Amid Lebanon’s monetary disaster, vital demonstrations have erupted in Beirut focusing on monetary establishments. Outraged Lebanese depositors, witnessing their financial savings vanish, have resorted to smashing financial institution home windows, setting fires, and interesting in riots. Concurrently, leaders of Lebanon’s central financial institution face grave allegations of fraud, embezzlement, and political corruption.

Lebanese Residents Left Penniless as Monetary Establishments Crumble

In February 2023, Lebanese depositors that have been incensed by the alleged theft of their life financial savings by the nation’s central financial institution, set ablaze the very banks that held their fortunes. Bitcoin.com Information highlighted this distressing scenario, revealing that regional banks had frozen accounts, leaving residents unable to entry their hard-earned funds. As if that weren’t sufficient, Lebanon was stricken by skyrocketing inflation, additional exacerbating the plight of its residents.

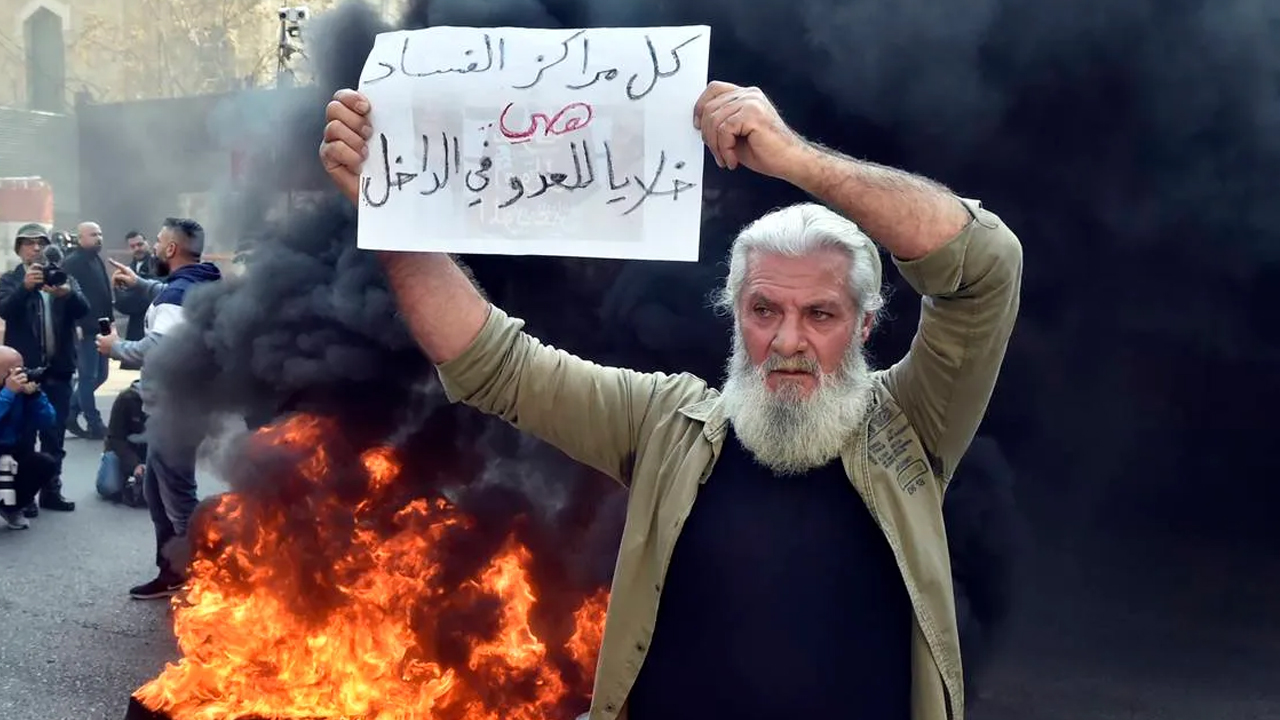

The wave of discontent continued in March 2023 when protests reverberated all through Beirut and different areas. Outlookindia.com vividly reported scenes of shattered home windows, burning tires, and passionate demonstrators venting their anger towards Riad Salameh, the governor of Lebanon’s central financial institution.

Amidst the month of Could 2023, resolute demonstrations persist as Lebanese residents grapple with mounting anxiousness over the destiny of their hard-earned financial savings. Reviews reveal that the financial institution, in a bid to revive order, enlisted assistance from safety personnel and known as upon riot police to quell the upheaval unfolding outdoors the downtown Beirut department of Financial institution Audi.

Frustration simmers amongst Lebanese residents who discover themselves completely disadvantaged of entry to their deposits, with accusatory fingers pointed squarely at Salameh and his brother. Alarming allegations have emerged from six European international locations, as detailed by The Nationwide, suggesting that Salameh and his brother orchestrated an intricate embezzlement scheme of colossal proportions.

“In Lebanon, it isn’t one agency or one financial institution however the entire monetary system that collapsed with out warning from auditing companies,” The Nationwide’s reporter Nada Maucourant Atallah explains. “The disaster uncovered losses of virtually $70 billion wiping depositors’ financial savings out and triggering an uncontrolled inflationary spiral, which plunged greater than 80 p.c of the inhabitants into poverty.”

Leaders of Lebanon’s Central Financial institution Underneath Hearth: Grave Allegations of Fraud and Corruption Floor

In line with French courtroom paperwork reviewed by Reuters, French prosecutors have unveiled their intentions to stage preliminary accusations of fraud and cash laundering towards Salameh. The costs revolve round allegations that he hid his wealth utilizing purportedly counterfeit financial institution statements. A scheduled listening to in France on Could 16th has been organized by the French judicial authorities.

In the meantime, the circumstances confronted by bizarre residents and Lebanese financial institution depositors persist, leaving them with none funds. The implications of this predicament have ignited relentless indignation, as individuals grapple with the pressing want to supply for his or her households and meet primary requirements akin to meals and shelter. Lebanese monetary establishments have now devolved into mere façades, with hole financial institution tellers, vacant ATMs, and fortified buildings standing as bleak reminders of Lebanon’s damaged economic system.

What are your ideas on the continued monetary turmoil in Lebanon and the allegations surrounding the central financial institution’s governor? Share your insights and opinions within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss brought about or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

More NFT News

El Salvador Boosts Bitcoin Purchases After IMF Settlement

No, BlackRock Can't Change Bitcoin

Canine Memecoins Rebound as Bitcoin Reaches $98,000