Fast Take

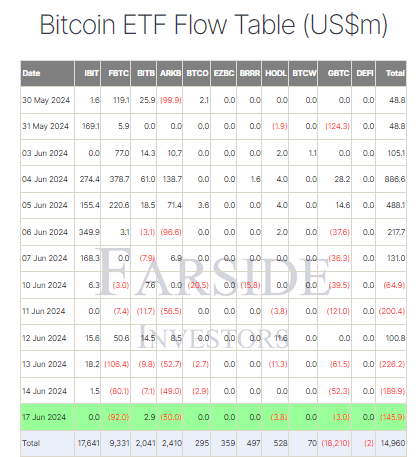

Farside information reveals that on June 17, Bitcoin (BTC) exchange-traded funds (ETFs) skilled one other day of great outflows, totaling $145.9 million. This marks the third consecutive buying and selling day of outflows and the fifth outflow up to now six buying and selling days.

The biggest outflow was from Constancy’s FBTC, which noticed a $92.zero million discount, bringing its complete internet influx to $9.Three billion. Ark’s ARKB adopted with a $50.zero million outflow, decreasing its complete internet influx to $2.four billion. Grayscale’s GBTC skilled a smaller outflow of $3.zero million, pushing its complete internet outflows to $18.2 billion. In distinction, BlackRock’s IBIT recorded no inflows or outflows, sustaining its complete internet influx at $17.6 billion. General, the full internet inflows for BTC ETFs now stand at $15 billion.

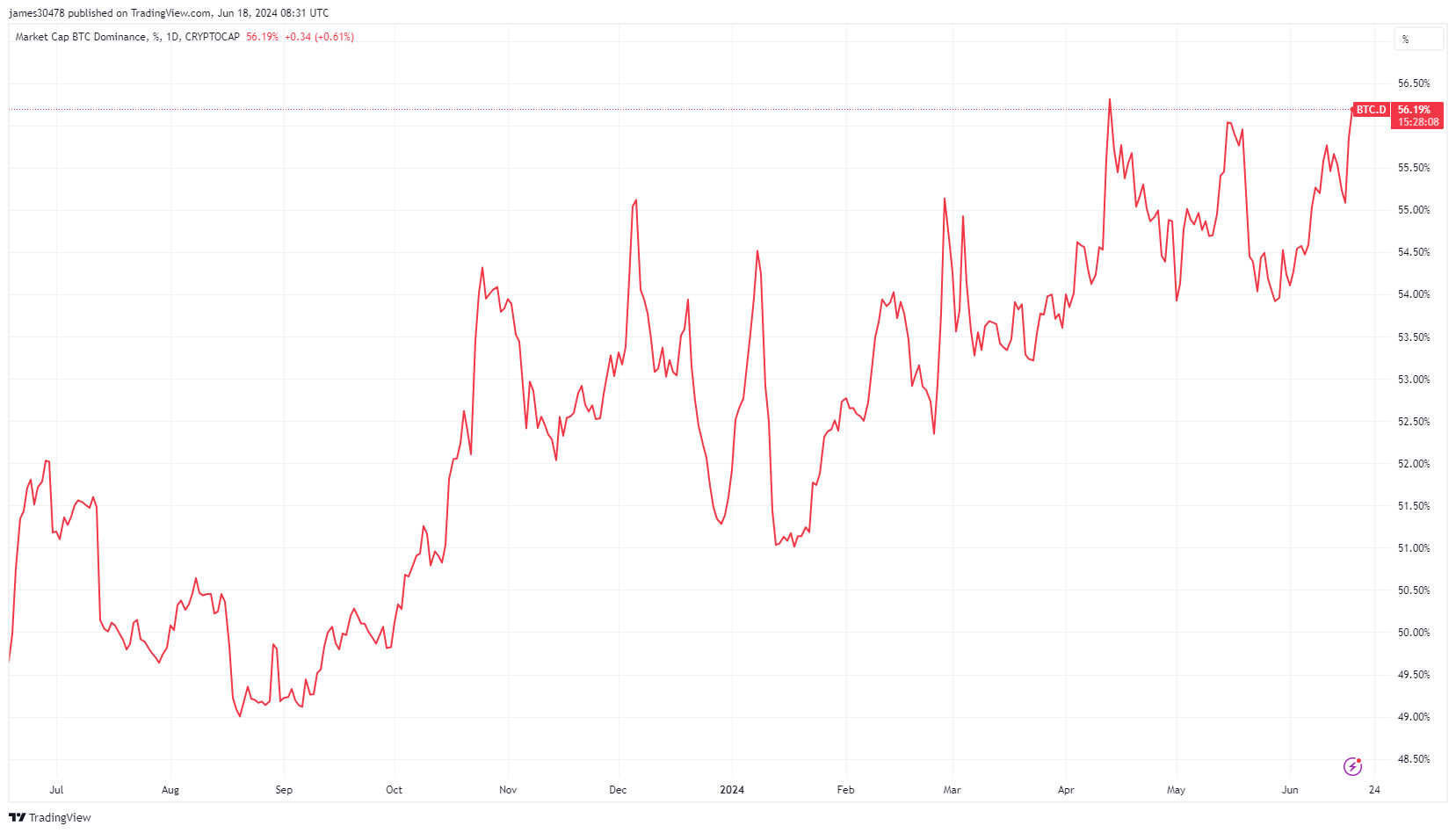

This development coincides with Bitcoin’s worth drop to $64,600, its lowest since Could 16, reflecting a greater than 11% decline from its all-time excessive. Whereas Bitcoin’s dominance continues to climb, reaching 56.2%, it marks the second-highest degree of the 12 months.

More NFT News

Chinese language Auto Supplier Dives Into Bitcoin Mining With $256M Funding

Harnessing idle GPU energy can drive a greener tech revolution

Will Dogecoin Attain $1? Crypto Volatility Returns as Bitcoin and Ethereum Slide