Fast Take

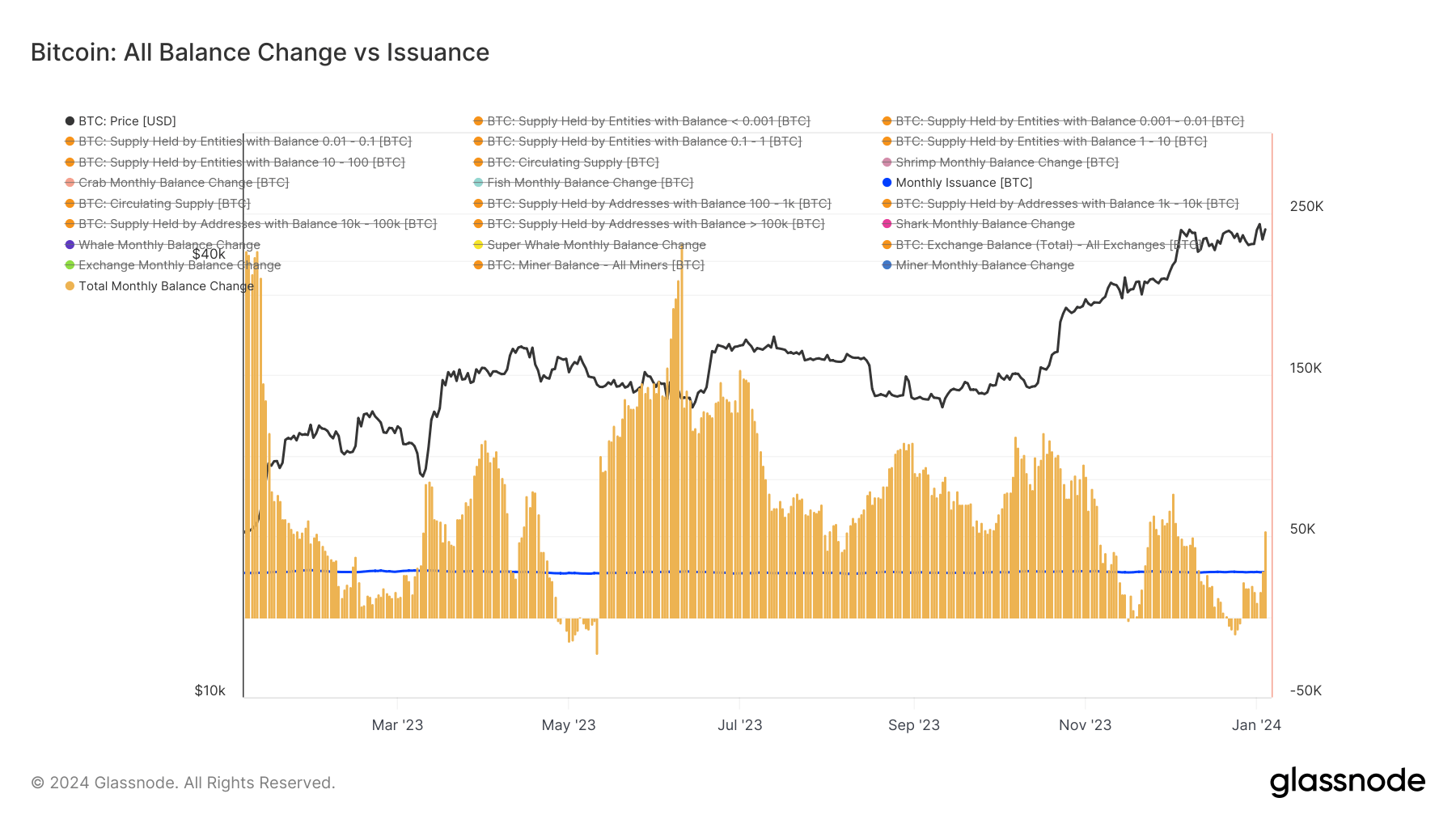

When juxtaposed with the amount of newly mined BTC, the stability change of Bitcoin investor cohorts provides intriguing insights into the dynamics of the digital asset markets’ ecosystem. This evaluation reveals a relative measure of latest Bitcoin issuance absorbed by all totally different investor cohorts. Impressively, values above the blue line point out a cohort’s mixture stability rising past the overall cash mined in a given month, performing as a internet absorber.

Contrarily, values on the blue line recommend a comparatively flat stability for the cohort over a month towards issuance, whereas unfavourable values point out a discount within the cohort’s mixture stability, indicating a distribution together with contemporary coin issuance. A every day mining fee of roughly 900 BTC interprets right into a month-to-month quantity of round 27,000 BTC.

For the primary time since Dec. 4th, the combination stability of all cohorts is surpassing this month-to-month issuance. As of Jan. 4th, the overall month-to-month stability change stood at 53,800, implying roughly 25,000 Bitcoins plus issuance have been absorbed from the market. This absorption marks a halt within the previous distribution section, a phenomenon solely beforehand seen in Might 2023.

The submit Investor cohorts outpace Bitcoin’s monthly mined supply for the first time since early December appeared first on CryptoSlate.

More NFT News

Chinese language Auto Supplier Dives Into Bitcoin Mining With $256M Funding

Harnessing idle GPU energy can drive a greener tech revolution

Will Dogecoin Attain $1? Crypto Volatility Returns as Bitcoin and Ethereum Slide