GFC vs. 2023

It appears contraction within the U.S. financial system is beginning to seem. Nevertheless, a recession just isn’t scheduled in the interim. Evaluating earlier eras and recessions would possibly match human psychology, however it’s going to undoubtedly be totally different. However probably, the Federal Reserve will proceed to hike charges till one thing materially breaks.

We’ve had a banking disaster, which is basically totally different from 2008. In 2008, we had mortgage defaults and noticed a knock-on impact with home costs falling drastically. On the similar time, banks had deep losses on loans on their stability sheets. SVB was basically totally different as depositors panicked about extreme unrealized losses on their treasury portfolio.

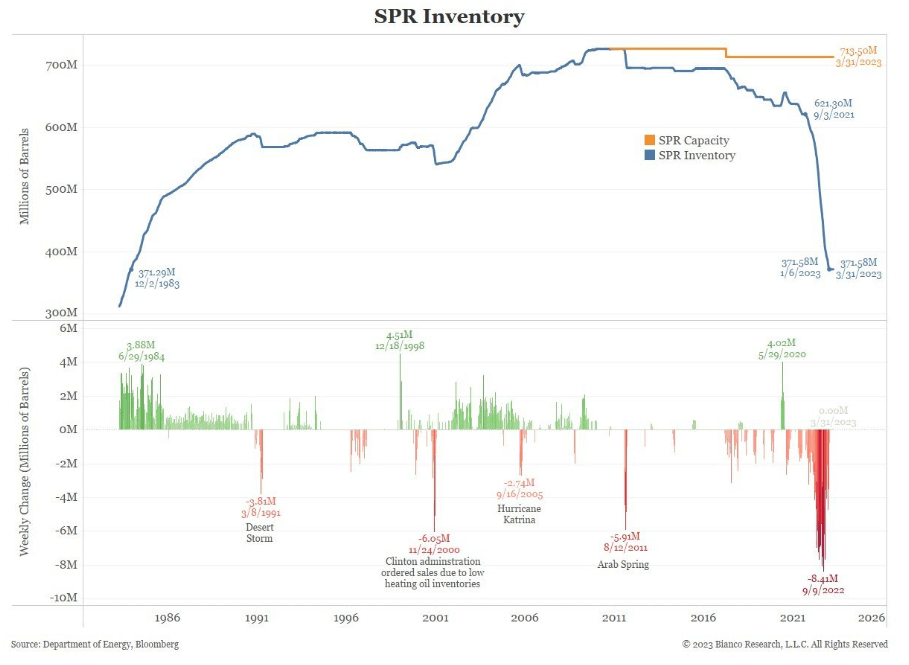

OPEC +

To begin the week, we had OPEC + announcement of reducing over 1m barrels/day beginning subsequent month, whereas 2m barrels/day are being lower from October. CryptoSlate analyzed the repercussions of those cuts; not solely is that this pure sign of demand collapsing. It additionally left the Biden administration in hassle after drawing down on the Strategic Petroleum Reserve whereas failing to construct on the reserves when costs had been surpassed. Crude Oil WTI (NYM $/bbl) closed the week at $80/ barrel whereas it was as little as $67, with some analysts anticipating triple digits.

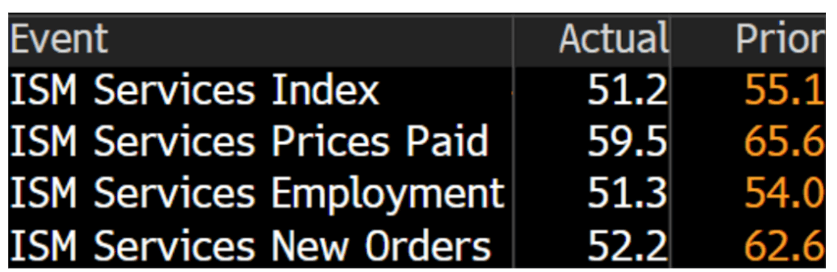

U.S. manufacturing slumps

The March ISM manufacturing survey continued its decline, staying inside the contraction zone of 46.3, undershooting expectations. As well as, JOLTS information printed 9.93 million vs. the 10.5 million anticipated. This was the smallest print since April 2021. Whereas each a part of ISM Providers PMI additionally continued to drop. New orders are all the way down to 52.2 from 62.6.

