Bitcoin mining is the cornerstone of the crypto trade and the crypto market. At its core, the profitability of mining comes right down to a single, essential metric — the price of producing every bitcoin.

The significance of this price turns into even higher with regards to publicly traded Bitcoin mining firms, because it’s basically what retains them operational and finally worthwhile. On this report, CryptoSlate will give attention to Marathon Digital and Riot Blockchain, two of the most important public Bitcoin miners.

Marathon Digital (MARA) and Riot Platforms (RIOT) are two of the most important public Bitcoin mining firms by market cap. Their operational capability and financials provide necessary insights into the state of Bitcoin mining at its highest and most organized stage.

Whereas all public Bitcoin mining firms, together with Marathon and Riot, present information on their mining prices, there’s typically extra to the numbers they publish. Some firms use completely different accounting therapies for digital property, which impacts their carrying worth. Some firms have a number of mining websites throughout varied geographical areas, every with completely different electrical energy costs and mining capacities.

To raised perceive the common price to mine one bitcoin, CryptoSlate adopted another strategy — dividing the overall prices of revenues for every firm by the variety of Bitcoins they produced. This technique, albeit extra speculative, guarantees a extra telling reflection of precise mining prices.

Dividing the overall prices of revenues by the variety of Bitcoins produced supplies a complete view of the bills incurred within the mining course of. This strategy goes past simply the electrical energy or operational prices, together with all direct and oblique prices related to mining, comparable to tools depreciation, upkeep, staffing, and administrative bills.

By aggregating these prices, this technique reveals what it really prices an organization to mine every Bitcoin. It precisely displays the financial actuality, capturing the complete spectrum of bills that influence the underside line. This helps us perceive the effectivity and profitability of Bitcoin mining operations and is a precious instrument for analysts and traders looking for to know mining firms’ monetary well being and operational efficacy.

Marathon Digital (MARA)

Marathon had a really profitable 2023, increasing its operational capability via acquisitions and new mining tools. The corporate additionally introduced that its acquisitions enabled it to lower operational prices by as a lot as 30%, drastically influencing its profitability.

Nonetheless, there’s little concrete info coming instantly from Marathon concerning the firm’s mining prices. A September analysis from Motley Idiot put Marathon’s price to mine 1 BTC at slightly below $19,000. The corporate’s newest month-to-month update for December 2023 solely states the will increase in hash price capability and technical particulars about its mining efficiency however comprises no details about its mining prices.

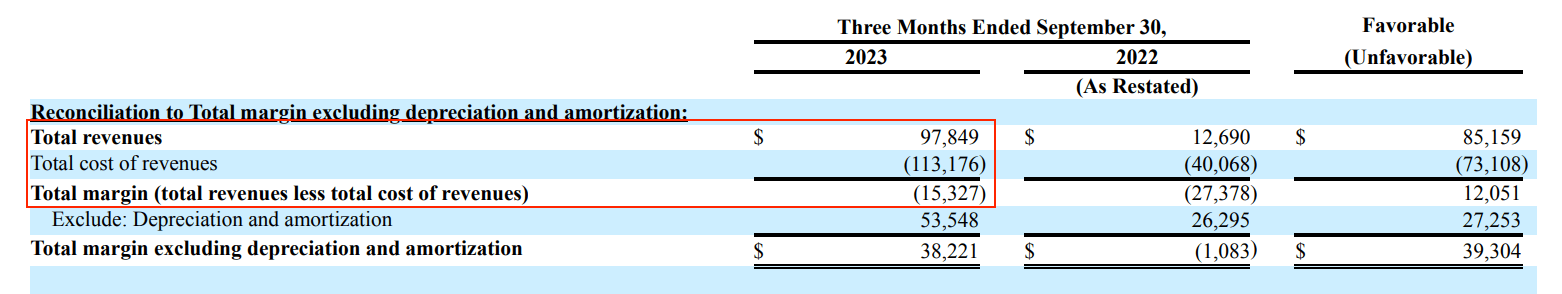

Our major information supply is the corporate’s 10-Q report for the third quarter of 2023. To find out the common price of mining 1 BTC, we’ll make use of the alternate technique of dividing the overall prices of revenues by the variety of Bitcoins produced within the three months ending Sep. 30, 2023. Knowledge from the report reveals the overall price of revenues as $113.176 million. Subtracting the overall margin from the price of revenues places it at $97.849 million.

With the corporate producing 3,490 BTC in the course of the quarter, dividing the price of revenues by the variety of produced bitcoins brings us to a price of mining of roughly $28,036.96.

Riot Platforms (RIOT)

Riot has spent the higher a part of 2023 implementing a long-term strategic plan to assist the corporate keep worthwhile after Bitcoin’s halving in April 2024. In its update for the third quarter of 2023, the corporate’s CEO stated its energy technique enabled it to scale back its YTD price to mine to $5,537 per Bitcoin.

This extraordinarily low price may be attributed to Riot’s particular enterprise technique, which concerned incomes energy credit from the Electrical Reliability Council of Texas (ERCOT). Riot participates in ERCOT’s demand response program, which reduces electrical energy consumption throughout peak demand intervals in alternate for energy credit. These credit cut back Riot’s electrical energy prices, a serious element of Bitcoin mining bills.

