That is an opinion editorial by Kudzai Kutukwa, a monetary inclusion advocate who was acknowledged by Quick Firm journal as certainly one of South Africa’s top-20 younger entrepreneurs beneath 30.

“Each report has been destroyed or falsified, each ebook rewritten, each image has been repainted, each statue and road constructing has been renamed, and each date has been altered. And the method is constant daily and minute by minute. Historical past has stopped. Nothing exists besides an countless current by which the Celebration is all the time proper.”

On the outbreak of the first world war, Nice Britain had the world’s most subtle undersea telegraph cable system, which wrapped across the complete world. On August 5, 1914, a day after the British had declared struggle on the Germans, a British ship, the Alert, set sail from the port of Dover with a mission of chopping off all of Germany’s communications with the world by sabotaging the Germans’ undersea cables and the mission was achieved efficiently.

A day earlier than the Alert set sail, on August 4, a person was deployed to the cable station at Porthcurno in Cornwall and the cables carrying visitors throughout the Atlantic got here ashore on the seaside. The job title of this man was “censor” and quite a few different censors have been deployed throughout the empire, from Hong Kong to Malta to Singapore. As soon as the censors have been in place, a worldwide system of intercepting communications often called “censorship” was born. Its essential purpose was to forestall the communication of strategic intelligence between the enemy and their brokers. In different phrases, the aim had developed from simply crippling the Germans’ means to speak, to additionally gathering intelligence.

Over 50,000 messages per day were handled by the network of 180 censors at U.K. offices. By leveraging their dominance over the worldwide telegraph infrastructure, the British created the primary world communications surveillance system that stretched from Cape City to Cairo and from Gibraltar to Zanzibar. This turned one of many choke factors that led to the defeat of the Germans.

Whereas the phenomenon of censorship is in no way a brand new one, as highlighted by the historic account above, the actual fact nonetheless stands that it’s a weapon that has been deployed all through historical past to silence opposing views, cripple impartial thought and in the end subjugate “enemies of the state” or complete nations.

2022 was in some ways what I might personally name the 12 months of the “censor.” As I look again and replicate on 2022, it appears to me that incidents of censorship at the moment are the rule and never the exception because of the rise of cancel culture on social media and varied impartial media voices providing numerous views on controversial subjects that, in some instances, contradict the “official narrative.” Trustworthy and open debate is stifled when these views get censored, leading to additional polarization.

Moreover the convergence of digital platforms and banking has led to the rise of one other, extra harmful and pervasive type of censorship: monetary censorship. This can be a extra malicious form of censorship that isn’t nearly hindering or intercepting communications, however is characterised by chopping off one’s entry to fundamental monetary providers, limiting who one can commerce with and hindering the flexibility to transact freely. This contains however isn’t restricted to shutting down the financial institution accounts of political opponents, being blacklisted and deplatformed by cost processors and financial sanctions. What began out as a instrument to cease criminals and different dangerous actors from financing their nefarious actions has now morphed right into a weapon for silencing critics, oppressing dissenters and harassing whistleblowers, in addition to not directly controlling the spending habits of individuals.

Given Bitcoin’s censorship resistance, it too was additionally subjected to quite a few assaults on this previous 12 months because the censors clearly perceive that it’s an alternate financial system that they can’t cease, management or affect.

In a world the place the definitions of what constitutes “acceptable speech or acceptable conduct” are consistently transferring targets, who is aware of when it’s possible you’ll find yourself having your financial institution accounts frozen for having a unique perspective or for one thing you posted on social media ten years in the past? Will impartial thought end in monetary retaliation? On this essay I’ll spotlight just a few of the important thing incidents of monetary censorship that occurred in 2022 which have been principally free Bitcoin advertising and marketing campaigns, and extra importantly, focus on how Bitcoin is the right defend going ahead.

The Freedom Convoy

“The best hazard to the State is impartial mental criticism.”

The elevated ranges of collusion between the State, bankers and massive tech towards people and organizations that maintain authorized however dissenting views is probably essentially the most obfuscated and harmful type of monetary censorship.

The Freedom Convoy protests that kicked off on January 22 by Canadian truckers who have been protesting towards COVID-19 vaccine mandates clearly demonstrated how third-party cost platforms and banks can collude with the State to financially lower off people with out due course of. By means of the crowdfunding web site GoFundMe the truckers managed to raise approximately $7.9 million in donations. GoFundMe then withheld and later refunded the donations to the donors citing a violation of their phrases of service towards the promotion of violence.

Not lengthy after that, Prime Minister Trudeau invoked the Emergencies Act, which allowed the federal government to freeze the financial institution accounts, droop insurance coverage insurance policies and withhold different monetary providers from the protestors and their donors.

