That is an opinion editorial by Alex Gladstein, chief technique officer of the Human Rights Basis and writer of “Verify Your Monetary Privilege.”

I. The Shrimp Fields

“Every part is gone.”

–Kolyani Mondal

Fifty-two years in the past, Cyclone Bhola killed an estimated 1 million folks in coastal Bangladesh. It’s, to at the present time, the deadliest tropical cyclone in recorded history. Native and worldwide authorities knew nicely the catastrophic dangers of such storms: within the 1960s, regional officers had built a massive array of dikes to guard the shoreline and open up extra territory for farming. However within the 1980s after the assassination of independence chief Sheikh Mujibur Rahman, overseas affect pushed a brand new autocratic Bangladeshi regime to vary course. Concern for human life was dismissed and the general public’s safety in opposition to storms was weakened, all to be able to enhance exports to repay debt.

As an alternative of reinforcing the native mangrove forests which naturally protected the one-third of the population that lived near the coast, and as an alternative of investing in rising meals to feed the shortly rising nation, the federal government took out loans from the World Bank and International Monetary Fund to be able to increase shrimp farming. The aquaculture course of — managed by a network of rich elites linked to the regime — concerned pushing farmers to take out loans to “improve” their operations by drilling holes within the dikes that protected their land from the ocean, filling their once-fertile fields with saltwater. Then, they might work back-breaking hours to hand-harvest younger shrimp from the ocean, drag them again to their stagnant ponds, and promote the mature ones to the native shrimp lords.

With financing from the World Financial institution and IMF, numerous farms and their surrounding wetlands and mangrove forests have been engineered into shrimp ponds often called ghers. The world’s Ganges river delta is an extremely fertile place, dwelling to the Sundarbans, the world’s greatest stretch of mangrove forest. However because of business shrimp farming changing into the area’s important financial exercise, 45% of the mangroves have been lower away, leaving tens of millions of individuals uncovered to the 10-meter waves that may crash in opposition to the coast throughout main cyclones. Arable land and river life has been slowly destroyed by extra salinity leaking in from the ocean. Whole forests have vanished as shrimp farming has killed a lot of the realm’s vegetation, “rendering this as soon as bountiful land right into a watery desert,” in response to Coastal Growth Partnership.

A farm in Khuna province, flooded to make shrimp fields

The shrimp lords, nonetheless, have made a fortune, and shrimp (known as “white gold”) has turn out to be the nation’s second-largest export. As of 2014, greater than 1.2 million Bangladeshis labored within the shrimp business, with 4.Eight million folks not directly depending on it, roughly half of the coastal poor. The shrimp collectors, who’ve the hardest job, make up 50% of the labor power however solely see 6% of the revenue. Thirty percent of them are ladies and boys engaged in baby labor, who work as a lot as 9 hours a day within the salt water, for lower than $1 per day, with many giving up college and remaining illiterate to take action. Protests in opposition to the enlargement of shrimp farming have occurred, solely to be put down violently. In a single distinguished case, a march was attacked with explosives from shrimp lords and their thugs, and a girl named Kuranamoyee Sardar was decapitated.

In a 2007 research paper, 102 Bangladeshi shrimp farms have been surveyed, revealing that, out of a price of manufacturing of $1,084 per hectare, the online revenue was $689. The nation’s export-driven earnings got here on the expense of the shrimp laborers, whose wages have been deflated and whose setting was destroyed.

In a report by the Environmental Justice Basis, a coastal farmer named Kolyani Mondal said that she “used to farm rice and preserve livestock and poultry,” however after shrimp harvesting was imposed, “her cattle and goats developed diarrhea-type illness and collectively along with her hens and geese, all died.”

Now her fields are flooded with salt water, and what stays is barely productive: years in the past her household may generate “18-19 mon of rice per hectare,” however now they will solely generate one. She remembers shrimp farming in her space starting within the 1980s, when villagers have been promised extra revenue in addition to a number of meals and crops, however now “every little thing is gone.” The shrimp farmers who use her land promised to pay her $140 per 12 months, however she says the perfect she will get are “occasional installments of $Eight right here or there.” Prior to now, she says, “the household bought many of the issues they wanted from the land, however now there aren’t any options however going to the market to purchase meals.”

In Bangladesh, billions of {dollars} of World Financial institution and IMF “structural adjustment” loans — named for the way in which they power borrowing nations to change their economies to favor exports on the expense of consumption — grew nationwide shrimp earnings from $2.9 million in 1973 to $90 million in 1986 to $590 million in 2012. As usually with growing international locations, the income was used to service overseas debt, develop navy belongings, and line the pockets of presidency officers. As for the shrimp serfs, they’ve been impoverished: much less free, extra dependent and fewer capable of feed themselves than earlier than. To make issues worse, research present that “villages shielded from the storm surge by mangrove forests expertise considerably fewer deaths” than villages which had their protections eliminated or broken.

Below public stress in 2013 the World Financial institution loaned Bangladesh $400 million to try to reverse the ecological harm. In different phrases, the World Financial institution shall be paid a price within the type of curiosity to try to repair the issue it created within the first place. In the meantime, the World Financial institution has loaned billions to international locations in every single place from Ecuador to Morocco to India to exchange conventional farming with shrimp manufacturing.

The World Financial institution claims that Bangladesh is “a exceptional story of poverty discount and improvement.” On paper, victory is said: international locations like Bangladesh have a tendency to point out financial progress over time as their exports rise to satisfy their imports. However exports earnings stream largely to the ruling elite and worldwide collectors. After 10 structural adjustments, Bangladesh’s debt pile has grown exponentially from $145 million in 1972 to an all-time excessive of $95.9 billion in 2022. The nation is at the moment going through yet one more steadiness of funds disaster, and simply this month agreed to take its 11th mortgage from the IMF, this time a $4.5 billion bailout, in alternate for extra adjustment. The Financial institution and the Fund declare to need to assist poor international locations, however the clear final result after greater than 50 years of their insurance policies is that nations like Bangladesh are extra dependent and indebted than ever earlier than.

In the course of the 1990s within the wake of the Third World Debt Disaster, there was a swell of worldwide public scrutiny on the Financial institution and Fund: crucial research, road protests, and a widespread, bipartisan perception (even within the halls of the U.S. Congress) that these establishments ranged from wasteful to harmful. However this sentiment and focus has largely pale. At this time, the Financial institution and the Fund handle to maintain a low profile within the press. After they do come up, they are typically written off as more and more irrelevant, accepted as problematic but crucial, and even welcomed as useful.

The fact is that these organizations have impoverished and endangered tens of millions of individuals; enriched dictators and kleptocrats; and forged human rights apart to generate a multi-trillion-dollar stream of meals, pure assets and low cost labor from poor international locations to wealthy ones. Their conduct in international locations like Bangladesh isn’t any mistake or exception: it’s their most popular manner of doing enterprise.

II. Inside The World Financial institution And IMF

“Allow us to keep in mind that the primary function of support is to not assist different nations however to assist ourselves.”

The IMF is the world’s worldwide lender of final resort, and the World Financial institution is the world’s largest development bank. Their work is carried out on behalf of their main collectors, which historically have been the USA, the UK, France, Germany and Japan.

The IMF and World Bank places of work in Washington, DC

The sister organizations — bodily joined collectively at their headquarters in Washington, DC — were created at the Bretton Woods Conference in New Hampshire in 1944 as two pillars of the brand new U.S.-led world financial order. Per custom, the World Financial institution is headed by an American, and the IMF by a European.

Their preliminary function was to assist rebuild war-torn Europe and Japan, with the Financial institution to give attention to particular loans for improvement tasks, and the Fund to handle balance-of-payment points by way of “bailouts” to maintain commerce flowing even when international locations couldn’t afford extra imports.

Nations are required to affix the IMF to be able to get entry to the “perks” of the World Financial institution. At this time, there are 190 member states: every one deposited a mixture of their very own foreign money plus “more durable foreign money” (usually {dollars}, European currencies or gold) once they joined, making a pool of reserves.

When members encounter power balance-of-payments points, and can’t make mortgage repayments, the Fund affords them credit score from the pool at various multiples of what they initially deposited, on more and more costly phrases.

The Fund is technically a supranational central financial institution, as since 1969 it has minted its personal foreign money: the particular drawing rights (SDR), whose worth relies on a basket of the world’s high currencies. At this time, the SDR is backed by 45% {dollars}, 29% euros, 12% yuan, 7% yen and seven% kilos. The entire lending capability of the IMF today stands at $1 trillion.

Between 1960 and 2008, the Fund largely centered on aiding growing international locations with short-term, high-interest-rate loans. As a result of the currencies issued by growing international locations aren’t freely convertible, they often can’t be redeemed for items or providers overseas. Creating states should as an alternative earn exhausting foreign money via exports. Not like the U.S., which might merely difficulty the worldwide reserve foreign money, international locations like Sri Lanka and Mozambique typically run out of cash. At that time, most governments — particularly authoritarian ones — want the fast repair of borrowing in opposition to their nation’s future from the Fund.

