That is an opinion editorial by Luke Mikic, a author, podcast host and macro analyst.

That is the second half in a two-part sequence in regards to the Greenback Milkshake Concept and the pure development of this to the “Bitcoin Milkshake.” On this piece, we’ll discover the place bitcoin suits into a world sovereign debt disaster.

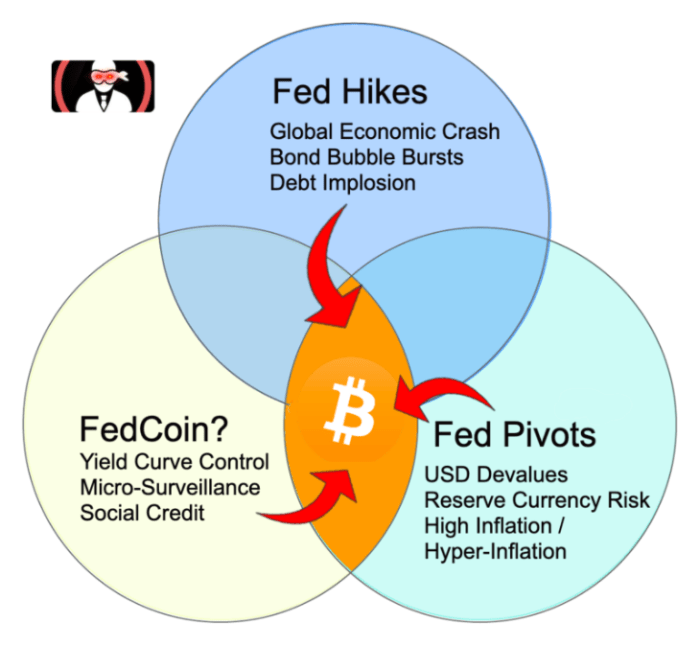

The Bitcoin Milkshake Concept

Most individuals imagine the monetization of bitcoin will most damage the US because it’s the nation with the present world reserve forex. I disagree.

The monetization of bitcoin advantages one nation disproportionally greater than every other nation. Prefer it, welcome it or ban it, the U.S. is the nation that can profit most from the monetization of bitcoin. Bitcoin will assist to increase the lifetime of the USD longer than many can conceptualize and this text explains why.

If we transfer ahead on the idea that the Greenback Milkshake Thesis continues to decimate weaker currencies world wide, these international locations could have a choice to make when their forex goes by way of hyperinflation. A few of these international locations will probably be compelled to dollarize, just like the more than 65 countries which might be both dollarized or have their native forex pegged to the U.S. greenback.

Some could select to undertake a quasi-gold commonplace like Russia just lately has. Some could even select to undertake the Chinese language yuan or the euro as their native medium of trade and unit of account. Some areas may copy what the shadow authorities of Myanmar have performed and adopt the Tether stablecoin as authorized tender. However most significantly, a few of these international locations will undertake bitcoin.

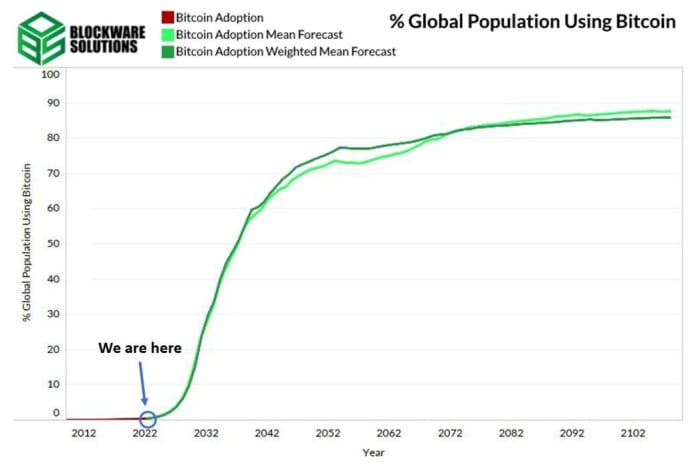

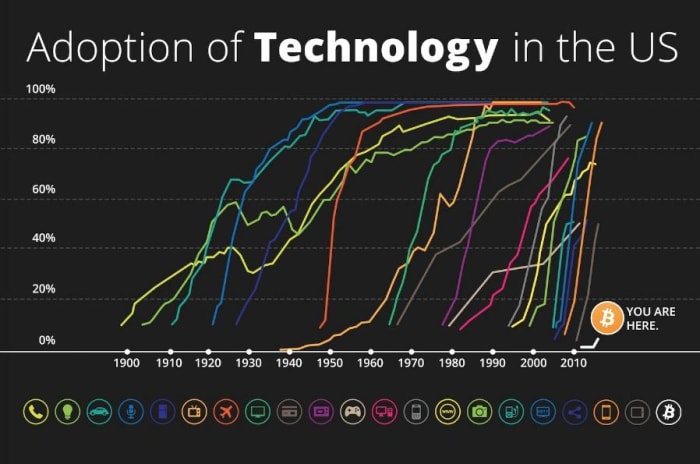

For the international locations that will undertake bitcoin, will probably be too risky to make financial calculations and use as a unit of account when it’s nonetheless so early in its adoption curve.

