Fast Take

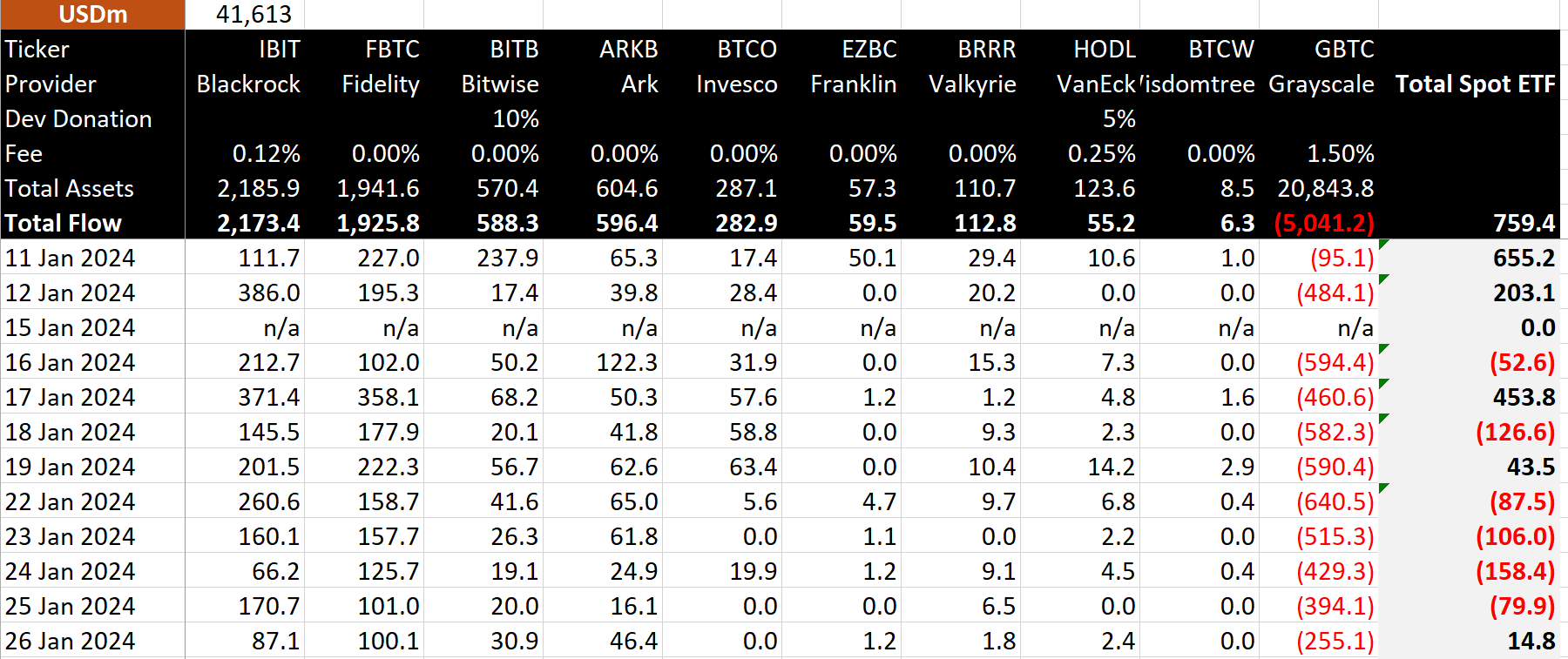

The eleventh buying and selling day marked a big milestone for the spot Bitcoin ETFs, registering a $14.eight million internet influx, in accordance with BitMEX Research.

This represents the primary day by day internet influx since Jan. 19, as GBTC noticed its outflows moderating to $255 million, the bottom recorded since Jan. 11. Nonetheless, GBTC’s whole outflows proceed to loom giant at over $5 billion.

