Bitcoin mining and its vitality consumption have lately been the topic of many heated debates. As governments and establishments all over the world maintain introducing new measures to fight air pollution and local weather change, Bitcoin’s energy-guzzling community stands out like a sore thumb.

Numerous knowledge aggregators and trackers work across the clock to offer the market with the precise quantity of vitality the community consumes. Many provide attention-grabbing comparisons with the purpose for instance simply how a lot energy Bitcoin requires.

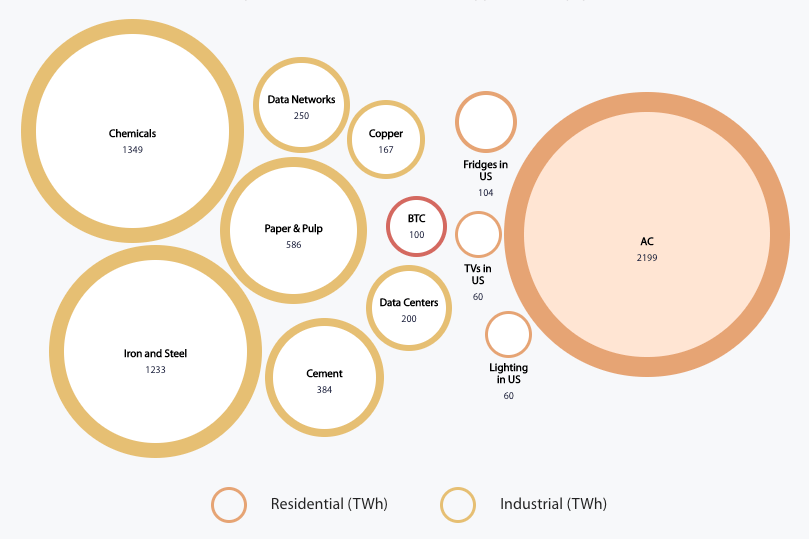

For instance, some knowledge exhibits that the quantity of electrical energy consumed by the Bitcoin community in a single yr may energy the whole College of Cambridge for 758 years. The networks’ one-year vitality consumption may additionally energy all of the tea kettles used to boil water within the U.Okay. for 23 years. Bitcoin additionally makes use of extra energy than the entire fridges and TVs, and nearly twice as a lot energy as the entire lightning in the whole U.S.

Whereas fashionable, this narrative doesn’t paint a transparent image and deliberately obscures the broader context.

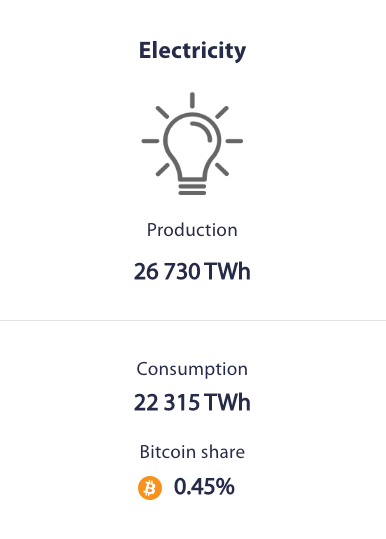

Knowledge analyzed by CryptoSlate exhibits that Bitcoin’s share within the international consumption of vitality is minuscule. Based on the Cambridge Bitcoin Electricity Consumption Index, Bitcoin’s share within the international consumption of electrical energy is simply 0.45%. This estimate is likely to be barely off right now because it’s primarily based on international vitality statistics from 2018, however nonetheless places Bitcoin’s consumption right into a broader context.