(Source)

Regardless of what the consensus narrative is surrounding those that say, “Bitcoin’s volatility is reducing as a result of the establishments have arrived,” I strongly imagine this isn’t a take rooted in actuality. In a earlier article written in late 2021 analyzing bitcoin’s adoption curve, I outlined why I imagine the volatility of bitcoin will proceed to extend from right here because it travels by way of $500,000, $1 million and even $5 million per coin. I believe bitcoin will nonetheless be too risky to make use of as a real unit of account till it breaches eight figures in at this time’s {dollars} — or as soon as it absorbs 30% of the world’s wealth.

(Source)

For that reason, I imagine the international locations who will undertake bitcoin, may even be compelled to undertake the U.S. greenback particularly as a unit of account. Nations adopting a bitcoin commonplace will probably be a Computer virus for continued world greenback dominance.

Put apart your opinions on whether or not stablecoins are shitcoins for only a second. With latest developments, equivalent to Taro bringing stablecoins to the Lightning Network, think about the potential for shifting stablecoins world wide, immediately and for practically zero charges.

The Federal Reserve of Cleveland appears to be paying shut consideration to those developments, as they just lately printed a paper titled, “The Lightning Network: Turning Bitcoin Into Money.”

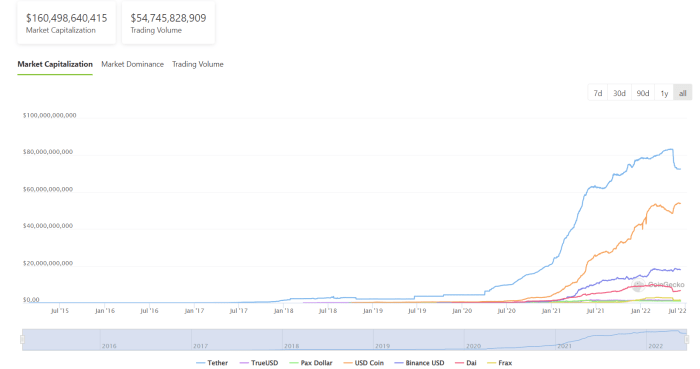

Zooming out, we will see that since March 2020, the stablecoin provide has grown from below $5 billion to over $150 billion.

(Source)

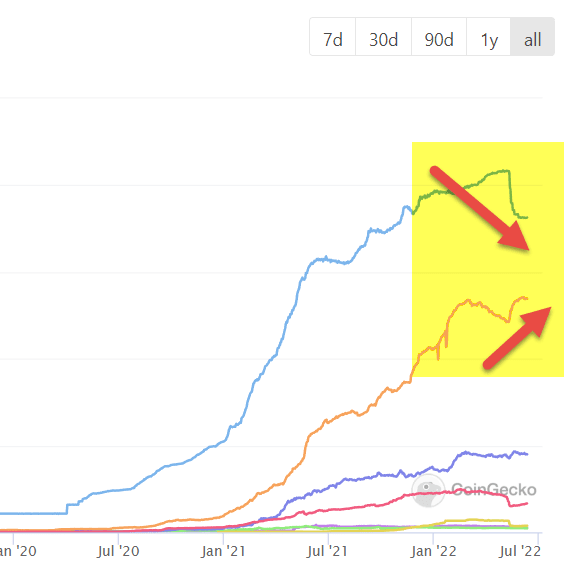

What I discover most fascinating just isn’t the speed of development of stablecoins, however which stablecoins are rising the quickest. After the latest Terra/LUNA debacle, capital fled from what’s perceived to be extra “dangerous” stablecoins like tether, to extra “protected” ones like USDC.

(Source)

It’s because USDC is 100% backed by cash and short-term debt.

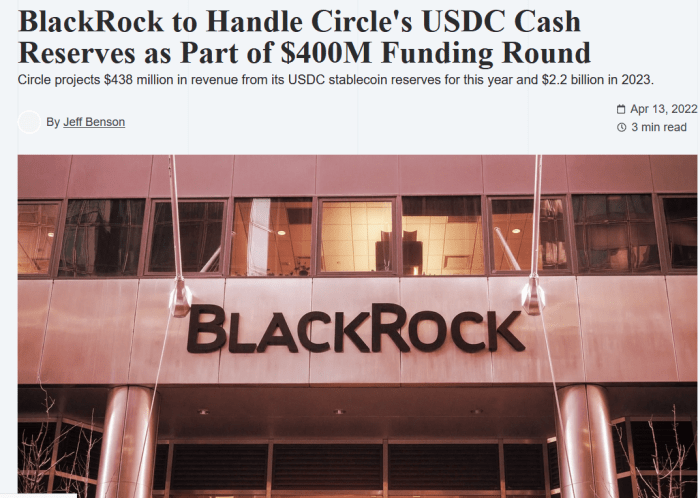

BlackRock is the world’s largest asset supervisor and just lately headlined a $440 million fundraising round by investing in Circle. Nevertheless it wasn’t only a funding spherical; BlackRock goes to be acting as the primary asset manager for USDC and their treasury reserves, which is now practically $50 billion.

