That is an opinion editorial by Stanislav Kozlovski, a software program engineer and macroeconomic researcher.

Many Bitcoiners have heard of Bitcoin’s “lack of scalability” — it is likely one of the commonest critiques waged towards the mission by each gluttonous cryptocurrency rivals and incumbent institution actors.

Some oldtimers could keep in mind the heated, bathed-in-controversy Blocksize Wars of 2015 to 2017 which, aided by business insiders, most shallowly aimed to make Bitcoin scale to extra transactions by growing the utmost block dimension and by doing so, nearly set precedent and altered Bitcoin’s future course forever.

Each of those points will finally show to be left on the mistaken facet of historical past. On this piece, we’re going to present how the Lightning Community addresses Bitcoin’s scalability issues and undoubtedly proves that the small-block resolution was finally the correct one.

Base Layer Limitations And Selections

Earlier than we perceive what the Lightning Community is fixing, we should always first perceive what the inherent downside is. Merely put: You can’t scale a blockchain to validate your complete world’s transactions in a decentralized method.

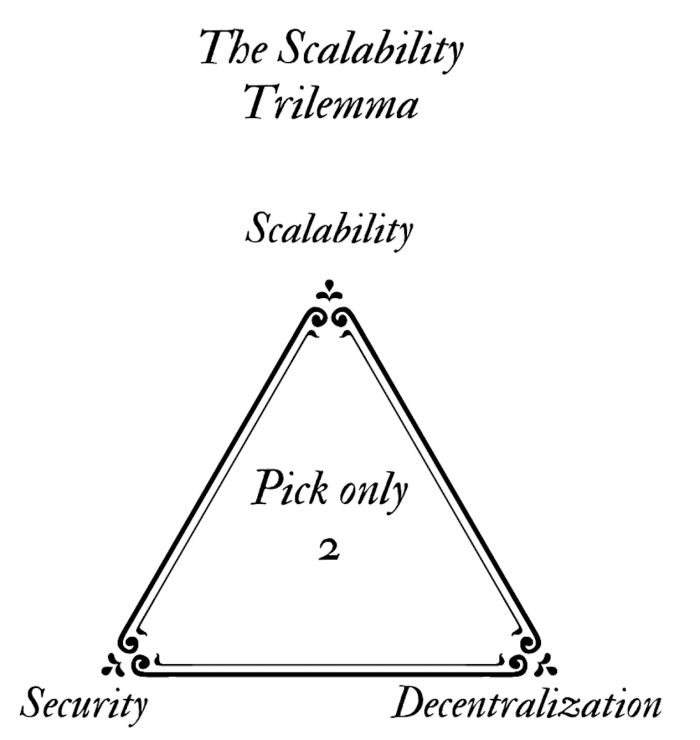

Blockchains undergo from an inherent limitation which forces them to commerce off between three qualities — one high quality of their system has to go for the opposite two. As pictured above, a blockchain can solely reliably have two of those three qualities:

- Decentralized: not managed by any single occasion or a small variety of elites

- Scalable: scale to a enough variety of transactions

- Safe: not be straightforward to assault and break its invariants

It’s price noting that each one of those traits sit on separate, complicated spectrums. For instance, you don’t change into “safe” over a sure threshold, it is rather dependent on the use case and many different characteristics.

Bitcoin is sluggish for a purpose. It explicitly picked to optimize the “safety” and “decentralization” sections of the trilemma, leaving “scalability” (transactions per second) on the sideline.

The important thing realization is that, very similar to as we speak’s web and monetary system, it’s extra optimum to comprise the entire system of separate layers, the place every layer optimizes for and is used for various issues.

Bitcoin, the bottom layer, is a globally-replicated public ledger — each transaction is broadcast to each participant within the community. It’s evident that one can not virtually scale such a ledger to accommodate your complete world’s rising transaction fee. Other than being impractical and privateness damaging, its drawbacks vastly outweigh its insignificant advantages.

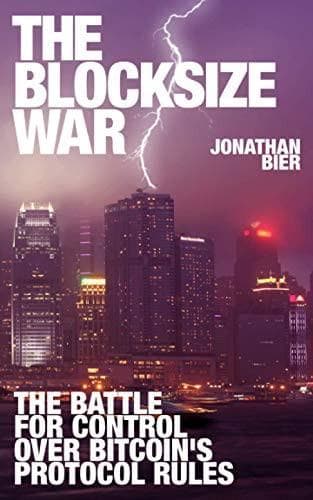

Again within the day, there was a serious civil struggle between the net neighborhood in what Bitcoin ought to do to extend its transaction throughput capability. There’s major, infuriating controversy in this story and is largely what formed Bitcoin to stay what it’s as we speak — a grassroots, bottom-up motion the place the average people (plebs), in combination with each other, dictate the principles of the community.