As for the Financial institution, it states that its job is to offer credit score to growing international locations to “cut back poverty, enhance shared prosperity, and promote sustainable improvement.” The Financial institution itself is break up up into 5 elements, starting from the Worldwide Financial institution for Reconstruction and Growth (IBRD), which focuses on extra conventional “exhausting” loans to the bigger growing international locations (assume Brazil or India) to the Worldwide Growth Affiliation (IDA), which focuses on “mushy” interest-free loans with lengthy grace intervals for the poorest international locations. The IBRD makes cash partially via the Cantillon impact: by borrowing on favorable phrases from its collectors and personal market contributors who’ve extra direct entry to cheaper capital after which loaning out these funds at greater phrases to poor international locations who lack that entry.

World Financial institution loans traditionally are project- or sector-specific, and have centered on facilitating the uncooked export of commodities (for instance: financing the roads, tunnels, dams, and ports wanted to get minerals out of the bottom and into worldwide markets) and on reworking conventional consumption agriculture into industrial agriculture or aquaculture in order that international locations may export extra meals and items to the West.

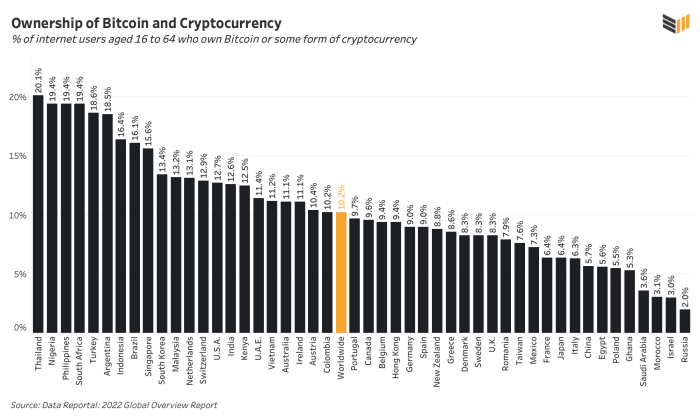

Financial institution and Fund member states shouldn’t have voting energy primarily based on their inhabitants. Reasonably, affect was crafted seven a long time in the past to favor the U.S., Europe and Japan over the remainder of the world. That dominance has solely weakened mildly lately.

At this time the U.S. nonetheless owns far and away the most important vote share, at 15.6% of the Bank and 16.5% of the Fund, sufficient to single-handedly veto any main determination, which requires 85% of votes at both establishment. Japan owns 7.35% of the votes on the Financial institution and 6.14% on the Fund; Germany 4.21% and 5.31%; France and the U.Okay. 3.87% and 4.03% every; and Italy 2.49% and three.02%.

In contrast, India with its 1.Four billion folks solely has 3.04% of the Financial institution’s vote and simply 2.63% on the Fund: much less energy than its former colonial grasp regardless of having a inhabitants 20 occasions greater. China’s 1.Four billion folks get 5.7% on the Financial institution and 6.08% on the fund, roughly the identical share because the Netherlands plus Canada and Australia. Brazil and Nigeria, the most important international locations in Latin America and Africa, have about the identical quantity of sway as Italy, a former imperial energy in full decline.

Tiny Switzerland with simply 8.6 million folks has 1.47% of votes on the World Financial institution, and 1.17% of votes on the IMF: roughly the identical share as Pakistan, Indonesia, Bangladesh, and Ethiopia mixed, regardless of having 90 occasions fewer folks.

These voting shares are purported to approximate every nation’s share of the world financial system, however their imperial-era construction helps shade how selections are made. Sixty-five years after decolonization, the economic powers led by the U.S. proceed to have roughly whole management over world commerce and lending, whereas the poorest international locations have in impact no voice in any respect.

The G-5 (the U.S., Japan, Germany, the U.Okay. and France) dominate the IMF govt board, although they make up a comparatively small p.c of the world’s inhabitants. The G-10 plus Eire, Australia, and Korea make up greater than 50% of the votes, that means that with a little bit stress on its allies, the U.S. could make determinations even on particular mortgage selections, which require a majority.

To enrich the IMF’s trillion-dollar lending energy, the World Financial institution group claims greater than $350 billion in excellent loans throughout greater than 150 international locations. This credit score has spiked over the previous two years, because the sister organizations have lent a whole lot of billions of {dollars} to governments who locked down their economies in response to the COVID-19 pandemic.

Over the previous few months, the Bank and Fund started orchestrating billion-dollar offers to “save” governments endangered by the U.S. Federal Reserve’s aggressive rate of interest hikes. These shoppers are sometimes human rights violators who borrow with out permission from their residents, who will in the end be those answerable for paying again principal plus curiosity on the loans. The IMF is at the moment bailing out Egyptian dictator Abdel Fattah El-Sisi — answerable for the most important massacre of protestors since Tiananmen Sq. — for instance, with $3 billion. In the meantime, the World Financial institution was, through the previous 12 months, disbursing a $300 million mortgage to an Ethiopian authorities that was committing genocide in Tigray.

The cumulative impact of Financial institution and Fund insurance policies is far bigger than the paper quantity of their loans, as their lending drives bilateral help. It’s estimated that “each greenback offered to the Third World by the IMF unlocks an extra 4 to seven {dollars} of recent loans and refinancing from business banks and rich-country governments.” Equally, if the Financial institution and Fund refuse to lend to a specific nation, the remainder of the world usually follows swimsuit.

It’s exhausting to overstate the vast impression the Financial institution and Fund have had throughout growing nations, particularly of their formative a long time after World Struggle II. By 1990 and the top of the Chilly Struggle, the IMF had prolonged credit score to 41 countries in Africa, 28 international locations in Latin America, 20 international locations in Asia, eight international locations within the Center East and 5 international locations in Europe, affecting Three billion folks, or what was then two-thirds of the global population. The World Financial institution has prolonged loans to greater than 160 international locations. They continue to be a very powerful worldwide monetary establishments on the planet.

III. Structural Adjustment

“Adjustment is an ever new and endless job”

–Otmar Emminger, former IMF director and creator of SDR

At this time, monetary headlines are stuffed with tales about IMF visits to international locations like Sri Lanka and Ghana. The end result is that the Fund loans billions of {dollars} to international locations in disaster in alternate for what is called structural adjustment.

In a structural-adjustment mortgage, debtors not solely need to pay again principal plus curiosity: in addition they need to conform to change their economies in response to Financial institution and Fund calls for. These necessities virtually all the time stipulate that shoppers maximize exports on the expense of home consumption.

Throughout analysis for this essay, the writer discovered a lot from the work of the event scholar Cheryl Payer, who wrote landmark books and papers on the affect of the Financial institution and Fund within the 1970s, 1980s and 1990s. This writer might disagree with Payer’s “options” — which, like these of most critics of the Financial institution and Fund, are typically socialist — however many observations she makes in regards to the world financial system maintain true no matter ideology.

“It’s an specific and primary goal of IMF packages,” she wrote, “to discourage native consumption to be able to free assets for export.”

This level can’t be confused sufficient.

The official narrative is that the Financial institution and Fund have been designed to “foster sustainable financial progress, promote greater requirements of residing, and cut back poverty.” However the roads and dams the Financial institution builds aren’t designed to assist enhance transport and electrical energy for locals, however relatively to make it simple for multinational firms to extract wealth. And the bailouts the IMF supplies aren’t to “save” a rustic from chapter — which might in all probability be the perfect factor for it in lots of instances — however relatively to permit it to pay its debt with much more debt, in order that the unique mortgage doesn’t flip right into a gap on a Western financial institution’s steadiness sheet.

In her books on the Financial institution and Fund, Payer describes how the establishments declare that their mortgage conditionality allows borrowing international locations “to attain a more healthy steadiness of commerce and funds.” However the true function, she says, is “to bribe the governments to forestall them from making the financial adjustments which might make them extra unbiased and self-supporting.” When international locations pay again their structural adjustment loans, debt service is prioritized, and home spending is to be “adjusted” downwards.

IMF loans have been typically allotted via a mechanism known as the “stand-by settlement,” a line of credit score that launched funds solely because the borrowing authorities claimed to attain sure goals. From Jakarta to Lagos to Buenos Aires, IMF employees would fly in (all the time first or enterprise class) to satisfy undemocratic rulers and supply them tens of millions or billions of {dollars} in alternate for following their financial playbook.

Typical IMF calls for would include:

- Forex devaluation

- Abolition or discount of overseas alternate and import controls

- Shrinking of home financial institution credit score

- Larger rates of interest

- Elevated taxes

- An finish to client subsidies on meals and power

- Wage ceilings

- Restrictions on authorities spending, particularly in healthcare and training

- Favorable authorized circumstances and incentives for multinational firms

- Promoting off state enterprises and claims on pure assets at hearth sale costs

The World Financial institution had its personal playbook, too. Payer provides examples:

- The opening up of beforehand distant areas via transportation and telecommunications investments

- Aiding multinational firms within the mining sector

- Insisting on manufacturing for export

- Pressuring debtors to enhance authorized privileges for the tax liabilities of overseas funding

- Opposing minimal wage legal guidelines and commerce union exercise

- Ending protections for locally-owned companies

- Financing tasks that applicable land, water and forests from poor folks and hand them to multinational firms

- Shrinking manufacturing and meals manufacturing on the expense of the export of pure assets and uncooked items

Third World governments have traditionally been compelled to conform to a mixture of these insurance policies — generally often called the “Washington Consensus” — to be able to set off the continuing launch of Financial institution and Fund loans.

