In an in depth evaluation released by crypto intelligence agency ChainArgos, allegations have surfaced concerning the Polygon workforce’s involvement in secret gross sales of MATIC tokens, doubtlessly resulting in a suppression of the token’s value. The revelations stem from an in-depth examination of the token allocations and subsequent flows to varied exchanges.

ChainArgos, in a sequence of statements on X (previously Twitter), elaborated on discrepancies between Polygon’s publicly said token allocation plan and the precise flows noticed. Notably, the agency recognized irregular outflows from a “vesting contract” and a basis contract, which ostensibly manages the allocations.

ChainArgos highlighted, “If you take a look at the flows you discover a ‘vesting contract’ which mechanically unlocks all flows… That form is odd and the gaps are all completely different sizes,” ChainArgos reported, indicating potential irregularities.

$1 Billion In MATIC Bought In Stealth Modus?

A crucial level of concern is the supposed allocation for staking. ChainArgos’s evaluation means that whereas the allocation desk indicated a spread from 400 million to 1.2 billion MATIC for staking, the precise stream into the staking contract began from zero and solely reached 800 million.

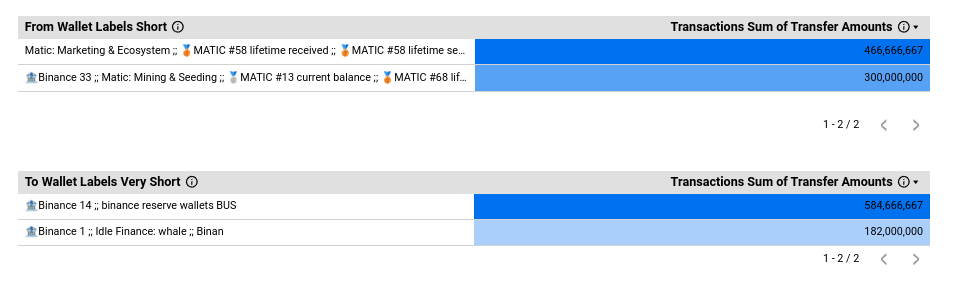

This discrepancy of 400 million MATIC was traced to an deal with labelled ‘Binance 33’ on Etherscan, which ChainArgos asserts shouldn’t be related to staking actions. This deal with, curiously, was additionally concerned in a major stream of 300 million MATIC to a different deal with, which in flip despatched 767 million MATIC to Binance exchange wallets.

“467 million [came] from the Etherscan-labeled “Matic: Advertising and marketing & Ecosystem pockets,” ChainArgos notes. The agency additional argues that this sample of outflows is a transparent indicator of value manipulation, suggesting a coordinated effort by the Polygon workforce and Binance to discreetly transfer giant quantities of MATIC.

“So this isn’t just a few Binance-adjacent factor. The workforce and Binance are clearly working collectively to feed these tokens out the again, reminiscent of it’s. As we’re speaking about 767 million tokens with a value someplace roughly $1-$2, that is one thing like a billion {dollars}”, the crypto intelligence agency claims.

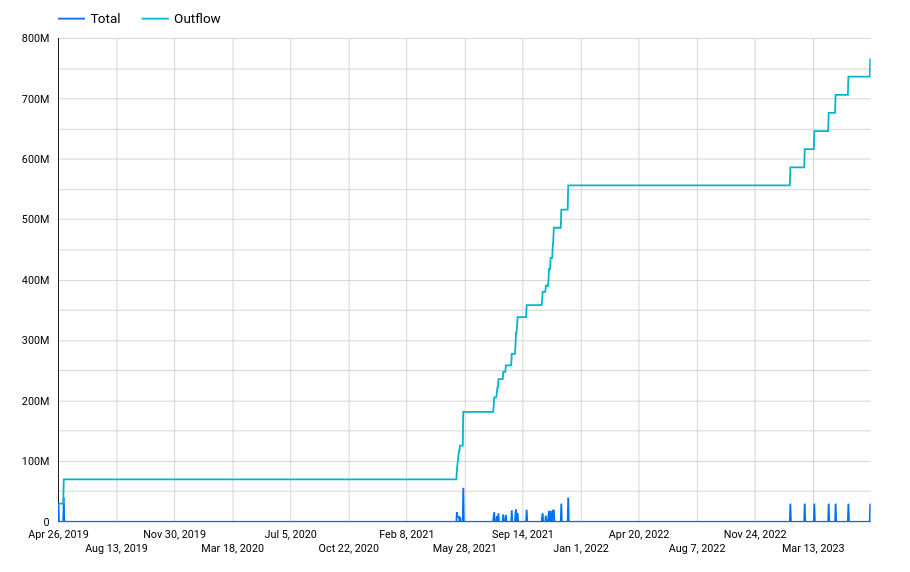

The agency additionally correlated the outflows from the deal with 0x2f4Ee with the MATIC price chart, suggesting that these actions have been indicative of impending value tops and subsequent declines. ChainArgos claims, “Now let’s take a look at the outflows from 0x2f4ee over time. Carry up a value chart. We go away it as an train for the reader to work out that is *very clearly* a great indicator for an upcoming prime and subsequent transfer decrease.”

Lack Of Transparency, Extra Inconsistencies?

ChainArgos criticized the shortage of transparency and oversight in these transactions, urging buyers to be extra diligent and questioning the place their funds are being allotted. “This isn’t even effectively hidden. Once more this has been in our demo for some time. This instance is revealed as a part of our docs. As a result of none of that is tough to search out. Do higher “buyers.” Additionally, possibly, ask the place your cash went,” ChainArgos states.

For context, the Polygon token provide distribution contains numerous classes reminiscent of Non-public Sale tokens (3.80% of the entire provide), Launchpad sale tokens (19%), Staff tokens (16%), Advisors tokens (4%), Community Operations tokens (12%), Basis tokens (21.86%), and Ecosystem tokens (23.33%). The Launchpad sale, particularly, was carried out in April 2019, elevating roughly $5,000,000 USD.

This report raises severe questions concerning the integrity of token allocations and the potential for market manipulation throughout the crypto house.

At press time, the Polygon workforce had not but responded to ChainArgos’ report. MATIC traded at $0.86, up 11.6% within the final seven days.

Featured picture from iStock, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site completely at your personal danger.

More NFT News

El Salvador Boosts Bitcoin Purchases After IMF Settlement

Canine Memecoins Rebound as Bitcoin Reaches $98,000

Faux Satoshi’ Craig Wright Receives One-12 months Jail Sentence