After a historically-bad yr for bitcoin mining, public firms that fell into penny inventory standing surged again in January following a powerful bitcoin rally.

2022 was arguably the worst yr on file for bitcoin mining. Each market suffered from the implications of unprecedented recklessness by central banks world wide. However as a result of bitcoin is nothing if not unstable — and since mining acts as a leveraged wager on bitcoin itself — the mining sector of the bitcoin economic system completed final yr battered and bruised. Actually, many public mining firms had been relegated to buying and selling as literal penny shares.

Because of an sudden, wildly-bullish begin to the brand new yr, nevertheless, buyers have seen bitcoin mining shares roar again to life. Little doubt the aid in share costs (and the worth of bitcoin itself) is welcome. How lengthy this rally will final, although, is an open query.

This text summarizes the state of bitcoin mining initially of this new yr, the tragedies left behind within the earlier yr and the alternatives that lay forward.

New Yr Mining Rally

2023 began with a bang for publicly-traded bitcoin mining firms.

Yr thus far, firms like Riot Platforms, Marathon Digital and CleanSpark have all gained between 40% to 110%, in response to market information from TradingView. These share worth surges are largely as a consequence of a sustained rally in bitcoin’s worth. Since New Yr’s Day, the main cryptocurrency has gained over 44%. Because of this, mining economics are additionally enhancing. Hash price has jumped 25% whilst hash price (which, when it will increase, usually causes hash worth to fall) set new all-time highs in January.

Throughout the board, bitcoin miners ended 2022 on a really bearish be aware, nevertheless. As famous above, a number of them traded as literal penny shares by the vacations.

A Rundown On Penny Shares

Penny shares intuitively counsel securities that commerce at market costs of mere pennies. And, in reality, many bitcoin mining firms noticed share costs drop to pennies. However formally, the definition of penny shares refers back to the inventory of a small firm that trades for lower than $5 per share. Penny shares can commerce on giant exchanges like Nasdaq, which has listed many bitcoin mining firms. However most of them commerce through over-the-counter (OTC) transactions.

A number of bitcoin mining firms would have been fortunate to see share costs above $5 by the tip of final yr, although. The information within the following sections exhibits that, after hovering to multi-billion-dollar market capitalizations, not a number of however many mining firms had shares buying and selling under a single greenback.

Bitcoin Mining Penny Shares Information

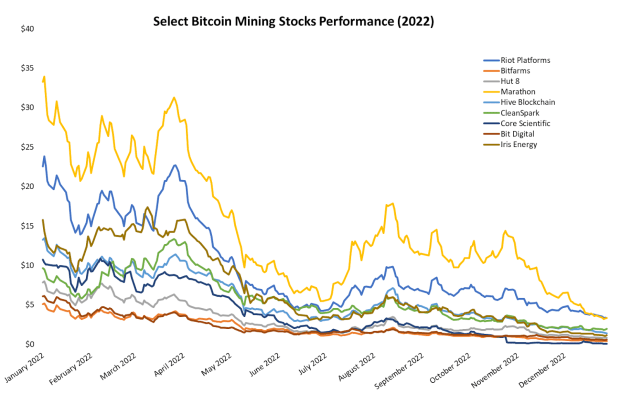

Bitcoin fell by roughly 65% in 2022. Regardless of not being the worst bear market drawdown on file for bitcoin itself, miners weren’t as fortunate. The road chart under exhibits actual share costs for a choose group of main mining firms at some point of 2022. Even a fast look on the visible will acknowledge a typical theme: down… so much.

The worst got here final for these poor firms. On the very finish of 2022, almost a dozen firms noticed their share costs drop under one greenback. The next record consists of bitcoin mining firms that traded below $1 by the tip of final yr.

- Core Scientific: $0.20

- Hut 8: $0.87

- TeraWulf: $0.58

- Mawson: $0.28

- Digihost: $0.47

- BIT Mining: $0.20

- Argo: $0.44

- Cipher: $0.62

- Bit Digital: $0.56

- Greenidge: $0.37

- Stronghold: $0.46

After reviewing the entire above information, you would possibly ask: Do bitcoin mining share costs even matter? Clearly not for the long-term success of Bitcoin. However the public mining sector does mirror on Bitcoin itself to a non-trivial diploma. The mess of unwinding bull market danger taking, greed and normal extra just isn’t nice. Hopefully, the worst is over.

The Street To Pink Slips

How did the once-booming public bitcoin mining sector fall to penny inventory standing?

After surging to a complete market worth of over $100 billion, bitcoin mining firms crashed laborious. This impact is considerably unavoidable when bitcoin itself is crashing. The enterprise of mining is pricey, capital intensive and extremely aggressive. When market situations are something however good, heads begin metaphorically rolling.

Additionally, it’s value noting that the macroeconomic headwinds going through each market successfully killed all expertise markets world wide. Bitcoin mining had no likelihood of escaping the bloodshed. Meta, for instance, was the worst performer within the Commonplace and Poor’s 500 index final yr. Apple, which dominates the weighting of the identical S&P 500 index at roughly 6%, additionally ended final yr down sharply.

However, past the macroeconomic panorama, bitcoin miners should not proof against greed and reckless enterprise selections. A considerable portion of the general public mining hash price development and mining firm valuations had been instantly tied to overleveraged buyers and operators making dangerous bets in the identical fashion as different “crypto” firms did, which have now gone bankrupt. Miners turning into penny shares or submitting for chapter is the results of the identical high quality of decisions.

New Yr, Previous Miners

Many new mining groups that entered the market over the previous few years didn’t make it to 2023. However each miner that survived the previous yr is now a hardened veteran. Is the bear market over? No one is aware of. However within the face of bankruptcies, lawsuits, govt departures, delistings and extra, miners who’re nonetheless hashing as we speak can probably maintain hashing by means of something.

Hopefully, classes from the greed and degeneracy of the final bull market is not going to be shortly forgotten, however this creator received’t be holding his breath.

It is a visitor submit by Zack Voell. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

More NFT News

Machine Studying in Focus as Chainalysis Acquires Hexagate

Extra Than Half of Crypto Tokens, Memecoins Launched in 2024 Have been Malicious: Blockaid

Hedera Value Prediction for Right now, December 18 – InsideBitcoins