Bitcoin’s (BTC) present sideways worth motion has left buyers questioning what the longer term holds for the world’s largest cryptocurrency. The upcoming rate of interest hikes by the Federal Reserve (Fed) could pose the subsequent large problem for Bitcoin, according to the crypto market evaluation agency Blofin Academy.

Is Bitcoin Prepared For The Warmth Of Curiosity Price Hikes?

The US financial system has proven appreciable resilience in current months, prompting the Fed to contemplate elevating rates of interest to forestall inflation. Nevertheless, this could possibly be dangerous information for the crypto market, as increased rates of interest are likely to make conventional investments extra engaging, probably resulting in a lower in demand for Bitcoin and different cryptocurrencies.

The correlation between rates of interest and Bitcoin’s worth motion has been noticed prior to now. When rates of interest rise, buyers have a tendency to maneuver their cash into conventional funding autos comparable to shares and bonds, resulting in a lower in demand for cryptocurrencies.

Nevertheless, it’s price noting that Bitcoin has usually been considered as a hedge in opposition to inflation, which implies that it might nonetheless maintain some attraction for buyers throughout occasions of financial uncertainty.

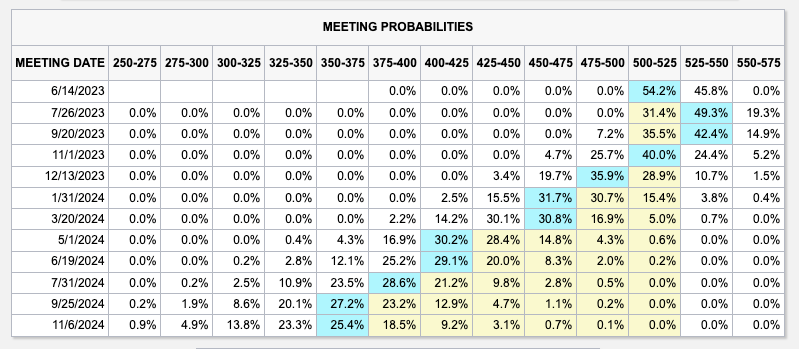

The subsequent scheduled Fed assembly is about to happen on June 14, 2023, the place the central financial institution will possible focus on the potential of elevating rates of interest in response to the present state of the US financial system.

Macro Determinants Depart Crypto Merchants Ready

Noelle Acheson, proprietor of the “Crypto Is Macro Now” publication, has cautioned in opposition to buyers piling into the crypto market right now. Whereas the upside potential for Bitcoin stays important, Acheson suggests that there’s presently no compelling motive for buyers to tackle further threat.

Based on Acheson, there are few macro determinants in the mean time, comparable to debt restrict negotiations and Fed charge coverage, that are leaving buyers ready for extra readability earlier than making any main funding choices. Because of this, there’s a sense of warning available in the market as merchants wait to see how these macro components will play out.

Regardless of the dearth of readability, Acheson notes that there’s not a lot motive for current crypto holders to promote their holdings. This means that the present wait-and-see interval just isn’t essentially an indication of bearish sentiment available in the market, however relatively a interval of warning as buyers await extra data.

Acheson additionally notes that there could also be some draw back motion within the close to time period, however the perception in a possible rally just isn’t sturdy sufficient to warrant the potential of lacking out on any potential good points. Because of this, there was some shopping for and promoting available in the market, however not sufficient to considerably enhance volatility regardless of low volumes and liquidity.

On the time of writing, Bitcoin is buying and selling at $26,700, reflecting a 1.2% enhance during the last 24 hours. Nevertheless, the 50-day Shifting Common (MA) has positioned the most important cryptocurrency in a slender vary between $26,200 and $26,800. Because of this Bitcoin could battle to surpass its present buying and selling vary within the close to time period, because the 50-day MA is presently located on the higher finish of this vary on the 1-hour chart, making it a difficult degree to breach.

Whereas Bitcoin has skilled some upside actions in current weeks, the present buying and selling vary means that additional good points could also be restricted till there’s a important shift in market sentiment or the emergence of a bullish catalyst.

Featured picture from iStock, chart from TradingView.com

More NFT News

Chinese language Auto Supplier Dives Into Bitcoin Mining With $256M Funding

Harnessing idle GPU energy can drive a greener tech revolution

Will Dogecoin Attain $1? Crypto Volatility Returns as Bitcoin and Ethereum Slide