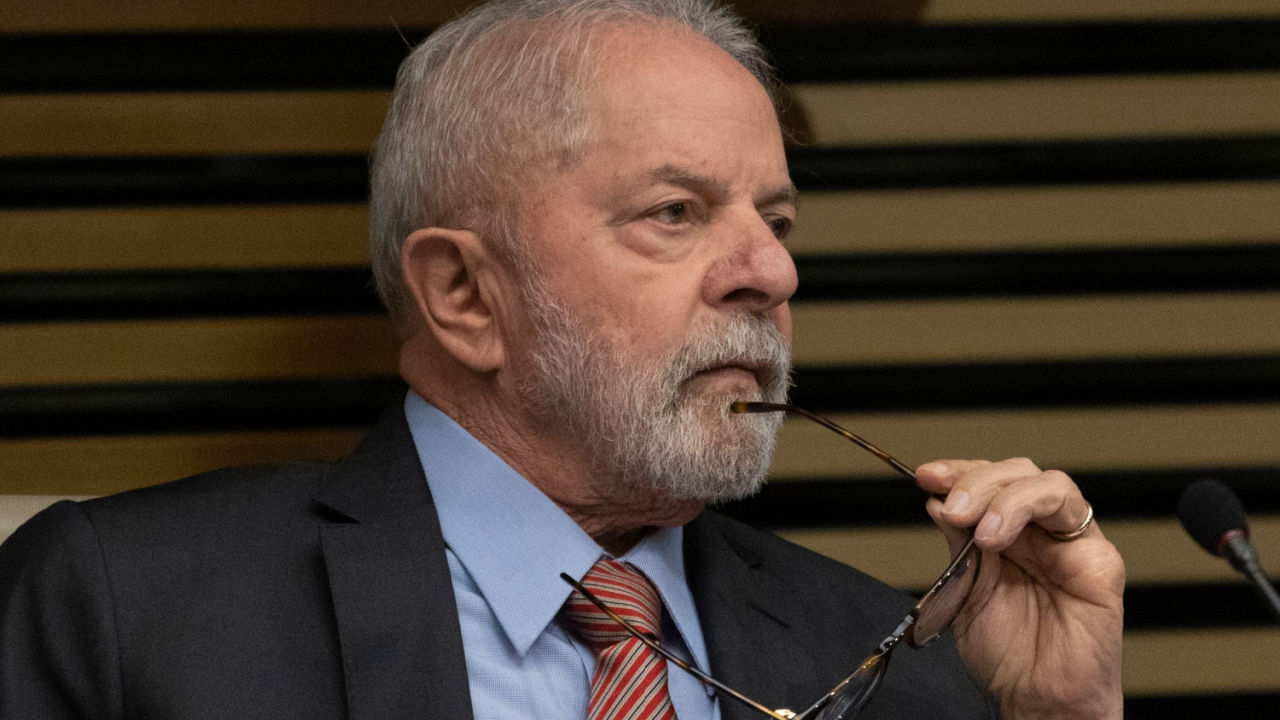

President of Brazil Luis Inacio Lula Da Silva clarified the scope and attain of the frequent forex that Brazil and Argentina are finding out to concern in Latam. Lula Da Silva clarified that he believed this forex could be used to settle cross-border funds between the 2 international locations and in addition international locations from BRICS and Mercosur.

Lula Clarifies Latam Widespread Foreign money Intention

Luis Inacio Lula Da Silva, president of Brazil, has clarified the info surrounding the intention that Argentina and Brazil have of making a Latam frequent forex, that might be later prolonged to all of Latam. Upon his arrival in Buenos Aires for the CELAC summit of chiefs of state, Lula defined that the dialogue would circle across the launch of a forex for multilateral settlements amongst international locations of various integration teams, together with BRICS and Mercosur.

Lula Da Silva stated:

Why not create a typical forex with the Mercosur international locations, with the BRICS international locations? I feel that’s what will occur. You may set up a sort of forex for commerce that the central financial institution units.

Lula additionally acknowledged that he would favor worldwide buying and selling transactions to be all the time settled in currencies native to their international locations to cut back dependence on the U.S. greenback.

Fernando Haddad, minister of financial system of Brazil, supplied extra perception into the aims of the 2 international locations, explaining:

Commerce could be very unhealthy and the issue is exactly the international forex, proper? So we’re looking for an answer, one thing in frequent that may develop the commerce.

Extra Particulars

President of Argentina Alberto Fernandez additionally referred to the hypothetical forex in the identical phrases that Lula did. Fernandez clarified:

The reality is that we don’t understand how a typical forex between Argentina and Brazil works, nor do we all know how a typical forex will work within the area. However what we do know is how the financial system works with foreign currency to commerce.

The joint statements of Fernandez and Lula Da Silva went towards the expectations that some had on the retail and widespread character that this forex would have, fueled by the statements that the minister of financial system of Argentina, Sergio Massa, offered Monetary Instances.

Additionally, reports from O’Globo clarify {that a} frequent forex memorandum to be signed by the 2 governments features a clause to guard the fiat currencies of every nation, the Brazilian actual and the Argentine peso, from being substituted by this settlement-focused forex.

What do you consider the Latam settlement forex being mentioned between Argentina and Brazil? Inform us within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Isaac Fontana / Shutterstock.com

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any injury or loss brought on or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

More NFT News

Machine Studying in Focus as Chainalysis Acquires Hexagate

Bitcoin Traders Are Now Up $67,000 On Common – And This Is Simply The Begin

Extra Than Half of Crypto Tokens, Memecoins Launched in 2024 Have been Malicious: Blockaid