“The Blocksize War” by Jonathan Bier illustrates the battle between the decentralized community supporters wanting what’s greatest for the long-term viability of the community and the greed and propaganda perpetuated by main gamers and firms to additional their very own power-gaining and profit-seeking agendas.

Lengthy story quick, Bitcoin was forked right into a failed fork named “Bitcoin Money.”

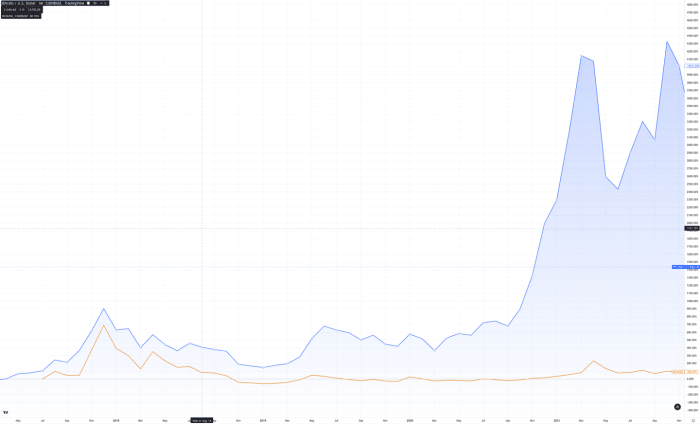

Bitcoin (blue) value in comparison with Bitcoin Money (orange). The fork could be seen in the beginning of the chart. Supply: tradingview.com.

The little man finally gained — Bitcoin didn’t rush any unhealthy design decisions that might come to compromise its decentralization, safety or censorship resistance. The choice was successfully made to scale Bitcoin by means of layers, introducing second layers that work individually from Bitcoin and checkpoint their state to the primary, slower-but-more-secure community.

In stark distinction, the evidently-unsuccessful fork Bitcoin Money sacrificed all hopes of decentralization by growing its block dimension to 32 megabytes, 32 times more than Bitcoin, for a mere most of 50 payments per second on the bottom chain.

Block Measurement

Every Bitcoin block has a cap on its dimension and this denotes the higher sure on what number of transactions can exist within a block. If demand grows to outpace the quantity of transactions a block can have, the block turns into full and transactions get left unconfirmed within the mempool. Customers start to outbid one another through the adjustable transaction charge with a view to have their transaction be included by the miners, who’re incentivized to decide on the highest-paying transactions.

A naive answer to this might be to easily enhance the block dimension restrict — that’s, enable extra transactions to be included in a block. The unfavourable uncomfortable side effects of this are sufficiently subtle that even intellectuals like Elon Musk make the mistake of suggesting it.

Growing the block dimension has second-order results which lower the decentralization of the community. Because the block dimension grows, the associated fee to run a node within the community will increase.

In Bitcoin, every node has to retailer and validate every transaction. Additional, stated transaction needs to be propagated to the node’s friends, which multiplies the community’s bandwidth necessities for supporting extra transactions. The extra transactions, the extra the community’s processing (CPU) and storage (disk) necessities develop for every node. As a result of working a node yields no monetary advantages, the motivation to run one disproportionately decreases the extra pricey it’s.

