Stablecoins, the digital belongings designed to keep up a secure worth, have lengthy been considered as a possible bridge between the cryptocurrency world and the normal monetary trade. Nevertheless, latest developments have forged a shadow of uncertainty over their perceived stability.

As international policymakers proceed to grapple with considerations in regards to the crypto sector’s influence on the established monetary system, a stunning twist occurred when stress within the US banking trade reverberated all through the stablecoin market.

According to Fitch Ratings, the tightening of economic situations, culminating within the high-profile failures of a number of banks, notably together with the collapse of the esteemed Silicon Valley Financial institution, had a profound influence on stablecoins.

Stablecoins: Market Shakeup

For example, Fitch Rankings experiences that the market capitalization of USD Coin (USDC), a stablecoin pegged to the US greenback at a 1:1 ratio, skilled a pointy decline of over 25% within the first quarter. Though the coin’s worth stays depressed, Fitch famous that it managed to get well its peg quickly after.

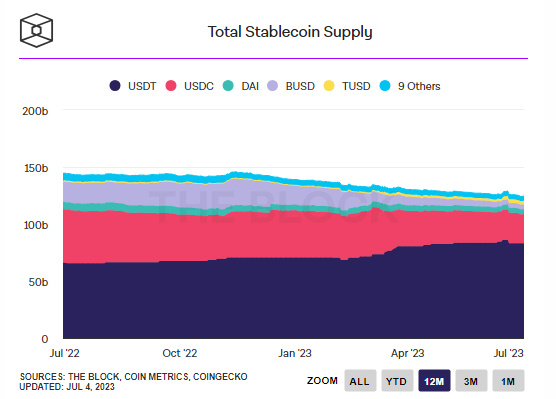

In line with data from The Block, the entire provide of stablecoins has decreased from $138 billion at the start of the 12 months to $124 billion as of July 3. This decline in provide additional underscores the challenges confronted by stablecoins and their battle to keep up stability amidst market turbulence.

Chart: The Block Crypto Data

“Important volatility, shaken investor confidence, and short-term however sharp de-pegging occurred within the stablecoin market in March as shockwaves unfold from conventional finance,” Fitch wrote.

Tether Bucks Pattern

In distinction to USDC, Tether, one other distinguished stablecoin, noticed a 12% enhance in its market capitalization throughout the identical interval. Notably, Tether captured roughly 72% of USDC’s redemption quantity, indicating a rising choice for Tether amongst buyers.

Regardless of Tether’s constructive efficiency, the top 10 stablecoins skilled a decline of their month-to-month common of each day buying and selling volumes. From March to Could 2023, these buying and selling volumes decreased from $53 billion to $28 billion.

This discount signifies a lower in exercise throughout the stablecoin market, presumably pushed by cautious investor sentiment within the face of ongoing market uncertainties.

Bitcoin approaches the $31Okay territory on the each day chart: TradingView.com

Fitch famous that efforts to manage stablecoins have been unfolding at various speeds in the US and Europe, resulting in notable variations within the reporting and transparency requirements of those digital belongings.

The contrasting approaches taken by the 2 areas have resulted in distinct regulatory landscapes for stablecoins, inflicting direct penalties on their reporting and transparency practices.

(The knowledge offered on this web site shouldn’t be interpreted as funding recommendation. Investing carries inherent dangers, and whenever you make investments, there’s a chance of experiencing capital loss as a consequence of these dangers).

Featured picture from Zebpay

More NFT News

El Salvador Boosts Bitcoin Purchases After IMF Settlement

No, BlackRock Can't Change Bitcoin

Canine Memecoins Rebound as Bitcoin Reaches $98,000