The previous colonial powers are inclined to focus their “improvement” lending on former colonies or areas of affect: France in West Africa, Japan in Indonesia, Britain in East Africa and South Asia and the U.S. in Latin America. A notable instance is the CFA zone, the place 180 million folks in 15 African international locations are nonetheless forced to use a French colonial foreign money. On the suggestion of the IMF, in 1994 France devalued the CFA by 50%, devastating the financial savings and buying energy of tens of tens of millions of individuals residing in international locations starting from Senegal to Ivory Coast to Gabon, all to make uncooked items exports more competitive.

The end result of Financial institution and Fund insurance policies on the Third World has been remarkably much like what was skilled underneath conventional imperialism: wage deflation, a lack of autonomy and agricultural dependency. The massive distinction is that within the new system, the sword and the gun have been changed by weaponized debt.

Over the past 30 years, structural adjustment has intensified with regard to the typical variety of circumstances in loans prolonged by the Financial institution and Fund. Earlier than 1980, the Financial institution didn’t typically make structural adjustment loans, most every little thing was project- or sector-specific. However since then, “spend this nonetheless you need” bailout loans with financial quid professional quos have turn out to be a rising a part of Financial institution coverage. For the IMF, they’re its lifeblood.

For instance, when the IMF bailed out South Korea and Indonesia with $57 billion and $43 billion packages through the 1997 Asian Monetary Disaster, it imposed heavy conditionality. Debtors needed to signal agreements that “appeared extra like Christmas bushes than contracts, with anyplace from 50 to 80 detailed circumstances protecting every little thing from the deregulation of garlic monopolies to taxes on cattle feed and new environmental legal guidelines,” in response to political scientist Mark S. Copelvitch.

A 2014 analysis confirmed that the IMF had connected, on common, 20 circumstances to every mortgage it gave out within the earlier two years, a historic enhance. International locations like Jamaica, Greece and Cyprus have borrowed lately with a median of 35 circumstances every. It’s price noting that Financial institution and Fund circumstances have by no means included protections on free speech or human rights, or restrictions on navy spending or police violence.

An added twist of Financial institution and Fund coverage is what is called the “double mortgage”: cash is lent to construct, for instance, a hydroelectric dam, however most if not the entire cash will get paid to Western corporations. So, the Third World taxpayer is saddled with principal and curiosity, and the North will get paid again double.

The context for the double mortgage is that dominant states lengthen credit score via the Financial institution and Fund to former colonies, the place native rulers typically spend the brand new money straight again to multinational corporations who revenue from advising, building or import providers. The following and required foreign money devaluation, wage controls and financial institution credit score tightening imposed by Financial institution and Fund structural adjustment drawback native entrepreneurs who’re caught in a collapsing and remoted fiat system, and profit multinationals who’re greenback, euro or yen native.

One other key supply for this writer has been the masterful ebook “The Lords of Poverty” by historian Graham Hancock, written to replicate on the primary 5 a long time of Financial institution and Fund coverage and overseas help normally.

“The World Financial institution,” Hancock writes, “is the primary to confess that out of each $10 that it receives, round $7 are in actual fact spent on items and providers from the wealthy industrialized international locations.”

Within the 1980s, when Financial institution funding was increasing rapidly world wide, he famous that “for each US tax greenback contributed, 82 cents are instantly returned to American companies within the type of buy orders.” This dynamic applies not simply to loans but additionally to assist. For instance, when the U.S. or Germany sends a rescue aircraft to a rustic in disaster, the price of transport, meals, drugs and employees salaries are added to what’s often called ODA, or “official improvement help.” On the books, it appears to be like like support and help. However many of the cash is paid proper again to Western corporations and never invested regionally.

Reflecting on the Third World Debt Disaster of the 1980s, Hancock famous that “70 cents out of each greenback of American help by no means truly left the USA.” The U.Okay., for its half, spent a whopping 80% of its support throughout that point straight on British items and providers.

“One 12 months,” Hancock writes, “British tax-payers offered multilateral support companies with 495 million kilos; in the identical 12 months, nonetheless, British companies obtained contracts price 616 million kilos.” Hancock mentioned that multilateral companies may very well be “relied upon to buy British items and providers with a worth equal to 120% of Britain’s whole multilateral contribution.”

One begins to see how the “support and help” we have a tendency to consider as charitable is actually fairly the alternative.

And as Hancock factors out, foreign-aid budgets all the time enhance irrespective of the end result. Simply as progress is proof that the help is working, a “lack of progress is proof that the dosage has been inadequate and have to be elevated.”

Some improvement advocates, he writes, “argue that it will be inexpedient to disclaim support to the speedy (those that advance); others, that it will be merciless to disclaim it to the needy (those that stagnate). Support is thus like champagne: in success you deserve it, in failure you want it.”

IV. The Debt Lure

“The idea of the Third World or the South and the coverage of official support are inseparable. They’re two sides of the identical coin. The Third World is the creation of the overseas support: with out overseas support there isn’t a Third World.”

In line with the World Financial institution, its objective is “to assist increase residing requirements in growing international locations by channeling monetary assets from developed international locations to the growing world.”

However what if the fact is the alternative?

At first, starting within the 1960s, there was an unlimited stream of assets from wealthy international locations to poor ones. This was ostensibly executed to assist them develop. Payer writes that it was lengthy thought of “pure” for capital to “stream in a single path solely from the developed industrial economies to the Third World.”

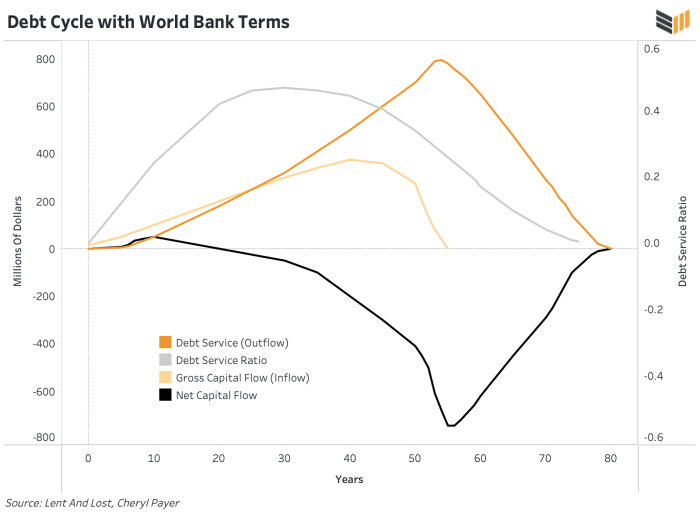

The life cycle of a World Financial institution mortgage: optimistic, then deeply unfavorable money flows for the borrower nation

However, as she reminds us, “sooner or later the borrower has to pay extra to his creditor than he has obtained from the creditor and over the lifetime of the mortgage this extra is far greater than the quantity that was initially borrowed.”