Throughout a press conference on the February 14, after the invocation of the Emergencies Act, Deputy Prime Minister Chrystia Freeland made the next remarks:

“The federal government is issuing an order with instant impact, beneath the Emergencies Act, authorizing Canadian monetary establishments to quickly stop offering monetary providers the place the establishment suspects that an account is getting used to additional the unlawful blockades and occupations. This order covers each private and company accounts…As of right this moment, a financial institution or different monetary service supplier will be capable of instantly freeze or droop an account and not using a courtroom order. In doing so, they are going to be protected towards civil legal responsibility for actions taken in good religion. Federal authorities establishments can have a brand new broad authority to share related data with banks and different monetary service suppliers to make sure that we are able to all work collectively to place a cease to the funding of those unlawful blockades.”

The Canadian authorities selected to close down the protests by nuking the protestors’ monetary infrastructure. Monetary providers suppliers got the inexperienced mild to take action with out due course of and got authorized cowl by the state for any blowback that would outcome from imposing this decree. Moreover, the federal government intends to extend these measures and make them everlasting.

Whether or not one agrees with the truckers or not, it is extremely apparent that utilizing monetary censorship to resolve home dissent is a horrible precedent to set.

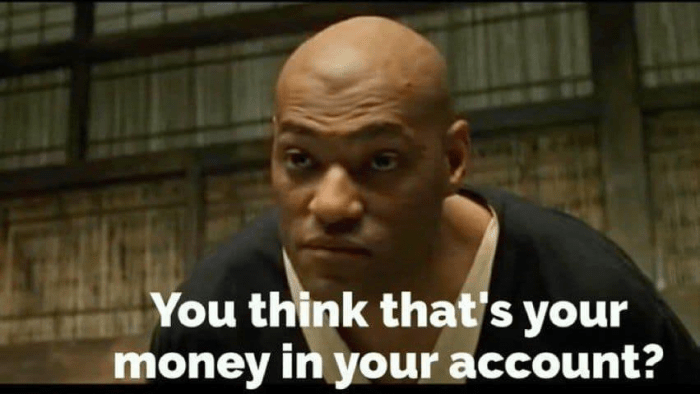

On the flip facet the weaknesses of State-controlled cash have been uncovered in full view for all to see. This incident was the very best Bitcoin industrial ever made, because it concurrently confirmed the weaknesses of centralized monetary platforms whereas proving the utility of a decentralized foreign money like bitcoin.

On the stroke of a pen, 1000’s of individuals have been denied entry to their very own cash and it was all “completely authorized.” The message was clear; reliance on a centralized monetary system that’s biased could be very dangerous. By making use of strain on this one choke level, the expression of different freedoms can also be curtailed, whether or not it’s freedom of expression or freedom of motion as all of them contingent on one’s means to transact. One of many truckers described how his private and enterprise accounts have been shut down. The enterprise in query wasn’t related in any manner with trucking, politics, protests or the Freedom Convoy, however its checking account was nonetheless shut down by the Canadian authorities and this has utterly crippled the proprietor’s means to make a residing.