(Source)

The aforementioned Tether seems to be following within the footsteps of USDC. Tether has lengthy been criticized for its opaqueness and the very fact it’s backed by dangerous business paper. Tether has been considered because the unregulated offshore U.S. greenback stablecoin. That being stated, Tether sold their riskier commercial paper for extra pristine U.S. authorities debt. In addition they agreed to bear a full audit to enhance transparency.

If Tether is true to their phrase and continues to again USDT with U.S. authorities debt, we may see a state of affairs within the close to future the place 80% of the overall stablecoin market is backed by U.S. authorities debt. One other stablecoin issuer, MakerDao, additionally capitulated this week, shopping for $500 million government bonds for its treasury.

It was essential that the U.S. greenback was the principle denomination for bitcoin throughout the first 13 years of its life throughout which 85% of the bitcoin provide had been launched. Community results are onerous to vary, and the U.S. greenback stands to profit most from the proliferation of the general “crypto” market.

This Bretton Woods III framework accurately describes the problem going through the US: The nation wants to seek out somebody to purchase their debt. Many greenback doomsayers assume the Fed must monetize numerous the debt. Others say that elevated rules are on the best way for the U.S. business banking system, which was regulated to carry extra Treasurys within the 2013-2014 period, as international locations like Russia and China started divesting and slowing their purchases. Nevertheless, what if a proliferating stablecoin market, backed by authorities debt, might help take in that misplaced demand for U.S. Treasurys? Is that this how the U.S. finds an answer to the unwinding petrodollar system?

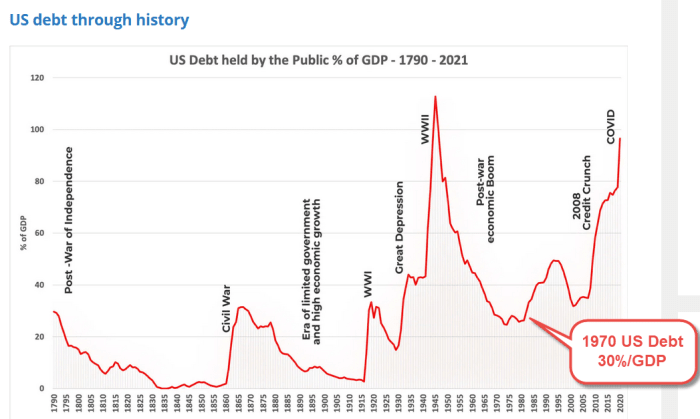

Apparently, the U.S. must discover a resolution to its debt issues, and quick. Nations world wide are racing to flee the dollar-centric petrodollar system that the U.S. for many years has been in a position to weaponize to entrench its hegemony. The BRICS nations have introduced their intentions to create a new reserve currency and there are a bunch of different international locations, equivalent to Saudi Arabia, Iran, Turkey and Argentina which might be applying to become a part of this BRICS partnership. To make issues worse, the US has $9 trillion of debt that matures within the subsequent 24 months.

Who’s now going to purchase all that debt?

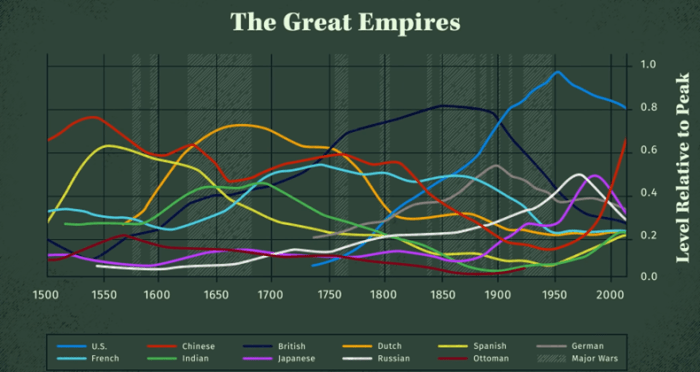

The U.S. is as soon as once more backed right into a nook prefer it was within the 1970s. How does the nation shield its practically 100-year hegemony as the worldwide reserve forex issuer, and 250-year hegemony because the globe’s dominant empire?