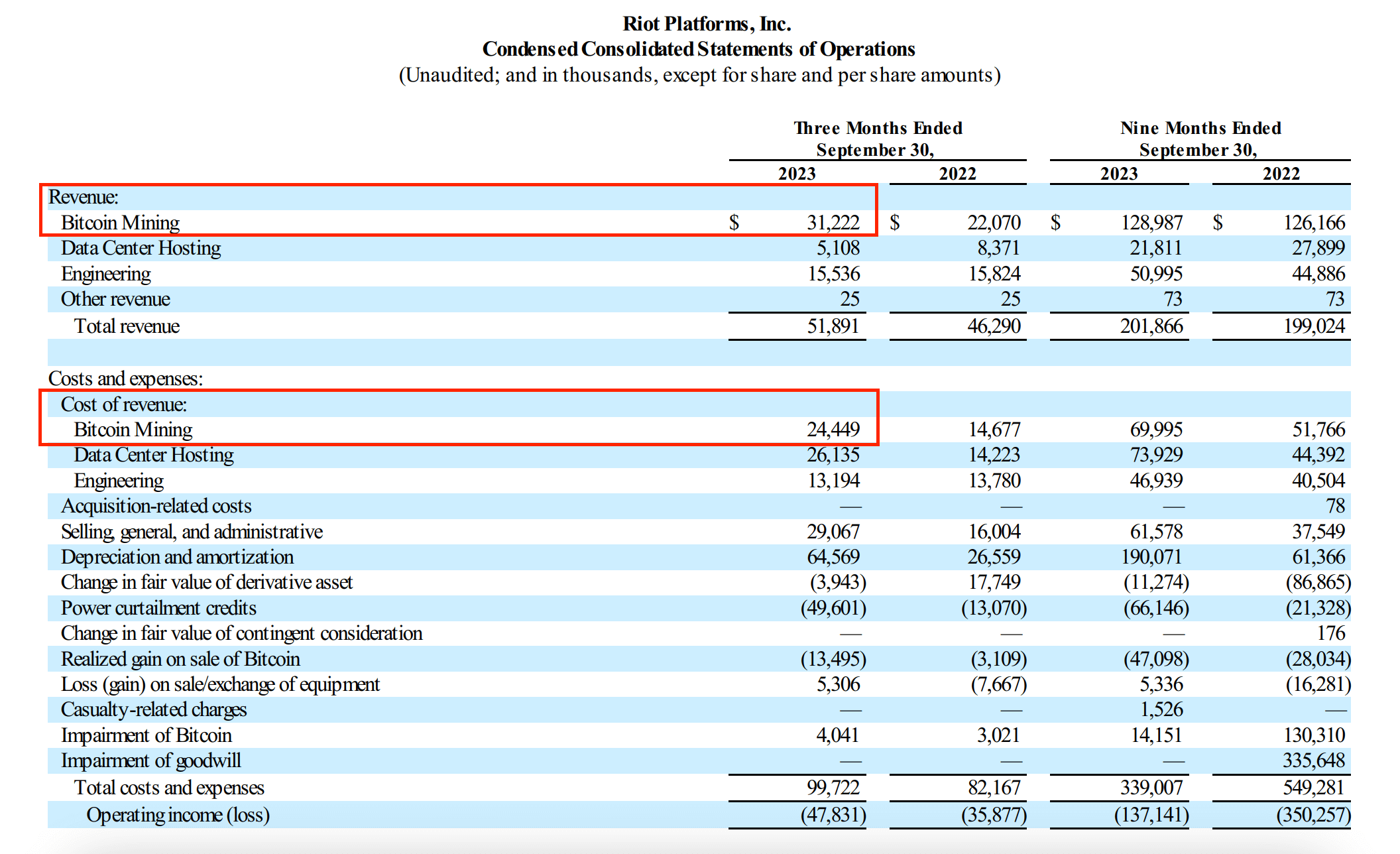

To get a median price of mining one bitcoin for Riot, we’ll apply the identical methodology to Marathon – dividing the price of income by the variety of bitcoins mined in a given interval. In line with Riot’s 10-Q submitting for the third quarter of 2023, Riot’s price of income for Bitcoin mining stood at $24.449 million. Throughout this era, Riot mined 1,106 BTC.

By dividing the overall price of revenues particular to Bitcoin mining by the variety of mined BTC, we discover that Riot’s common price for mining one Bitcoin within the third quarter was roughly $22,105.78.

This places Riot’s price for mining near Marathon’s $28,036.96. Nonetheless, a crucial element of Riot’s operational technique is its engagement with ERCOT. Throughout the third quarter of final 12 months, Riot acquired roughly $49.6 million in energy curtailment credit from ERCOT.

In line with its 10-Q submitting, if the $49.6 million in energy curtailment credit for the quarter had been instantly allotted to Bitcoin mining price of income primarily based on its proportional energy consumption, it could lower by $31.2 million. On this case, the adjusted price of income would end in a unfavorable worth of -$6.751 million, exhibiting that the credit would offset Riot’s unique price.

Given this information, the common price to mine one bitcoin can be roughly -$6,105.78. Whereas it is a extremely unlikely situation, it reveals how substantial the influence of the facility curtailment credit might be on Riot’s mining operation and the way a lot it may contribute to total profitability.

The put up Marathon vs Riot: Analyzing the true cost of mining 1 bitcoin appeared first on CryptoSlate.

More NFT News

Chinese language Auto Supplier Dives Into Bitcoin Mining With $256M Funding

Harnessing idle GPU energy can drive a greener tech revolution

Will Dogecoin Attain $1? Crypto Volatility Returns as Bitcoin and Ethereum Slide