Fast Take

In August, a number of publicly traded Bitcoin miners supplied updates on their manufacturing and operations.

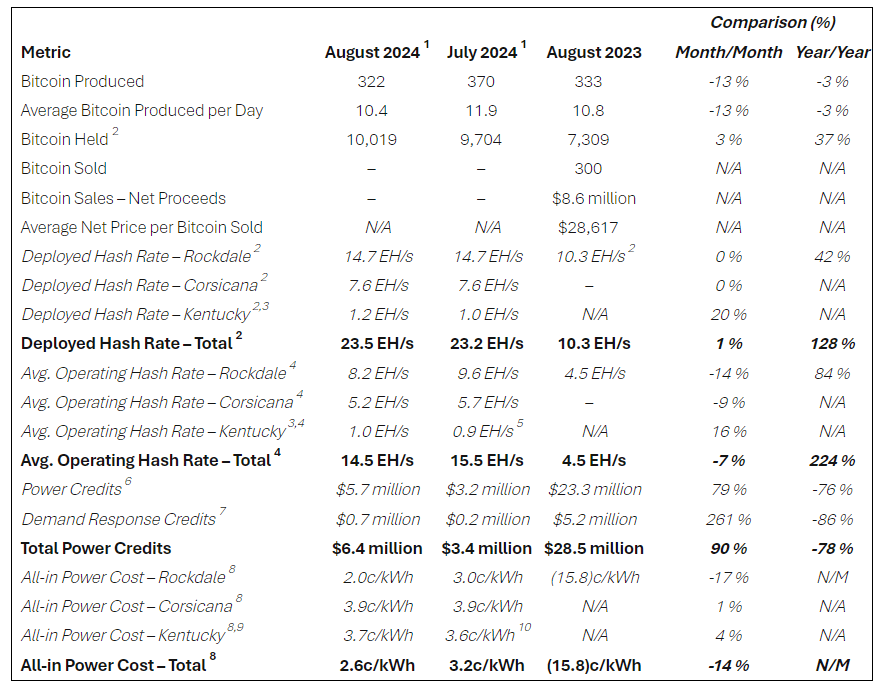

RIOT reported producing 322 BTC, a 13% lower in comparison with July. Nevertheless, the corporate elevated its Bitcoin holdings by 3%, bringing the entire to 10,019 BTC. RIOT’s deployed hash fee stood at 23.5 EH/s, whereas its operational hash fee was 14.5 EH/s. The decrease operational hash fee was influenced by energy and demand response credit amounting to $6.four million. Their whole energy price was 2.6 cents per kWh.

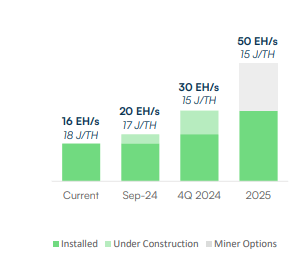

In the meantime, IREN mined 245 BTC in August, marking a 10% enhance month-over-month. The corporate put in 16 EH/s and stays on monitor to realize 30 EH/s by This autumn, with plans to succeed in 50 EH/s by 2025. IREN additionally reported a big discount in electrical energy prices per Bitcoin mined, from $61,677 in July to $29,958 in August, due to a transition to identify pricing. Their AI cloud companies continued to develop, with extra income and clients. IREN stays financially sturdy, with $405 million in money and no debt.

Whereas Core Scientific skilled a 14% drop in manufacturing, mining 358 BTC in August, the corporate reported a complete energized hash fee of 25.four EH/s.

More NFT News

Chinese language Auto Supplier Dives Into Bitcoin Mining With $256M Funding

Harnessing idle GPU energy can drive a greener tech revolution

Will Dogecoin Attain $1? Crypto Volatility Returns as Bitcoin and Ethereum Slide