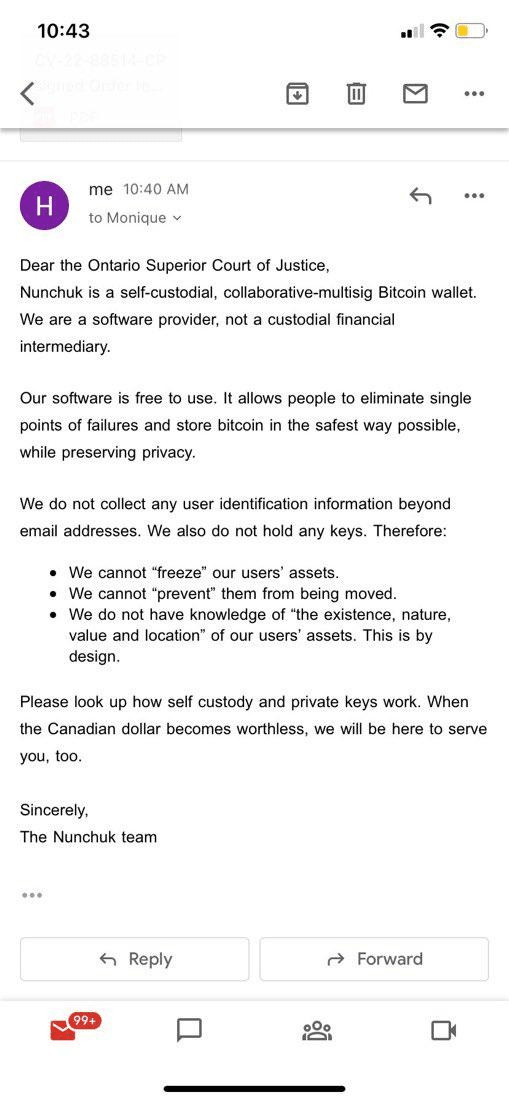

Following the motion taken by GoFundMe, a Bitcoin fundraising marketing campaign dubbed “Honk Honk Hodl” was began on Twitter with the intention of elevating 21 bitcoin (price roughly $1,100,000 on the time) for the truckers they usually efficiently raised more than 14 bitcoin. In response to this, the federal government extended the ban to incorporate bitcoin and different cryptocurrency donations and pressured cryptocurrency exchanges to freeze the accounts of anybody concerned in funding the truckers in addition to to share their private data with the State. The Ontario Superior Courtroom of Justice ordered self-custody pockets supplier Nunchuk to disclose user information and freeze Bitcoin wallets of its customers in accordance with the federal government decree. The official response from Nunchuk was as follows:

As soon as once more, Bitcoin’s censorship resistance handed the take a look at, and Nunchuk’s response not solely highlights the significance of proudly owning cash that can’t be seized or censored, however of self custody as effectively.

To not be outdone, the Iranian regime took a web page out of the Canadian authorities’s playbook of utilizing monetary censorship as a weapon to crush dissent amongst its residents once they issued a decree that can allow the state to freeze the financial institution accounts of girls that won’t put on a hijab. Protests have been going on in Iran since September 17, when Mahsa Amini, an Iranian lady, was arrested by the morality police for not sporting a hijab and later died beneath doubtful circumstances at a Tehran hospital. The case for Bitcoin, a censorship resistant type of cash, has by no means been stronger.

It’s towards this background that I’m satisfied that central financial institution digital currencies (CBDCs) are a menace to particular person liberty and monetary sovereignty as they endow the state with the flexibility to financially censor anybody, for any motive on the push of a button, with out due course of. In a CBDC world, a protest such because the Freedom Convoy would in all probability not have occurred. For this reason it’s a matter of nice concern that nine out of 10 of the world’s central banks are presently actively engaged on launching their very own CBDCs. Moreover, based on a report launched by the Financial institution for Worldwide Settlements in Might this 12 months, “the expansion of cryptoassets and stablecoins’ is the principle motive that almost all of those central banks are actively pursuing CBDCs.

In different phrases, the censors’ high precedence is to neuter Bitcoin and stablecoins since they neither need to lose their energy to print cash advert infinitum nor to loosen their grip on the scepter of monetary censorship.

This explains why the Nigerian central financial institution issued an edict on December 6, that capped ATM withdrawals at a most of $45 a day and $225 per week in a bid to coerce extra folks to make use of the eNaira, the nation’s CBDC. After experiencing similar financial censorship to the truckers in 2020 throughout the anti-police brutality “End Sars” protests, Nigerians are positively not eager on signing up for CBDC induced digital serfdom. In consequence adoption of the eNaira has been dismal to say the least, with only 0.5% of the nation’s 217 million residents having used it since its launch in October 2021. The Nigerian central financial institution’s draconian measures to advertise the eNaira by declaring struggle on money will simply serve to strengthen Bitcoin’s attraction and adoption is probably going going to maintain rising. Having stated that, I wouldn’t be stunned to see within the coming 12 months extra measures of this kind being applied by central banks as they “promote” their CBDCs.

Censorship-Resistant Design

“After we can safe crucial performance of a monetary community by laptop science moderately than by the normal accountants, regulators, investigators, police, and legal professionals, we go from a system that’s guide, native, and of inconsistent safety to 1 that’s automated, world, and rather more safe.”

Bitcoin is a worldwide, fully-decentralized, trustless, permissionless, non-sovereign and censorship-resistant type of cash. It exists past the management of the State or any company and features completely with out the necessity for coordination by any centralized third events. Of the various attributes of Bitcoin, censorship resistance stays one of the crucial unappreciated but essential on this age of pervasive surveillance and monetary censorship.

Censorship resistance is the flexibility of a foreign money to be saved and transacted, unhindered and unencumbered. Censorship-resistant cash is resistant to confiscation, freezing or interception by any third get together. Anybody can entry Bitcoin as a result of it’s permissionless and, because it scales, it turns into extra decentralized and due to this fact more durable to censor.

Legitimate transactions which are processed on the Bitcoin community are uncensorable and no third get together can block them or blacklist a pockets handle. Customers are protected against asset seizures by the state or freezing by non-public firms — in brief, it’s impartial cash that’s ruled by guidelines and never rulers. If WikiLeaks had been receiving donations through Bitcoin from day one, the monetary blockade it skilled would have meant nothing.

The Bitcoin structure is by design constructed to be censorship resistant as this ensures that no arbitrary adjustments to its financial coverage or to the protocol itself will be made unilaterally, thus guaranteeing the steadiness and integrity of the community. With out this attribute in place, what can be the assure that the utmost provide cap of 21 million bitcoin won’t be elevated unilaterally in future?