Forex Wars And Financial Wild Playing cards

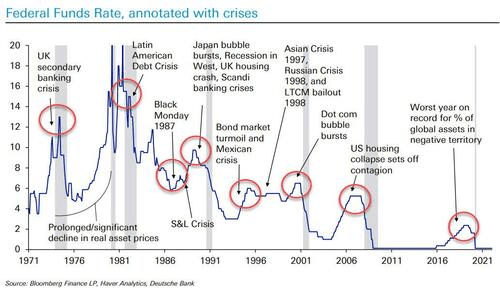

That is the place the thesis turns into much more speculative. Why is the Fed persevering with to aggressively increase rates of interest, bankrupting its supposed allies like Europe and Japan, whereas seemingly sending the world into a world melancholy? “To struggle inflation,” is what we’re informed.

Let’s discover another, doable cause why the Fed may very well be elevating charges so aggressively. What choices does the U.S. should defend its hegemony?

In a world presently below a scorching warfare, would it not appear so far-fetched to take a position that we may very well be coming into an financial chilly warfare? A warfare of central banks, if you’ll? Have we forgotten in regards to the “weapons of mass destruction?” Have we forgotten what we did to Libya and Iraq for making an attempt to route across the petrodollar system and cease utilizing the U.S. greenback within the early 2000s?

(Source)

Till six months in the past, my base case was that the Fed and central banks across the globe would act in unison, pinning rates of interest low and use the “financial repression sandwich” to inflate away the globe’s huge and unsustainable 400% debt-to-GDP ratio. I anticipated them to observe the financial blueprints laid out by two financial white papers. The primary one printed by the IMF in 2011 titled, “The Liquidation Of Government Debt” after which the second paper printed by BlackRock in 2019 titled, “Dealing With The Next Downturn.”

I additionally anticipated all of the central banks to work in tandem to maneuver towards implementing central financial institution digital currencies (CBDCs) and dealing collectively to implement the “Nice Reset.” Nevertheless, when the information modifications, I modify my opinions. Because the creepingly coordinated insurance policies from governments and central banks world wide in early 2020, I believe some international locations usually are not so aligned as they as soon as have been.

Till late 2021, I held a powerful view that it was mathematically unattainable for the U.S. to boost charges — like Paul Volcker did within the 1970s — at this stage of the long-term debt cycle with out crashing the worldwide debt market.

However, what if the Fed needs to crash the worldwide debt markets? What if the U.S. acknowledges {that a} strengthening greenback causes extra ache for its world rivals than for themselves? What if the U.S. acknowledges that they’d be the final domino left standing in a cascade of sovereign defaults? Would collapsing the worldwide debt markets result in hyperdollarization? Is that this the one financial wild card the U.S. has up its sleeve to delay its reign because the dominant world hegemon?

(Source)

Whereas everyone seems to be ready for the Fed pivot, I believe crucial pivot has already occurred: the Dalio pivot.

(Source)

As a Ray Dalio disciple, I’ve constructed my complete macroeconomic framework on the concept “money is trash.” I imagine that mantra nonetheless holds true for anybody utilizing every other fiat forex, however has Dalio stumbled upon some new details about the USD that has modified his thoughts?

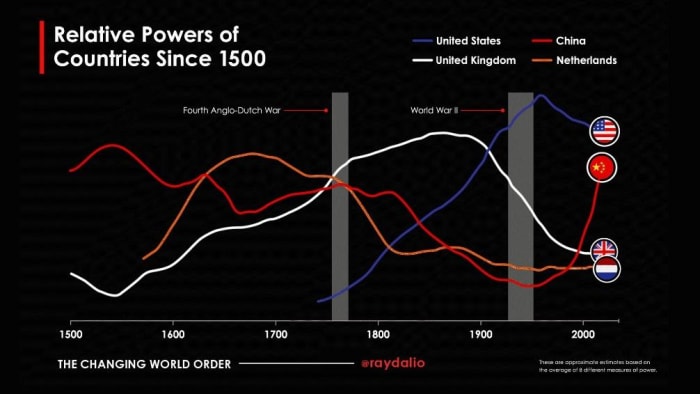

Dalio wrote an outstanding guide “The Changing World Order: Why Nations Succeed or Fail” that particulars how wars happen when world empires conflict.

(Source)

Has he concluded that the US may very well be about to weaponize the greenback, making it not so trashy? Has he concluded that the U.S. isn’t going to willingly enable China to be the world’s subsequent rising empire like he as soon as proclaimed? Would the U.S. aggressively elevating charges result in a capital flight to the U.S., a rustic that has a relatively more healthy banking system than its rivals in China, Japan and Europe? Do we’ve got any proof for this outlandish left-field, hypothetical state of affairs?

Let’s additionally not overlook, this isn’t only a race with the US versus China. The second-most used overseas forex on the earth — the euro — most likely wouldn’t thoughts gaining energy from a declining U.S. empire. We now have to ask the query, why is Jerome Powell refusing to align financial insurance policies with certainly one of our closest allies in Europe?

