Fast Take

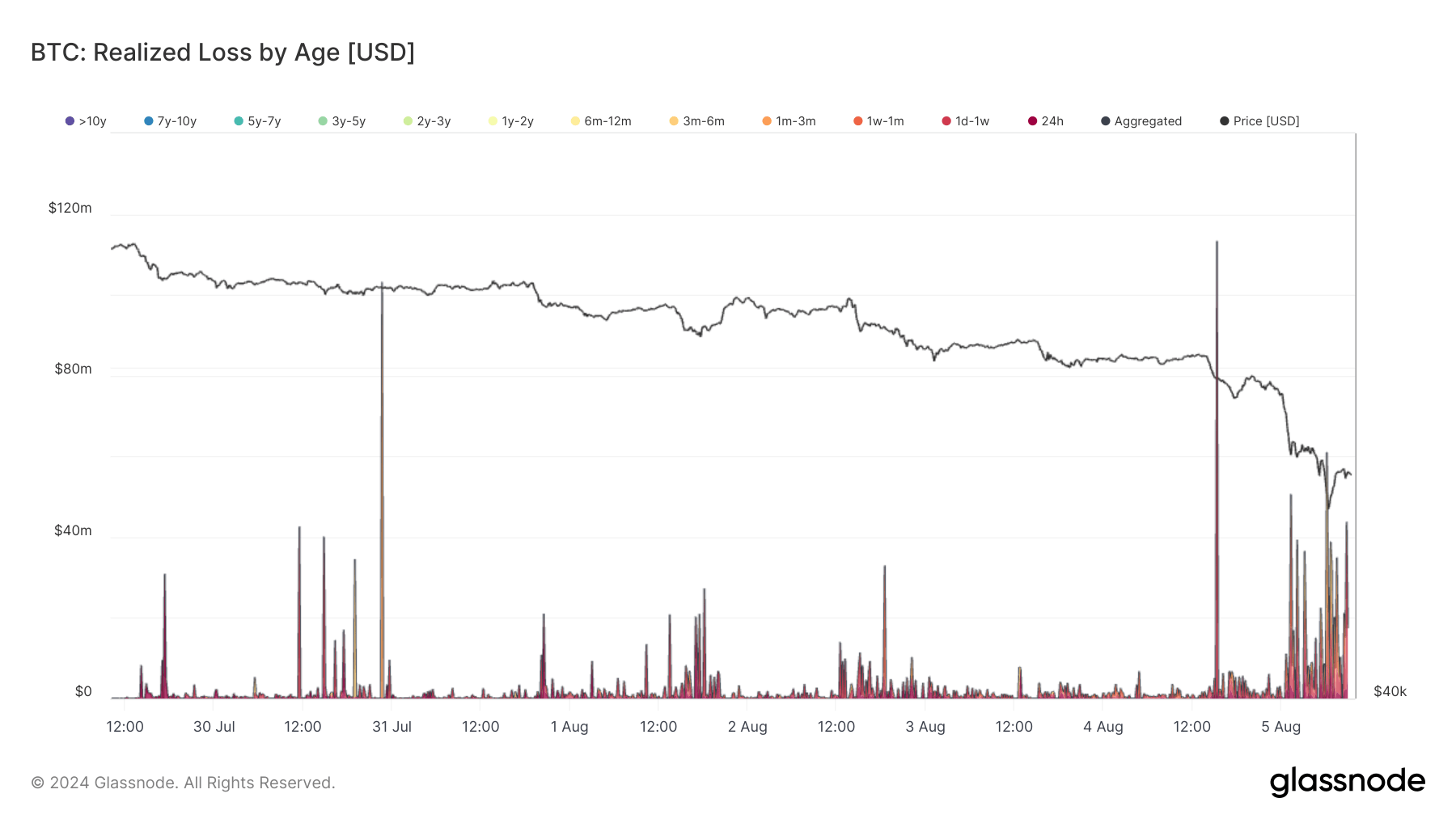

On Aug. 2, Bitcoin (BTC) was buying and selling round $65,000, however by Aug. 5, it had plummeted to a low of $49,000 earlier than recovering to about $51,000. This drastic fluctuation has led to substantial realized losses, significantly amongst short-term holders (STHs).