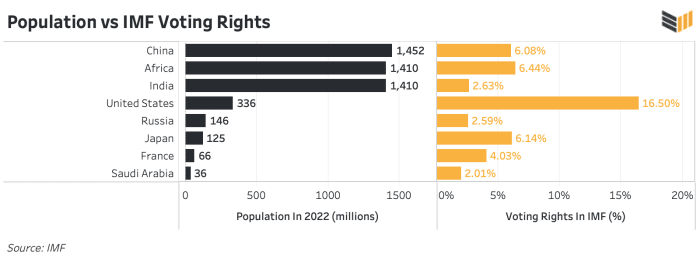

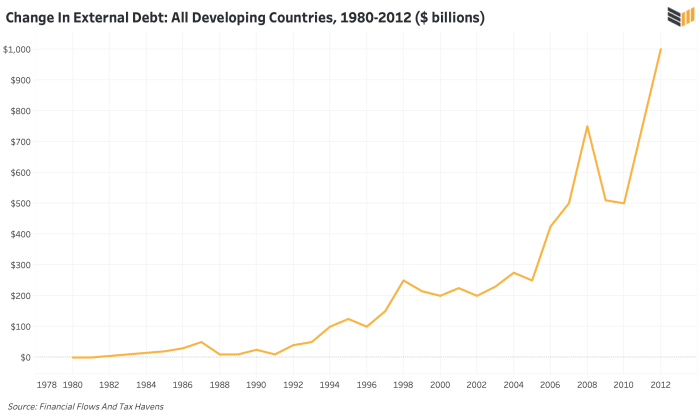

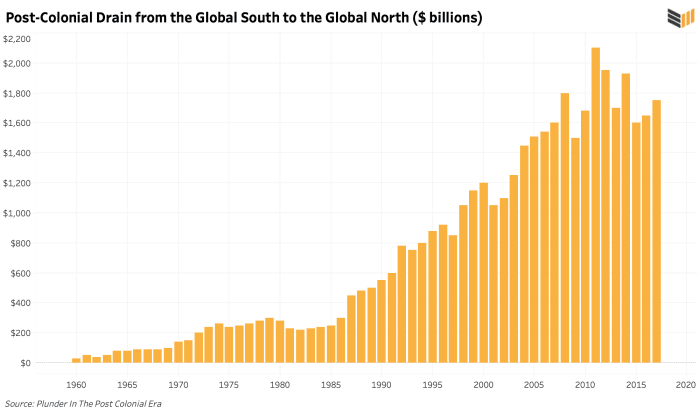

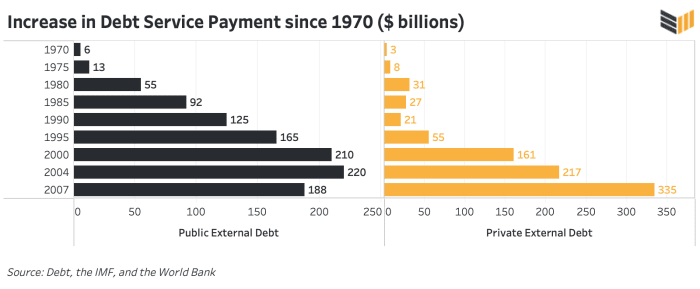

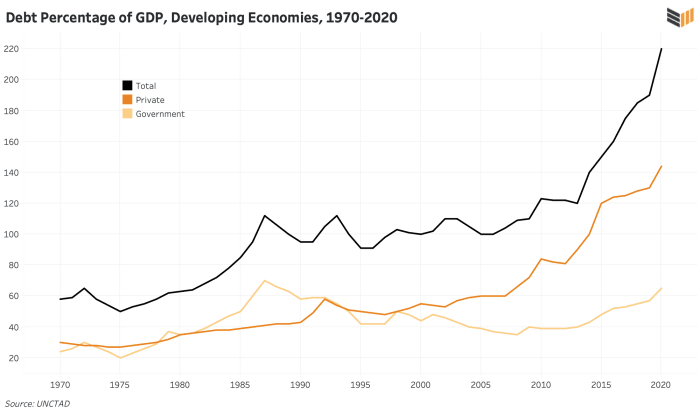

In world economics, this level occurred in 1982, when the stream of assets completely reversed. Ever since, there was an annual internet stream of funds from poor international locations to wealthy ones. This began as a median of $30 billion per 12 months flowing from South to North within the mid-to-late 1980s, and is today within the vary of trillions of {dollars} per 12 months. Between 1970 and 2007 — from the top of the gold customary to the Nice Monetary Disaster — the whole debt service paid by poor international locations to wealthy ones was $7.15 trillion.

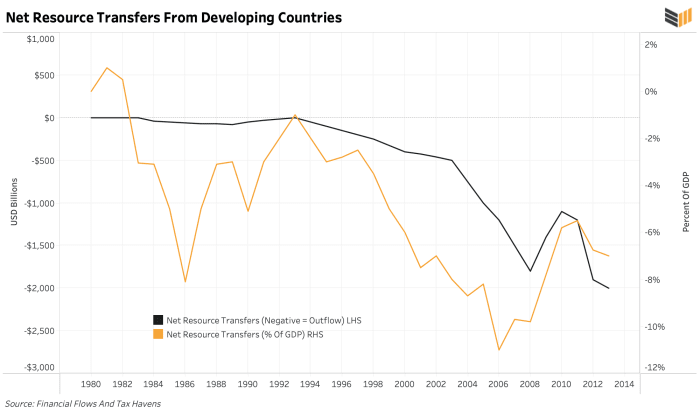

Web useful resource transfers from growing international locations: more and more unfavorable since 1982

To provide an instance of what this may seem like in a given 12 months, in 2012 growing international locations obtained $1.3 trillion, together with all revenue, support and funding. However that very same 12 months, greater than $3.Three trillion flowed out. In different phrases, according to anthropologist Jason Hickel, “growing international locations despatched $2 trillion extra to the remainder of the world than they obtained.”

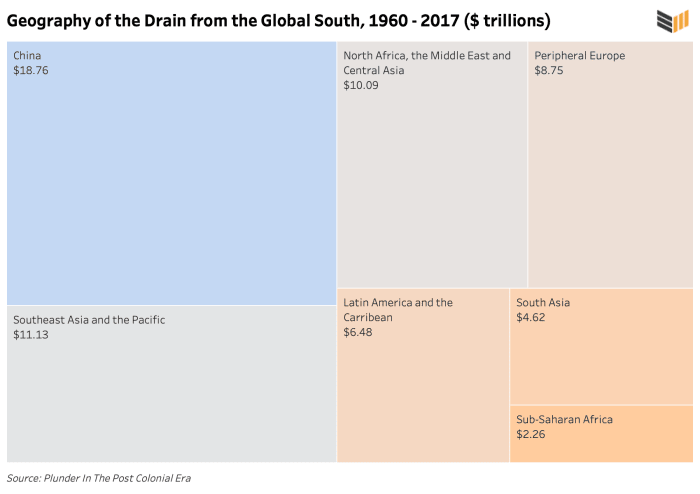

When all of the flows have been added up from 1960 to 2017, a grim fact emerged: $62 trillion was drained out of the growing world, the equal of 620 Marshall Plans in in the present day’s {dollars}.

The IMF and World Financial institution have been supposed to repair steadiness of funds points, and assist poor international locations develop stronger and extra sustainable. The proof has been the direct reverse.

“For each $1 of support that growing international locations obtain,” Hickel writes, “they lose $24 in internet outflows.” As an alternative of ending exploitation and unequal alternate, research show that structural adjustment insurance policies grew them in a large manner.

Since 1970, the exterior public debt of growing international locations has elevated from $46 billion to $8.7 trillion. Prior to now 50 years, international locations like India and the Philippines and the Congo now owe their former colonial masters 189 occasions the quantity they owed in 1970. They’ve paid $4.2 trillion on curiosity funds alone since 1980.

Even Payer — whose 1974 ebook “The Debt Trap” used financial stream knowledge to point out how the IMF ensnared poor international locations by encouraging them to borrow greater than they might presumably pay again — could be shocked on the dimension of in the present day’s debt entice.

Her commentary that “the typical citizen of the US or Europe will not be conscious of this monumental drain in capital from elements of the world they consider as being pitifully poor” nonetheless rings true in the present day. To this writer’s personal disgrace, he didn’t know in regards to the true nature of the worldwide stream of funds and easily assumed that wealthy international locations sponsored poor ones earlier than embarking on the analysis for this undertaking. The tip result’s a literal Ponzi scheme, the place by the 1970s, Third World debt was so huge that it was solely attainable to service with new debt. It has been the identical ever since.

Many critics of the Financial institution and Fund assume that these establishments are working with their coronary heart in the correct place, and once they do fail, it’s due to errors, waste or mismanagement.

It’s the thesis of this essay that this isn’t true, and that the foundational objectives of the Fund and Financial institution are to not repair poverty however relatively to complement creditor nations on the expense of poor ones.

This writer is solely not prepared to imagine {that a} everlasting stream of funds from poor international locations to wealthy ones since 1982 is a “mistake.” The reader might dispute that the association is intentional, and relatively might imagine it’s an unconscious structural final result. The distinction hardly issues to the billions of individuals the Financial institution and Fund have impoverished.

V. Changing the Colonial Useful resource Drain

“I’m so uninterested in ready. Aren’t you, for the world to turn out to be good and exquisite and type? Allow us to take a knife and lower the world in two — and see what worms are consuming on the rind.”

By the top of the 1950s, Europe and Japan had largely recovered from warfare and resumed important industrial progress, whereas Third World international locations ran out of funds. Regardless of having wholesome steadiness sheets within the 1940s and early 1950s, poor, raw-material-exporting international locations bumped into balance-of-payments issues as the worth of their commodities tanked within the wake of the Korean Struggle. That is when the debt entice started, and when the Financial institution and Fund began the floodgates of what would find yourself changing into trillions of {dollars} of lending.

This period additionally marked the official finish of colonialism, as European empires drew again from their imperial possessions. The institution assumption in worldwide improvement is that the financial success of countries is due “primarily to their inside, home circumstances. Excessive-income international locations have achieved financial success,” the idea goes, “due to good governance, sturdy establishments and free markets. Decrease-income international locations have did not develop as a result of they lack this stuff, or as a result of they endure from corruption, purple tape and inefficiency.”

That is actually true. However one other main motive why wealthy international locations are wealthy and poor international locations are poor is that the previous looted the latter for a whole lot of years through the colonial interval.

“Britain’s industrial revolution,” Jason Hickel writes, “depended largely on cotton, which was grown on land forcibly appropriated from Indigenous People, with labor appropriated from enslaved Africans. Different essential inputs required by British producers — hemp, timber, iron, grain — have been produced utilizing compelled labor on serf estates in Russia and Jap Europe. In the meantime, British extraction from India and different colonies funded greater than half the nation’s home price range, paying for roads, public buildings, the welfare state — all of the markets of contemporary improvement — whereas enabling the acquisition of fabric inputs crucial for industrialization.”

