KAUNAS, LITHUANIA –Information Direct– DappRadar

DappRadar, the worldwide app retailer for decentralized purposes, predicts in its new report on the state of the NFT market that regardless of financials falling in Q3 that whole gross sales are anticipated to develop by 6% by the top of the quarter.

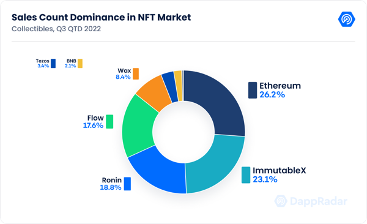

Though the NFT market’s buying and selling quantity decreased by 75% ($2 billion) from the prior quarter, gross sales are estimated to succeed in 21.1 million by the top of Q3. As well as, regardless of the overall fall within the NFT market, with robust financial headwinds and the impression of the Terra Luna crash, with a decline of buying and selling quantity of 75% for Q3, the variety of distinctive merchants rely has elevated by 36%, in comparison with Q3 2021.

Supply: DappRadar

“Making an allowance for the quantity of manufacturers which can be beginning to implement NFTs and the variety of distinctive merchants of this quarter (2.2 million), the enlargement of the NFT market will proceed increasing additionally in 2023, however the highway forward will probably be rocky,” the report concludes.

Ethereum NFT tasks

On the draw back, in Q3 the market cap for Ethereum’s high 100 NFT tasks suffered a 44% ($19 billion) lower in USD worth from the earlier quarter; although over the identical interval, the market cap by way of ETH based mostly NFTs as an entire decreased solely 27% (12.2 million ETH). In distinction, NFTs on ImmutableX elevated buying and selling quantity by 87% from the earlier quarter exhibiting the potential of web3 video games.

With Ethereum internet hosting the high-end collectibles contributing to millionaire gross sales, one of many optimistic standout NFT information from the quarter was the sale of the costliest NFT this 12 months, with the acquisition by Deepak Thapliyal, the CEO of Chain of CryptoPunk #5822 for a record-breaking 8,000 ETH (roughly $23.7 million). This sale is the largest CryptoPunks NFT buy in historical past.

Bluechip collectibles

Certainly, the report finds that although blue chip collectibles’ buying and selling quantity in Q3 fell by 88% reaching greater than $334 million, virtually the identical worth as within the second quarter of 2021, “once we have a look at the ground value of the highest 11 blue chips collections it hasn’t decreased, however it has maintained virtually the identical worth as earlier than Terra’s collapse.”

Wanting on the September information for flooring costs of the highest 11 bluechip collections, Azuki has a rise of 43.18% (11.44 ETH) from the earlier month, adopted by Cool Cats with a 15.83% (2.78 ETH) improve. Alternatively, the 4 tasks of Yuga, moreover Mutant Ape Yacht Membership’s improve of two.14% (14.30 ETH) from August, decreased their flooring value. CryptoPunks decreased by 5.19% (63.95 ETH), Bored Ape Yacht Membership 7.36% (73 ETH), and Otherdeed simply 0.57% in comparison with August..

Digital artwork

Asides from avatars, there’s a thriving marketplace for digital artwork incorporating NFTs, with over 4.5 million gross sales since January 2021, and a complete buying and selling quantity of over $three billion. Whereas the market has cooled off in Q3 the digital artwork {industry} is increasing. This 12 months, modern artwork establishments are starting to accumulate artwork produced as NFTs, whereas digital artwork is a vital factor of the increasing metaverse.

Blockchain gaming NFTs

The blockchain gaming market which is price greater than $8.6 billion, and with 847,000 every day Distinctive Energetic Wallets (UAW) registered in August, noticed the overall buying and selling quantity of NFTs decline sharply from $1 billion in Q1 of 2022 to only $71 million in Q3. Gross sales numbers additionally fell off from 12 million in Q1 to three.three million in Q3.

Vogue and luxurious NFTs

Within the style and luxurious NFT market, whereas buying and selling quantity dropped off considerably from Q1 to Q3, the report argues that demand for style and luxurious NFTs stay one of many strongest use circumstances. A living proof, the gathering was created by Tiffany & Co, with a mint value of 30 ETH ($50,000), offered out in 20 minutes, price $12.5 million in income.

Sports activities NFT market

The game NFT market led by soccer and basketball, with Sorare and NBA High Shot, mixed generated $128 million in trades throughout Q1 from greater than 4 million trades. The amount decreased 63% in Q2 whereas the variety of gross sales crashed by 54%. In Q3 the overall buying and selling quantity is greater than $18 million, an additional 61% lower from the earlier quarter, and the gross sales rely is a million, a 47% from Q2. Regardless of the awful financials the report believes the sports activities marketplace for NFTs continues to be robust, with Sorare to profit from the 2022 World Cup later this 12 months.

The impression of The Merge

Lastly, by way of the impression of Ethereum’s Merge on NFTs, the ensuing discount in power consumption required by the brand new Proof of Stake mechanism, was a optimistic step ahead to fight criticism of NFTs, the report finds: “It is a important development for Ethereum and notably for NFTs, efficiently rebutting one of the crucial widespread NFT objections.”

Notes to Editors

[2] The Merge and risks of NFT duplication

Regardless of The Merge being supported by most builders within the Ethereum group some builders within the Ethereum group cut up the blockchain and created a brand new chain that continues to make use of the present proof-of-work mechanism. Probably the most notable instance thus far is ETHPOW, which is headed by the famend Chinese language miner Chandler Guo.

As ETHPOW and different forks diverge from the Ethereum mainnet, they produce duplicate copies of Ethereum’s NFTs. An NFT is barely a blockchain token that will function proof of possession for digital property like paintings and collectibles. Subsequently, a branched Ethereum chain will comprise a number of deeds pointing to the identical piece of artwork or media.

A Bored Ape Yacht Membership NFT proprietor might promote the duplicated model on the proof-of-work chain, but when the identical transaction is “replayed” by a malicious actor on the merged proof-of-stake chain, the vendor may lose the unique model on that chain.

[3] Digital artwork in Q3

In Q3 the general commerce quantity is $58 million, a 72% discount from the earlier quarter. The variety of gross sales decreased by 43% over the earlier quarter, reaching 258,000.

Socials: Twitter – Discord – Reddit – Telegram – Facebook

Based in 2018, DappRadar is the The World’s Dapp Retailer: a world decentralized purposes (dapps) retailer, which makes it straightforward for its base of greater than 1 million customers monthly to trace, analyze, and uncover dapp exercise through its on-line platform. The platform presently hosts 9,000 dapps from throughout 30+ protocols and provides a plethora of consumer-friendly instruments, together with complete NFT valuation, portfolio administration, and every day industry-leading, actionable perception.

Contact Particulars

Dan Edelstein

View supply model on newsdirect.com: https://newsdirect.com/news/nft-financials-falling-in-q3-but-on-chain-metrics-remain-bullish-dappradars-new-nft-report-shows-150634659

More NFT News

SOL Eyes $200 After 5% Each day Surge, BTC Calms at $95Ok (Weekend Watch)

Demystifying algo buying and selling in crypto markets

The Prime 100 Crypto Belongings’ 6 Greatest Performers in 2024