Unemployment at report lows

Staggeringly, unemployment dropped to three.5% from 3.6%. On the similar time, the U.S. Bureau of Labor Statistics employment report confirmed 236,000 nonfarm jobs added for March. Economists anticipated 239,000 jobs.

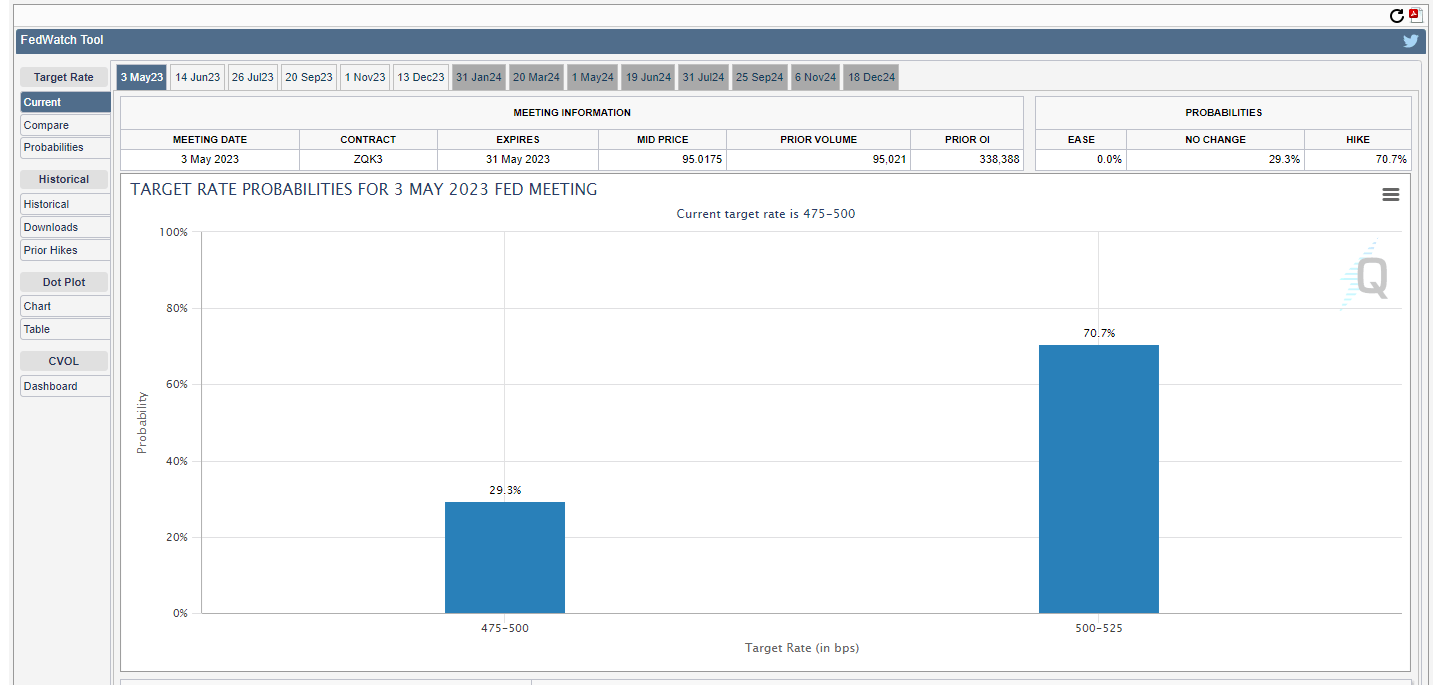

Consequently, we now see a 69% likelihood of one other .25 fee hike on the Might FOMC. This might put the federal funds fee over 5%.

