What We’re Studying: Bitcoin: A Global Liquidity Barometer

I’ve been intrigued by the numerous enhance in international liquidity throughout 2024, pushed by intensive cash printing and debt enlargement, and the way it impacts Bitcoin’s value.

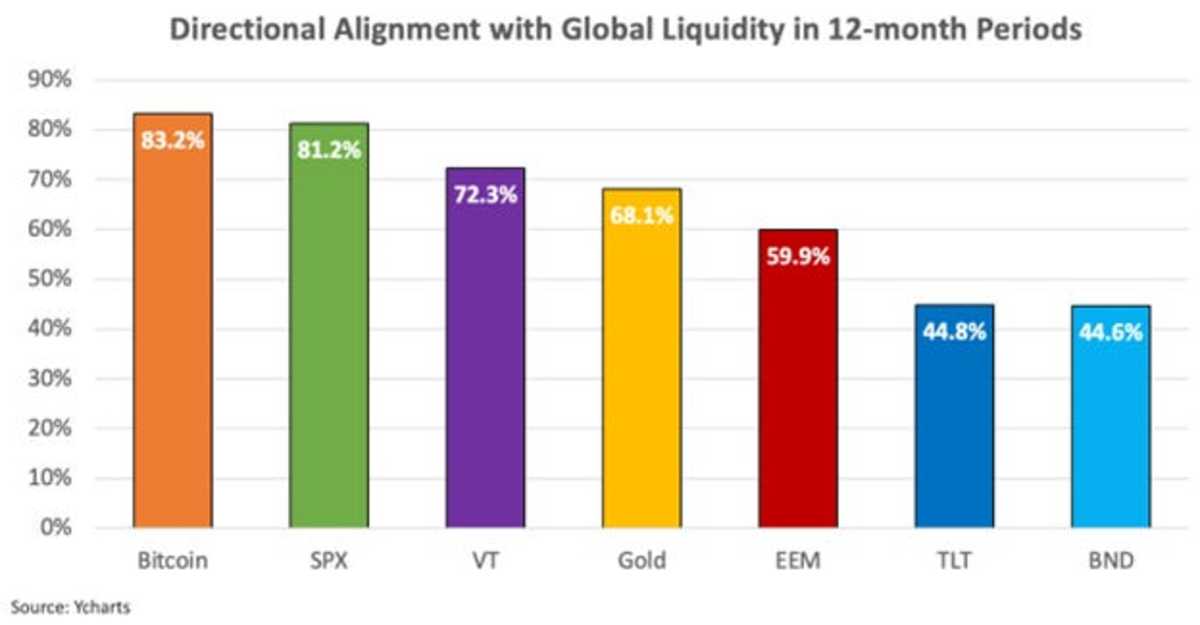

Bitcoin is an expression in opposition to the federal government’s financial expansionist insurance policies, so its value follows international liquidity, as seen right here on this chart.

It was fascinating to learn the latest report by Lyn Alden and Sam Callahan analyzing Bitcoin’s correlation to international liquidity. This additional reconfirmed my view that extra financial enlargement drives extra individuals to Bitcoin, growing costs.

Their rigorous evaluation discovered that over 12-month intervals, Bitcoin’s value strikes in the identical path as international liquidity a exceptional 83% of the time. That is greater than some other main asset class, making Bitcoin a uniquely pure barometer for international liquidity tendencies.

The report quantified Bitcoin’s correlation with international M2 cash provide, discovering a really robust 0.94 total correlation between Might 2013 and July 2024. Bitcoin’s common 12-month rolling correlation was 0.51, whereas shares and gold confirmed reasonably excessive correlations as nicely within the 0.four to 0.7 vary.

After all, Bitcoin’s correlation is not excellent. Shorter-term breakdowns can happen round crypto-specific occasions like change hacks or Ponzi schemes collapsing.

Provide-demand imbalances additionally trigger non permanent decoupling when Bitcoin reaches excessive overvaluation ranges throughout market cycle peaks. But regardless of these breakdowns, the long-term relationship persists.

Proper now, liquidity is hovering to unprecedented ranges, suggesting Bitcoin may quickly embark on an enormous bull run if this relationship holds. Whereas I consider no mannequin completely captures Bitcoin’s complexity, recognizing its position as a financial canary within the coal mine can lend invaluable perception. If historical past rhymes, Bitcoin’s sirens are ringing loudly {that a} liquidity-driven increase will quickly be underway.

More NFT News

Machine Studying in Focus as Chainalysis Acquires Hexagate

Bitcoin Traders Are Now Up $67,000 On Common – And This Is Simply The Begin

Extra Than Half of Crypto Tokens, Memecoins Launched in 2024 Have been Malicious: Blockaid