Information reveals that Bitcoin sentiment is nearly within the excessive concern zone. Right here’s what this might imply for the asset’s worth.

Bitcoin Concern & Greed Index Is Presently Sitting Deep Inside ‘Concern’

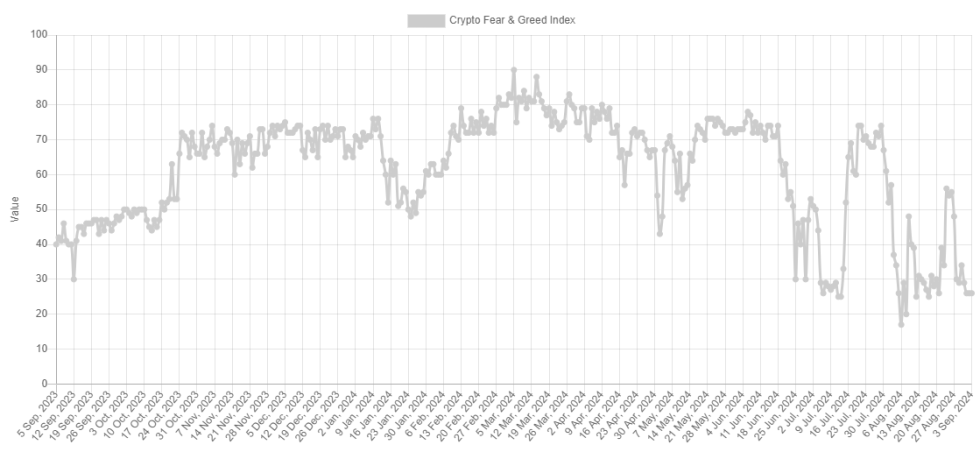

The “Fear & Greed Index” is an indicator created by Alternative that tells us concerning the basic sentiment among the many buyers of Bitcoin and different high cryptocurrencies.

The index represents the sentiment as a rating on a scale between zero to hundred, which it determines utilizing the next 5 elements: volatility, buying and selling quantity, social media sentiment, market cap dominance, and Google Traits.

When the indicator has a price higher than 53, the merchants share a sentiment of greed. However, it being underneath 47 implies the presence of concern available in the market. Naturally, the area between the 2 cutoffs corresponds to a net-neutral mentality.

Now, right here is the place the Bitcoin market stands proper now in keeping with the Concern & Greed Index:

Appears to be like just like the index has a price of 26 in the intervening time | Supply: Alternative

As is seen above, the Bitcoin Concern & Greed Index has a price of 26 proper now, which suggests the market is deep into the concern zone. The metric is true on the boundary of a particular area generally known as extreme fear.

Excessive concern happens when the indicator reaches a price of 25 or decrease and represents a state of immense misery amongst buyers. An identical however reverse zone for the greed facet, known as extreme greed, happens at 75 and better.

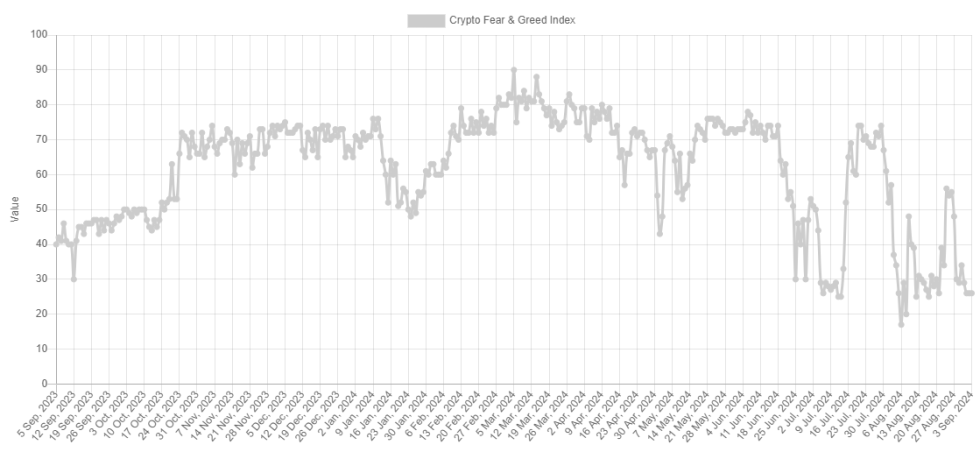

The most recent market sentiment contrasts to that solely round every week in the past, when the index nonetheless alerts “greed values.” The under chart reveals how the indicator’s worth has modified over the previous 12 months.

The worth of the metric seems to have been comparatively low not too long ago | Supply: Alternative

The present fearful market is pure as a result of Bitcoin has registered one other drop, with its worth slipping underneath $58,000 this time. If historical past is something to go by, this improvement will not be fully unhealthy for the asset.

BTC has tended to maneuver in the other way from what the bulk anticipate, and the chance of such a opposite transfer has solely elevated the extra the buyers have change into positive of the asset’s path.

This expectation is the strongest inside the intense sentiment zones, so it’s no shock that main tops and bottoms have typically shaped when the index has been in these areas.

For the reason that Concern & Greed Index has been on the sting of the intense concern zone throughout the previous couple of days, a fall could happen within the coming days, main in direction of a possible backside for Bitcoin. That’s provided that the value doesn’t present a sudden sharp turnaround from right here.

BTC Worth

Bitcoin had recovered above $59,000 earlier within the day, however the restoration was fairly short-lived as it’s already all the way down to $57,700.

The value of the asset seems to have plunged | Supply: BTCUSD on TradingView

Featured picture from Dall-E, Various.me, chart from TradingView.com

More NFT News

El Salvador Boosts Bitcoin Purchases After IMF Settlement

No, BlackRock Can't Change Bitcoin

Canine Memecoins Rebound as Bitcoin Reaches $98,000