The potential approval of a Bitcoin ETF (Change Traded Fund) is certain to open new alternatives for merchants. The expectations surrounding this occasion affect the market now, however an skilled believes they’ll have a extra substantial impact within the coming months.

As of this writing, Bitcoin trades at $37,400 with a 1% revenue within the final 24 hours. Over the earlier week, the cryptocurrency stayed within the inexperienced with a 3% revenue, holding the essential degree of $37,000 regardless of the rise in promoting stress.

The Profitable Technique In Anticipation Of Bitcoin ETF Approval

As Bitcoin’s worth soars with a exceptional 125% enhance this 12 months, a brand new buying and selling technique emerges, promising excessive returns within the wake of the anticipated Bitcoin ETF. A seasoned market analyst, Markus Thielen, unveils insights into leveraging the evolving crypto market dynamics for worthwhile buying and selling in an essay posted by choices platform Deribit.

Thielen’s analysis reveals an “uncommon” pattern within the Bitcoin market: regardless of its vital rally, the 30-day realized volatility stays at a modest 41%, starkly contrasting to the 5-year common of 63%.

Based on the analyst, this subdued volatility displays a declining curiosity in leveraged Bitcoin choices, a direct consequence of institutional gamers coming into the crypto area.

These gamers, holding vital Bitcoin belongings, will seemingly promote volatility, fostering a extra steady market surroundings that mirrors conventional monetary markets.

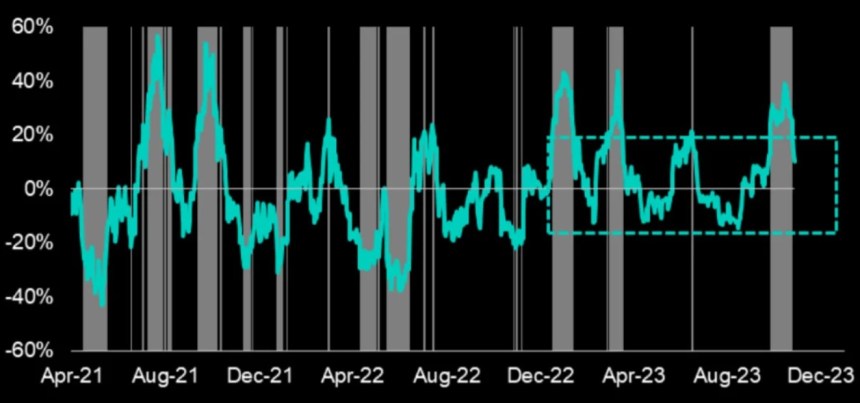

On this panorama, the technique of promoting strangles (120% name and 80% put) on a 30-day rolling foundation stands out. Based on Thielen, this strategy has proven profitability in roughly 23% of instances over the previous 12 months, as seen within the chart under, marking a big enchancment from the decentralized finance (DeFi) summer time’s high-risk profile.

At the moment, DeFi protocols attracted billions in capital to the crypto ecosystem contributing to the incipient Bitcoin rally. Whereas there are variations within the present market dynamics, choices gamers are more likely to profit from this technique.

This technique, notably efficient throughout low-risk durations, suggests a window of alternative for merchants to capitalize on earlier than introducing institutional affect.

Institutional Involvement Anticipated to Stabilize Bitcoin Market

The anticipated launch of the Bitcoin ETF is ready to rework the market additional. This occasion is anticipated to recalibrate the put/name ratio, which leans closely towards calls.

Thielen compares it to the S&P 500, the place the put/name ratio has been extra balanced. The Bitcoin market would possibly quickly witness an analogous equilibrium, presenting a possibility for merchants to harness volatility by means of a sell-put technique.

Moreover, Thielen notes that the post-ETF approval part could possibly be the final probability for merchants to use excessive volatility ranges. As soon as institutional gamers start systematically promoting volatility, the market is anticipated to enter a part of decreased value fluctuations, making volatility-based methods much less efficient.

The evaluation additionally touches upon Bitcoin’s correlation with broader market indicators just like the VIX index. Whereas the Bitcoin market has maintained excessive volatility relative to the VIX index, this hole is anticipated to slim, providing merchants a strategic edge in timing their trades successfully.

In conclusion, because the Bitcoin ETF approaches and institutional participation will increase, savvy merchants can look in the direction of promoting strangles as a strategic strategy to capitalize on the present market circumstances.

Cowl picture from Unsplash, chart from Deribit and Tradingview

More NFT News

Osprey Funds Launches First US Publicly Quoted BNB Belief

Will Binance's BNB Attain $1000? Worth Prediction Amid Authorized Challenges in Australia

What Does Spot Buying and selling Imply in Cryptocurrency and How Is It Accomplished?