(Source)

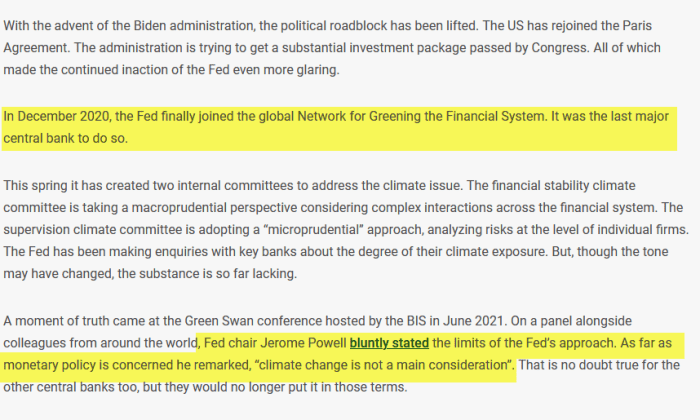

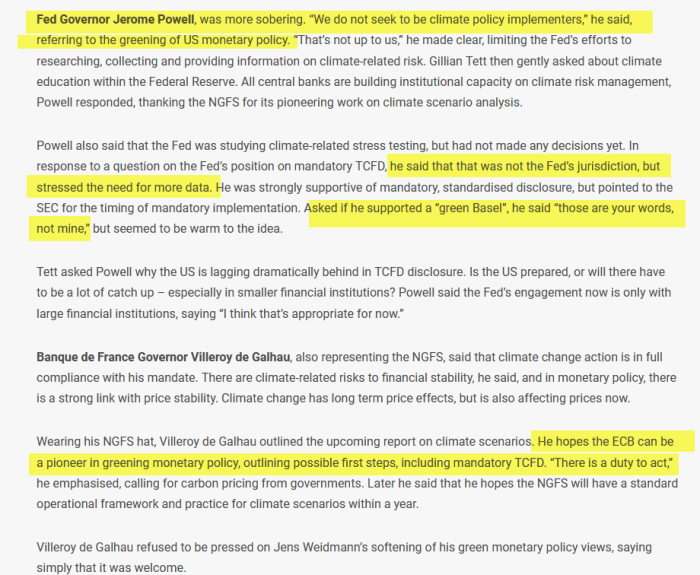

On this illuminating 2021 webinar, on the Inexperienced Swan central banking convention, Powell blatantly refused to associate with the “inexperienced central banking” insurance policies that have been mentioned. This visibly infuriated Christine Lagarde, head of the European Central Financial institution, who was additionally a part of the occasion.

(Source)

A few of the quotes from Powell in that interview are illuminating.

(Source)

(Source)

Is that this an indication the U.S. is not a fan of the Nice Reset ideologies popping out of Europe? Why is the Fed additionally ignoring the United Nations begging them to decrease charges?

(Source)

We are able to speculate about what Powell’s intentions could also be all day, however I want to have a look at information. Since Powell’s preliminary heated debate with Lagarde and the Fed’s subsequent price improve on the reverse repo days after, the greenback has decimated the euro.

In April 2022, Powell was dragged into one other “debate” with Lagarde, led by the top of the IMF. Powell reaffirmed his stance on local weather change and central banking.

The plot thickens after we think about the implications of the LIBOR and SOFR rate of interest transition that occurred at first of 2022. Will this rate of interest change allow the Fed to hike rates of interest and insulate the banking system from the contagion that’ll ensue from a wave of worldwide debt defaults within the wider eurodollar market?

(Source)

I do suppose it’s fascinating that by some metrics the U.S. banking system is exhibiting comparatively fewer indicators of stress than in Europe or the remainder of the world, validating the thesis that SOFR is insulating the U.S. to a level.

A New Reserve Asset

Whether or not the U.S. is at warfare with different central banks or not doesn’t change the truth that the nation wants a brand new impartial reserve asset to again the greenback. Creating a world deflationary bust, and weaponizing the greenback is only a short-term play. Scooping up belongings on a budget and weaponizing the greenback will solely drive dollarization within the brief time period. The BRICS nations and others which might be disillusioned with the SWIFT-centered monetary system will proceed to de-dollarize and attempt to create a substitute for the greenback.

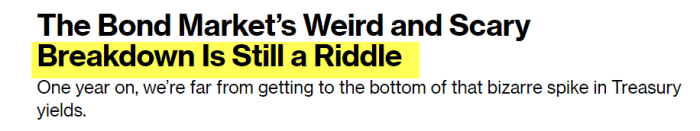

The worldwide reserve forex has been informally backed by the U.S. Treasury be aware for the previous 50 years, since Nixon closed the gold window in 1971. In occasions of danger, individuals run to the reserve asset as a technique to come up with {dollars}. For the previous 50 years, when equities dump, buyers fled to the “security” of bonds which might respect in “danger off” environments. This dynamic constructed the muse of the notorious 60/40 portfolio — till this commerce in the end broke in March 2020 when the Treasury market grew to become illiquid.