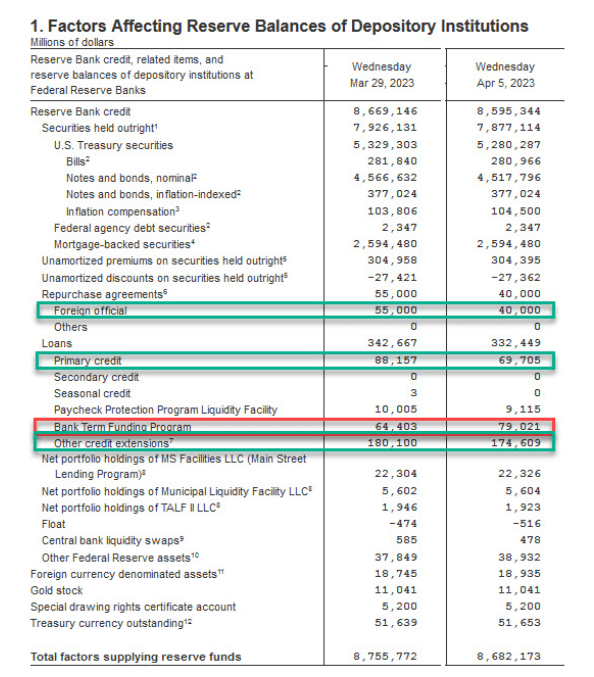

Fed stability sheet replace

Thursday afternoon clock watch of the fed stability sheet is now turning into a fundamental occasion. The fed stability sheet fell by $74 billion this week, roughly decreased by $100 billion up to now two weeks. The fed stability sheet is now shrinking sooner than earlier than the SVB collapse.

This exhibits fewer banks and fewer distressed property are wanted to be supported by the Fed. As well as, BTFP loans rose to $79 billion from $64.four billion because the Fed low cost window utilization dropped to $69.7 billion from $88.2 billion.

It’s secure to say this was not a spherical of quantitative easing however short-term emergency loans that will likely be paid again.

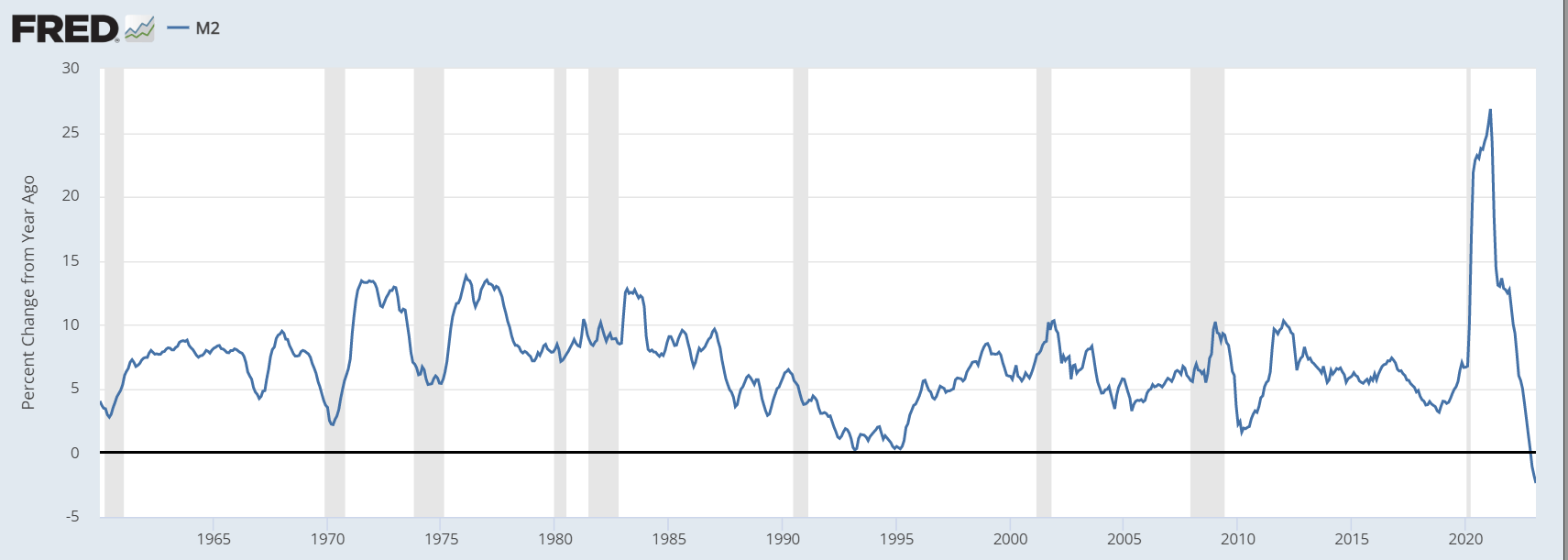

However the important thing points listed here are quantitative tightening and liquidity being drained from the system. We’ve witnessed the quickest tightening cycle in historical past; the cash provide measured by M2 has fallen 2.5% since final 12 months, the sharpest deterioration for the reason that nice despair in 1929.