The theft dynamic was described by Utsa and Prabhat Patnaik of their ebook “Capital And Imperialism”: colonial powers just like the British empire would use violence to extract uncooked supplies from weak international locations, making a “colonial drain” of capital that boosted and sponsored life in London, Paris and Berlin. Industrial nations would remodel these uncooked supplies into manufactured items, and promote them again to weaker nations, profiting massively whereas additionally crowding out native manufacturing. And — critically — they might preserve inflation at dwelling down by suppressing wages within the colonial territories. Both via outright slavery or via paying nicely beneath the worldwide market charge.

Because the colonial system started to falter, the Western monetary world confronted a disaster. The Patnaiks argue that the Nice Melancholy was a outcome not merely of adjustments in Western financial coverage, but additionally of the colonial drain slowing down. The reasoning is easy: wealthy international locations had constructed a conveyor belt of assets flowing from poor international locations, and when the belt broke, so did every little thing else. Between the 1920s and 1960s, political colonialism grew to become just about extinct. Britain, the U.S., Germany, France, Japan, the Netherlands, Belgium and different empires have been compelled to surrender management over greater than half of the world’s territory and assets.

Because the Patnaiks write, imperialism is “an association for imposing revenue deflation on the Third World inhabitants to be able to get their major commodities with out operating into the issue of accelerating provide value.”

Publish 1960, this grew to become the brand new operate for the World Financial institution and IMF: recreating the colonial drain from poor international locations to wealthy international locations that was as soon as maintained by simple imperialism.

Officers within the U.S., Europe and Japan wished to attain “inside equilibrium” — in different phrases, full employment. However they realized they might not do that by way of subsidy inside an remoted system, or else inflation would run rampant. To realize their aim would require exterior enter from poorer international locations. The extra surplus value extracted by the core from employees within the periphery is called “imperialist lease.” If industrial international locations may get cheaper supplies and labor, after which promote the completed items again at a revenue, they might inch nearer to the technocrat dream financial system. They usually bought their want: as of 2019, wages paid to employees within the growing world have been 20% the extent of wages paid to employees within the developed world.

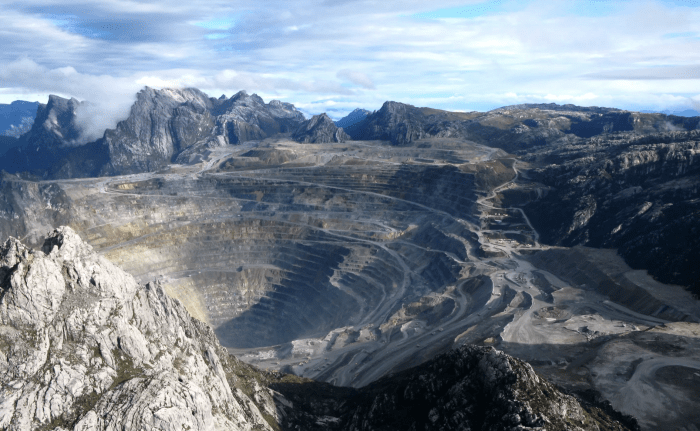

For example of how the Financial institution recreated the colonial drain dynamic, Payer provides the traditional case of 1960s Mauritania in northwest Africa. A mining undertaking known as MIFERMA was signed by French occupiers earlier than the colony grew to become unbiased. The deal finally grew to become “simply an old style enclave undertaking: a metropolis in a desert and a railroad resulting in the ocean,” because the infrastructure was solely centered on spiriting minerals away to worldwide markets. In 1969, when the mine accounted for 30% of Mauritania’s GDP and 75% of its exports, 72% of the revenue was despatched overseas, and “virtually all of the revenue distributed regionally to workers evaporated in imports.” When the miners protested in opposition to the neocolonial association, safety forces savagely put them down.

MIFERMA is a stereotypical instance of the form of “improvement” that might be imposed on the Third World in every single place from the Dominican Republic to Madagascar to Cambodia. And of those tasks quickly expanded within the 1970s, because of the petrodollar system.

Publish-1973, Arab OPEC international locations with monumental surpluses from skyrocketing oil costs sank their earnings into deposits and treasuries in Western banks, which wanted a spot to lend out their rising assets. Navy dictators throughout Latin America, Africa and Asia made nice targets: that they had excessive time preferences and have been glad to borrow in opposition to future generations.

Serving to expedite mortgage progress was the “IMF put”: personal banks began to imagine (appropriately) that the IMF would bail out international locations in the event that they defaulted, defending their investments. Furthermore, rates of interest within the mid-1970s have been typically in unfavorable actual territory, additional encouraging debtors. This — mixed with World Financial institution president Robert McNamara’s insistence that help increase dramatically — resulted in a debt frenzy. U.S. banks, for instance, elevated their Third World mortgage portfolio by 300% to $450 billion between 1978 and 1982.

The issue was that these loans have been largely floating rate of interest agreements, and some years later, these charges exploded because the U.S. Federal Reserve raised the worldwide price of capital near 20%. The rising debt burden mixed with the 1979 oil value shock and the following world collapse within the value of commodities that energy the worth of growing nation exports paved the way in which for the Third World Debt Disaster. To make issues worse, little or no of the cash borrowed by governments through the debt frenzy was truly invested within the common citizen.

Of their aptly named ebook “Debt Squads,” investigative journalists Sue Branford and Bernardo Kucinski clarify that between 1976 and 1981, Latin governments (of which 18 of 21 have been dictatorships) borrowed $272.9 billion. Out of that, 91.6% was spent on debt servicing, capital flight and build up regime reserves. Solely 8.4% was used on home funding, and even out of that, a lot was wasted.

Brazilian civil society advocate Carlos Ayuda vividly described the impact of the petrodollar-fueled drain on his personal nation:

“The navy dictatorship used the loans to put money into large infrastructure tasks — notably power tasks… the concept behind creating an unlimited hydroelectric dam and plant in the course of the Amazon, for instance, was to supply aluminum for export to the North… the federal government took out large loans and invested billions of {dollars} in constructing the Tucuruí dam within the late 1970s, destroying native forests and eradicating huge numbers of native peoples and poor rural people who had lived there for generations. The federal government would have razed the forests, however the deadlines have been so quick they used Agent Orange to defoliate the area after which submerged the leafless tree trunks underwater… the hydroelectric plant’s power [was then] offered at $13-20 per megawatt when the precise value of manufacturing was $48. So the taxpayers offered subsidies, financing low cost power for transnational firms to promote our aluminum within the worldwide market.”

In different phrases, the Brazilian folks paid overseas collectors for the service of destroying their setting, displacing the lots and promoting their assets.

At this time the drain from low- and middle-income international locations is staggering. In 2015, it totaled 10.1 billion tons of uncooked supplies and 182 million person-years of labor: 50% of all items and 28% of all labor used that 12 months by high-income international locations.

VI. A Dance With Dictators

“He could also be a son of a bitch, however he’s our son of a bitch.”

In fact, it takes two sides to finalize a mortgage from the Financial institution or Fund. The issue is that the borrower is usually an unelected or unaccountable chief, who makes the choice with out consulting with and and not using a in style mandate from their residents.

As Payer writes in “The Debt Lure,” “IMF packages are politically unpopular, for the superb concrete causes that they harm native enterprise and depress the true revenue of the voters. A authorities which makes an attempt to hold out the circumstances in its Letter of Intent to the IMF is more likely to discover itself voted out of workplace.”

Therefore, the IMF prefers to work with undemocratic shoppers who can extra simply dismiss troublesome judges and put down road protests. In line with Payer, the navy coups in Brazil in 1964, Turkey in 1960, Indonesia in 1966, Argentina in 1966 and the Philippines in 1972 have been examples of IMF-opposed leaders being forcibly changed by IMF-friendly ones. Even when the Fund wasn’t straight concerned within the coup, in every of those instances, it arrived enthusiastically just a few days, weeks or months later to assist the brand new regime implement structural adjustment.

The Financial institution and Fund share a willingness to help abusive governments. Maybe surprisingly, it was the Financial institution that began the custom. In line with improvement researcher Kevin Danaher, “the Financial institution’s unhappy document of supporting navy regimes and governments that brazenly violated human rights started on August 7, 1947, with a $195 million reconstruction mortgage to the Netherlands. Seventeen days earlier than the Financial institution accepted the mortgage, the Netherlands had unleashed a warfare in opposition to anti-colonialist nationalist in its large abroad empire within the East Indies, which had already declared its independence because the Republic of Indonesia.”

“The Dutch,” Danaher writes, “despatched 145,000 troops (from a nation with solely 10 million inhabitants on the time, economically struggling at 90% of 1939 manufacturing) and launched a complete financial blockade of nationalist-held areas, inflicting appreciable starvation and well being issues amongst Indonesia’s 70 million inhabitants.”

In its first few a long time the Financial institution funded many such colonial schemes, together with $28 million for apartheid Rhodesia in 1952, in addition to loans to Australia, the UK, and Belgium to “develop” colonial possessions in Papua New Guinea, Kenya and the Belgian Congo.

In 1966, the Financial institution directly defied the United Nations, “persevering with to lend cash to South Africa and Portugal regardless of resolutions of the Common Meeting calling on all UN-affiliated companies to stop monetary help for each international locations,” in response to Danaher.