(Source)

As we transition into the Bretton Woods III period, the Triffin dilemma is lastly changing into untenable. The U.S. wants to seek out one thing to again the greenback with. I discover it unlikely that they’ll again the greenback with gold. This is able to be enjoying into the fingers of Russia and China who’ve far bigger gold reserves.

This leaves the U.S. with their backs in opposition to a wall. Religion is being misplaced within the greenback and they’d certainly need to retain their world reserve forex standing. The final time the U.S. was in a equally weak place was within the 1970s with excessive inflation. It appeared just like the greenback would fail till the U.S. successfully pegged the greenback to grease by way of the petrodollar settlement with the Saudis in 1973.

The nation is confronted with the same conundrum at this time however with a unique set of variables. They not have the choice of backing the greenback with oil or gold.

Enter Bitcoin!

Bitcoin can stabilize the greenback and even delay its world reserve forex standing for for much longer than many individuals anticipate! Most significantly, bitcoin provides the U.S. the one factor it wants for the 21st-century financial wars: belief.

Nations could belief a gold-backed (petro-)ruble/yuan greater than a greenback backed by nugatory paper. Nevertheless, a bitcoin-backed greenback is much extra reliable than a gold-backed (petro-)ruble/yuan.

As talked about earlier, the monetization of bitcoin not solely helps the U.S. economically, but it surely additionally instantly hurts our financial rivals, China and to a lesser diploma, Europe — our supposed ally.

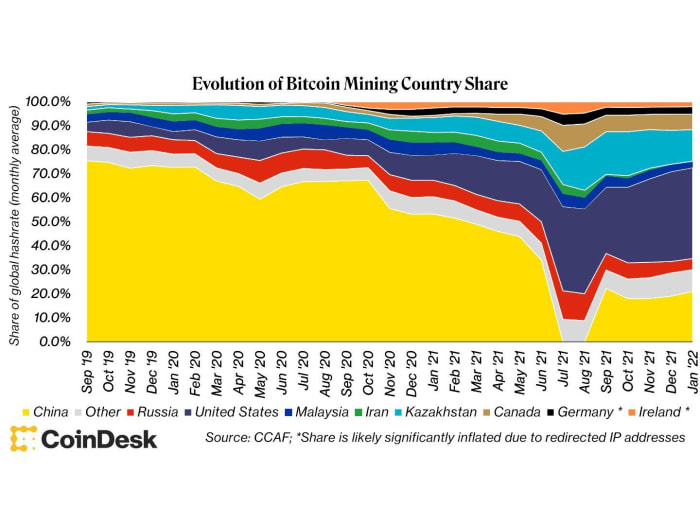

Will the U.S. notice that backing the greenback with power instantly hurts China and Europe? China and Europe are each going through important energy-related headwinds and have each infamously banned Bitcoin’s proof-of-work mining. I made the case that the power disaster in China was the true cause China banned bitcoin mining in 2021.

Right this moment, as we transition into the digital age, I imagine a basic shift is coming:

For 1000’s of years, cash has been backed by belief and gold, and guarded by ships. Nevertheless, on this millennium, cash will now be backed by encryption and math, and guarded by chips.

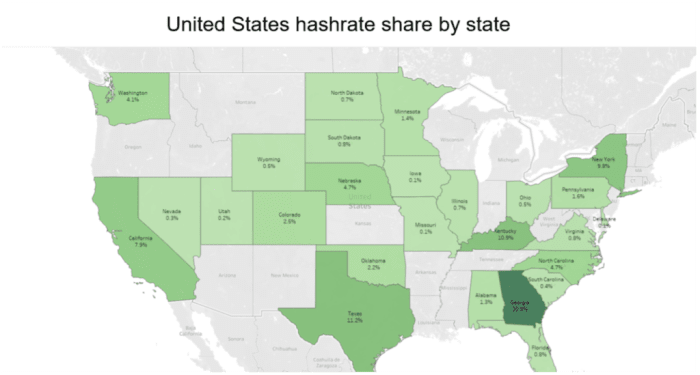

If you’ll enable me to as soon as once more interact in some hypothesis, I imagine the U.S. understands this actuality, and is making ready for a deglobalized world in many various methods. The U.S. seems to be the Western nation taking the friendliest method to Bitcoin. We now have senators all throughout the U.S. tripping over themselves to make their states Bitcoin hubs by enacting pleasant regulation for mining. The nice hash migration of 2021 has seen the lion’s share of the Chinese language hash being transferred to the U.S., which now homes over 35% of the world’s hash price.

(Source)

Current sanctions on Russian miners may solely additional speed up this hash migration. Other than some noise in New York, and the delayed spot ETF decision, the U.S. seems to be as if it’s embracing bitcoin.