Since Aug. 4, over $850 million in realized losses have been recorded, with the majority of those losses attributed to STHs, who’ve held Bitcoin for lower than 155 days. In distinction, long-term holders (LTHs) have solely realized about $600,000 in losses, highlighting that the current market downturn has primarily impacted newer buyers.

| Time | Worth |

|---|---|

| 24h | $101,547,395 |

| 1d_1w | $394,421,018 |

| 1w_1m | $175,281,805 |

| 1m_3m | $101,741,897 |

| 3m_6m | $94,699,637 |

| 6m_12m | $101,737 |

| 1y_2y | $2,497 |

| 2y_3y | $295,917 |

| 3y_5y | $292,370 |

| 5y_7y | – |

| 7y_10y | – |

| more_10y | – |

| aggregated | $868,384,273 |

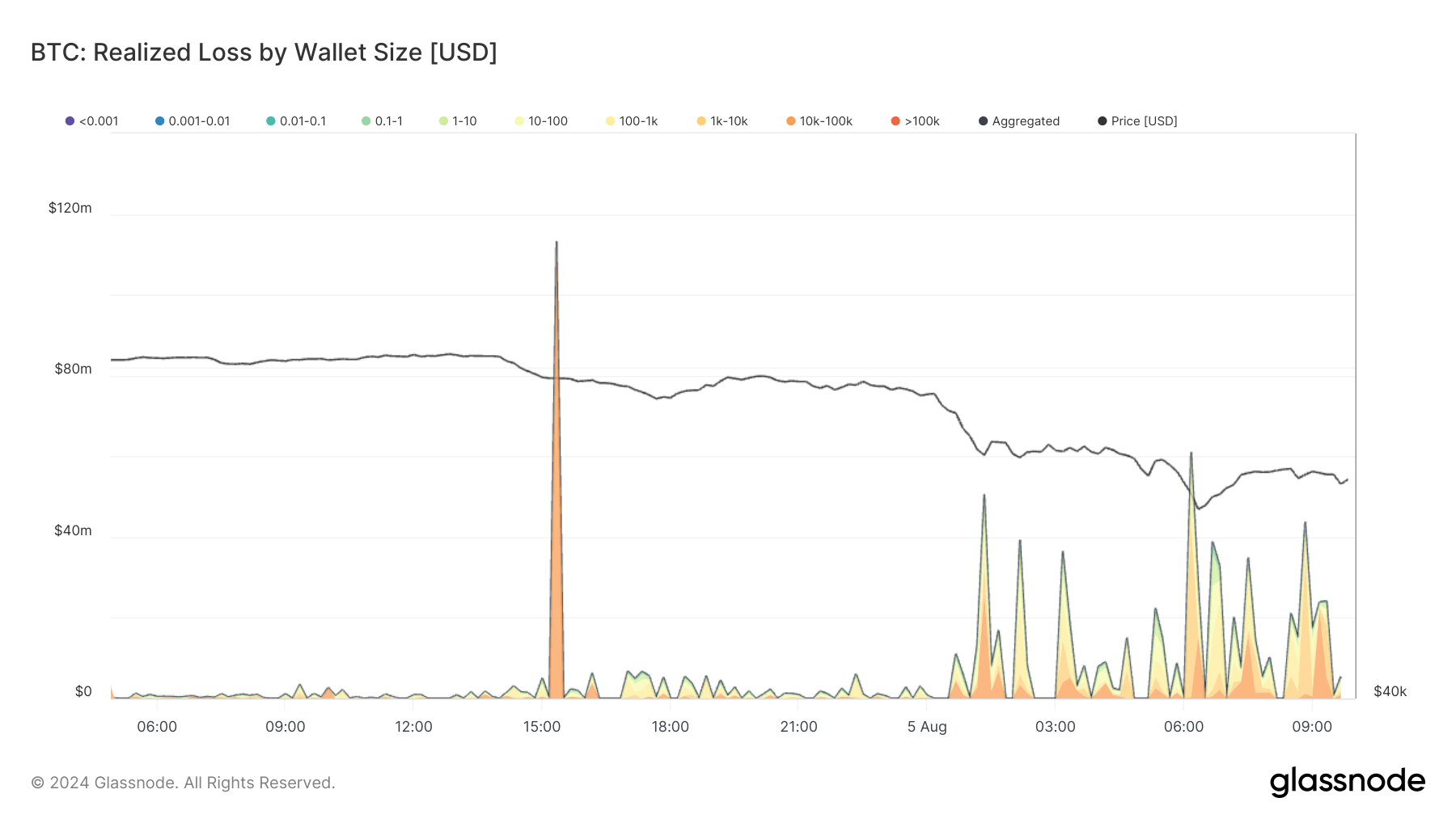

Analyzing the losses by measurement, it’s evident that the losses span throughout totally different investor cohorts, from these holding roughly 1 BTC to these holding as much as 100,000 BTC. Notably, there was a major spike on Aug. 4, when a whale with a stability of 10k-100ok BTC offered over $100 million in realized losses.

More NFT News

NAGA Founder Is Constructing Crypto Startup Promising “A New Means of Buying and selling”

10 Finest Crypto Platforms for Day Buying and selling in 2025

Crypto dealer will get sandwich attacked in stablecoin swap, loses $215Ok