Danaher writes that “Portugal’s colonial domination of Angola and Mozambique and South Africa’s apartheid have been flagrant violations of the UN constitution. However the Financial institution argued that Article IV, Part 10 of its Constitution which prohibits interference within the political affairs of any member, legally obliged it to ignore the UN resolutions. In consequence the Financial institution accepted loans of $10 million to Portugal and $20 million to South Africa after the UN decision was handed.”

Typically, the Financial institution’s desire for tyranny was stark: it lower off lending to the democratically-elected Allende authorities in Chile within the early 1970s, however shortly after started to lend large portions of money to Ceausescu’s Romania, one of many world’s worst police states. That is additionally an instance of how the Financial institution and Fund, opposite to in style perception, didn’t merely lend alongside Chilly Struggle ideological strains: for each right-wing Augusto Pinochet Ugarte or Jorge Rafael Videla consumer, there was a left-wing Josip Broz Tito or Julius Nyerere.

In 1979, Danaher notes, 15 of the world’s most repressive governments would obtain a full third of all Financial institution loans. This even after the U.S. Congress and the Carter administration had stopped support to 4 of the 15 — Argentina, Chile, Uruguay and Ethiopia — for “flagrant human rights violations.” Just some years later, in El Salvador, the IMF made a $43 million mortgage to the navy dictatorship, only a few months after its forces dedicated the most important bloodbath in Chilly Struggle-era Latin America by annihilating the village of El Mozote.

There have been a number of books written in regards to the Financial institution and the Fund in 1994, timed as 50-year retrospectives on the Bretton Woods establishments. “Perpetuating Poverty” by Ian Vàsquez and Doug Bandow is a type of research, and is a very precious one because it supplies a Libertarian evaluation. Most crucial research of the Financial institution and Fund are from the left: however the Cato Institute’s Vásquez and Bandow noticed lots of the identical issues.

“The Fund underwrites any authorities,” they write, “nonetheless venal and brutal… China owed the Fund $600 million as of the top of 1989; in January 1990, only a few months after the blood had dried in Beijing’s Tiananmen Sq., the IMF held a seminar on financial coverage within the metropolis.”

Vásquez and Bandow point out different tyrannical shoppers starting from navy Burma, to Pinochet’s Chile, Laos, Nicaragua underneath Anastasio Somoza Debayle and the Sandinistas, Syria, and Vietnam.

“The IMF,” they are saying, “has not often met a dictatorship that it didn’t like.”

Vásquez and Bandow detail the Financial institution’s relationship with the Marxist-Leninist Mengistu Haile Mariam regime in Ethiopia, the place it offered for as a lot as 16% of the federal government’s annual price range whereas it had one of many worst human rights information on the planet. The Financial institution’s credit score arrived simply as Mengistu’s forces have been “herding folks into focus camps and collective farms.” In addition they level out how the Financial institution gave the Sudanese regime $16 million whereas it was driving 750,000 refugees out of Khartoum into the desert, and the way it gave a whole lot of tens of millions of {dollars} to Iran — a brutal theocratic dictatorship — and Mozambique, whose safety forces have been notorious for torture, rape and abstract executions.

In his 2011 ebook “Defeating Dictators,” the celebrated Ghanaian improvement economist George Ayittey detailed a protracted listing of “aid-receiving autocrats”: Paul Biya, Idriss Déby, Lansana Conté, Paul Kagame, Yoweri Museveni, Hun Sen, Islam Karimov, Nursultan Nazarbayev and Emomali Rahmon. He identified that the Fund had distributed $75 billion to those 9 tyrants alone.

In 2014, a report was launched by the Worldwide Consortium of Investigative Journalists, alleging that the Ethiopian authorities had used a part of a $2 billion Financial institution mortgage to forcibly relocate 37,883 indigenous Anuak households. This was 60% of the nation’s complete Gambella province. Troopers “beat, raped, and killed” Anuak who refused to depart their properties. Atrocities have been so bad that South Sudan granted refugee standing to Anuaks streaming in from neighboring Ethiopia. A Human Rights Watch report mentioned that the stolen land was then “leased by the federal government to traders” and that the Financial institution’s cash was “used to pay the salaries of presidency officers who helped perform the evictions.” The Financial institution accepted new funding for this “villagization” program even after allegations of mass human rights violations emerged.

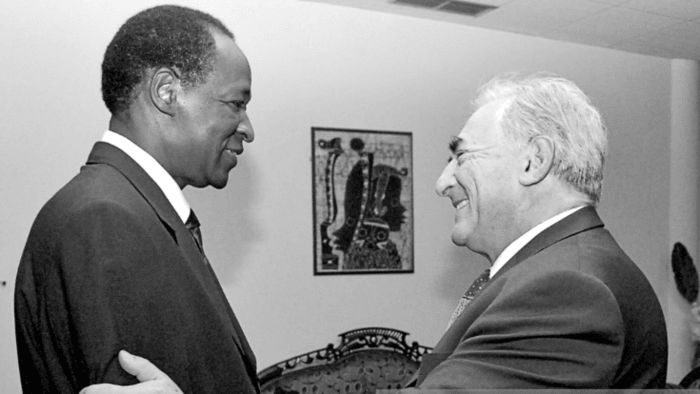

Mobutu Sese Soko and Richard Nixon on the White Home in 1973

It will be a mistake to depart Mobutu Sese Soko’s Zaire out of this essay. The recipient of billions of {dollars} of Financial institution and Fund credit score throughout his bloody 32-year reign, Mobutu pocketed 30% of incoming support and help and let his folks starve. He complied with 11 IMF structural changes: throughout one in 1984, 46,000 public college academics have been fired and the nationwide foreign money was devalued by 80%. Mobutu known as this austerity “a bitter capsule which we’ve no different however to swallow,” however didn’t promote any of his 51 Mercedes, any of his 11 chateaus in Belgium or France, and even his Boeing 747 or 16th century Spanish citadel.

Per capita revenue declined in every year of his rule on common by 2.2%, leaving greater than 80% of the inhabitants in absolute poverty. Kids routinely died earlier than the age of 5, and swollen-belly syndrome was rampant. It’s estimated that Mobutu personally stole $5 billion, and presided over one other $12 billion in capital flight, which collectively would have been greater than sufficient to wipe the nation’s $14 billion debt clear on the time of his ouster. He looted and terrorized his folks, and couldn’t have executed it with out the Financial institution and Fund, which continued to bail him out although it was clear he would by no means repay his money owed.

That each one mentioned, the true poster boy for the Financial institution and Fund’s affection for dictators could be Ferdinand Marcos. In 1966, when Marcos got here to energy, the Philippines was the second-most affluent nation in Asia, and the nation’s foreign debt stood at roughly $500 million. By the point Marcos was eliminated in 1986, the debt stood at $28.1 billion.

As Graham Hancock writes in “Lords Of Poverty,” most of those loans “had been contracted to pay for extravagant improvement schemes which, though irrelevant to the poor, had pandered to the large ego of the top of state… a painstaking two-year investigation established past critical dispute that he had personally expropriated and despatched out of the Philippines greater than $10 billion. A lot of this cash — which after all, ought to have been on the disposal of the Philippine state and folks — had disappeared eternally in Swiss financial institution accounts.”

“$100 million,” Hancock writes, “was paid for the artwork assortment for Imelda Marcos… her tastes have been eclectic and included six Previous Masters bought from the Knodeler Gallery in New York for $5 million, a Francis Bacon canvas provided by the Marlborough Gallery in London, and a Michelangelo, ‘Madonna and Little one’ purchased from Mario Bellini in Florence for $3.5 million.”

“Over the last decade of the Marcos regime,” he says, “whereas precious artwork treasuries have been being held on penthouse partitions in Manhattan and Paris, the Philippines had decrease dietary requirements than every other nation in Asia aside from war-torn Cambodia.”

To comprise in style unrest, Hancock writes that Marcos banned strikes and “union organizing was outlawed in all key industries and in agriculture. Hundreds of Filipinos have been imprisoned for opposing the dictatorship and lots of have been tortured and killed. In the meantime the nation remained persistently listed among the many high recipients of each US and World Financial institution improvement help.”

After the Filipino folks pushed Marcos out, they still needed to pay an annual sum of anyplace between 40% and 50% of your complete worth of their exports “simply to cowl the curiosity on the overseas money owed that Marcos incurred.”

One would assume that after ousting Marcos, the Filipino folks wouldn’t need to owe the debt he incurred on their behalf with out consulting them. However that isn’t the way it has labored in observe. In concept, this idea is known as “odious debt” and was invented by the U.S. in 1898 when it repudiated Cuba’s debt after Spanish forces have been ousted from the island.

American leaders decided that money owed “incurred to subjugate a folks or to colonize them” weren’t respectable. However the Financial institution and Fund have by no means adopted this precedent throughout their 75 years of operations. Satirically, the IMF has an article on its web site suggesting that Somoza, Marcos, Apartheid South Africa, Haiti’s “Child Doc” and Nigeria’s Sani Abacha all borrowed billions illegitimately, and that the debt must be written off for his or her victims, however this stays a suggestion unfollowed.

