Onchain Highlights

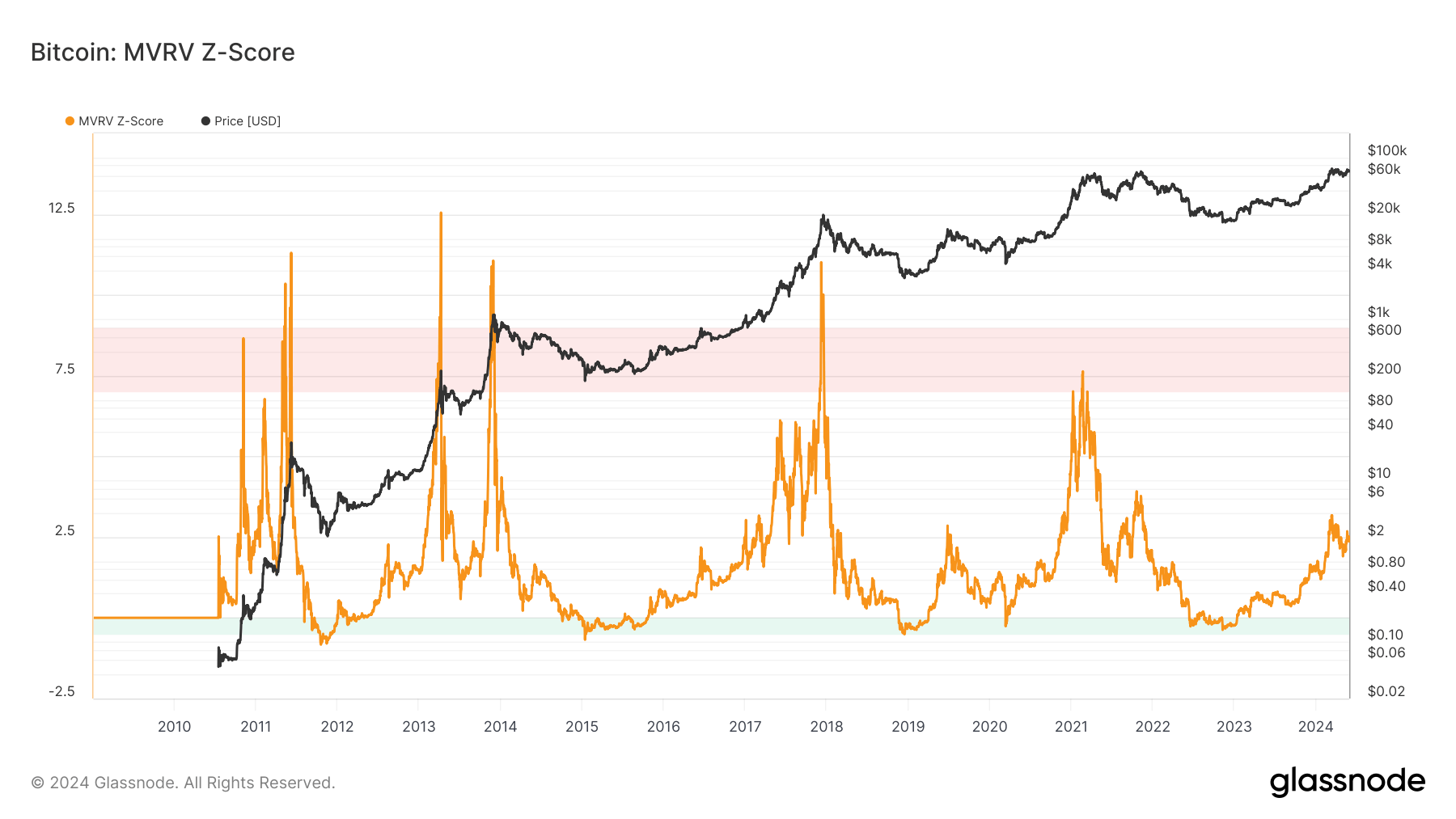

DEFINITION: The MVRV Z-Rating evaluates whether or not Bitcoin is overvalued or undervalued relative to its “honest worth.” As a substitute of utilizing a conventional z-score technique, the MVRV Z-Rating uniquely compares the market worth to the realized worth. When the market worth, measured as community valuation by spot worth multiplied by provide, is considerably increased than the realized worth, represented by the cumulative capital influx into the asset, it has sometimes signaled a market high (pink zone). Conversely, a considerably decrease market worth than the realized worth typically signifies market bottoms (inexperienced zone).

Latest knowledge from Glassnode signifies key insights into Bitcoin’s market developments by means of its MVRV Z-Rating. This metric helps perceive the valuation extremes and potential worth actions by analyzing the market worth to realized worth ratio.

The MVRV Z-Rating has proven that Bitcoin’s worth developments are considerably influenced by the actions of long-term holders (LTHs) and short-term holders (STHs). LTHs are inclined to dictate market actions, typically resulting in important worth shifts, whereas STHs typically react to those actions.

