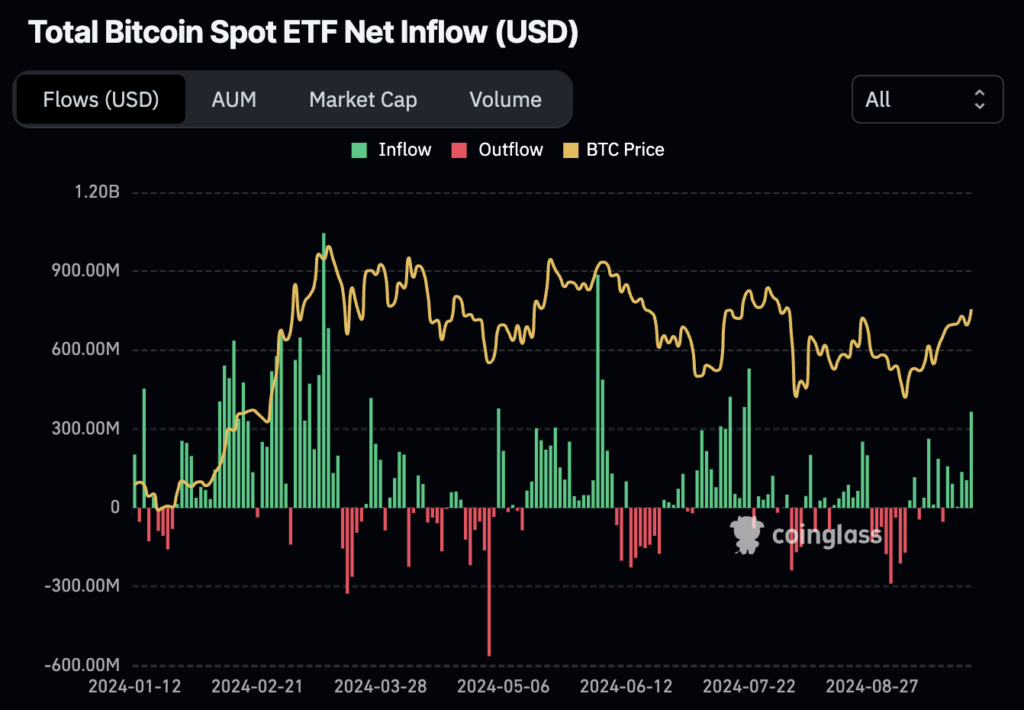

On Sept. 26, Bitcoin ETFs recorded substantial inflows totaling $365.7 million, marking the very best single-day influx since July 22, when $530 million entered the market.

In accordance with Farside data, Ark’s ARKB ETF led with $113.eight million, marking a major shift after latest outflows seen earlier this month. BlackRock’s IBIT ETF added $93.four million, whereas Constancy’s FBTC ETF reported inflows of $74 million. Bitwise’s BITB ETF additionally noticed robust participation with $50.four million, and VanEck’s HODL ETF contributed $22.1 million. Invesco’s BTCO and Franklin’s EZBC reported smaller additions of $6.5 million and $5.7 million, respectively. Grayscale’s GBTC continued its development of outflows, dropping $7.7 million, whereas its smaller BTC ETF gained $2.9 million.

Ethereum ETFs experienced internet outflows of $0.1 million, persevering with the latest development of combined investor sentiment within the Ethereum area. Grayscale’s ETHE fund noticed probably the most important motion with outflows of $36 million, contrasting with BlackRock’s ETHA and Constancy’s FETH, which introduced in $15.three million and $15.9 million, respectively. Inflows had been additionally recorded for Bitwise’s ETHW, Invesco’s QETH, and 21Shares’ CETH, albeit in smaller quantities. Different funds, together with these from VanEck and Franklin, remained comparatively flat.

The contrasting flows spotlight evolving developments. Bitcoin ETFs appeal to substantial inflows throughout main funds, primarily pushed by Ark and BlackRock, whereas Ethereum ETFs face continued outflows, primarily from Grayscale. The flows coincided with Bitcoin additionally breaking $65k for the primary time since August.

More NFT News

Will Binance's BNB Attain $1000? Worth Prediction Amid Authorized Challenges in Australia

What Does Spot Buying and selling Imply in Cryptocurrency and How Is It Accomplished?

Ethena Labs Launches USDtb, Backed by BlackRock’s BUIDL Fund