Bitcoin (BTC), the biggest cryptocurrency by market capitalization, has confronted a setback in its current good points after failing to consolidate above the $27,000 degree. With no optimistic macro information to drive BTC past higher resistance traces, business consultants are in search of a chart evaluation that implies BTC could also be on the verge of a major transfer towards $20,000.

This potential lower cost level may function a brand new greater low in Bitcoin’s 1-week chart, harking back to its trajectory in 2019 earlier than the halving occasion.

Bitcoin Chart Flashing Purple

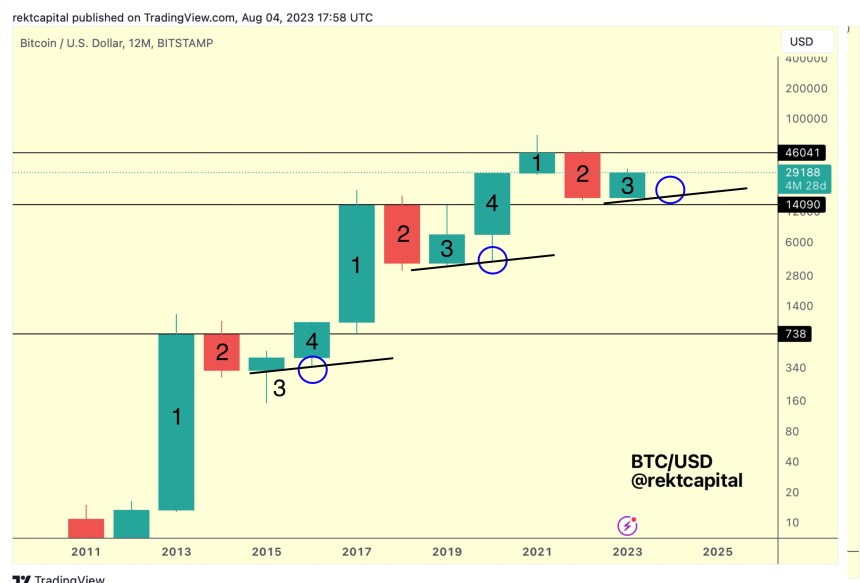

Crypto analyst Rekt Capital lately shared a chart on X (previously Twitter) outlining Bitcoin’s potential downward trajectory. Based on Rekt Capital’s evaluation, Bitcoin might revisit the $20,000 mark, establishing a brand new greater low on its 1-week chart, mirroring the worth motion noticed in 2019 earlier than the halving occasion.

Rekt Capital highlights the importance of a revisit to the Macro Larger Low within the present cycle, which may happen in early 2024, coinciding with the halving yr. Within the four-year cycle, this may signify that the draw back wick of Candle Four would kind a Macro Larger Low relative to Candle 3, as seen in one other chart shared by Rekt under.

Whereas some argue that one other drop into the Macro Larger Low is unlikely because of the COVID-19 crash in March 2020 as a black swan occasion, Rekt Capital emphasizes that the magnitude of a possible upcoming drop might differ significantly.

The COVID-19 crash resulted in a 72% drop from the 2019 native prime to the March 2020 greater low. Nonetheless, if the 2023 native prime had been round $31,000, it could solely require a 37% drop to revisit the upper low.

Whereas a repeat of the -72% crash is unlikely, Rekt Capital means that Bitcoin may retrace -37% without having one other black swan occasion.

With Bitcoin being 210 days away from halving in April 2024, Rekt Capital parallels the 2019 cycle, throughout which BTC skilled a aid rally earlier than forming one other decrease excessive.

Throughout, Bitcoin seems to be experiencing the same aid rally. Rekt Capital means that Bitcoin might not want a drastic crash or one other black swan occasion over the next months to achieve its Macro Larger Low on this cycle however fairly a retracement of roughly 27% from present costs.

At the moment, the biggest cryptocurrency available in the market is buying and selling at $26,600. Regardless of experiencing a retracement under the $27,000 degree, Bitcoin has achieved a slight revenue of 0.7% inside the 24-hour.

As highlighted by Rekt Capital, it stays unsure whether or not Bitcoin will comply with the trail noticed in 2019. Nonetheless, what is obvious is that the BTC market is exhibiting indicators of stagnation, with a possible value breakout looming on both facet.

Featured picture from iStock, chart from TradingView.com

More NFT News

XRP Worth On Its Approach To $10 In Solely Three Months If It Follows This Sample

El Salvador Boosts Bitcoin Purchases After IMF Settlement

No, BlackRock Can't Change Bitcoin