The CEO of the on-chain analytics agency CryptoQuant has prompt that Grayscale’s current Bitcoin promoting will not be behind the newest downtrend.

Bitcoin Has Been Derivatives-Pushed Lately, Not Spot

In a brand new post on X, CryptoQuant CEO and founder Ki Younger Ju discusses how the derivatives market has been the driving power behind current worth motion in BTC.

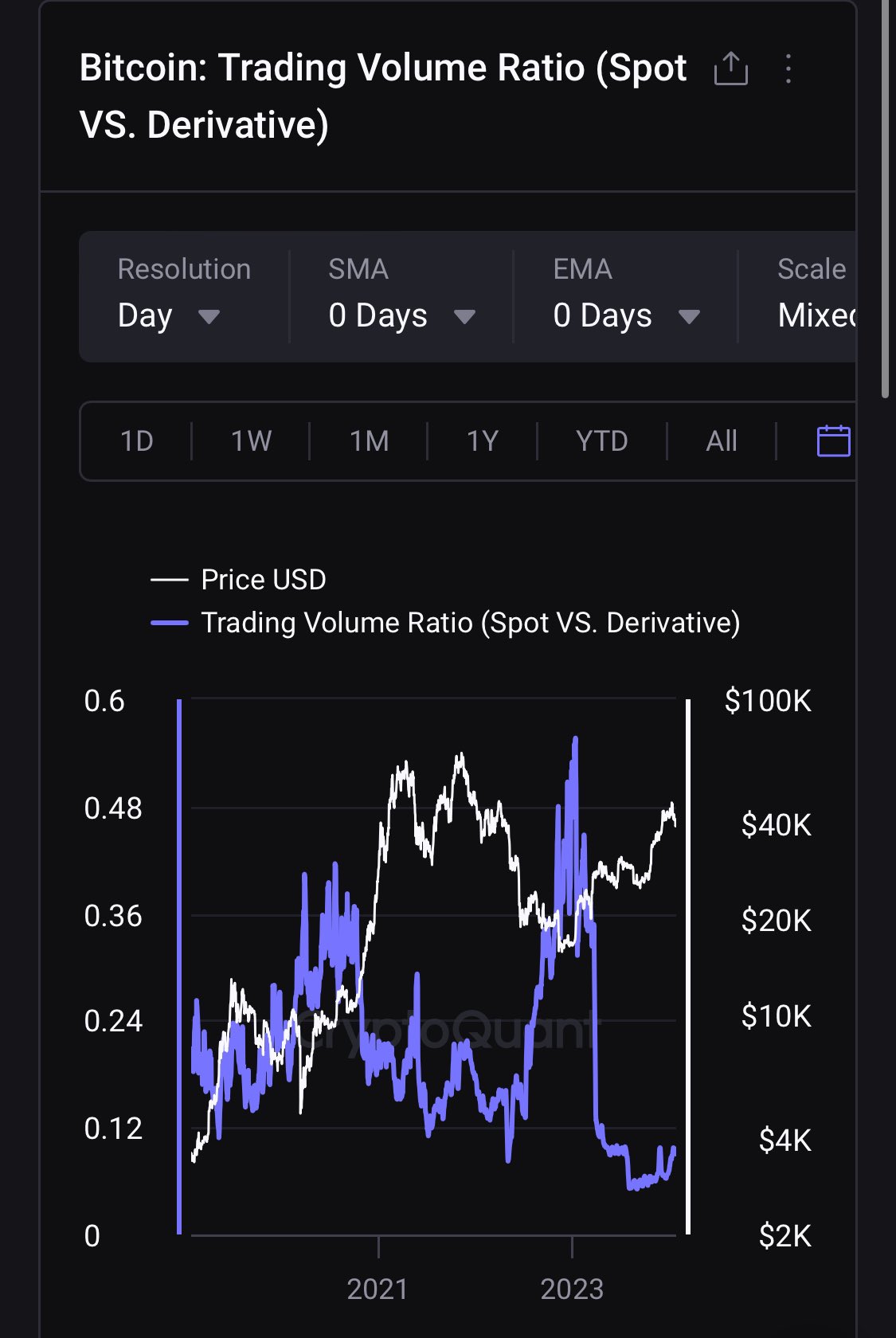

The analyst has cited the “spot vs derivatives buying and selling quantity ratio” indicator to showcase this. The “trading volume” refers to a metric that retains the entire quantity of Bitcoin concerned in some sort of buying and selling exercise each day on a given trade or group of exchanges.

When the worth of this metric is excessive, it means that the platform in query is at the moment observing a excessive quantity of buying and selling exercise. Such a pattern implies that the trade’s customers are extremely thinking about making trades proper now.

The spot vs derivatives buying and selling quantity ratio, the primary metric of curiosity right here, compares the mixed buying and selling volumes on all spot and spinoff platforms.

The ratio’s worth is increased than one, suggesting the spot exchanges are at the moment receiving the next quantity whereas being beneath the market, implying that derivative-based platforms are the dominant power within the sector.

Now, here’s a chart that exhibits the pattern within the Bitcoin buying and selling quantity ratio for these two teams of exchanges over the previous few years:

Appears just like the metric's worth has been fairly low in current days | Supply: @ki_young_ju on X

The spot exchanges naturally function a way for buyers to make spot shopping for and promoting strikes, whereas the spinoff platforms allow customers to open positions on the futures market. As such, the ratio’s worth tells us about which of the 2 modes of buying and selling have increased curiosity in the meanwhile.

The above graph exhibits that the Bitcoin sector has been dominated by the spinoff platforms for some time now, because the ratio’s worth has been lower than one.

The metric’s worth has not too long ago been significantly low, suggesting that buyers’ curiosity in spinoff merchandise has been particularly excessive. This may increasingly point out that the current worth discovery has had the futures market play a bigger position than spot buying and selling.

For the reason that Bitcoin spot ETFs gained approval earlier within the month, the asset’s worth has been struggling, registering a major drawdown towards the $40,000 degree.

Grayscale Bitcoin Belief (GBTC) has been making notable outflows on this similar interval, making some suppose that this promoting stress from the fund may be behind the asset’s drawdown. The CryptoQuant CEO explains, nevertheless, “Bitcoin is in a futures-driven market, much less affected by spot promoting from $GBTC points.”

BTC Value

Bitcoin had slipped beneath the $39,000 mark simply earlier, however it will seem the asset has seen a little bit of a rebound because it’s now buying and selling round $40,000 once more.

BTC is slowly making restoration from its plunge | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, CryptoQuant.com

More NFT News

El Salvador Boosts Bitcoin Purchases After IMF Settlement

No, BlackRock Can't Change Bitcoin

Canine Memecoins Rebound as Bitcoin Reaches $98,000