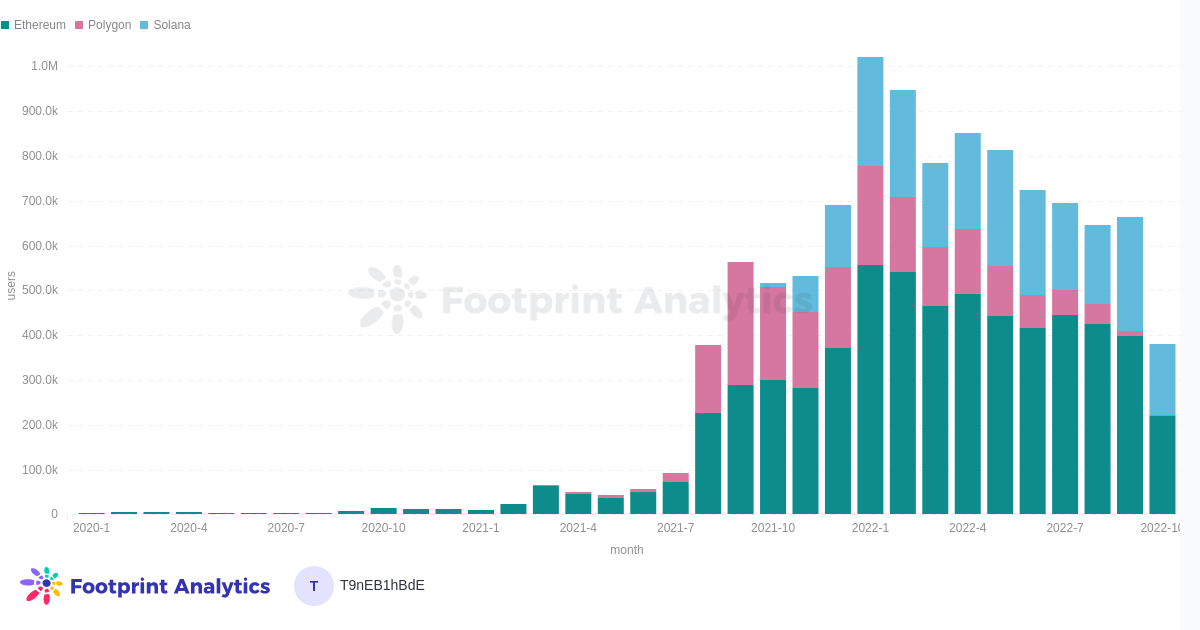

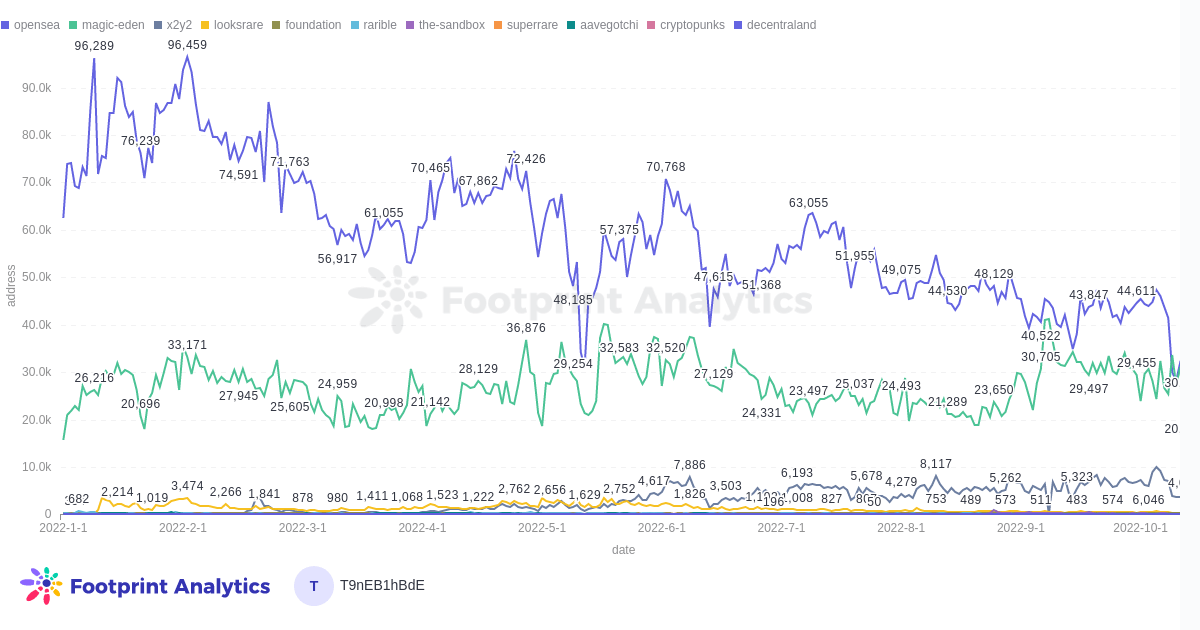

This time one yr in the past, Polygon was the second largest chain for the variety of NFT customers, which Footprint Analytics counts as a pockets deal with that has purchased or bought an NFT asset at the very least as soon as within the earlier month.

