The fluctuations in Bitcoin’s value have marked the tempo of the crypto market and the group’s sentiment. Whereas some really feel pessimistic concerning the rally slowdown, some analysts consider the flagship cryptocurrency is simply on the point of attain greater notes.

Subsequent Cease: Bitcoin’s “Parabolic Upside”

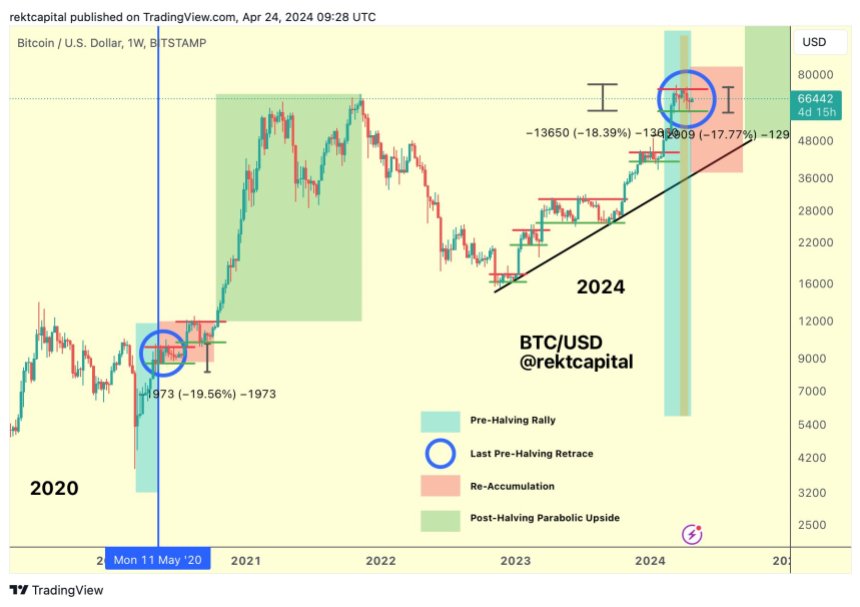

Crypto analyst and dealer Rekt Capital considers Bitcoin (BTC) is at the moment awaiting a interval of consolidation. In an X post, the dealer highlighted that, throughout the earlier “Halvings,” BTC noticed “Re-Accumulation Ranges.”

The analyst shared his chart for Bitcoin phases throughout the “Halving,” which he has previously used to clarify BTC was on the “Final Pre-Halving Retrace” earlier than April 19.

On the time, the analyst identified that the re-accumulation section was subsequent. Bitcoin went via one throughout the earlier “Halving,” as seen within the chart.

The re-accumulation consisted of two consolidation durations adopted by the “Put up-Halving Parabolic Upside,” which noticed BTC attain final cycle’s all-time excessive (ATH) of $69,000.

Bitcoin phases throughout the "Halving". Supply: Rekt Capital on X

Rekt Capital highlighted that, throughout this cycle, the flagship cryptocurrency has already skilled 5 re-accumulation ranges. Equally to the final cycle, the most recent re-accumulation section appears to have began throughout the “Pre-Halving Rally” section. Per the analyst, this might be adopted by the “Parabolic Upside” if historical past repeats itself.

Analyst Mikybull appears to share an identical view to Rekt Capital’s, as he highlights that Bitcoin’s “parabolic rally is loading.” The re-accumulation breakout is set to be “explosive,” and “not many are ready for this,” he added.

The analyst explained that “the RSI on a macro scale is on the similar degree because it was in 2017, which was adopted by an enormous rally to cycle high.” Based mostly on this, he believes the present consolidation comes from establishments getting ready “for an enormous rally to cycle high.”

Analyst Units Essential Degree For Bitcoin’s Breakout

A day earlier than Bitcoin’s “Halving,” the cryptocurrency confronted a correction that shredded 7% of its value in a couple of hours. BTC went from hovering between the $64,000-$63,000 value vary to buying and selling under the $60,000 help zone.

Since then, the biggest cryptocurrency by market capitalization seems to have steadily recovered from the drop. Over the weekend, Bitcoin regained the $65,000 help degree earlier than testing the $66,000 one, which it reclaimed on Monday.

Over the previous few days, BTC has hovered between $66,000 and $67,000. Nevertheless, it has not been capable of efficiently check the resistance degree set on the $67,000 value vary.

In keeping with the crypto analyst Bluntz, Bitcoin’s most up-to-date efficiency suggests that the value will proceed to maneuver sideways between the $66,000 and the $67,000 vary.

Nevertheless, he additionally considers that BTC is “gagging for a breakout quickly,” because the chart shows a bullish pennant sample forming. Per the analyst, “as soon as we clear 67okay,” the entire market will fly above the most recent ATH.

As of this writing, Bitcoin is buying and selling at $66,665, a 7.5% improve from per week in the past and a 66.22% within the final three months.

Bitcoin's efficiency within the weekly chart. Supply: BTCUSDT on TradingView

Featured Picture from Unsplash.com, Chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this web site completely at your individual danger.

More NFT News

Osprey Funds Launches First US Publicly Quoted BNB Belief

Will Binance's BNB Attain $1000? Worth Prediction Amid Authorized Challenges in Australia

What Does Spot Buying and selling Imply in Cryptocurrency and How Is It Accomplished?