As Parker Lewis aptly puts it, “Censorship resistance reinforces shortage and shortage reinforces censorship resistance.” Bitcoin’s absolute shortage is the inspiration for each monetary incentive that makes the Bitcoin community useful and worthwhile; thus, with out censorship resistance inbuilt, the whole system is compromised.

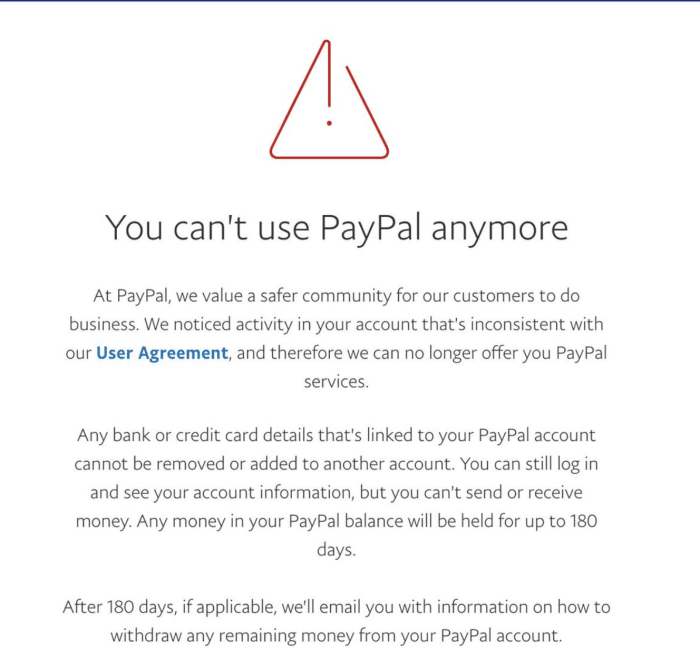

Distinction this with the present fiat system and its varied cost rails which have phrases of service that may be modified on the drop of a hat by a committee or as a consequence of strain from social justice warriors in addition to the State. An instance that involves thoughts can be PayPal’s deplatforming of other media websites, Consortium Information and Mint Publishing, for publishing tales that have been crucial of the “official narrative” almost about Western assist of Ukraine. PayPal didn’t cease there, in September of this 12 months, it additionally concurrently shut down the accounts of the Free Speech Union and “UsforThemUK” (a mother and father group against locking down faculties throughout the pandemic) as a result of “nature of its actions.” This was accomplished with no prior warning, or clear rationalization and it was unable to withdraw the 1000’s of kilos’ price of donations that have been nonetheless in its account.

Different organizations that have been added to PayPal’s blacklist this 12 months embrace: The Daily Sceptic; the U.K. Medical Freedom Alliance; Law Or Fiction, an internet site that educates residents on their rights and the way they’ve been affected by the British authorities’s response to COVID-19; and Moms For Liberty, to call just some. These organizations will quickly notice that the answer to the predicament of monetary censorship is the adoption of a Bitcoin commonplace, the place no entity, irrespective of how highly effective, can censor their transactions.

The Rise Of Monetary Restrictions

“Liberty as soon as misplaced, is misplaced eternally.”

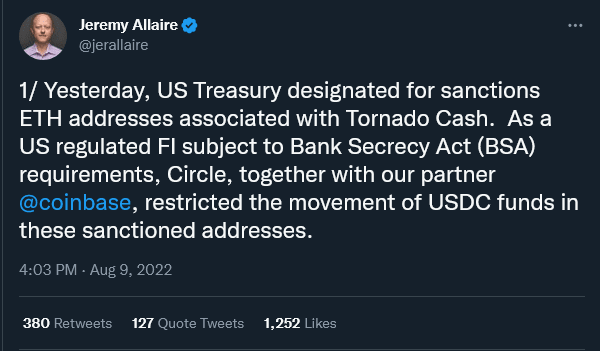

On August 8, the U.S. Treasury’s Workplace of Overseas Property Management (OFAC) sanctioned Twister Money (TC), an Ethereum smart contract mixer, and added it to the Specially Designated Nationals (SDN) List. In keeping with OFAC, TC was allegedly used to launder cryptocurrency price $455 million that was hacked by the North Korean government-backed hacker group the Lazarus group. In keeping with the Financial Times, a senior, unnamed Treasury official commenting on the sanction of TC stated:

“‘We do consider that this motion will ship a extremely crucial message to the non-public sector in regards to the dangers related to mixers writ massive,’ including that it was ‘designed to inhibit Twister Money or any kind of reconstituted variations of it to proceed to function. At present’s motion is the second motion by Treasury towards a mixer, nevertheless it won’t be our final.’”

