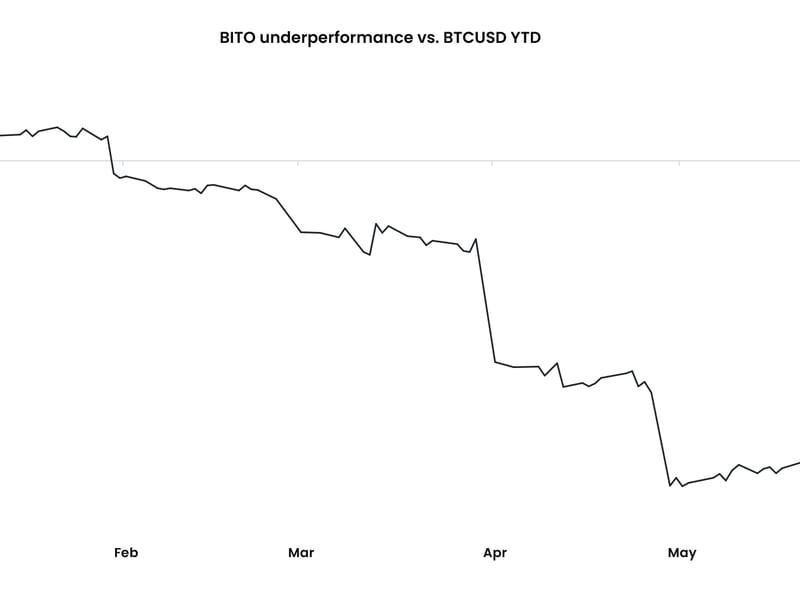

The underperformance stems from the prices related to the fund’s construction. BITO doesn’t buy tokens, as an alternative it holds BTC futures contracts on the Chicago Mercantile Trade (CME). The fund should roll over the contracts each month as they expire, making it susceptible to the worth distinction between phrases. If subsequent month’s contract trades at a premium to the closest expiry – a phenomenon known as contango and typical throughout a bull market – over a sustainable interval, the fund will compound losses because of the “contango bleed.”

More NFT News

El Salvador Boosts Bitcoin Purchases After IMF Settlement

No, BlackRock Can't Change Bitcoin

Canine Memecoins Rebound as Bitcoin Reaches $98,000