By rising from almost zero p.c of the market share of NFT customers to 48% in simply 6 months, it appeared like Polygon may simply turn into the dominant chain for NFTs.

However because the begin of the bear market, the state of affairs has modified, with Solana turning into the second most necessary ecosystem for digital property.

Observe: The above chart doesn’t embody transactions in Factor, a market which has turn into a serious power for Polygon, which means that it doesn’t precisely symbolize the variety of Polygon NFT customers at the moment. It’s nonetheless legitimate to see the expansion of Solana.

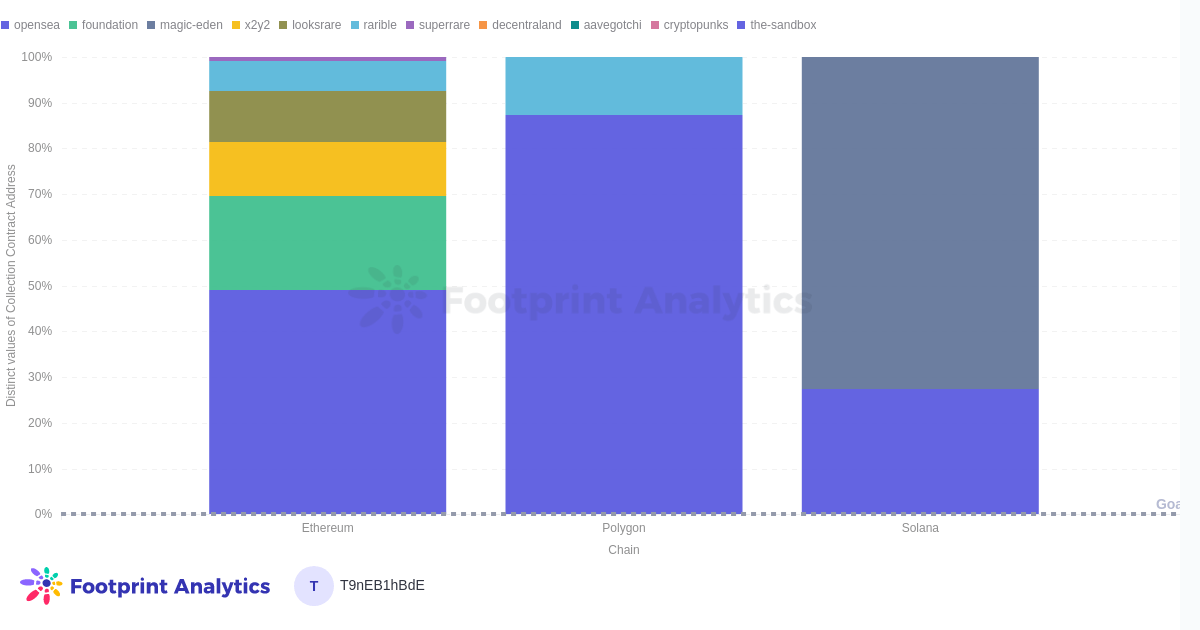

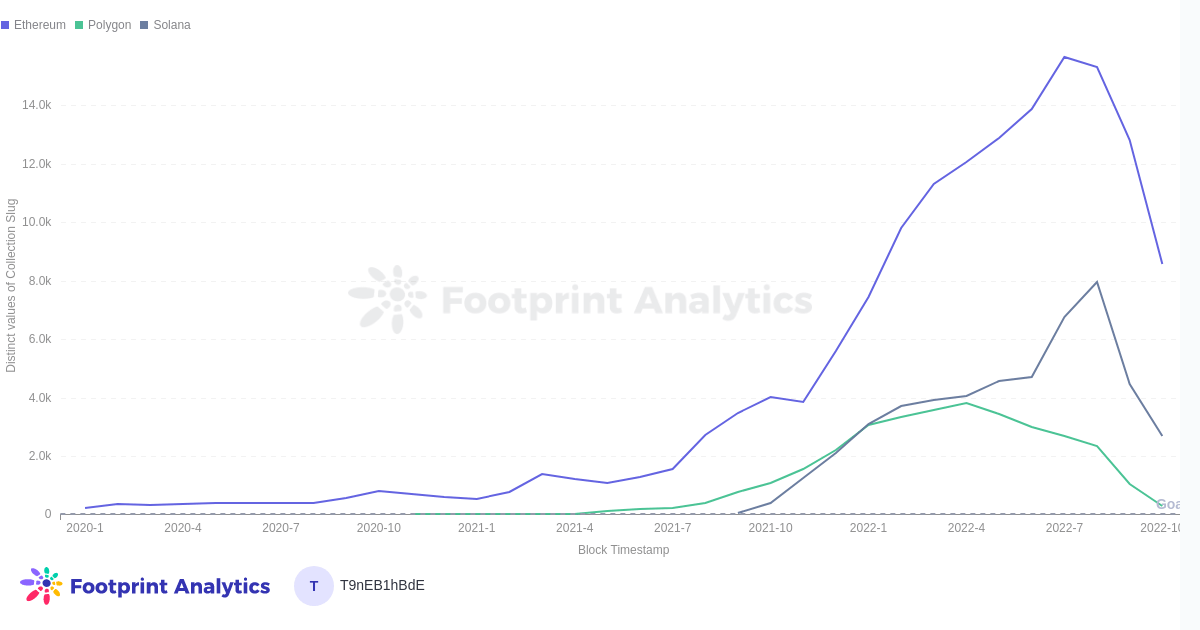

Polygon’s NFT collections, the vast majority of that are listed on OpenSea, Aavengotchi and Factor Market, at the moment are much less traded and make up a smaller share of the market than earlier than. Considerably extra customers commerce on Ethereum and Solana.

Why did Polygon’s NFT ecosystem adoption explode a yr in the past?

Polygon was launched in 2017 as a blockchain scaling resolution for Ethereum. Utilizing a modified proof-of-stake consensus, the protocol may course of transactions rapidly and affordably in comparison with congested, costly Ethereum.

Across the starting of the final bull market, Layer 2s have been the primary contender for fixing the issue of blockchain scalability. Polygon was the main progressive resolution on this class of merchandise. To most individuals on the time, it was a protected guess that Ethereum would stay the underlying infrastructure of the blockchain, with enhancements constructed on prime of it.

Nonetheless, over the past yr, the narrative shifted. Builders and analysts started foreseeing the opportunity of “Ethereum-killers”—new chains with their very own languages, consensus mechanisms and applied sciences. Somewhat than attaching an HOV lane to a freeway to enhance the move of site visitors, these new tasks promised to design roads for brand new use instances, like NFTs and GameFi, from the bottom up.