Technically and morally talking, a big proportion of Third World debt must be thought of “odious” and never owed anymore by the inhabitants ought to their dictator be compelled out. In any case, usually, the residents paying again the loans didn’t elect their chief and didn’t select to borrow the loans that they took out in opposition to their future.

In July 1987, the revolutionary chief Thomas Sankara gave a speech to the Organistion of African Unity (OAU) in Ethiopia, the place he refused to pay the colonial debt of Burkina Faso, and inspired different African nations to affix him.

“We can’t pay,” he mentioned, “as a result of we’re not answerable for this debt.”

Sankara famously boycotted the IMF and refused structural adjustment. Three months after his OAU speech, he was assassinated by Blaise Compaoré, who would set up his personal 27-year navy regime that might obtain four structural adjustment loans from the IMF and borrow dozens of times from the World Financial institution for numerous infrastructure and agriculture tasks. Since Sankara’s dying, few heads of state have been prepared to take a stand to repudiate their money owed.

Burkinese dictator Blaise Compaoré and IMF managing director Dominique Strauss-Kahn. Compaoré seized energy after assassinating Thomas Sankara (who tried to refuse Western debt) and he went on to borrow billions from the Financial institution and Fund.

One huge exception was Iraq: after the U.S. invasion and ouster of Saddam Hussein in 2003, American authorities managed to get a few of the debt incurred by Hussein to be thought of “odious” and forgiven. However this was a singular case: for the billions of people that suffered underneath colonialists or dictators, and have since been compelled to pay their money owed plus curiosity, they haven’t gotten this particular therapy.

Lately, the IMF has even acted as a counter-revolutionary power in opposition to democratic actions. Within the 1990s, the Fund was extensively criticized on the left and the right for serving to to destabilize the previous Soviet Union because it descended into financial chaos and congealed into Vladimir Putin’s dictatorship. In 2011, because the Arab Spring protests emerged throughout the Center East, the Deauville Partnership with Arab Countries in Transition was fashioned and met in Paris.

By way of this mechanism, the Financial institution and Fund led huge mortgage affords to Yemen, Tunisia, Egypt, Morocco and Jordan — “Arab international locations in transition” — in alternate for structural adjustment. In consequence, Tunisia’s overseas debt skyrocketed, triggering two new IMF loans, marking the primary time that the nation had borrowed from the Fund since 1988. The austerity measures paired with these loans compelled the devaluation of the Tunisian dinar, which spiked costs. Nationwide protests broke out as the federal government continued to comply with the Fund playbook with wage freezes, new taxes and “early retirement” within the public sector.

Twenty-nine-year-old protestor Warda Atig summed up the scenario: “So long as Tunisia continues these offers with the IMF, we are going to proceed our battle,” she mentioned. “We imagine that the IMF and the pursuits of individuals are contradictory. An escape from submission to the IMF, which has introduced Tunisia to its knees and strangled the financial system, is a prerequisite to result in any actual change.”

VII. Creating Agricultural Dependence

“The concept growing international locations ought to feed themselves is an anachronism from a bygone period. They may higher guarantee their meals safety by counting on the U.S. agricultural merchandise, which can be found usually at decrease price.”

On account of Financial institution and Fund coverage, all throughout Latin America, Africa, the Center East, and South and East Asia, international locations which as soon as grew their very own meals now import it from wealthy international locations. Rising one’s personal meals is essential, looking back, as a result of within the post-1944 monetary system, commodities aren’t priced with one’s native fiat foreign money: they’re priced within the greenback.

Take into account the worth of wheat, which ranged between $200 and $300 between 1996 and 2006. It has since skyrocketed, peaking at practically $1,100 in 2021. In case your nation grew its personal wheat, it may climate the storm. In case your nation needed to import wheat, your inhabitants risked hunger. That is one motive why international locations like Pakistan, Sri Lanka, Egypt, Ghana and Bangladesh are all at the moment turning to the IMF for emergency loans.

Traditionally, the place the Financial institution did give loans, they have been mostly for “trendy,” large-scale, mono-crop agriculture and for useful resource extraction: not for the event of native business, manufacturing or consumption farming. Debtors have been inspired to give attention to uncooked supplies exports (oil, minerals, espresso, cocoa, palm oil, tea, rubber, cotton, and many others.), after which pushed to import completed items, foodstuffs and the elements for contemporary agriculture like fertilizer, pesticides, tractors and irrigation equipment. The result’s that societies like Morocco find yourself importing wheat and soybean oil as an alternative of thriving on native couscous and olive oil, “mounted” to turn out to be dependent. Earnings have been usually used to not profit farmers, however to service overseas debt, buy weapons, import luxurious items, fill Swiss financial institution accounts and put down dissent.

Take into account a few of the world’s poorest international locations. As of 2020, after 50 years of Financial institution and Fund coverage, Niger’s exports have been 75% uranium; Mali’s 72% gold; Zambia’s 70% copper; Burundi’s 69% espresso; Malawi’s 55% tobacco; Togo’s 50% cotton; and on it goes. At occasions in previous a long time, these single exports supported just about all of those international locations’ exhausting foreign money earnings. This isn’t a pure state of affairs. These things aren’t mined or produced for native consumption, however for French nuclear crops, Chinese language electronics, German supermarkets, British cigarette makers, and American clothes corporations. In different phrases, the power of the labor power of those nations has been engineered towards feeding and powering different civilizations, as an alternative of nourishing and advancing their very own.

Researcher Alicia Koren wrote in regards to the typical agricultural impression of Financial institution coverage in Costa Rica, the place the nation’s “structural adjustment known as for incomes extra exhausting foreign money to repay overseas debt; forcing farmers who historically grew beans, rice, and corn for home consumption to plant non-traditional agricultural exports resembling decorative crops, flowers, melons, strawberries, and purple peppers… industries that exported their merchandise have been eligible for tariff and tax exemptions not out there to home producers.”

“In the meantime,” Koren wrote, “structural adjustment agreements eliminated help for home manufacturing… whereas the North pressured Southern nations to get rid of subsidies and ‘limitations to commerce,’ Northern governments pumped billions of {dollars} into their very own agricultural sectors, making it unattainable for primary grains growers within the South to compete with the North’s extremely sponsored agricultural business.”

Koren extrapolated her Costa Rica evaluation to make a broader point: “Structural adjustment agreements shift public spending subsidies from primary provides, consumed primarily by the poor and center lessons, to luxurious export crops produced for prosperous foreigners.” Third World international locations weren’t seen as physique politics however as corporations that wanted to extend revenues and reduce expenditures.

The testimony of a former Jamaican official is very telling: “We instructed the World Financial institution group that farmers may hardly afford credit score, and that greater charges would put them out of enterprise. The Financial institution instructed us in response that this implies ‘The market is telling you that agriculture will not be the way in which to go for Jamaica’ — they’re saying we must always hand over farming altogether.”

“The World Financial institution and IMF,” the official mentioned, “don’t have to fret in regards to the farmers and native corporations going out of enterprise, or hunger wages or the social upheaval that can outcome. They merely assume that it’s our job to maintain our nationwide safety forces sturdy sufficient to suppress any rebellion.”

Creating governments are caught: confronted with insurmountable debt, the one issue they actually management by way of rising income is deflating wages. In the event that they do that, they need to present primary meals subsidies, or else they are going to be overthrown. And so the debt grows.

Even when growing international locations attempt to produce their very own meals, they’re crowded out by a centrally-planned world commerce market. For instance, one would assume that a budget labor in a spot like West Africa would make it a greater exporter of peanuts than the USA. However since Northern international locations pay an estimated $1 billion in subsidies to their agriculture industries each single day, Southern international locations typically battle to be aggressive. What’s worse, 50 or 60 international locations are sometimes directed to give attention to the exact same crops, crowding one another out within the world market. Rubber, palm oil, espresso, tea and cotton are Financial institution favorites, because the poor lots can’t eat them.

It’s true that the Green Revolution has created extra meals for the planet, particularly in China and East Asia. However regardless of advances in agricultural know-how, a lot of those new yields go to exports, and huge swathes of the world stay chronically malnourished and dependent. To at the present time, for instance, African nations import about 85% of their meals. They pay greater than $40 billion per 12 months — a quantity estimated to succeed in $110 billion per 12 months by 2025 — to purchase from different elements of the world what they might develop themselves. Financial institution and Fund coverage helped remodel a continent of unimaginable agricultural riches into one reliant on the surface world to feed its folks.

Reflecting on the outcomes of this coverage of dependency, Hancock challenges the widespread perception that the folks of the Third World are “basically helpless.”

“Victims of anonymous crises, disasters, and catastrophes,” he writes, endure from a notion that “they will do nothing until we, the wealthy and highly effective, intervene to avoid wasting them from themselves.” However as evidenced by the truth that our “help” has solely made them extra depending on us, Hancock rightfully unmasks the notion that “solely we are able to save them” as “patronizing and profoundly fallacious.”

