Introduction

Based in 1989, MicroStrategy is a U.S. firm that gives enterprise intelligence, cellular software program, and cloud-based companies. Led by Michael Saylor, one in every of its three co-founders, the corporate noticed its first main success in 1992 after touchdown a $10 million contract with Mcdonald’s.

All through the 1990s, MicroStrategy noticed its income develop by over 100% yearly because it positioned itself as a pacesetter in information analytics software program. The onset of the dot.com growth within the late 1990s supercharged the corporate’s development and culminated in 1998 when it went public.

And whereas the corporate has been a staple of the worldwide enterprise surroundings for many years, it wasn’t till it acquired its first Bitcoins in August 2020 that it got here below the radar of the crypto trade.

Saylor made information by making MicroStrategy one in every of a handful of public corporations to carry BTC as a part of its treasury reserve coverage. On the time, MicroStrategy stated that its $250 million funding in BTC would offer an affordable hedge towards inflation and allow it to earn a excessive return sooner or later.

Since August 2020, the corporate has periodically been buying giant portions of Bitcoin, affecting each the worth of its inventory and BTC.

On the time of MicroStrategy’s first Bitcoin buy, BTC was buying and selling at round $11,700, whereas MSTR was buying and selling at roughly $144. At press time, Bitcoin’s worth hovers round $22,300 whereas MSTR closed the earlier buying and selling day at $252.5.

This represents a 75.6% lower from MSTR’s July 2021 excessive of $1,304. Mixed with Bitcoin’s worth volatility, the sharp drop within the firm’s inventory worth previously two years pushed many to criticize MicroStrategy’s treasury administration technique and even actively quick it.

On this report, CryptoSlate dives deep into MicroStrategy and its holdings to find out whether or not its bold guess on Bitcoin makes its inventory at present undervalued.

MicroStrategy’s Bitcoin holdings

As of Mar. 1, 2023, MicroStrategy held 132,500 BTC acquired at an mixture buy worth of $3.992 billion and a median buy worth of roughly $30,137 per BTC. Bitcoin’s present market worth of $22,300 places MicroStrategy’s BTC holdings at $2.954 billion.

The corporate’s Bitcoins had been acquired by means of 25 completely different purchases, with the biggest one made on Feb. 24, 2021. On the time, the corporate bought 19,452 BTC for $1.206 billion when BTC was buying and selling at just below $45,000. The second largest buy was made on Dec. 21, 2020, when it acquired 29,646 BTC for $650 million.

Throughout Bitcoin’s ATH originally of November 2021, the 114,042 BTC MicroStrategy held was price properly over $7.86 billion. Bitcoin’s hunch to $15,500 in early November 2022 valued the corporate’s holdings at simply over $2.05 billion. On the time, the market capitalization of all MSTR inventory reached $1.90 billion.

As CryptoSlate evaluation confirmed, it wasn’t till the top of February 2023 that MicroStrategy’s market cap acquired on par with the market worth of its Bitcoin holdings. The discrepancy between the 2 is what prompted many to wonder if MSTR may very well be undervalued.

Nonetheless, figuring out over or undervaluation requires extra than simply MicroStrategy’s market cap.

MicroStrategy’s debt

The corporate has issued $2.four billion of debt to fund its Bitcoin purchases. As of Dec. 31, 2022, MicroStrategy’s debt consists of the next:

- $650 million of 0.750% convertible senior notes due 2025

- $1.05 billion of 0% convertible senior notes due 2027

- $500 million of 6.125% senior secured notes due 2028

- $205 million below a secured time period mortgage

- $10.9 million of different long-term indebtedness

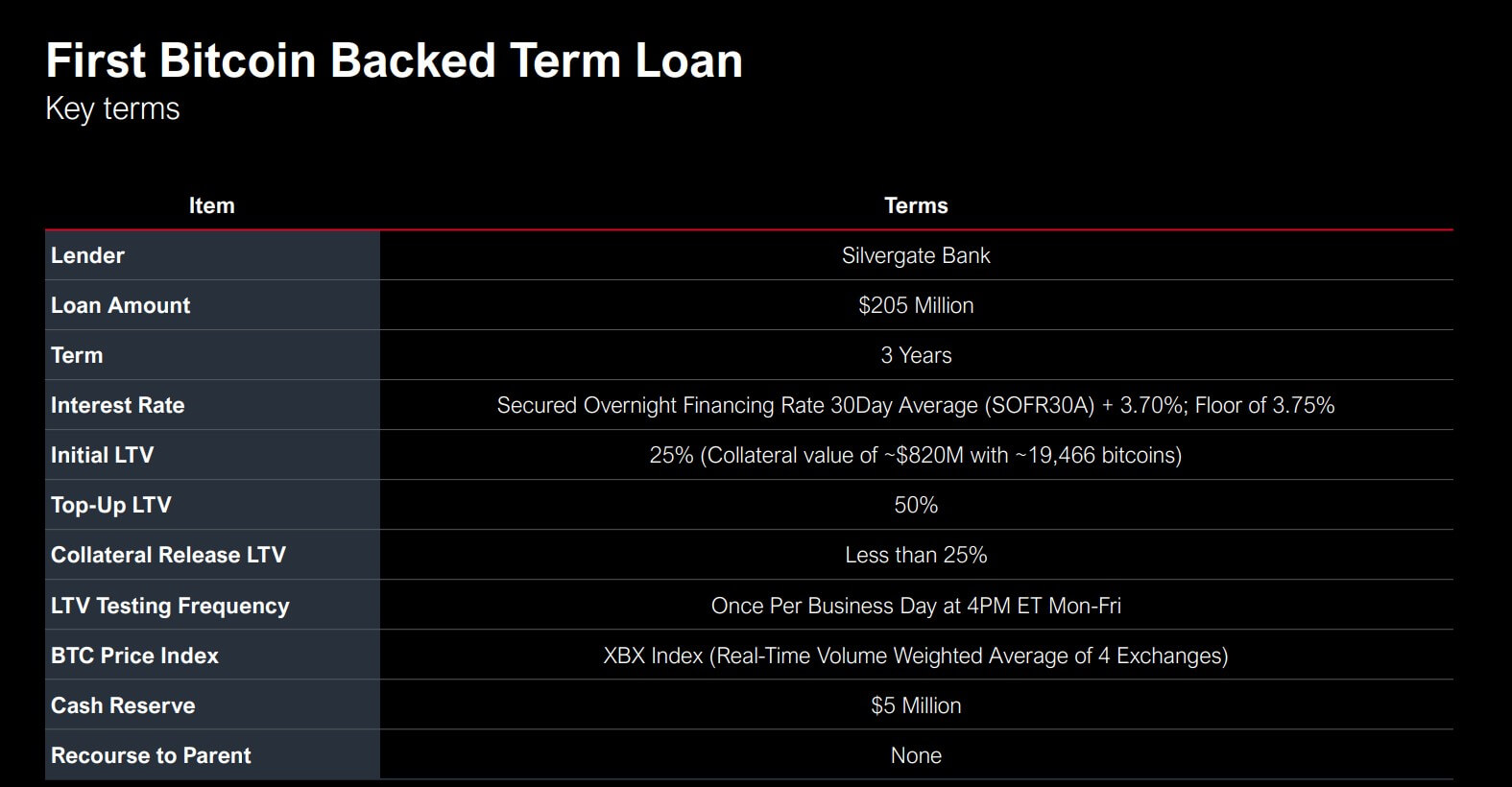

The charges the corporate secured on the 2025 and 2027 convertible notes proved massively useful, particularly in gentle of the just lately rising rates of interest. Nonetheless, the advantages MicroStrategy accrued on the convertible notes are offset by the dangers it took on with its $205 secured time period mortgage from Silvergate financial institution in March 2022.

The mortgage was collateralized with 19,466 BTC, price $820 million on the time, with an LTV ratio of 25%. Till it matures in March 2025, the mortgage should stay collateralized with a most LTV ratio of 50% — if LTV passes 50%, the corporate might be required to prime up its collateral to deliver the ratio again right down to 25% or much less.