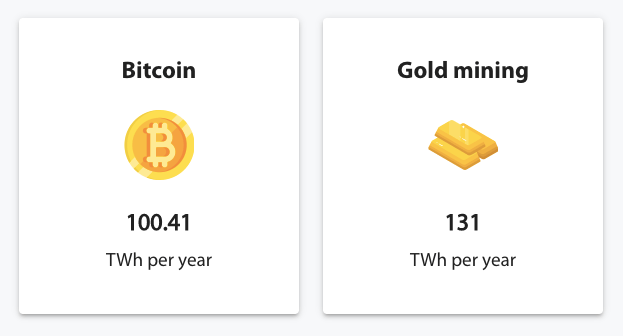

Evaluating the vitality consumption of the Bitcoin community to gold additional illustrates this level. Estimates from 2019 confirmed that gold mining consumes round 131 TWh of vitality per yr. Purchase the consequences gold mining has on the surroundings don’t cease with its consumption of electrical energy. Assessing an trade’s impression on the surroundings requires wanting on the quantity of air pollution it causes — i.e. the carbon dioxide it releases into the ambiance, the land it deforests, the water sources it contaminates, and so on.

And whereas consultants are nonetheless debating the sustainability of gold mining, the direct impact it has on the surroundings is visibly larger than Bitcoin mining.

Nevertheless, governments and establishments all over the world aren’t racing to instate strict bans on gold mining.

In contrast to gold and different energy-guzzling industries, Bitcoin mining is extraordinarily cell. With out ties to any explicit location, miners transfer wherever there’s low-cost and ample energy, establishing new services shortly and effectively all all over the world.

The mobility of Bitcoin miners was greatest seen in the summertime of 2021 when a state-wide ban on crypto-related actions in China left hundreds of mining operations looking for different areas. On the time, miners positioned in China’s hydropower-rich provinces accounted for nearly three-quarters of the Bitcoin hash price.

When confronted with an imminent ban in China, miners shortly regrouped and started relocating — some to neighboring international locations like Kazakhstan, and others abroad to the U.S.

Those who moved their operations to the U.S. benefited from the welcoming angle of states like Texas and Wyoming. Bitcoin miners, apart from their mobility, even have a novel benefit in relation to vitality consumption — they don’t compete with different industries for a similar vitality assets.

Bitcoin mining farms can faucet into vitality belongings on the manufacturing level somewhat than getting their electrical energy by the common energy grid. Because of this miners are ready to absorb surplus vitality that might have in any other case been misplaced or wasted — each lowering its impression on the surroundings and rising its profitability.

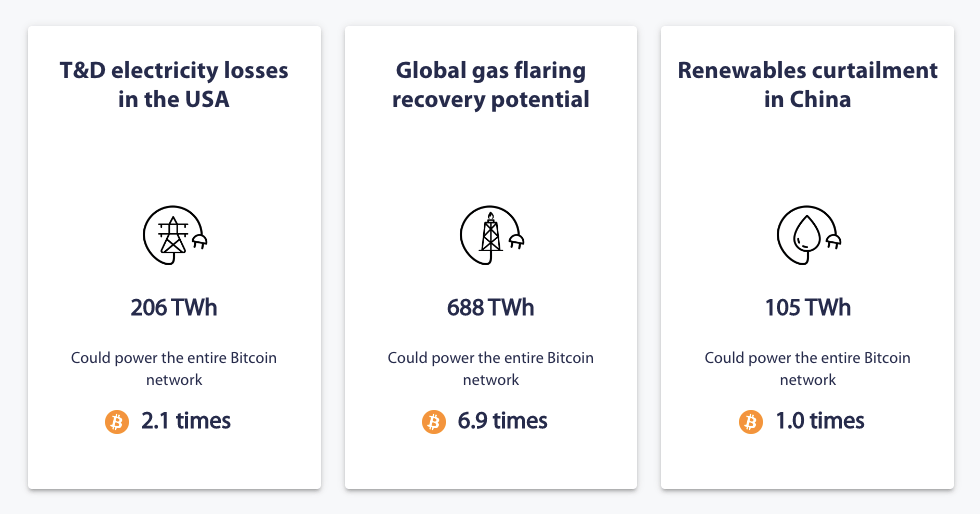

Based on the U.S. Power Info Administration (EIA), round 5% of the entire electrical energy transmitted and distributed by energy grids between 2016 and 2020 was misplaced. These losses accounted for round 206 TWh of electrical energy, which is sufficient to energy the whole Bitcoin community 2.1 instances. The pure gasoline misplaced by flaring and venting on oil fields may create 688 TWh of electrical energy, sufficient to energy the whole Bitcoin community 6.9 instances.