That is clearly a warning that the State intends to proceed tightening the screws on monetary privateness instruments and won’t hesitate to blacklist any insufficiently-decentralized protocols. This motion by OFAC of sanctioning an open-source protocol units a precedent that not directly outlaws monetary privateness. This additional breeds uncertainty throughout the open-source group, as builders could also be prosecuted for writing code, ought to or not it’s deployed by criminals in a while.

As if on cue, 4 days after TC was sanctioned, certainly one of TC’s contributing builders, Alex Pertsev, was arrested by Dutch authorities on allegations of cash laundering. Other than being a contributor to TC’s code, no concrete proof has been disclosed but that ties Pertsev to the laundered funds, nor have any official prices towards him been made, but he stays in pre-trial detention.

Following a current listening to, he was remanded in custody till February 20, 2023, pending investigation because the courtroom deemed him to be a flight danger. It stays to be seen how this case will prove, however as one of many largest crypto-related instances to succeed in a courtroom of legislation, the end result of it should set a precedent throughout the EU that would negatively have an effect on the Bitcoin ecosystem within the area, significantly the place monetary privateness is anxious. That is the slippery slope that we discover ourselves on, the place the gradual creep towards monetary privateness is one other tactic that censors are utilizing to guard their powers.

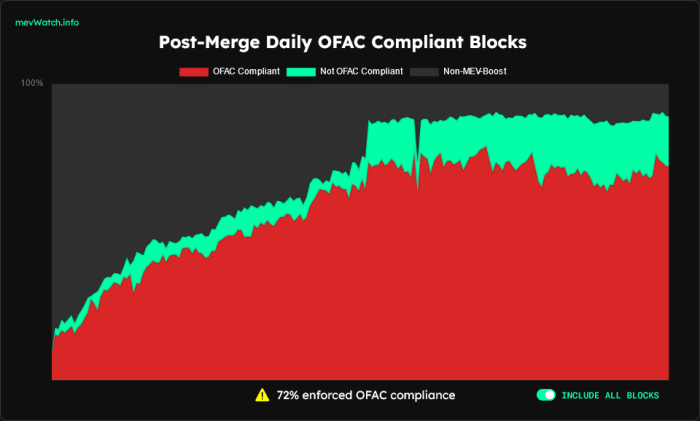

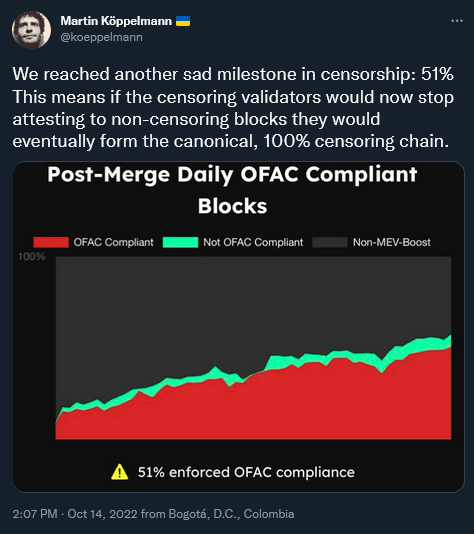

OFAC’s tentacles have additionally prolonged to Ethereum, which is progressively getting more centralized and fewer censorship resistant as a consequence of OFAC compliance as MEV-boost relays turn into increasingly more dominant. Following the lengthy awaited merge improve in September that transitioned Ethereum to a proof-of-stake (PoS) consensus mechanism, data by Santiment signifies that 46.15% of Ethereum’s PoS nodes are managed by simply two addresses that belong to Coinbase and Lido. MEV-boost relays are additionally centralized entities that perform as a bridge between block producers and block builders, giving all Ethereum PoS validators the choice to outsource block manufacturing to 3rd events. On account of this centralization, OFAC-compliant blocks got here into existence, the place it’s potential to censor sure transactions; like these from blacklisted TC addresses and another sanctioned pockets addresses as designated by OFAC.

To place issues in perspective, as of December 19, 2022, the manufacturing of OFAC-compliant blocks each day stands at 72%, up from 51% in October. Whereas the likelihood exists for sanctioned transactions to make it onto the Ethereum blockchain as issues presently stand, this can turn into a rarity as extra validators (and relays) will doubtless choose to exclude these transactions.

In case you weren’t paying consideration, this is without doubt one of the largest the explanation why requires Bitcoin to “change the code” and transition to PoS preserve getting louder. The censors know that Bitcoin because it exists right this moment is censorship resistant, largely as a consequence of proof of labor, and in a bid to grab management of it at a protocol stage, the assaults to pressure such a change are going to accentuate within the years to come back.