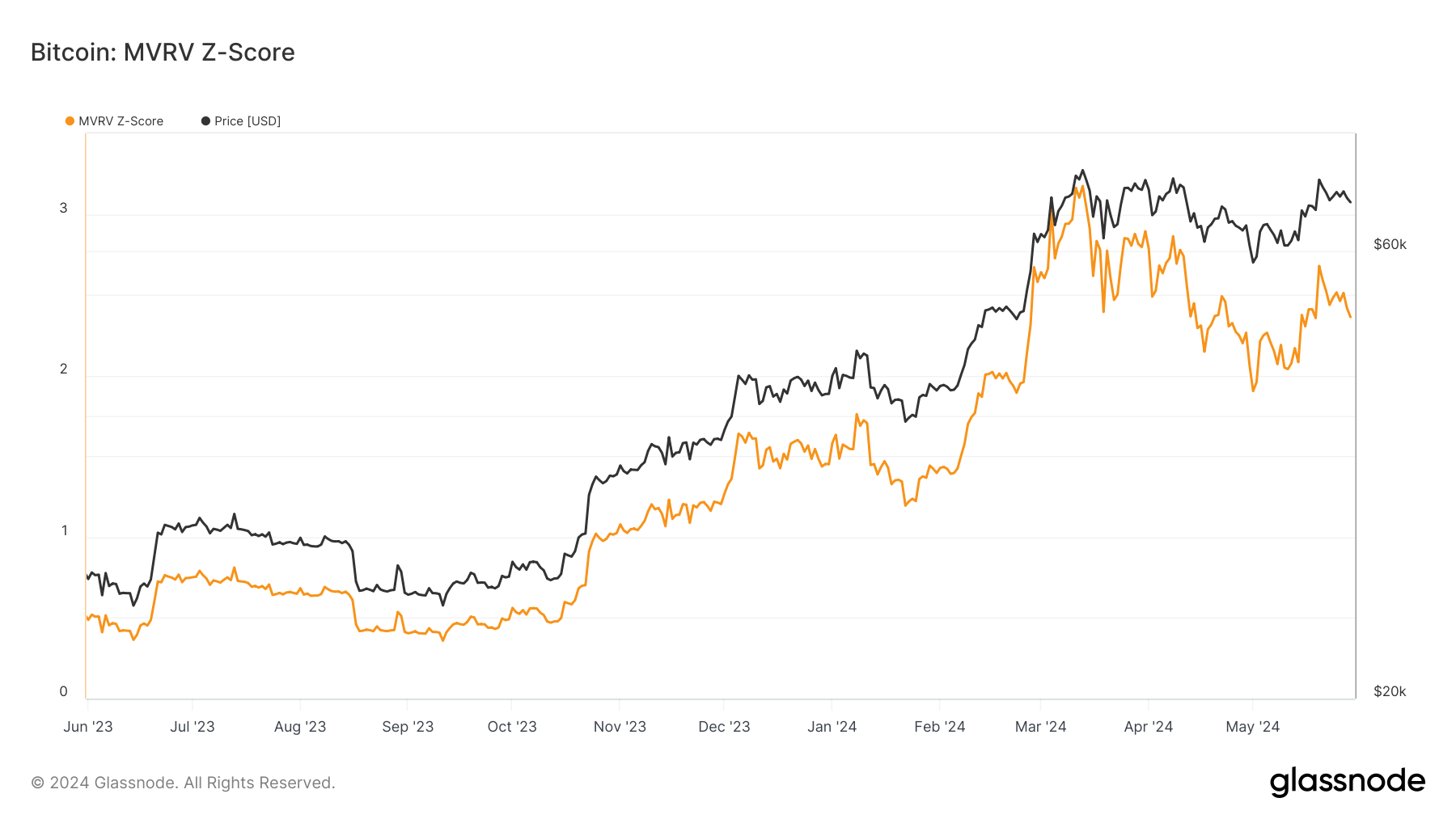

As an illustration, throughout the current market fluctuations, LTHs have maintained a excessive MVRV ratio, suggesting intervals the place they might doubtlessly understand important positive aspects. This was significantly evident as Bitcoin’s worth peaked at round $73,700 after which stabilized at $71,600, reflecting strategic exits by long-term buyers.

Moreover, previous analysis exhibits that such on-chain metrics proceed to sign a possible bottoming of Bitcoin costs. The convergence and subsequent divergence of MVRV ratios between LTHs and STHs have traditionally indicated market reversals. This sample has been noticed in current months, aligning with earlier cycles the place comparable metrics have marked the top of bearish developments and the beginning of latest bullish phases.

These components collectively point out a cautiously optimistic outlook for Bitcoin, though the MVRV Z-Rating means that buyers ought to stay vigilant about potential corrections. Understanding these metrics can present insights into market cycles and inform strategic funding selections.

More NFT News

Chinese language Auto Supplier Dives Into Bitcoin Mining With $256M Funding

Harnessing idle GPU energy can drive a greener tech revolution

Will Dogecoin Attain $1? Crypto Volatility Returns as Bitcoin and Ethereum Slide