Bitcoin (BTC) is likely to be value greater than Ethereum (ETH), however obtainable Glassnode information, as analyzed by CryptoSlate, reveals that ETH’s peak dominance has outperformed BTC’s within the final two years.

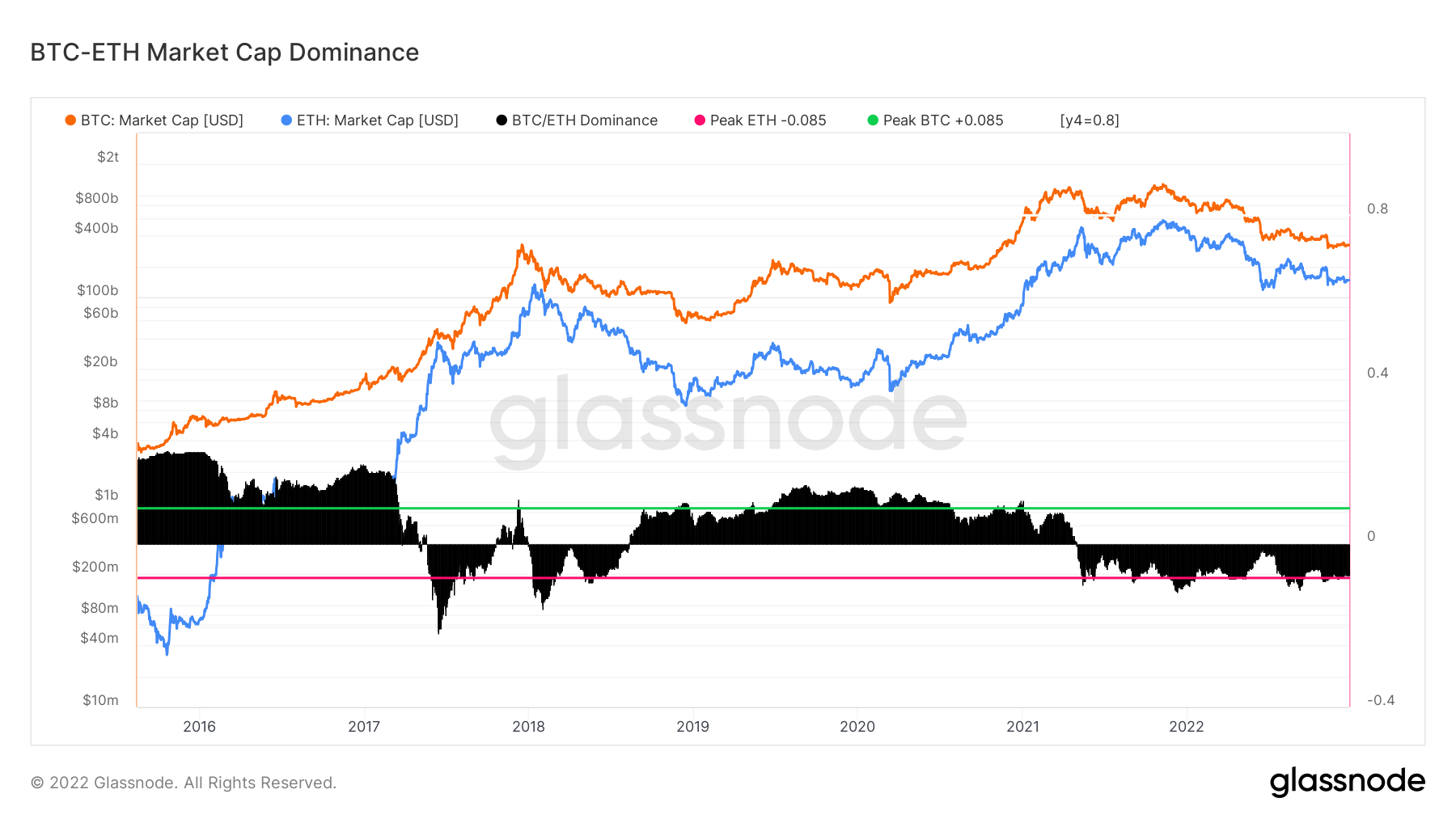

Glassnode’s BTC-ETH Market Dominance metric is an oscillator that tracks the macro efficiency developments for the highest two cryptocurrencies. The market cap dominance reductions misplaced and long-dormant cash, offering a mannequin that precisely assesses the capital inflows and outflows of the belongings. This metric considers BTC and ETH’s market cap alone.