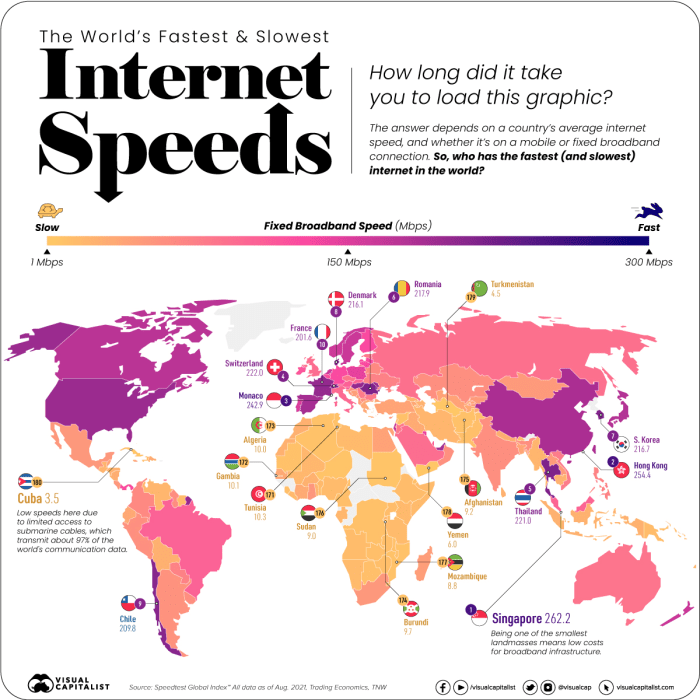

To place it into numbers, if Bitcoin is to ever scale to Visa’s purported peak capability ranges (24,000 transactions per second) a node would need 48 megabytes per second simply to obtain the transactions over the community. The next is a map displaying the common web pace on the planet:

As you’ll be able to see, a large a part of the world’s common pace would exclude them from the flexibility to run a node beneath these situations. Notice that common pace implies that many are even decrease than stated threshold. Moreover, it doesn’t account for the truth that a person would produce other makes use of for his or her bandwidth — few selfless folks would dedicate 50% of their web bandwidth for a Bitcoin node.

Extra importantly, the quantity of knowledge this might generate would make it unattainable for anyone to virtually retailer it — it will end in 518 gigabytes of knowledge per day, or 190 terabytes of knowledge a 12 months.

Additional, spinning up a brand new node would require one to obtain all of those petabytes of knowledge and confirm every signature — each of which might make it so {that a} new node would take a very long time (years) to spin up.

And to make issues worse, 24,000 transactions per second doesn’t make for a very distinctive world funds community in and of itself. Visa isn’t the one funds community on the planet, and the world is rising extra interconnected day by day.

Lightning Community 101

The Lightning Community is a separate, second-layer network that works on prime of the primary Bitcoin community. Merely stated, it batches Bitcoin transactions.

To entry it, that you must run your individual node or use anyone else’s. The community has two ideas price understanding for the needs right here:

- A Lightning node: separate software program that communicates with one another and constitutes a brand new peer-to-peer community.

- Channels: a connection opened between two Lightning nodes, permitting for funds to circulate between them.

A channel is actually a Bitcoin base layer transaction, anchoring the channel to the safe chain.

As soon as two nodes open a channel between each other, funds begin flowing between them. Every subsequent cost modifies the channel’s state, cryptographically revoking the previous one and checkpointing the brand new one in reminiscence and on disk of each nodes, however critically, to not the bottom chain.

Channels can and for my part ideally ought to keep open for a very long time (e.g., a 12 months or extra). If the nodes ever determine to shut down their channel, their newest steadiness after all of the off-chain funds is restored to their authentic wallets. That is cryptographically-secured by hashed timelocked contracts (HTLC) and digital signatures, which we gained’t get into element for the needs of this text.

This permits one to batch billions of funds into two on-chain transactions — one for opening the channel and one for closing it. As soon as a cost is full, it’s indeniable what the most recent steadiness is between all events (assuming nodes redundantly retailer their channel checkpoints).

Critically, one needn’t be immediately related to a different occasion with a view to pay them — channels can be utilized by different nodes within the community with a view to enhance their reachability. In different phrases, if Alice is related to Bob and Bob is related to Caroline, Alice and Caroline can seamlessly pay one another by means of Bob.

Lightning Scalability

As we’ll now show, the Lightning Community already scales to assist 16,264 transactions a second as we speak and due to this fact solves the scalability downside whereas preserving all the advantages Bitcoin has to supply — permissionlessness, shortage, person sovereignty, portability, verifiability, decentralization and censorship resistance.

For a cost to make its method by means of the community, it sometimes has to undergo a number of cost channels. To reply what number of funds the community can do in a second, we have to perceive what number of a median channel helps.

Statistics present that the common cost goes by means of round three channels.

The benchmark numbers we’ll use for this evaluation have per-node throughput capability, not per-channel. Due to this fact, we’ll inaccurately assume that every node has only one channel. The default LND node is alleged to have the ability to do 33 funds per second with an honest machine (eight vCPUs, 32 GB reminiscence) based on the benchmark.

With 16,266 nodes in the network (as of November 2022), assuming every cost has to undergo three channels (4 nodes), the community ought to have the ability to obtain round 134,194 funds per second.

That’s, every cost has to undergo a bunch of 4 nodes, and there are 4,066 such distinctive teams within the community. Assuming every node can do 33 funds a second, we multiply 4,066 by 33 to achieve 134,194.