(Source)

On this video, Treasury Secretary Janet Yellen talks about Satoshi Nakamoto’s innovation. The SEC Chair Gary Gensler regularly differentiates Bitcoin from “crypto” and has additionally praised Satoshi Nakamoto’s invention.

(Source)

ExxonMobil is the most important oil firm within the U.S. and announced it was using bitcoin mining to offset its carbon emissions.

Then there’s the query, why has Michael Saylor been allowed to wage a speculative attack on the greenback to buy bitcoin? Why is the Fed releasing tools highlighting how to price eggs (and different items) in bitcoin phrases? If the U.S. was so against banning bitcoin, why has all of this been allowed within the nation?

(Source)

We’re transitioning from an oil-backed greenback to a bitcoin-backed greenback reserve asset. Crypto-eurodollars, aka stablecoins backed by U.S. debt, will present the bridge between the present energy-backed greenback system and this new energy-backed bitcoin/greenback system. I discover it awfully poetic that the nation based on the ideology of freedom and self-sovereignty seems to be positioning itself to be the one that almost all takes benefit of this technological innovation. The bitcoin-backed greenback is the one various to a rising Chinese language risk positioning for the worldwide reserve forex.

Sure, the US has dedicated many atrocities, I’d argue that at occasions they’ve been responsible of abusing their energy as the worldwide hegemon. Nevertheless, in a world that’s being quickly consumed by ramped totalitarianism, what occurs if the mighty U.S. experiment fails? What occurs to our civilization if we enable a social-credit-scoring Chinese language empire to rise and export its CBDC-backed digital panopticon to the world? I used to be as soon as certainly one of these individuals cheering for the demise of the U.S. empire, however I now worry the survival of our very civilization depends upon the survival of the nation that was initially based on the rules of life, liberty and property.

Conclusions

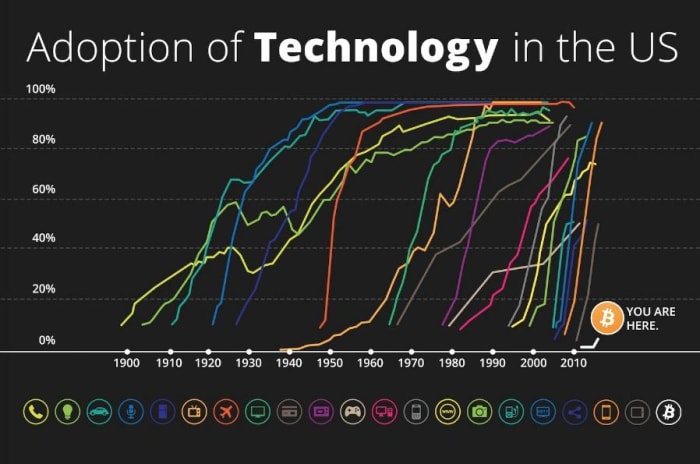

Zooming out, I stand by my authentic thesis that we’re in a brand new financial order by the tip of the last decade. Nevertheless, the occasions of the earlier months have actually accelerated that already-rapid 2030 timeline. I additionally stand by my authentic thesis from the 2021 article surrounding how bitcoin’s adoption curve unfolds due to how damaged the present financial regime is.

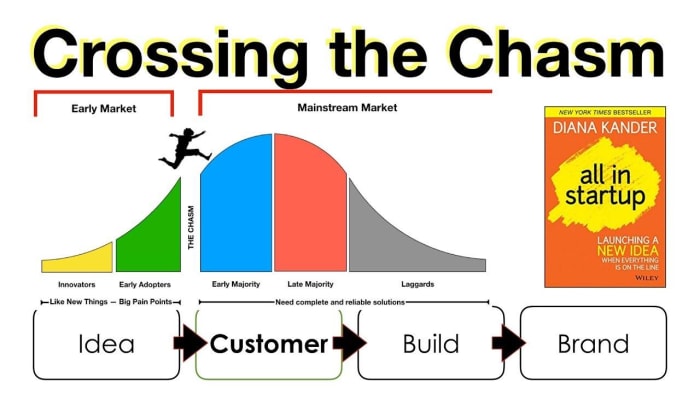

(Source)

I imagine 2020 was the financial inflection level that would be the catalyst that takes bitcoin from 3.9% global adoption to 90% adoption this decade. That is what crossing the chasm entails for all transformative applied sciences that attain mainstream penetration.