In an op-ed piece titled, “Get Ready For The ‘No-Buy’ List,” David Sacks, the founding COO of PayPal, wrote:

“Kicking folks off social media deprives them of the best to talk in our more and more on-line world. Locking them out of the monetary economic system is worse: It deprives them of the best to make a residing. We’ve seen how cancel tradition can obliterate one’s means to earn an revenue, however now the canceled could discover themselves and not using a solution to pay for items and providers. Beforehand, canceled staff who would by no means once more have the chance to work for a Fortune 500 firm not less than had the choice to enter enterprise for themselves. But when they can’t buy tools, pay staff, or obtain cost from shoppers and clients, that door closes on them, too.”

This commentary is 100% correct and mirrors the Chinese social credit system, which is a harbinger of a soon-to-be-global pattern, particularly because the wave of stakeholder capitalism sweeping the non-public sector intensifies.

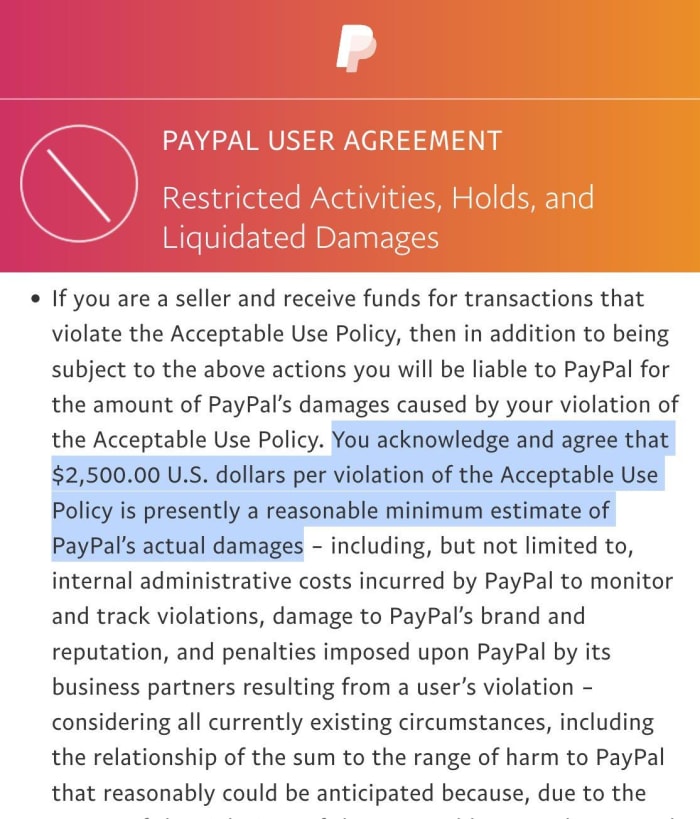

The time period “stakeholder capitalism” is a euphemism for fascism and is used to regulate non-public firms via “woke” financial metrics like environmental, social and governance (ESG) scores. Adherence to woke capitalism is then not directly compelled upon the shoppers of the businesses in query, with dissent being punished by denial of providers and even monetary penalties. PayPal as soon as once more surfaces as a textbook instance of this. In September, it introduced a coverage via which it meant to fine users $2,500 for sharing “misinformation” on-line. Final time I checked, PayPal was neither a content material moderation platform nor a social media firm.

Following a social media backlash towards this proposed coverage, PayPal then issued a statement citing that the coverage was put out erroneously and consequently wouldn’t be applied. Effectively, three weeks after backtracking on this coverage, PayPal re-introduced the $2,500 fine in its newly-updated coverage. The $2,500 advantageous was quietly added to its phrases of service after the social media pushed furor towards it had disappeared. As if that’s not sufficient, PayPal added a clause that permits it to “freeze” all the cash in your accounts for as much as six months, “if fairly wanted to guard towards the danger of legal responsibility or when you have violated our Acceptable Use Coverage.”

What we’re witnessing is the gradual roll out of a Chinese language Communist Celebration type social credit score system. Take this as an early warning, particularly on this period the place “software is eating the world” and the whole lot from banking to buying has migrated to digital platforms.

Escaping Sanctions

“Whoever controls the amount of cash in any nation is absolute grasp of all business and commerce.”

Monetary censorship is just not unique to people and organizations however it is usually prolonged to nations within the type of sanctions. They’re additionally most well-liked as an appropriate different to navy battle since they’re an avenue for non-kinetic energy projection and are thus weapons of financial warfare.

The aim of financial sanctions is to impoverish and sicken the civilians of the sanctioned nation with the intention of pressuring the federal government of the sanctioned nation into compliance in its hopes of avoiding civil unrest. Sadly, this hardly occurs and consequently it’s the extraordinary residents that bear the brunt of sanctions and never the focused politicians.

