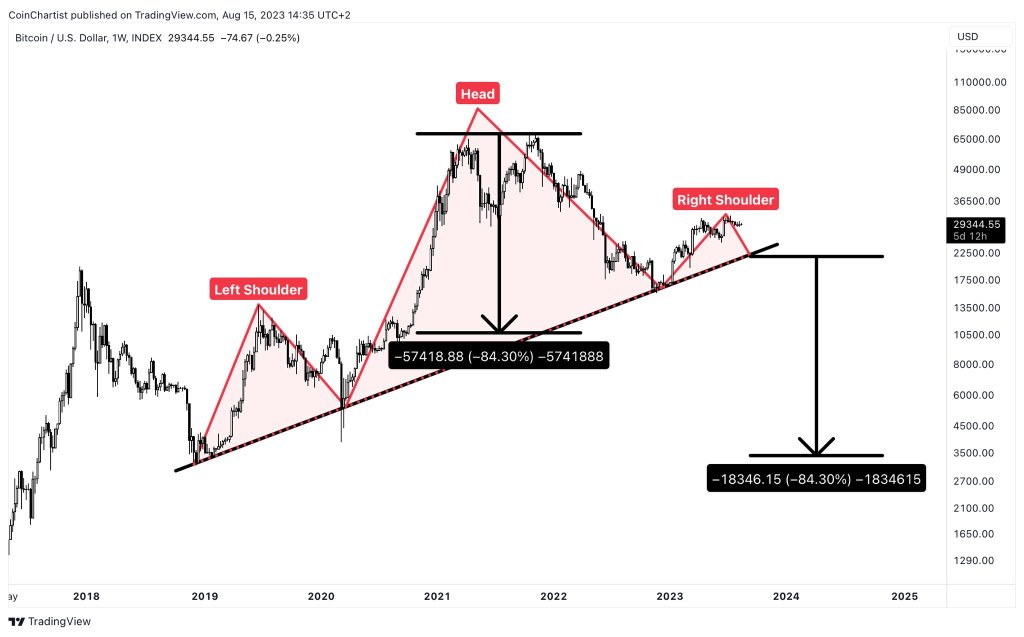

Bitcoin, probably the most invaluable crypto asset, is at a crucial juncture at spot charges if candlestick formation within the weekly chart is something to go by. One analyst on X, previously Twitter and NewsBTC Editorial Director Tony Spilotro, is sounding the alarm after selecting out the bearish head-and-shoulder sample within the weekly chart.

Will Bitcoin Crack?

Though the sample is technically within the final part of formation, if realized, it may have dire implications for Bitcoin bulls as it might push costs beneath a multi-month crucial assist line towards $18,000 or decrease within the weeks forward. Even so, the risky nature of crypto and BTC costs means merchants ought to undertake a wait-and-see method till it prints out.

As of August 15, Bitcoin is secure and inside a broader uptrend from a top-down perspective. Notably, the coin is confined throughout the buying and selling vary established between June and July 2023, as seen within the each day chart.

Regardless of the final optimism of a value restoration above July 2023 highs, BTC was transferring sideways and held above the $28,000 assist degree however beneath the $31,800 printed within the final days of H1 2023. Any breakout above $32,000 with increasing volumes would possibly induce demand, forming an anchor for value beneficial properties towards $35,000 or higher.

Whereas the shortcoming of sellers to drive costs decrease is bullish, a minimum of from the place patrons sit, the potential formation of the top and shoulder sample within the weekly chart casts a shadow of doubt over bullish prospects. Subsequently, merchants stay cautiously optimistic because the candlestick association, significantly within the weekly timeframe, suggests a vulnerability that would have an effect on market sentiment and hopes for sustained development.

Charge Hikes And Halving: Which Will Be A Stronger Affect?

A number of elementary components additional complicate the outlook for Bitcoin’s value within the coming days. Inflation is comparatively excessive in the US (versus the benchmark price of two%), which can immediate the Federal Reserve to renew rate of interest hikes within the third and fourth quarters of the 12 months.

Regardless of comparatively secure labor circumstances and considerably subdued inflation, the Fed’s recent price hikes, now on the 5.25%-5.50% vary, underscore the central financial institution’s dedication to curbing inflation and sustaining financial stability.

The potential impression of the Federal Reserve’s tightening coverage on crypto is paying homage to the occasions in 2022 when Bitcoin cracked, falling from 2021 peaks to beneath $16,000 in late 2022. Whereas Bitcoin’s potential to function a retailer of worth, akin to gold, throughout occasions of disaster generally is a risk in 2023 and the long run, analysts nonetheless view it as a “dangerous” asset.

From a bullish lens, Bitcoin will halve its miner rewards from 6.25 BTC in 2024. This discount might trigger a provide shock, making BTC scarcer, and should assist costs within the second half of subsequent 12 months.

Function picture from Canva, chart from TradingView

More NFT News

XRP Worth On Its Approach To $10 In Solely Three Months If It Follows This Sample

El Salvador Boosts Bitcoin Purchases After IMF Settlement

No, BlackRock Can't Change Bitcoin