Ethereum (ETH), the second-largest cryptocurrency by market capitalization, seems to be on the verge of a possible reversal.

Technical evaluation exhibits a compelling case for Ethereum’s potential reversal towards the $1,900 mark. The coin has proven indicators of discovering help at its present ranges, and with mounting shopping for strain, a bullish pattern could possibly be on the horizon.

Because the crypto market continues to evolve, all eyes at the moment are on Ethereum and its potential reversal.

Reducing Volatility, Buying and selling Quantity Point out Potential Reversal For Ethereum

Ethereum’s worth charts reveal a notable decline in volatility, indicating a potential shift in market sentiment. Volatility, which measures the frequency and magnitude of worth fluctuations, is on the decline, suggesting that the bearish sentiment surrounding Ethereum could also be shedding steam.

This drop in volatility typically precedes pattern reversals and signifies a market that’s maturing and discovering consensus amongst traders.

Accompanying the lowering volatility, Ethereum has additionally skilled a decline in buying and selling quantity, an important indicator of market exercise and investor curiosity. The lowered buying and selling quantity is important because it signifies a lower in promoting strain, creating an surroundings conducive to potential worth spikes.

For Ethereum, the diminishing buying and selling quantity units the stage for a bullish reversal and hints at the potential of an upward worth surge.

Supply: Coingecko

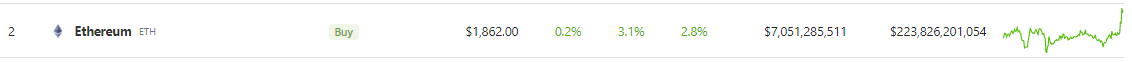

Amidst these constructive indicators, Ethereum continues to trip the wave of success, with CoinGecko reporting a formidable worth of $1,862, reflecting a outstanding 3.1% rally up to now 24 hours alone. Moreover, the cryptocurrency demonstrates a promising seven-day enhance of two.8%, including to its rising momentum.

Supply: CryptoQuant

Combined Alerts: Staking Inflows Down

Regardless of Ethereum’s constructive worth momentum and lowering volatility, current knowledge from CryptoQuant reveals a decline in staking inflows. On Sunday, staking inflows stood at 93,952 ETH however dropped to 71,648 ETH on Monday. Though nonetheless larger in comparison with current dips, the lower in staking inflows suggests a possible shift in investor habits.

However, the whole worth staked continues to climb. This means that whereas the speed of enhance has slowed down, there’s nonetheless ongoing interest in staking Ethereum, probably pushed by the prospect of incomes passive earnings by way of staking rewards.

ETHUSD presently at $1,861 on the day by day chart at TradingView.com

One other facet to think about is the withdrawal profile, which has introduced combined alerts. In a single day, there was a notable spike in principal withdrawals, indicating a bearish sentiment. Nonetheless, projections for the morning session counsel a extra bullish outlook, with expectations of principal ETH withdrawals falling to below-normal ranges.

These withdrawal patterns contribute to the general uncertainty surrounding Ethereum’s short-term market outlook. Whereas staking inflows lower and withdrawal exercise stays inconsistent, traders and analysts are carefully monitoring these indicators to gauge the path of the market and the sentiment of Ethereum holders.

-Featured picture from WSJ

More NFT News

Chinese language Auto Supplier Dives Into Bitcoin Mining With $256M Funding

Harnessing idle GPU energy can drive a greener tech revolution

Will Dogecoin Attain $1? Crypto Volatility Returns as Bitcoin and Ethereum Slide