Financial sanctions are enabled by the centralized nature of the monetary infrastructure of the fiat financial system which is principally managed by the U.S. and the EU. One of many financial warfare instruments of their arsenal is the SWIFT community. SWIFT is an international bank messaging system which has been operational because the 1970s that allows the transmission of just about $5 trillion globally daily. This technique permits monetary establishments to ship and obtain details about monetary transactions in a safe, standardized surroundings.

Because the greenback is the worldwide reserve foreign money, SWIFT facilitates the worldwide greenback system. Though SWIFT is headquartered in Belgium, greenback dominance offers the U.S. quite a lot of leverage over different nations. On account of this dominance, the U.S. is ready to use SWIFT as a monetary weapon towards nation states like Russia and Iran that violate “the rules based order.” Deplatforming or eradicating a rustic from SWIFT is principally chopping it off economically from buying and selling with the remainder of the world.

In stark distinction to this, Bitcoin is a fully-decentralized digital foreign money and peer-to-peer funds system that isn’t beneath the management of any nation state. In keeping with a report titled, “The Treasury 2021 Sanctions Review” by the U.S. Treasury Division, between 2001 and 2021 the variety of sanctions that have been imposed by the U.S. Treasury had elevated by a whopping 933%! In a world of accelerating weaponization of the greenback and centralized monetary infrastructure, nation state adoption of Bitcoin is a matter of nationwide safety.

In his article titled, “Why India Should Buy Bitcoin,” Balaji Srinivasan made the next comment:

“It’s this property (referring to Bitcoin’s decentralization) that makes Bitcoin so treasured for safeguarding Indian nationwide safety. A community that can’t be shut down by any state is a community that India and its diaspora can depend on in instances of battle. For a similar motive that Germany not too long ago repatriated 3,378 tons of gold from america, India ought to prioritize nationwide assist for digital gold as a monetary rail of final resort in a state of affairs just like the 2008 monetary disaster or the 2020 COVID crash…Bear in mind additionally that India has had a multi-millennia lengthy love affair with gold, and is the world’s largest importer of gold. Gold was by no means a menace to India; gold has all the time been an asset for India. And Bitcoin is efficacious for all the identical causes gold is valuable. It’s an internationally accepted retailer of worth, it is extremely scarce, and it is a so-called bearer instrument that may’t be seized with a keypress.”

I might additionally add that Bitcoin adoption on the nation state stage is a defend towards being deplatformed from monetary cost rails like SWIFT. Sanctions have downstream ripple results that negatively have an effect on everybody tied to a selected nation, business or firm that might have been sanctioned. Bitcoin’s censorship resistance shields the residents of a sanctioned nation from the crippling results of sanctions, and insulates a complete nation’s economic system from being unjustifiably attacked. By leveraging off of Bitcoin’s decentralization and censorship resistance folks residing in sanctioned nations are ready to make use of it in lieu of the greenback for commerce and an alternate funds rail to SWIFT.

In late February, the EU together with the U.S., Australia, Canada and Japan agreed to disconnect some Russian banks from the SWIFT community as a part of restrictive measures meant to forestall the Russian central financial institution from circumventing sanctions that had been imposed on Russia on account of its “navy operation” in Ukraine. In a bid to pile extra strain on Russia to stop its “navy operation,” Western powers seized Russia’s $640 billion price of foreign currency reserves.

The implications of this unprecedented transfer are a lot greater than the deplatforming from SWIFT however for my part this was the dying knell for the risk-free standing of U.S. treasuries, which central banks all over the world maintain. Not solely is the whole premise of holding reserves nullified however this motion has additionally confirmed {that a} sovereign nation’s reserves will be confiscated on the drop of a hat. What had beforehand been considered secure and risk-free property turned danger free no extra as non-existent credit score danger was changed by very actual confiscation danger. What good are reserves you could’t entry if you want them?

To cite a comment from an article within the Wall Street Journal:

“Barring gold, these property (i.e. foreign exchange reserves) are another person’s legal responsibility—somebody who can simply resolve they’re price nothing…If foreign money balances have been to turn into nugatory laptop entries and didn’t assure shopping for important stuff, Moscow can be rational to cease accumulating them and stockpile bodily wealth in oil barrels, moderately than promote them to the West.”

The monetary censorship of Russia could appear justified right this moment, however is there any assure that the weaponization of the monetary system won’t be abused in future? Each nation that doesn’t need to turn into weak to “denial-of-service assaults” might want to maintain bitcoin in its treasury as a matter of nationwide safety. This additionally contains nations that aren’t sanctioned as they nonetheless must diversify and restrict their geopolitical danger in a vastly-polarized world. The identical additionally holds true for particular person residents as they’re the collateral injury when financial warfare is unleashed on their nations.