Terra’s crash in June 2022 triggered volatility out there that required MicroStrategy to deposit an extra 10,585 BTC into the collateral. Along with risky Bitcoin costs, the floating price Silvergate’s mortgage bears resulted in an annualized rate of interest of seven.19%, placing vital pressure on the corporate.

The current controversy surrounding Silvergate, coated by CryptoSlate, prompted many to fret about the way forward for MicroStrategy’s mortgage. Nonetheless, the corporate famous that the way forward for the mortgage isn’t depending on Silvergate and that the corporate would continue paying off the mortgage even when the financial institution went below.

Of the 132,500 BTC the corporate holds, solely 87,559 BTC are unencumbered. Except for the 30,051 BTC used as collateral for the Silvergate secured time period mortgage, MicroStrategy put 14,890 BTC as a part of the collateral for the 2028 senior secured notes. If the collateral for the Silvergate mortgage would must be topped off, the corporate might dip into the 87,559 unencumbered BTC.

Saylor additionally famous that the corporate might publish different collateral if Bitcoin’s worth fell under the $3,530 that might set off a margin name on the mortgage.

MSTR vs BTC

One of many largest stars of the dot com growth, MicroStrategy has seen its inventory undergo intervals of intense volatility in instances of growth.

Following its 1998 IPO, MSTR noticed its worth improve by over 1,500%, peaking in February 2000 at over $1,300. After a spectacular worth drop that marked the start of the dot com crash, it took the corporate greater than ten years to regain the $120 share worth it posted in 1998.

Earlier than its first Bitcoin buy in August 2020, MicroStrategy’s inventory traded at $160. September introduced on a notable rally that pushed its worth to a brand new peak of $1,300 in February 2021.

Since then, MSTR posted a notable correlation to Bitcoin’s worth actions, with the corporate’s efficiency now tied to the crypto market.

