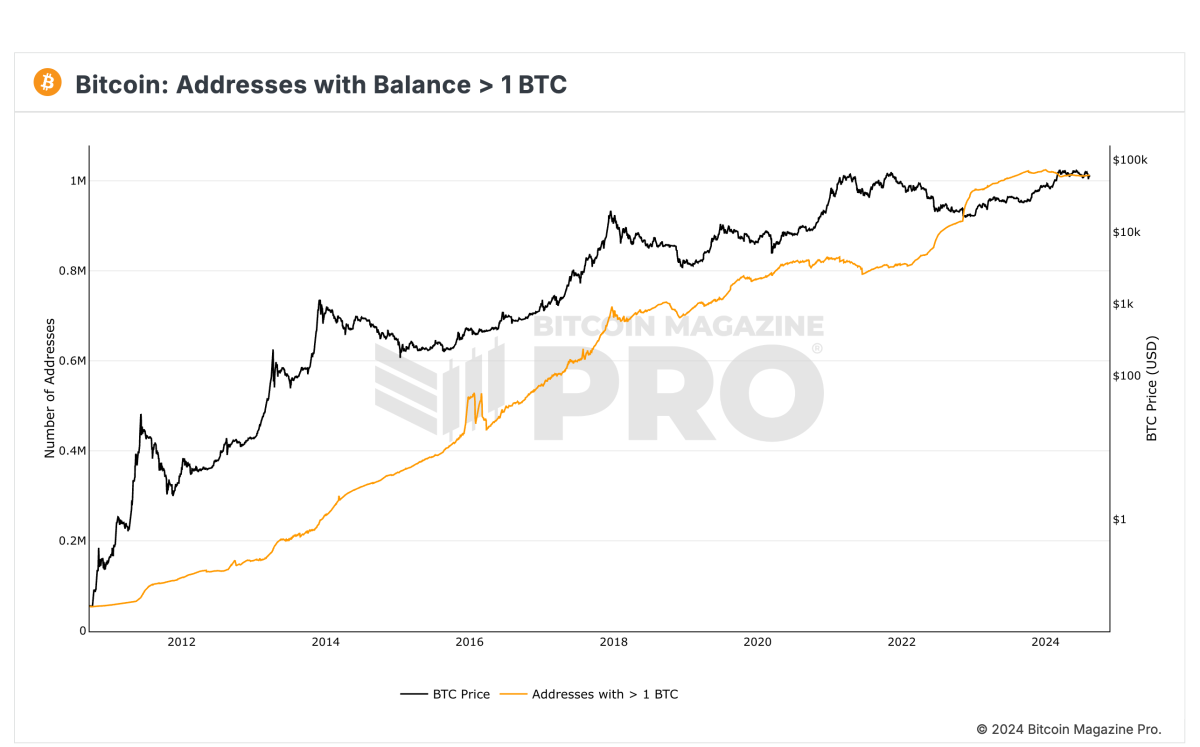

In accordance with knowledge from Bitcoin Magazine Pro, there are 1,012,650 Bitcoin addresses that comprise 1 BTC or extra.

This represents greater than 1 million BTC probably taken off the market and held by robust arms, a good portion of the 21 million BTC that may ever exist. Demand continues to rise as U.S. spot Bitcoin ETFs collectively maintain over 901,000 BTC, whereas MicroStrategy, a significant company Bitcoin holder, owns 226,500 BTC. Moreover, MicroStrategy plans to lift $2 billion to purchase extra Bitcoin, additional emphasizing the development of establishments shopping for and holding substantial quantities of BTC, tightening the obtainable provide as demand will increase.

The variety of Bitcoin addresses holding 1 BTC or extra has traditionally lagged behind BTC’s worth. Nonetheless, prior to now two years, this development has reversed, with the variety of these addresses growing extra quickly than Bitcoin’s worth. This shift alerts rising adoption and displays rising long-term confidence in Bitcoin, as extra customers accumulate and maintain vital quantities of Bitcoin.

The rise in addresses with 1 BTC or extra signifies that each retail and institutional buyers are actively accumulating Bitcoin. With solely 21 million BTC ever to be mined, and roughly 19 million already in circulation, the demand for Bitcoin seems to be growing as customers purpose to safe their share of the restricted provide.

For extra detailed data, insights, and to enroll to entry Bitcoin Journal Professional’s knowledge and analytics, go to the official web site here.

More NFT News

Extra Than Half of Crypto Tokens, Memecoins Launched in 2024 Have been Malicious: Blockaid

Hedera Value Prediction for Right now, December 18 – InsideBitcoins

Morocco’s New Crypto Framework Guarantees Regulation And Innovation