A nation can’t be actually sovereign if its monetary future is managed by one other nation. The chance of being deplatformed from the present dollar-based fiat financial system both through SWIFT, the IMF or non-public firms like PayPal continues to develop every day, each for nation states and people alike. Whereas the IMF or SWIFT aren’t establishments that deal straight with the general public, they do have nice affect on the monetary effectively being of a rustic. Nice consideration must be made when deciding which property to amass in an effort to preserve particular person sovereignty and defend your freedom to transact within the face of an assault. Bitcoin is presently the one monetary asset that can be utilized as a protection towards monetary censorship at a person stage in addition to at a nation state stage.

Had the Russian central financial institution’s reserves been in bitcoin, no nation would have had the flexibility to arbitrarily freeze or seize them. On the flip facet, this occasion could be the greenback system’s Waterloo and will result in fast de-dollarization by nations looking for to cut back their vulnerability to the U.S.’s management.

Assaults On Bitcoin Will Enhance In 2023

“Lots of people robotically dismiss e-currency as a misplaced trigger due to all the businesses that failed because the 1990’s. I hope it’s apparent it was solely the centrally managed nature of these programs that doomed them. I feel that is the primary time we’re attempting a decentralized, non-trust-based system.”

In conclusion, because the curtain comes down on 2022, it’s clear from the few examples that we explored on this essay that monetary censorship is a large drawback of nice concern given its elevated utilization with no indicators of slowing down.

Monetary censorship will proceed to be one of many most-preferred levers that the state, massive tech and bankers will use to silence critics in addition to to pressure compliance with authoritarian insurance policies. As the connection between the state and “non-public sector” gamers will get cozier almost about monetary censorship, our society will proceed its gradual creep towards a dystopian digital feudalistic future.

The censors are usually not ignoring Bitcoin anymore and are taking lively steps to seize it and/or limit its utilization as a lot as potential. Senator Warren’s Digital Asset Anti-Money Laundering bill together with the EU’s Markets In Crypto Assets law (MiCA) are two examples of ongoing makes an attempt at regulatory seize, the place the low-hanging fruit of fiat on/off ramps are the preliminary targets. Given the whole lot that transpired this 12 months, it will be naive to anticipate the state and its non-public sector allies to desert their plans to destroy Bitcoin within the coming 12 months.

That stated, there’s loads of mild on the finish of the tunnel. With every assault that the State throws at Bitcoin, the community will get extra resilient and stronger. Each try at banning Bitcoin, or destroying it, or financially censoring dissenters can have the alternative impact of additional substantiating the explanation for Bitcoin’s existence. These “free advertising and marketing campaigns” will drive dwelling the significance of decentralization and censorship resistance in a simpler manner.

The centralized nature of the fiat financial system and its dependency on trusted third events is each its power (as that is how monetary censorship is enforced) and its Achilles heel (as that is what Bitcoin dematerialized). Within the coming 12 months, as extra folks get canceled financially, it’s incumbent upon us to construct extra user-friendly instruments that improve monetary privateness, develop Bitcoin round economies and extra Bitcoin-focused instructional content material. Decreasing the Bitcoin studying curve, coupled with enhanced monetary privateness and thriving Bitcoin round economies, shall be an ideal bulwark towards assaults from the censors.

In a February 1995 email, Wei Dai, the cryptographer who invented B-Money, which was referenced within the Bitcoin white paper, completely captured the spirit of the above answer when he wrote the next:

“There has by no means been a authorities that did not eventually attempt to cut back the liberty of its topics and acquire extra management over them, and there in all probability by no means shall be one. Subsequently, as an alternative of attempting to persuade our present authorities to not attempt, we’ll develop the know-how that can make it unattainable for the federal government to succeed. Efforts to affect the federal government (e.g., lobbying and propaganda) are necessary solely in as far as to delay its tried crackdown lengthy sufficient for the know-how to mature and are available into huge use. However even when you don’t consider the above is true, give it some thought this fashion: When you’ve got a sure period of time to spend on advancing the reason for higher private privateness, are you able to do it higher through the use of the time to find out about cryptography and develop the instruments to guard privateness, or by convincing your authorities to not invade your privateness?”

Bitcoin’s censorship resistance presents a viable choice to each people and nations alike to resist monetary deplatforming and preserve sovereignty in addition to neutrality in a highly-polarized and cancel-culture pushed world. Regardless of the prevailing bear market, Bitcoin’s censorship resistance stays unchanged. Having a Bitcoin “insurance coverage fund” is essentially the most prudent factor one can do.

As Satoshi Nakamoto wrote, “It’d make sense simply to get some in case it catches on.”

This can be a visitor put up by Kudzai Kutukwa. Opinions expressed are fully their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.

More NFT News

Machine Studying in Focus as Chainalysis Acquires Hexagate

Extra Than Half of Crypto Tokens, Memecoins Launched in 2024 Have been Malicious: Blockaid

Hedera Value Prediction for Right now, December 18 – InsideBitcoins