In a Keynote tackle at MicroStrategy World: Bitcoin for Corporations, MicroStrategy Govt Chairman Michael Saylor delivered a masterclass on company finance and the facility of bitcoin to supercharge company steadiness sheets. Saylor made a degree to emphasise Bitcoin because the single answer for capital appreciation in an inflationary atmosphere.

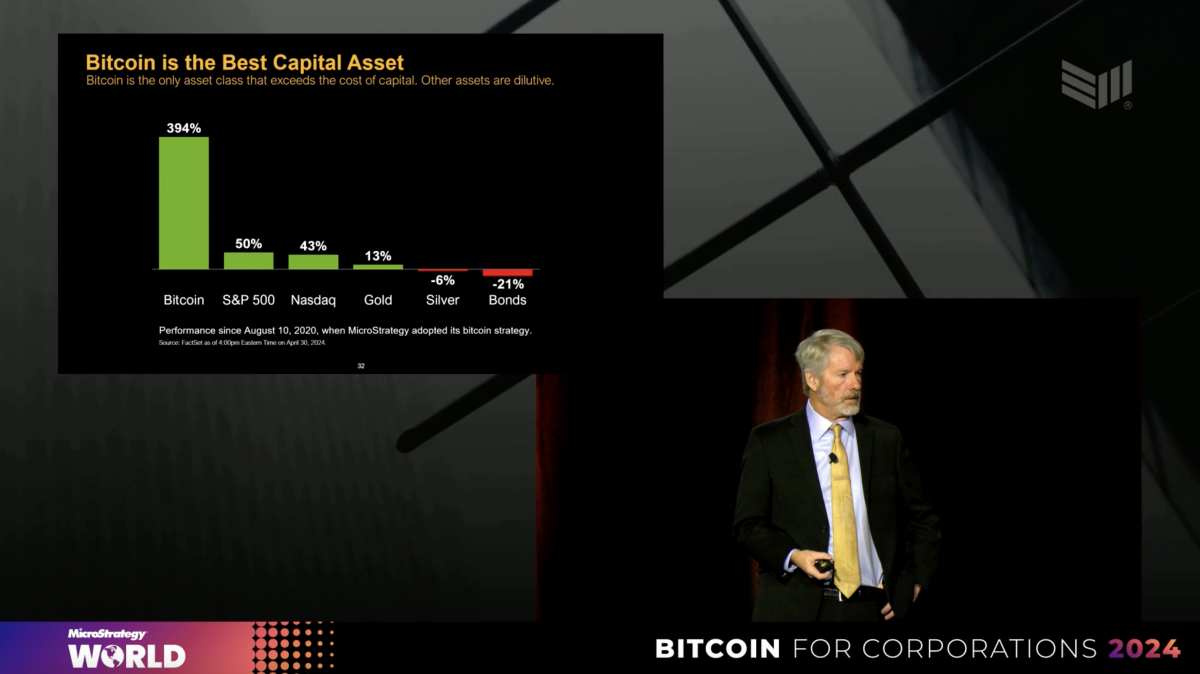

In his speech, Saylor likened the price of capital to being the benchmark which an organization should surpass to enhance its buying energy, arguing that “Bitcoin is the solely asset that exceeds the price of capital. One other method to say that, is every thing else is dilutive.”

Additional describing the true value of capital, he famous that the “S&P is the trendy surrogate for the price of capital… For those who needed to decide one metric and say, what is the metric that provides you a way of how quickly the world foreign money provide is increasing in {dollars}? In all probability the S&P 500… that is one other method to see inflation.”

Saylor went on to emphasise his perception that every one belongings, besides bitcoin, aren’t accretive to company steadiness sheets regardless of their basic acceptance. Specifically, he highlighted the relative underperformance of the silver, gold and US authorities bonds:

“[If companies] invested in T-bills, they’ll get 3% after tax towards a 12% value of capital per 12 months. And so that you maintain $100 billion of capital, you destroy $9 billion of shareholder worth a 12 months… The story right here is that the bonds do not maintain worth, proper? They’re terrible capital belongings. Silver does not work. Gold does not sustain with the price of capital.”

There Is No Second-Greatest Crypto Asset

The MicroStrategy Govt Chairman famous key variations between Bitcoin and different cryptocurrencies like Ethereum, expressing the significance and necessity of proof-of-work-based consensus in making a digital commodity.

“You could possibly see the writing on the wall when the spot ETF of Bitcoin was permitted in January. By the tip of Could, you will know that Ethereum is just not going to be permitted. And when Ethereum is just not going to be permitted, someday this summer season it will be very clear to everybody that Ethereum is deemed a crypto asset safety, not a commodity. After that, you are going to see that [for] Ethereum, BNB, Solana, Ripple, Cardano – every thing down the stack.”

On the purpose of Bitcoin’s vitality use, Saylor invoked the concept of a “bodily linkage to the true world” in Bitcon’s consensus. He described the community as having “uncooked digital energy standing in the best way of anyone that may attempt to undermine the integrity of the community… The community is feeding on electrical energy, and that creates a decentralizing dynamic that drives all the community to the tip of the grid within the quest of stranded vitality.”

It’s Going Up, Eternally

Saylor’s conviction and use of physics-based metaphors have been current as ever as he spoke on Bitcoin’s value appreciation and continued monetization. “It is by no means declining. The chart’s not ever reducing. It solely goes a method. Bitcoin is a capital ratchet. It is a one-way ratchet. Archimedes stated, give me a lever lengthy sufficient and a spot to face and I can transfer the world. Bitcoin is the place to face.”

“There is no extra highly effective concept than the digital transformation of capital… No pressure on earth can cease an concept whose time has come. That is an concept. Its time has come. It is unstoppable. And so I’ll finish with the commentary that Bitcoin is one of the best. The most effective what? The most effective.”

More NFT News

Machine Studying in Focus as Chainalysis Acquires Hexagate

Extra Than Half of Crypto Tokens, Memecoins Launched in 2024 Have been Malicious: Blockaid

Hedera Value Prediction for Right now, December 18 – InsideBitcoins