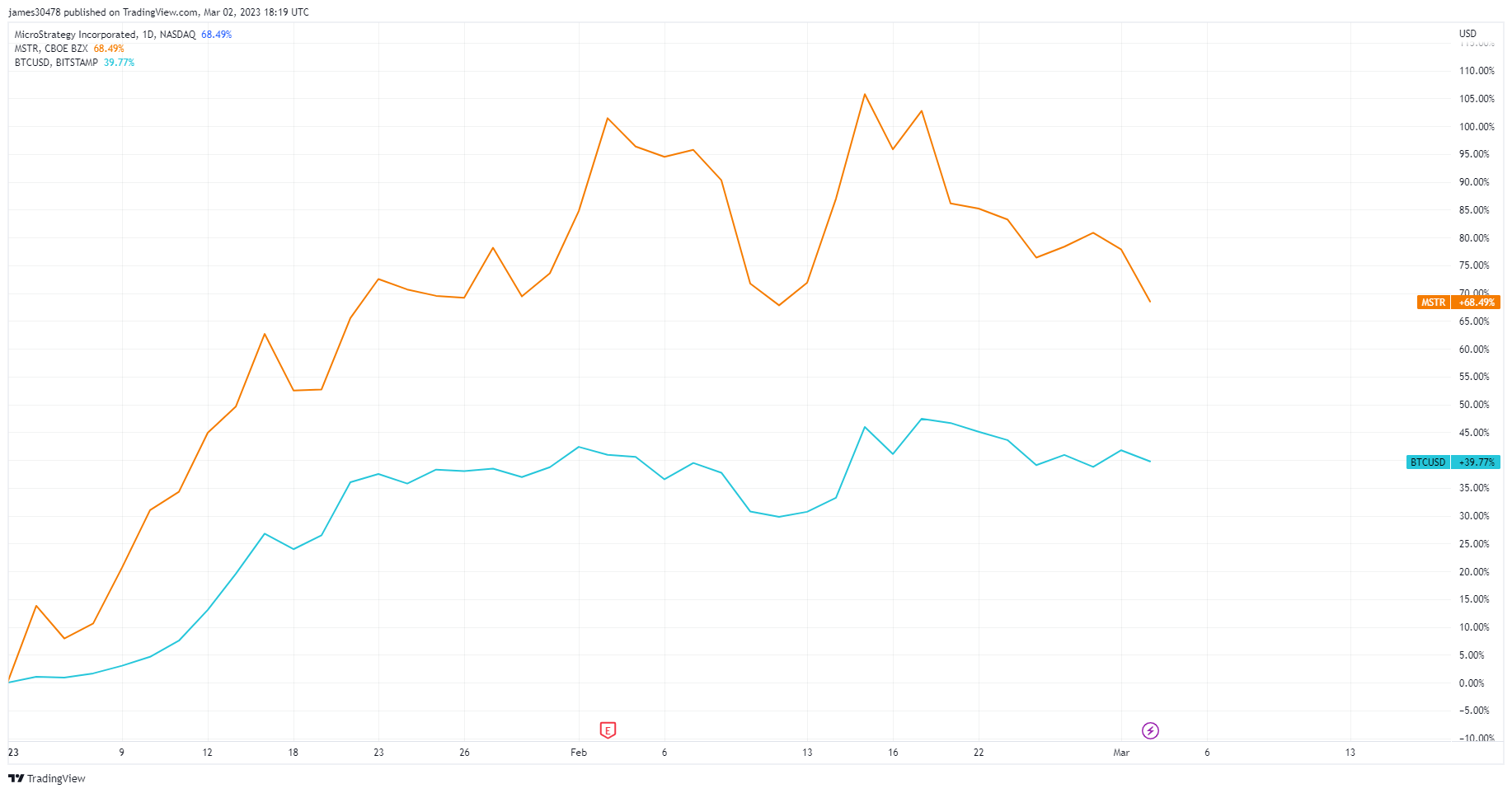

Up over 68% because the starting of the yr, MSTR has outperformed BTC, which noticed its worth improve by just below 40%.

