyers who’re holding ETH may see their holdings improve in worth.

However the impact of increased ETH staking goes past simply incomes rewards and potential value will increase. It additionally has a optimistic impact on the general well being and stability of the Ethereum community.

By staking their ETH, buyers are primarily locking it up, making it tougher for unhealthy actors to assault the community. This makes the community safer and reliable, which may appeal to extra customers and buyers to the platform.

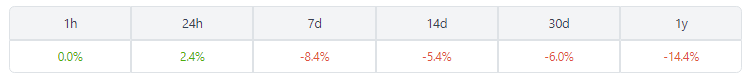

Supply: Coingecko

On the time of writing, the value of ETH stands at $1,798 based on CoinGecko, with a 2.4% rally previously 24 hours. Nevertheless, it’s price noting that ETH has skilled a seven-day hunch of 8.5%, highlighting the volatility that’s attribute of the cryptocurrency market.

-Featured picture from Siam Blockchain

More NFT News

El Salvador Boosts Bitcoin Purchases After IMF Settlement

No, BlackRock Can't Change Bitcoin

Canine Memecoins Rebound as Bitcoin Reaches $98,000