The crypto market has witnessed a number of fluctuations, however particular sectors’ resilience inside this area stays engaging. Not too long ago, regardless of a noticeable dip within the broader crypto market, one space appears poised to the touch its peak, demonstrating the potential and adaptableness throughout the crypto ecosystem, per a report.

Liquid staking, a sector that facilitates rewards for token pledges supporting blockchain operations, exhibits indicators of resurgence. This re-emergence happens regardless of an overarching downturn in crypto belongings.

Restoration Amid Crypto Disaster

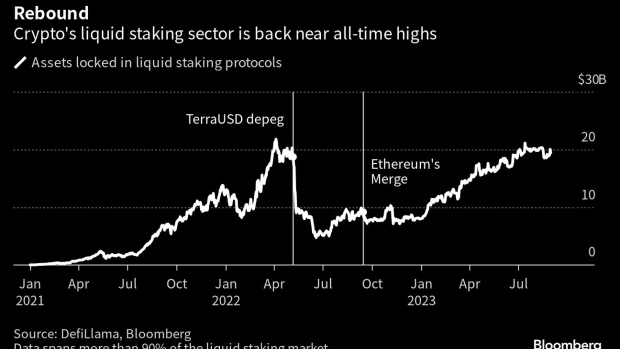

Based on Bloomberg, citing knowledge from DefiLlama, there’s a roughly 292% surge in belongings secured in liquid staking providers, reaching a monumental $20 billion from a low in June 2022. This ascent is all of the extra important contemplating the broader crypto stoop throughout that interval.

Bloomberg famous a restoration in liquid staking’s place as “the titan of decentralized finance (DeFi).” Because of blockchain-based automated software program, this crypto framework permits people to commerce, borrow, and lend with out intermediaries.

Notably, as soon as the crown jewel of DeFi functions, liquid staking has overtaken lending. Protocols specialised in liquid staking, reminiscent of Lido and Rocket Pool, witnessed their zenith in April of the earlier yr.

They amassed belongings barely exceeding $21 billion. Nevertheless, this momentum was disrupted by the destabilization of TerraUSD, main to an enormous $2 trillion setback within the crypto market.

Regardless of the gloomy overtones within the crypto sector, the place main tokens and a majority of DeFi providers are but to recuperate from the blows of 2021 and 2022, liquid staking stands out, showcasing a comeback, as seen within the chart beneath.

World Regulatory Stance On Staking

Liquid staking performs a pivotal function, particularly within the Ethereum blockchain. It presents a mechanism the place customers can stake their tokens and, in return, obtain a liquid token representing their staked quantity.

This course of permits customers to take part in securing the community whereas sustaining liquidity. Merely put, they’ll earn staking rewards with out locking up their belongings, guaranteeing flexibility and maximizing potential features.

Kunal Goel, a analysis analyst at Messari, parallels these providers to “the on-chain equal of presidency bonds.” The analyst elaborates that whereas these aren’t devoid of dangers, they exude a relatively decrease threat profile and, to date, have remained untainted by hacks or exploits.

This resurgence in liquid staking doesn’t go unnoticed and has been juxtaposed with regulatory choices regarding crypto globally. The US, as an example, has intensified its regulatory lens on the crypto sector, particularly on staking merchandise.

Such measures prompted key gamers like Kraken and Bitstamp to halt their regional staking merchandise. Richard Galvin, co-founder at DACM, famous:

The regulatory crackdown round staking merchandise supplied by centralized exchanges has undoubtedly helped liquid staking.

Featured picture from iStock, Chart from TradingView

More NFT News

XRP Worth On Its Approach To $10 In Solely Three Months If It Follows This Sample

El Salvador Boosts Bitcoin Purchases After IMF Settlement

No, BlackRock Can't Change Bitcoin