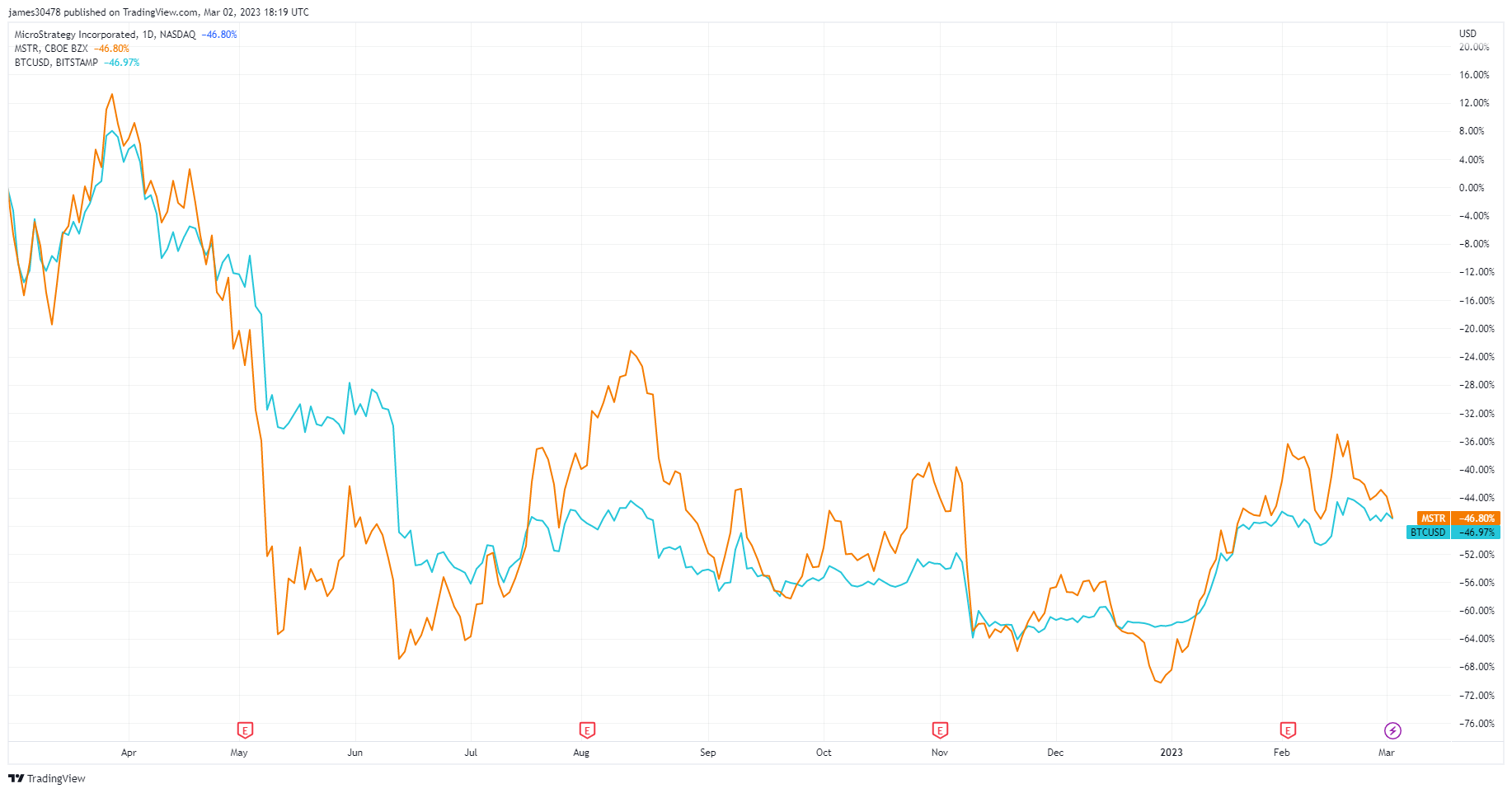

MSTR adopted Bitcoin’s efficiency on a one-year scale as each posted a 46% loss.