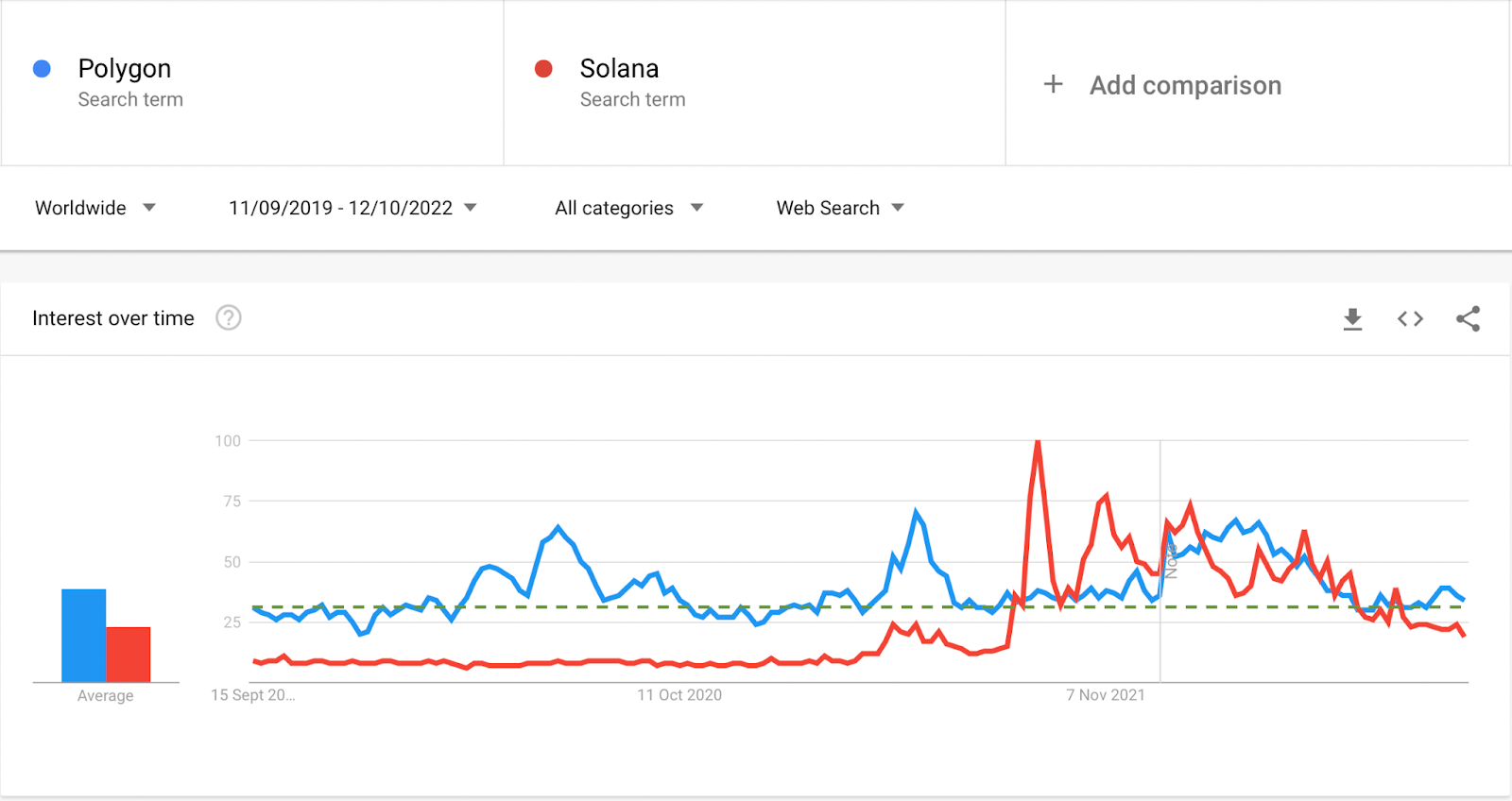

Solana launched in 2019 and rapidly grew to become a dominant Ethereum-killer Layer 1. Crypto revolves round hype cycles; it took a number of of those for folks to return round to Solana.

The inexperienced dotted line is a baseline for searches for “polygon” the form, which stay fixed.

The chart illustrates how Polygon was ready to make use of its first-mover benefit to achieve traction in a number of earlier hype cycles. Whereas Polygon remains to be a strong, progressive protocol with an especially energetic mission base and powerful token efficiency, Solana nonetheless garners extra curiosity.