Now, to be real looking: Not each node is working a machine just like the one within the benchmark — many are simply running on a Raspberry Pi. Fortunately, it doesn’t take a lot to have the ability to beat the present cost methods.

Lightning Vs. Conventional Funds

Discovering genuine numbers concerning the peak capability of conventional cost methods is tough, so we’ll depend on their common cost fee all through the 2021 monetary 12 months. We’ll examine that to the theoretical capability of Lightning, as a result of conversely, getting the common fee of funds in Lightning is unattainable as a result of its non-public nature, and can be not revealing of functionality as a result of the demand for Lightning funds remains to be comparatively low. This comparability will give us an thought of what number of funds a Lighting node must be able to routing with a view to out-compete conventional finance.

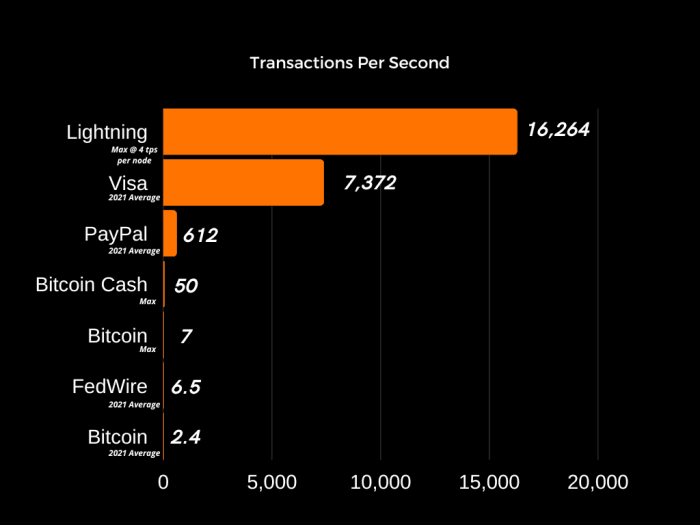

Visa noticed 165 billion payments in 2021, PayPal noticed 19.3 billion payments throughout its entire platform and FedWire noticed 204 million. Respectively, these quantity to 7,372, 612 and 6.5 funds per second on common for 2021. To place into perspective, Bitcoin did 2.44 payments per second in 2021 and scales as much as a most of seven per second.

The numbers are promising — it takes every Lightning node to be able to doing simply 4 funds a second with a view to beat the present cost networks by no less than two occasions. At that fee, 4,066 distinctive four-node teams can obtain 16,264 funds per second — 2.2 occasions that of the biggest competitor, Visa.

To make issues worse for conventional cost networks, the common Lightning transaction charge is 13 occasions much less that of Visa — 0.1% in comparison with 1.29%.

It’s price remembering that one might at all times proceed to scale the Lightning Community by creating new nodes. Since it’s peer to look, its scalability is theoretically limitless so long as nodes within the community develop.

Additional, the aforementioned benchmark by Bottlepay makes the case that there are not any actual technical blockers for Lightning node implementations to finally attain 1,000 funds per second. At such a quantity, the community’s present throughput could be nearer to 4 million per second, to not point out what it will be with a rise within the variety of nodes.

And lastly, it’s price remembering that the Lightning Community remains to be very a lot immature software program and has a good quantity of future optimizations to be carried out, each within the protocol and its implementations. Sources by way of builders are the one short-term constraint to growing scalability, which has rightfully come second to extra necessary issues like reliability.

To present a way of the progress there, River Financial recently shared that its cost success fee is 98.7% at a median dimension of $46, which is astonishingly higher than the earliest publicly-available data it could find from 2018, the place $5 transactions had been failing 48% of the time.

Conclusion

On this piece, we uncovered the entire unfavourable drawbacks of scaling the Bitcoin blockchain by means of growing the bottom layer’s block dimension, most notably severely compromising its decentralization and finally failing to attain its goal of reaching the immense scalability wanted for the calls for a worldwide funds community has and can proceed to more and more have sooner or later.

We confirmed that the Lightning Community, as a second-layer answer, most elegantly solves the scalability downside by each preserving all of Bitcoin’s advantages whereas on the similar time scaling it method past what any base-layer options promise.

It is a visitor publish by Stanislav Kozlovski. Opinions expressed are fully their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.

More NFT News

Machine Studying in Focus as Chainalysis Acquires Hexagate

Bitcoin Traders Are Now Up $67,000 On Common – And This Is Simply The Begin

Extra Than Half of Crypto Tokens, Memecoins Launched in 2024 Have been Malicious: Blockaid