Removed from enjoying the function of fine samaritan, the Fund doesn’t even comply with the timeless human custom, established greater than 4,000 years in the past by Hammurabi in historical Babylon, of forgiving curiosity after pure disasters. In 1985, a devastating earthquake hit Mexico City, killing greater than 5,000 folks and inflicting $5 billion of harm. Fund employees — who declare to be saviors, serving to to finish poverty and save international locations in disaster — arrived just a few days later, demanding to be repaid.

VIII. You Can’t Eat Cotton

“Growth prefers crops that may’t be eaten so the loans could be collected.”

The Togolese democracy advocate Farida Nabourema’s personal private and household expertise tragically matches the massive image of the Financial institution and Fund laid out so far.

The best way she places it, after the 1970s oil growth, loans have been poured into growing nations like Togo, whose unaccountable rulers didn’t assume twice about how they might repay the debt. A lot of the cash went into large infrastructure tasks that didn’t assist the vast majority of the folks. A lot was embezzled and spent on pharaonic estates. Most of those international locations, she says, have been dominated by single party-states or households. As soon as rates of interest began to hike, these governments may now not pay their money owed: the IMF began “taking on” by imposing austerity measures.

“These have been new states that have been very fragile,” Nabourema says in an interview for this text. “They wanted to take a position strongly in social infrastructure, simply because the European states have been allowed to do after World Struggle II. However as an alternative, we went from free healthcare and training someday, to conditions the subsequent the place it grew to become too expensive for the typical individual to get even primary drugs.”

No matter what one thinks about state-subsidized drugs and education, eliminating it in a single day was traumatic for poor international locations. Financial institution and Fund officers, after all, have their very own personal healthcare options for his or her visits and their very own personal faculties for his or her youngsters each time they need to reside “within the discipline.”

Due to the compelled cuts in public spending, Nabourema says, the state hospitals in Togo stay to at the present time in “full decay.” Not like the state-run, taxpayer-financed public hospitals within the capitals of former colonial powers in London and Paris, issues are so dangerous in Togo’s capital Lomé that even water needs to be prescribed.

“There was additionally,” Nabourema mentioned, “reckless privatization of our public corporations.” She defined how her father used to work on the Togolese metal company. Throughout privatization, the corporate was offered off to overseas actors for lower than half of what the state constructed it for.

“It was mainly a storage sale,” she mentioned.

Nabourema says {that a} free market system and liberal reforms work nicely when all contributors are on an equal enjoying discipline. However that isn’t the case in Togo, which is compelled to play by completely different guidelines. Irrespective of how a lot it opens up, it could’t change the strict insurance policies of the U.S. and Europe, who aggressively subsidize their very own industries and agriculture. Nabourema mentions how a sponsored inflow of low cost used garments from America, for instance, ruined Togo’s native textile business.

“These garments from the West,” she mentioned, “put entrepreneurs out of enterprise and littered our seashores.”

Essentially the most horrible facet, she mentioned, is that the farmers — who made up 60% of the inhabitants in Togo within the 1980s — had their livelihoods turned the other way up. The dictatorship wanted exhausting foreign money to pay its money owed, and will solely do that by promoting exports, so that they started a large marketing campaign to promote money crops. With the World Financial institution’s assist, the regime invested closely in cotton, a lot in order that it now dominates 50% of the nation’s exports, destroying nationwide meals safety.

Within the adolescence for international locations like Togo, the Financial institution was the “largest single lender for agriculture.” Its technique for preventing poverty was agricultural modernization: “huge transfers of capital, within the type of fertilizers, pesticides, earth-moving tools, and costly overseas consultants.”

Nabourema’s father was the one who revealed to her how imported fertilizers and tractors have been diverted away from farmers rising consumption meals, to farmers rising money crops like cotton, espresso, cocoa and cashews. If somebody was rising corn, sorghum or millet — the fundamental foodstuffs of the inhabitants — they didn’t get entry.

“You possibly can’t eat cotton,” Nabourema reminds us.

Over time, the political elite in international locations like Togo and Benin (the place the dictator was literally a cotton mogul) grew to become the client of all of the money crops from the entire farms. They’d have a monopoly on purchases, Nabourema says, and would purchase the crops for costs so low that the peasants would barely make any cash. This complete system — known as “sotoco” in Togo — was primarily based on funding offered by the World Financial institution.

When farmers would protest, she mentioned, they might get overwhelmed or their farms would get burned to rubble. They may have simply grown regular meals and fed their households, like that they had executed for generations. However now they might not even afford the land: the political elite has been buying land at an outrageous charge, typically via unlawful means, jacking up the worth.

For example, Nabourema explains how the Togolese regime may seize 2,000 acres of land: not like in a liberal democracy (just like the one in France, which has constructed its civilization off the backs of nations like Togo), the judicial system is owned by the federal government, so there isn’t a option to push again. So farmers, who was self-sovereign, are actually compelled to work as laborers on another person’s land to offer cotton to wealthy international locations distant. Essentially the most tragic irony, Nabourema says, is that cotton is overwhelmingly grown within the north of Togo, within the poorest a part of the nation.

“However while you go there,” she says, “you see it has made nobody wealthy.”

Ladies bear the brunt of structural adjustment. The misogyny of the coverage is “quite clear in Africa, the place ladies are the most important farmers and suppliers of gasoline, wooden, and water,” Danaher writes. And but, a latest retrospective says, “the World Financial institution prefers responsible them for having too many youngsters relatively than reexamining its personal insurance policies.”

As Payer writes, for lots of the world’s poor, they’re poor “not as a result of they’ve been left behind or ignored by their nation’s progress, however as a result of they’re the victims of modernisation. Most have been crowded off the nice farmland, or disadvantaged of land altogether, by wealthy elites and native or overseas agribusiness. Their destitution has not ‘dominated them out’ of the event course of; the event course of has been the reason for their destitution.”

“But the Financial institution,” Payer says, “continues to be decided to remodel the agricultural practices of small farmers. Financial institution coverage statements make it clear that the true goal is integration of peasant land into the business sector via the manufacturing of a ‘marketable surplus’ of money crops.”

Payer noticed how, within the 1970s and 1980s, many small plotters nonetheless grew the majority of their very own meals wants, and were not “dependent available on the market for the near-totality of their sustenance, as ‘trendy’ folks have been.” These folks, nonetheless, have been the goal of the Financial institution’s insurance policies, which remodeled them into surplus producers, and “typically enforced this transformation with authoritarian strategies.”

In a sworn statement in entrance of U.S. Congress within the 1990s, George Ayittey remarked that “if Africa have been capable of feed itself, it may save practically $15 billion it wastes on meals imports. This determine could also be in contrast with the $17 billion Africa obtained in overseas support from all sources in 1997.”

In different phrases, if Africa grew its personal meals, it wouldn’t want overseas support. But when that have been to occur, then poor international locations wouldn’t be shopping for billions of {dollars} of meals per 12 months from wealthy international locations, whose economies would shrink because of this. So the West strongly resists any change.

IX. The Growth Set

Excuse me, buddies, I have to catch my jet

I am off to affix the Growth Set

My luggage are packed, and I’ve had all my photographs

I’ve traveller’s checks and capsules for the trots!

The Growth Set is vibrant and noble

Our ideas are deep and our imaginative and prescient world

Though we transfer with the higher lessons

Our ideas are all the time with the lots

In Sheraton Resorts in scattered nations

We rattling multinational firms

Injustice appears simple to protest

In such seething hotbeds of social relaxation.

We focus on malnutrition over steaks

And plan starvation talks throughout espresso breaks.

Whether or not Asian floods or African drought

We face every difficulty with open mouth.

And so begins “The Development Set,” a 1976 poem by Ross Coggins that hits on the coronary heart of the paternalistic and unaccountable nature of the Financial institution and the Fund.

The World Financial institution pays excessive, tax-free salaries, with very beneficiant advantages. IMF employees are paid even higher, and traditionally have been flown first or enterprise class (relying on the gap), by no means financial system. They stayed in five-star inns, and even had a perk to get free upgrades onto the supersonic Concorde. Their salaries, not like wages made by folks residing underneath structural adjustment, have been not capped and all the time rose quicker than the inflation charge.

Till the mid-1990s the janitors cleansing the World Financial institution headquarters in Washington — largely immigrants who fled from international locations that the Financial institution and Fund had “adjusted” — weren’t even allowed to unionize. In distinction, Christine Lagarde’s tax-free wage as head of the IMF was $467,940, plus a further $83,760 allowance. In fact, throughout her time period from 2011 to 2019, she oversaw quite a lot of structural changes on poor international locations, the place taxes on probably the most susceptible have been virtually all the time raised.

Graham Hancock notes that redundancy funds on the World Financial institution within the 1980s “averaged 1 / 4 of 1,000,000 {dollars} per individual.” When 700 executives misplaced their jobs in 1987, the cash spent on their golden parachutes — $175 million — would have been sufficient, he notes, “to pay for an entire elementary college training for 63,000 youngsters from poor households in Latin America or Africa.”

In line with former World Financial institution head James Wolfensohn, from 1995 to 2005 there have been greater than 63,000 Financial institution tasks in growing international locations: the prices of “feasibility research” and journey and lodging for specialists from industrialized international locations alone absorbed as a lot as 25% of the whole support.