Cardano (ADA), the blockchain platform famend for its scalability and technological strategy, has made vital strides within the crypto market, as highlighted by the not too long ago launched Messari report.

The report supplies helpful insights into Cardano’s achievements in Q2 2023, solidifying its place as a distinguished participant inside the business.

With a robust deal with fostering a strong ecosystem and pushing the boundaries of decentralized finance (DeFi) and non-fungible tokens (NFTs), Cardano is poised to reshape the panorama of blockchain expertise, in response to Messari.

Cardano TVL Rating Skyrockets, Climbs From 34th to 21st

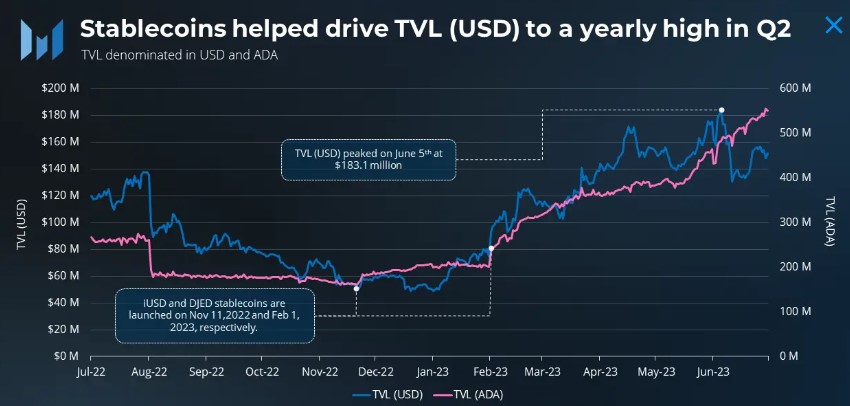

Per the report, Cardano skilled substantial development in stablecoin worth, with a 34.9% quarter-over-quarter (QoQ) improve and a big 382.1% year-to-date (YTD) surge.

Indigo Protocol emerged as a frontrunner in stablecoin and artificial asset issuance, solidifying its dominance within the area. Moreover, the Complete Worth Locked (TVL) witnessed a shift in direction of newer tasks, as protocols created previously six months accounted for 47.4% of TVL dominance in Q2.

The TVL in USD rose by 9.7% QoQ and 198.6% YTD. Cardano’s TVL rating climbed from 34th to 21st throughout all chains in 2023.

Alternatively, common every day decentralized utility (dapp) transactions on Cardano surged by 49% QoQ, marking the third consecutive quarterly improve. Furthermore, Minswap, an automatic market maker (AMM), showcased the most important absolute development in transaction quantity.

Nevertheless, a number of new dapps additionally contributed to the general surge. Minswap’s reputation soared in Q2, surpassing the main NFT market jpg.retailer relating to dapp transactions.

This pattern aligned with the sectoral shift, as DeFi exercise gained momentum whereas NFT exercise skilled a decline. The general improve in dapp transactions reached a considerable 49.0% QoQ, averaging 57,900 every day transactions.

Q2 NFT Metrics Mirror Market Correction

Based on Messari, NFT metrics skilled a decline in Q2. Common every day NFT transactions dropped by 35.7% QoQ to 2,900, whereas the whole quarterly buying and selling quantity fell by 41.9% QoQ to $46.2 million.

This downward pattern aligned with the broader market, as even blue-chip assortment ground costs declined in 2023.

Notably, NFT gross sales quantity remained concentrated primarily in jpg.retailer, which dominated {the marketplace} with a 98% market share. However, distinctive patrons continued to drive NFT exercise, whereas a comparatively small variety of sellers catered to this bigger pool of patrons.

Messari additional highlights that Cardano’s ecosystem showcased enlargement in a number of sectors, notably in DeFi. Protocols for swaps, stablecoins, synthetics, and distinctive Cardano-centric providers like lending staking energy surfaced alongside the incumbents.

Cardano’s second quarter confirmed substantial development and diversification throughout varied sectors, together with DeFi, NFTs, and Layer-2 options.

Key statistics revealed a surge in stablecoin worth, a shift in TVL dominance in direction of newer tasks, and a formidable improve in common every day dapp transactions.

Whereas NFT metrics skilled a decline, the ecosystem demonstrated resilience and competitors amongst protocols.

In distinction, Cardano’s native token, ADA, has been experiencing a decline according to the broader market pattern since April 15, after reaching its yearly peak of $0.4620.

ADA is buying and selling at $0.2933, reflecting a 1.4% lower previously 24 hours. During the last fourteen days, it has declined almost 6%.

Featured picture from iStock, chart from TradingView.com

More NFT News

XRP Worth On Its Approach To $10 In Solely Three Months If It Follows This Sample

El Salvador Boosts Bitcoin Purchases After IMF Settlement

No, BlackRock Can't Change Bitcoin