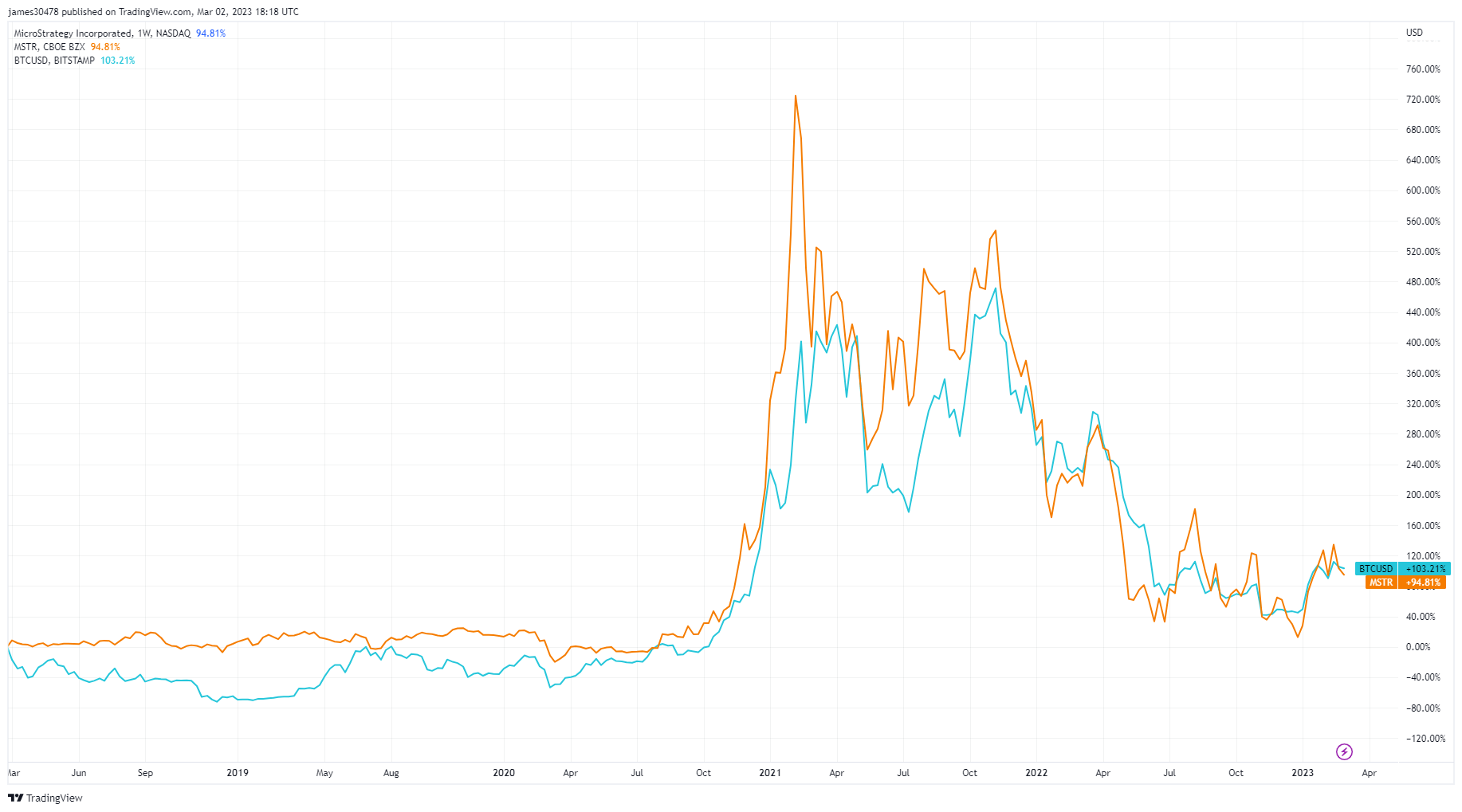

Zooming out to a five-year timeframe exhibits a notable correlation in efficiency, with BTC barely outperforming MSTR with a 103% improve.

Nonetheless, MSTR’s market efficiency has usually been overshaddowed by MicroStrategy’s worsening monetary statements. On the finish of the fourth quarter of 2022, the corporate reported an working lack of $249.6 million, up from $89.9 million within the fourth quarter of 2021. This introduced the corporate’s complete working loss for 2022 to $1.46 billion.

The accounting conundrum

With an working lack of $.1.46 billion in 2022, a dangerous mortgage which will require re-collateralization, and a risky crypto market behind it, MicroStrategy definitely doesn’t look overvalued.

Nonetheless, the corporate’s reported working loss is likely to be obfuscating its profitability. Particularly, the SEC requires corporations to report unrealized quarterly losses on their Bitcoin holdings as impairment losses. Based on MicroStrategy’s Bitcoin Accounting Therapy, the corporate’s impairment loss provides to its working loss. Because of this a unfavorable change in Bitcoin’s market worth exhibits up as a considerable loss on MicroStrategy’s quarterly statements, despite the fact that the corporate hasn’t offered the asset.

On Dec. 31, 2022, the corporate reported an impairment lack of $2.15 billion on its Bitcoin holdings for the yr. It reported an working lack of $1.32 billion earlier than taxes.

Conclusion

Given MSTR’s correlation to Bitcoin’s efficiency, a bull market rally might push the inventory again to its 2021 excessive.

The standard monetary market has traditionally had bother maintaining with the speedy tempo of development seen within the crypto trade. The sort of volatility the crypto market has change into accustomed to, each constructive and unfavorable, continues to be a uncommon incidence within the inventory market. In a bull rally much like the one which took Bitcoin to its ATH, MSTR might considerably outperform different tech shares, together with the large-cap FAANG giants.

Nonetheless, whereas MSTR’s development might mimic the expansion seen within the crypto market, it’s extremely unlikely that the corporate will see any vital volatility in its inventory worth within the subsequent couple of years. If MicroStrategy continues to service its money owed, it is going to be extraordinarily well-positioned to reap the advantages of a crypto-heavy market within the coming decade.

Its longstanding repute might make it a go-to proxy for establishments to get publicity to Bitcoin, creating demand that retains shopping for stress excessive.

More NFT News

Chinese language Auto Supplier Dives Into Bitcoin Mining With $256M Funding

Harnessing idle GPU energy can drive a greener tech revolution

Will Dogecoin Attain $1? Crypto Volatility Returns as Bitcoin and Ethereum Slide