Even small contractions within the cash provide may cause huge financial issues and result in financial institution runs. You’d assume banks will begin to in the reduction of lending and maintain additional cash readily available, which is able to doubtlessly trigger a credit score crunch. Little question lending requirements will tighten.

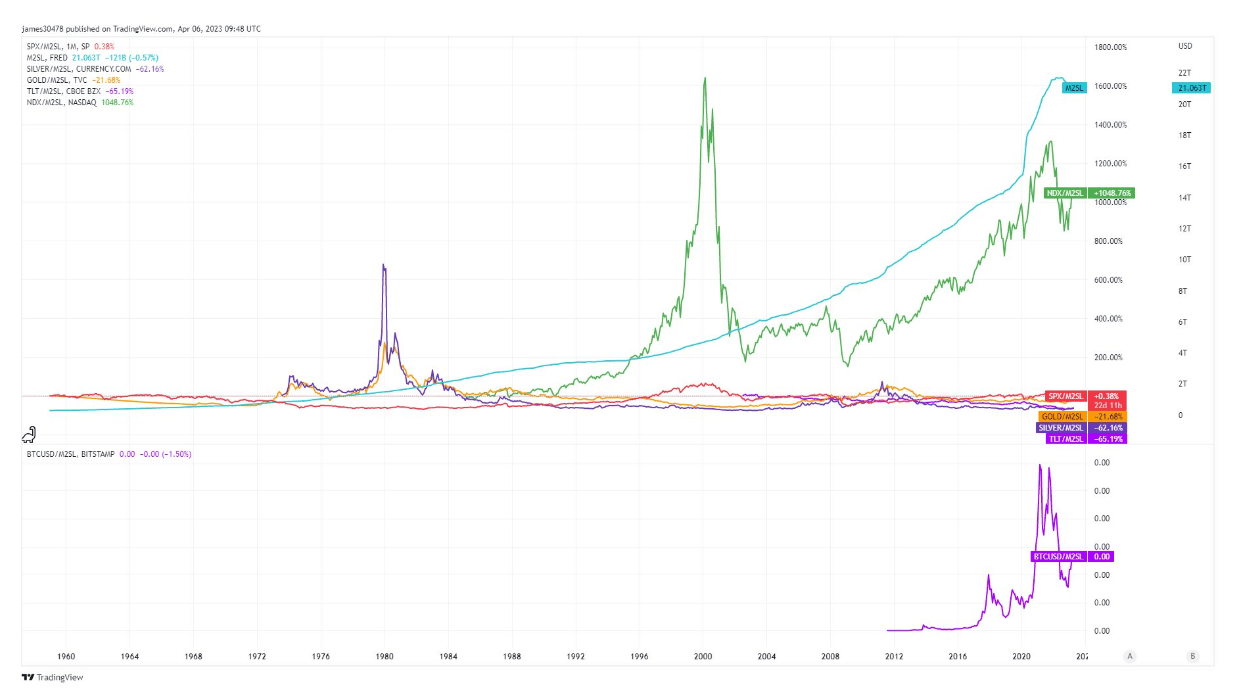

Bitcoin vs. M2

Within the quick time period, it is vitally arduous to present definitive solutions a few credit score crunch, a recession, and if Bitcoin will exceed a sure worth goal. However we champion Bitcoin as a result of it’s an asset that permits you to ignore all of the macro uncertainty and geo-political video games and concentrate on the larger activity at hand. An asset with no counter-party danger doesn’t endure from the contagion potential of TradFi property.

The lengthy sport is cash provide will proceed to increase; the stability sheet will increase, inevitably inflating all our property.

CryptoSlate analyzed main assets vs. M2 cash provide, and it’s clear to see one winner on this sport. The phantasm of cash printing makes you suppose you’re getting wealthier; nevertheless, in actual phrases, you aren’t even staying afloat.

Bitcoin stays the primary asset to maintain you forward of the devaluation of the forex.

More NFT News

Chinese language Auto Supplier Dives Into Bitcoin Mining With $256M Funding

Harnessing idle GPU energy can drive a greener tech revolution

Will Dogecoin Attain $1? Crypto Volatility Returns as Bitcoin and Ethereum Slide