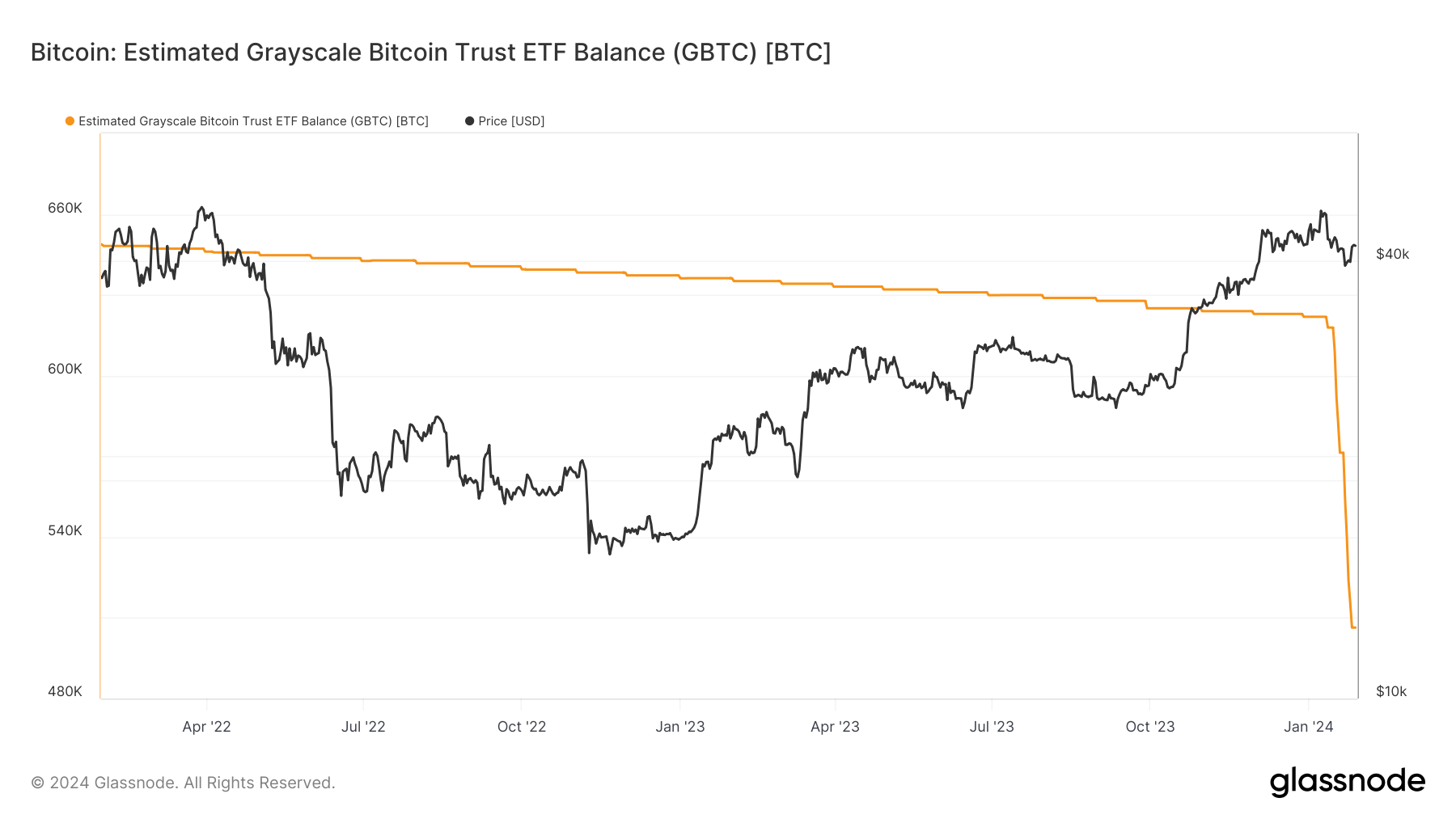

Previous to the launch of the ETF on Jan. 11, Grayscale’s GBTC held roughly 621,000 BTC. Based on current knowledge from Glassnode, the fund’s Bitcoin steadiness has been lowered to roughly 506,000 BTC. This represents a decrease of nearly 20% for the reason that ETF’s inception.

BlackRock’s IBIT has emerged as a beneficiary, logging internet inflows of $87 million on Jan. 26 and taking its whole to $2.2 billion, in accordance with BitMEX Research.

Including to the optimistic pattern, Constancy noticed one other internet influx of $100 million, taking the agency’s whole to $1.9 billion. Notably, Constancy’s FBTC ETF has persistently attracted a minimum of $100 million of internet inflows each buying and selling day, in accordance with BitMEX Research.

Altogether, whole internet inflows now stand at $759.four million, in accordance with BitMEX Research.

The publish Spot Bitcoin ETFs hit $14.8 million daily net inflow, first in 5 trading days appeared first on CryptoSlate.

More NFT News

Chinese language Auto Supplier Dives Into Bitcoin Mining With $256M Funding

Harnessing idle GPU energy can drive a greener tech revolution

Will Dogecoin Attain $1? Crypto Volatility Returns as Bitcoin and Ethereum Slide