(Source)

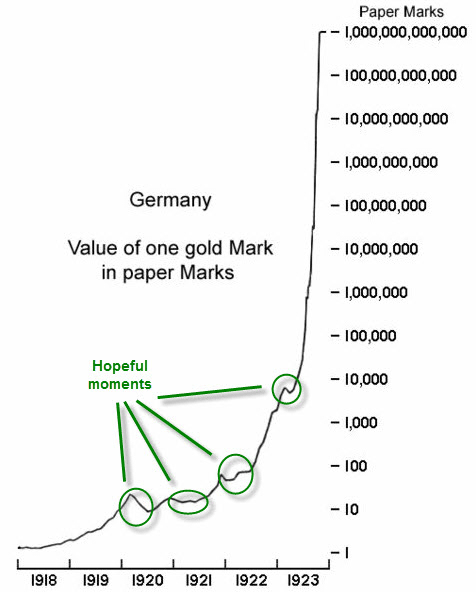

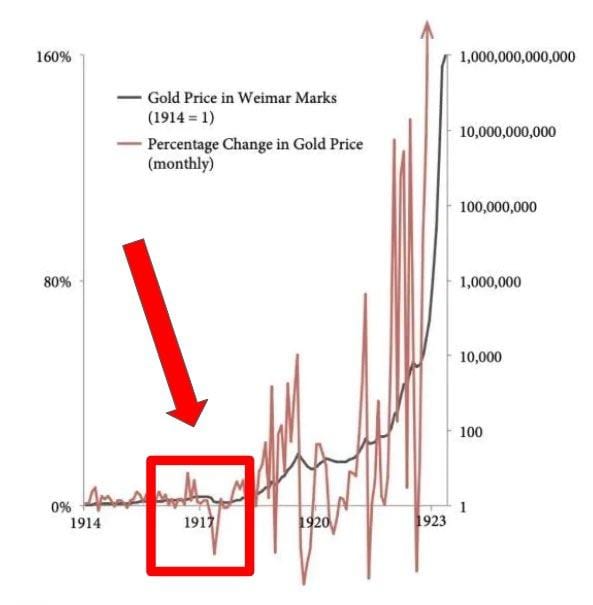

There’ll nevertheless be many “hopeful moments” alongside the best way, like there was within the German Weimar hyperinflationary occasion of the 1920s.

(Source)

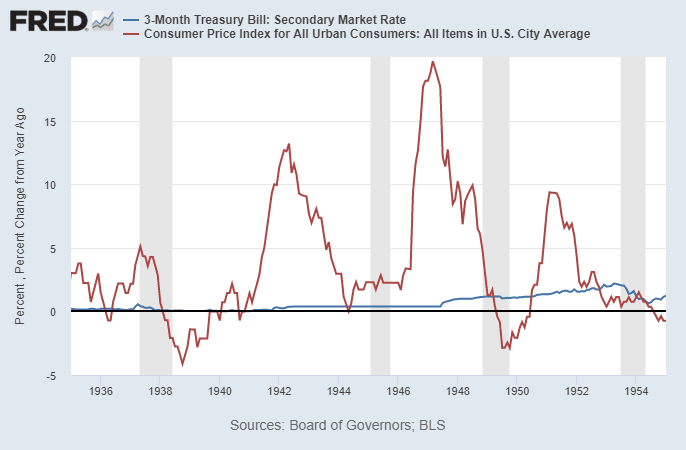

There will probably be dips and spikes in inflation, like there was within the 1940s throughout U.S. authorities deleveraging.

(Source)

Deglobalization would be the excellent scapegoat for what was all the time going to be a decade of presidency debt deleveraging. The financial contractions and spasms have gotten extra frequent and extra violent with every drawdown we encounter. I imagine the vast majority of fiat currencies are within the 1917 levels of the Weimar hyperinflation.

(Source)

This text was very centered on nation-state adoption of bitcoin, however don’t lose sight of what’s actually unfolding right here. Bitcoin is a Computer virus for freedom and self-sovereignty within the digital age. Apparently, I additionally really feel that hyperdollarization will speed up this peaceable revolution.

Hyperinflation is the occasion that causes individuals to do the work and study cash. As soon as many of those power-hungry dictators are compelled to dollarize and not have the management of their native cash printer, they might be extra incentivized to take a wager on one thing like bitcoin. Some could even do it out of spite, not eager to have their financial coverage dictated to them by the U.S.

(Source)

Cash is the first instrument utilized by states to train their autocratic, authoritarian powers. Bitcoin is the technological innovation that’ll dissolve the nation-state, and fracture the facility the state has, by eradicating its monopoly on the cash provide. In the identical method the printing press fractured the facility of the dynamic duo that was the church and state, bitcoin will separate cash from state for the primary time in 5,000+ years of financial historical past.

(Source)

So, to reply the greenback doomsdayers, “Is the greenback going to die?” Sure! However what’s going to we see within the interim? De-dollarization? Possibly on the margins, however I imagine we are going to see hyperdollarization adopted by hyperbitcoinization.

This can be a visitor publish by Luke Mikic. Opinions expressed are fully their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.

More NFT News

Machine Studying in Focus as Chainalysis Acquires Hexagate

Extra Than Half of Crypto Tokens, Memecoins Launched in 2024 Have been Malicious: Blockaid

Hedera Value Prediction for Right now, December 18 – InsideBitcoins