The chart above reveals that Ethereum had its peak market dominance way back to 2017, even earlier than the asset’s realized market cap peak. ETH additionally noticed its dominance return in 2018 and has maintained it since late 2021.

BTC peaked through the bear market interval between the top of 2018 and early 2021 — exhibiting that it’s a higher asset through the risk-off surroundings.

A risk-off surroundings describes a bear market state of affairs the place buyers exit dangerous belongings like shares and hedge their funds in safe-haven investments like gold and bonds. This may clarify why many analysts and buyers take into account Bitcoin digital gold.

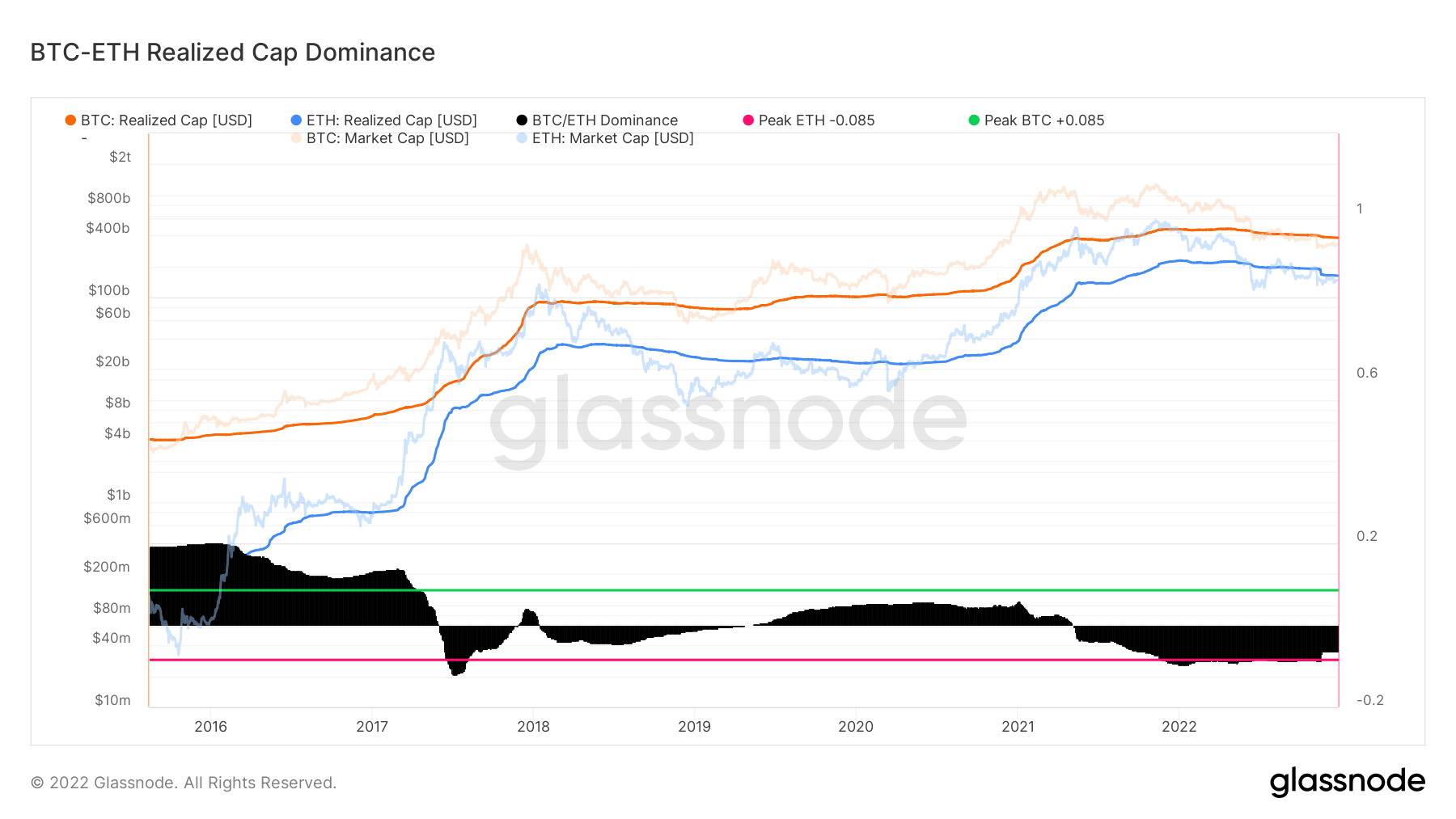

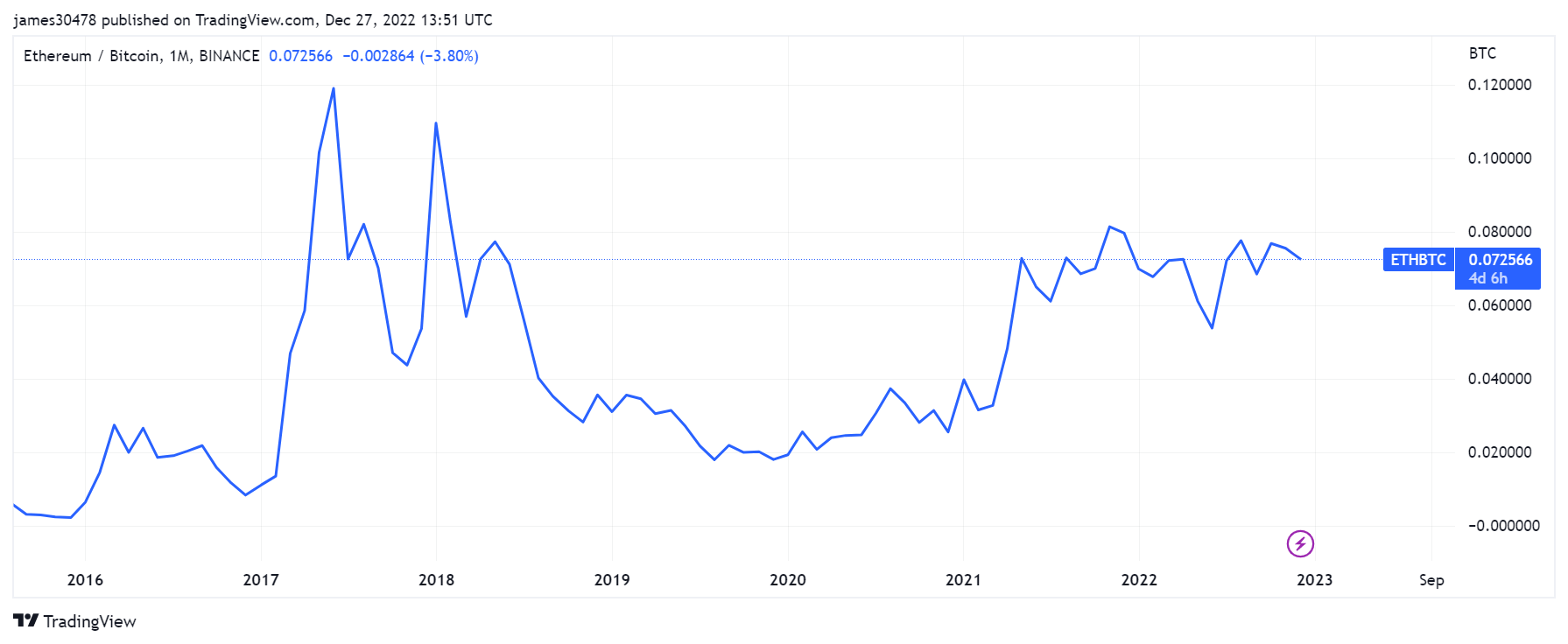

However, ETH trades higher in a risk-on surroundings when buyers are extra keen to place their funds into dangerous belongings. Because of this ETH’s dominance flipped that of BTC because the early bull run of 2021 and has maintained that efficiency till now. Ethereum’s dominance over BTC when it comes to realized market cap peaked at over 0.765, in line with the Glassnode chart beneath.

Nevertheless, ETH’s dominance over the previous two years has not translated into higher efficiency for the asset. Its dominance has regularly declined since 2017, with all different peaks in 2021 and 2022 failing to beat the earlier highs. The rationale behind this decline stays unknown.

Nevertheless, the success of the Ethereum Merge has seen the asset flip deflationary a number of instances, and its issuance fee has considerably declined. Stories have suggested that the asset is likely to be regularly turning right into a retailer of worth based mostly on the conviction of long-term holders.

With the markets turning into extra bearish once more, BTC is already exhibiting indicators that it might outperform ETH in a risk-off surroundings. It has surpassed Ethereum within the final 60 days.

A number of information and market analysts are predicting a recession in 2023; this might proceed to play into BTC’s power of being a safer asset in a risk-off surroundings.

More NFT News

Marathon and Hut Eight scoop up $1.6 billion price of Bitcoin throughout market dip

Osprey Funds Launches First US Publicly Quoted BNB Belief

Will Binance's BNB Attain $1000? Worth Prediction Amid Authorized Challenges in Australia