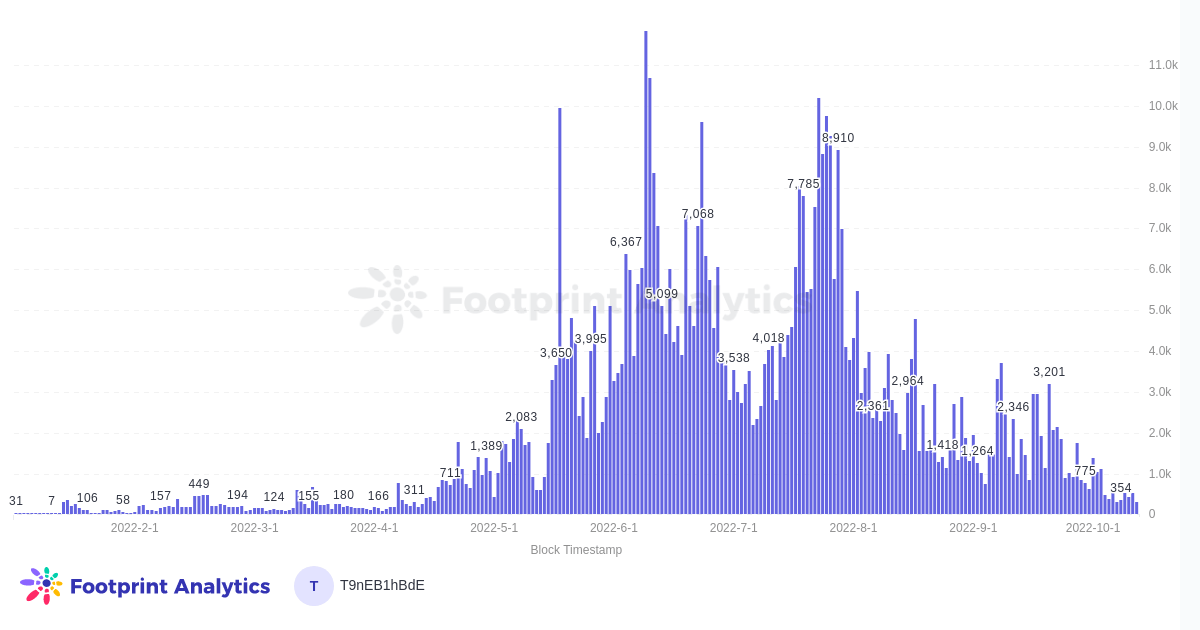

NFT fans, and smaller creators particularly, flocked to the upstart Solana ecosystem and its community-driven market, Magic Eden.

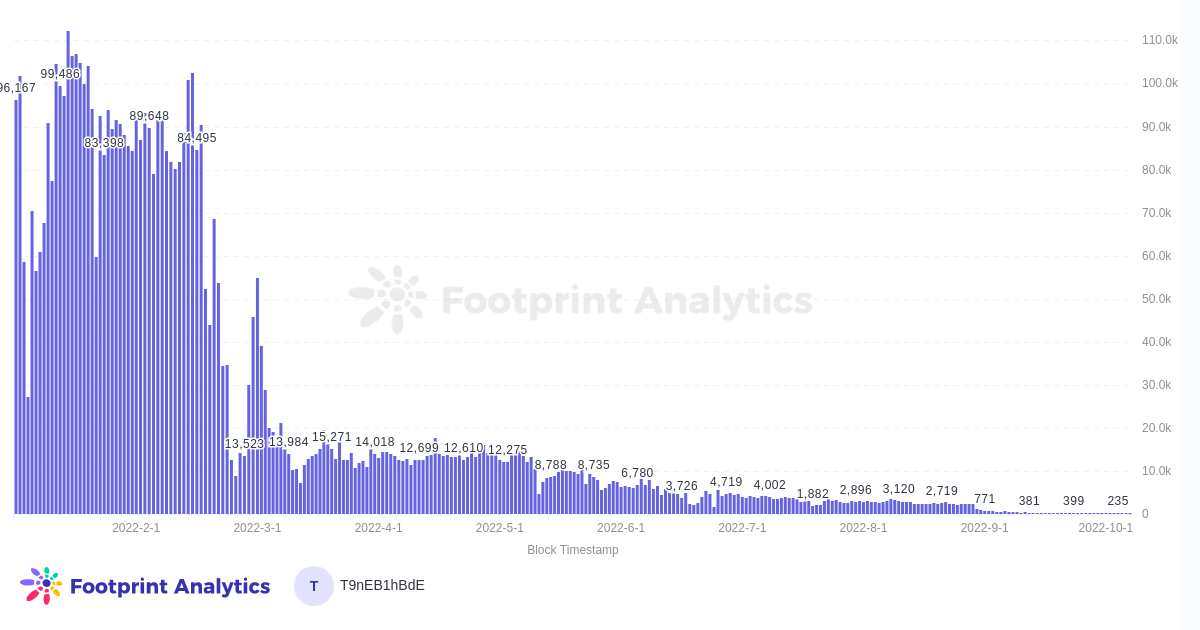

This exodus from Polygon to Solana turns into obvious when evaluating OpenSea transaction information from the two chains from the identical interval side-by-side.

Abstract

Polygon remains to be doing wonderful issues in Web3, nevertheless it’s clear that it’s now not the best choice after Ethereum for NFT tasks. Whereas among the above charts don’t present the complete image (which seems to be considerably higher for Polygon as soon as Factor Market and Playdapp Market are included), it’s clear that Solana has attracted a lot of the hype within the NFT trade.

This piece is contributed by the Footprint Analytics group in October 2022 by: [email protected]

The Footprint Neighborhood is a spot the place information and crypto fans worldwide assist one another perceive and acquire insights about Web3, the metaverse, DeFi, GameFi, or some other space of the fledgling world of blockchain. Right here you’ll discover energetic, various voices supporting one another and driving the group ahead.

Supply: OpenSea Ethereum – Polygon – Solana

More NFT News

Marathon and Hut Eight scoop up $1.6 billion price of Bitcoin throughout market dip

Osprey Funds Launches First US Publicly Quoted BNB Belief

Will Binance's BNB Attain $1000? Worth Prediction Amid Authorized Challenges in Australia