In a meticulously detailed letter to Choose Analisa Torres of the Southern District of New York, the US Securities and Alternate Fee (SEC) has delineated its grounds for searching for an interlocutory enchantment in opposition to Ripple Labs Inc. This transfer, which has despatched ripples (pun supposed) by means of the XRP neighborhood, focuses on the intricate legalities surrounding Ripple’s gross sales and distributions of XRP.

Ripple Vs. SEC: Interlocutory Enchantment Incoming

The SEC’s major rivalry revolves round Ripple’s “programmatic” gross sales to XRP consumers over crypto asset buying and selling platforms and Ripple’s “different distributions” in change for labor and providers. The regulatory physique asserts that these transactions ought to be labeled as presents or gross sales of securities, drawing upon the precedent set by the Howey case.

The SEC’s letter states, “Particularly, the SEC seeks to certify the Courtroom’s holding that Defendants’ ‘Programmatic’ presents and gross sales to XRP consumers over crypto asset buying and selling platforms and Ripple’s ‘Different Distributions’ in change for labor and providers didn’t contain the provide or sale of securities beneath SEC v. W.J. Howey Co., 328 U.S. 293 (1946).”

Delving deeper into the doc, the SEC underscores the existence of an intra-district break up (Choose Jed Rakoff’s ruling within the SEC vs. Terra case) indicating that there are substantial grounds for variations in authorized opinion. The letter factors out, “Interlocutory overview is warranted right here. These two points contain controlling questions of legislation on which there’s substantial floor for variations of opinion, as mirrored by an intra-district break up that has already developed.”

The SEC additional attracts consideration to the potential implications of the courtroom’s earlier order, suggesting that it might affect a mess of pending litigations. The doc reads, “The Programmatic Gross sales and Different Distributions rulings concern points that will come up in varied pending instances, together with many on this Circuit the place the alleged funding contracts have been supplied and bought by issuers – like Ripple – on crypto asset buying and selling platforms or for non-cash consideration.”

Jeremy Hogan, a authorized luminary within the XRP neighborhood, weighed in, noting, “AND… the SEC continues making questionable selections, requesting an interlocutory enchantment. Word that it’s NOT interesting whether or not XRP itself is a safety – simply its losses on the programmatic and particular person gross sales points.”

Stuart Alderoty, Ripple’s Chief Authorized Officer (CLO), clarified the SEC’s intent, emphasizing that the regulatory physique is within the preliminary levels of searching for the courtroom’s permission for the enchantment. He said, “The SEC doesn’t have the proper to enchantment simply but which is why they’re asking permission to file an interlocutory enchantment. Ripple will file its response with the Courtroom subsequent week.”

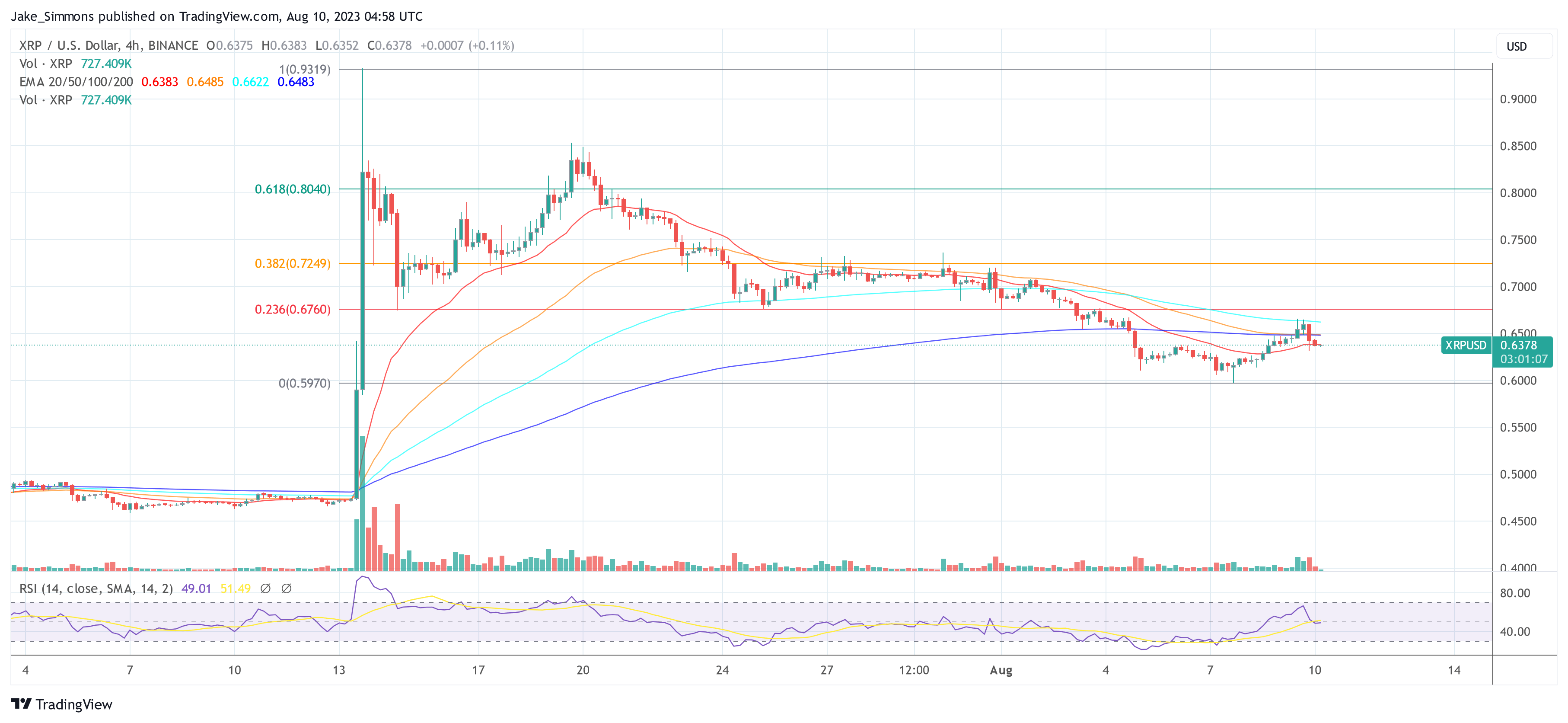

XRP Worth

Regardless of the intricate authorized maneuvers and the potential ramifications, XRP’s market worth has remained notably steady, suggesting a mature market response to the continued authorized developments. At press time, XRP really noticed a slight uptick, buying and selling at $0.6378.

Featured picture from Fox Enterprise, chart from TradingView.com

More NFT News

Chinese language Auto Supplier Dives Into Bitcoin Mining With $256M Funding

Harnessing idle GPU energy can drive a greener tech revolution

Will Dogecoin Attain $1? Crypto Volatility Returns as Bitcoin and Ethereum Slide