Some Bitcoin miners have seen the potential in these vitality losses. Bitcoin miners in Texas have been turning off their ASICs to return energy to the grid when demand is excessive and wolfing down extra vitality when demand is low.

A number of corporations are additionally engaged on utilizing the natural gas found in oil fields. They use the gasoline that might have in any other case been flared or vented into the ambiance to energy turbines that produce electrical energy utilized by Bitcoin mining machines. Killing two birds with one stone, this strategy reduces the impression pure gasoline has on the surroundings and makes it worthwhile.

One other massively vital however typically missed level when discussing Bitcoin’s sustainability is its impact on the financial system.

Knowledge facilities all over the world eat twice as a lot electrical energy because the Bitcoin community, however their financial worth is so excessive any dialogue about sustainability is out of the query. Air conditioners guzzle up nearly 220 TWh of vitality yearly and are hardly ever the goal of aggressive environmental advertising.

Bitcoin’s rising vitality consumption can result in financial prosperity that outweighs any results it may need on the surroundings.

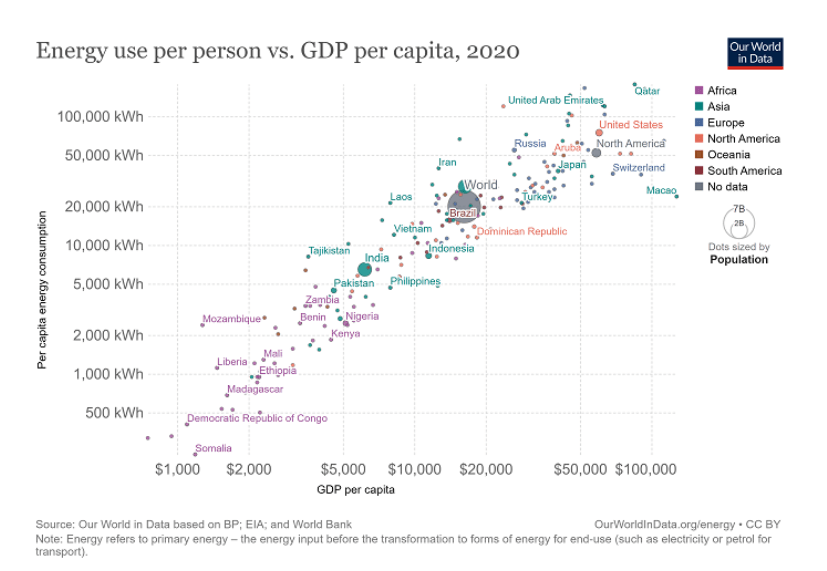

International locations with excessive vitality utilization universally rank excessive on the GDP per capita scale, displaying that elevated consumption correlates with elevated residing requirements. Qatar, the UAE, the U.S., Switzerland, Japan, and Macao rank excessive in relation to GDP and all eat excessive quantities of electrical energy per capita.

Bitcoin mining by the eyes of financial prosperity and GDP exhibits that it’s not the environmental catastrophe many make it to be. Whereas we are able to’t make sure that elevated vitality consumption successfully results in financial abundance, we all know for certain that the correlation is simply too excessive to disregard.

Rising vitality consumption attributable to an inflow of Bitcoin miners would result in a development in a extremely expert workforce, deliver a notable enhance in earnings, and enhance surrounding infrastructure. All whereas absorbing extra vitality, renewable vitality, and vitality that might have in any other case been wasted.

More NFT News

Marathon and Hut Eight scoop up $1.6 billion price of Bitcoin throughout market dip

Osprey Funds Launches First US Publicly Quoted BNB Belief

Will Binance's BNB Attain $1000? Worth Prediction Amid Authorized Challenges in Australia