DeFi, or Decentralized Finance, is an strategy to managing monetary transactions that eliminates the necessity for banks or middlemen. In contrast to conventional banks, DeFi works 24/7 and is open to anybody with a WiFi information or web connection.

On this information, we are going to clarify what’s DeFi, the way it works, and why it’s turning into common. You’ll find out about its advantages, dangers, and the way it may change the way forward for finance.

Key Takeaways:

- DeFi is a blockchain-based monetary system that operates with out centralized intermediaries like bankers, attorneys, or brokers.

- DeFi purposes embrace decentralized exchanges, lending platforms, prediction markets, and yield farming.

- The very best DeFi platforms within the crypto area are Uniswap, Aave, Lido, MakerDAO, Compound Finance, and Curve Finance.

What Is Decentralized Finance (DeFi)?

DeFi is a blockchain-based monetary system that makes an attempt to copy and enhance commonplace monetary providers with out the necessity for centralized middlemen. Eliminating middlemen from transactions, corresponding to banks and different conventional monetary establishments, is the core precept of DeFi.

Quite, DeFi automates monetary providers together with lending, borrowing, buying and selling, and insurance coverage utilizing good contracts, that are self-executing contracts written in code. This strategy helps prospects to entry monetary providers worldwide whereas sustaining full management over their belongings.

DeFi goals to empower finance by establishing an open, permissionless infrastructure that anyone with an web connection can leverage with out counting on centralized authority. For instance, quite than requesting a mortgage via a financial institution, you’ll be able to make the most of a DeFi lending protocol corresponding to Aave to supply digital currencies as collateral and borrow straight from a liquidity pool.

How Does DeFi Work?

DeFi works on blockchain know-how, the place all transactions are saved on distributed ledgers, making the whole lot clear and unchangeable.

On the coronary heart of DeFi are good contracts, that are items of code on the blockchain. These contracts routinely full transactions when sure circumstances are met, with out the necessity for middlemen like attorneys, bankers, or brokers.

Decentralized Finance vs Centralized Finance

DeFi provides extra transparency, decentralization, and management to customers, however could carry dangers associated to safety and regulatory uncertainty.

CeFi supplies a extra conventional, regulated system with larger belief in centralized monetary establishments, however with much less management for the consumer and probably larger charges.

| Function | Decentralized Finance (DeFi) | Centralized Finance (CeFi) |

| Management | Managed by decentralized networks (blockchains, good contracts) | Managed by centralized entities (checking account, change, and many others.) |

| Governance | Ruled by the group, usually via tokens and voting mechanisms | Ruled by the corporate’s executives or regulators |

| Transparency | Absolutely clear, as all transactions are recorded on public blockchains | Restricted transparency, with customers depending on centralized establishments for data |

| Custody | Customers have management over their very own belongings (non-custodial wallets) | Establishments maintain custody of customers’ belongings (custodial wallets) |

| Accessibility | Open to anybody with an web connection, no KYC required | Requires KYC (Know Your Buyer) and could also be restricted by geography |

| Belief Mannequin | Trustless | Belief-based |

| Intermediaries | No intermediaries, peer-to-peer transactions by way of good contracts | Requires intermediaries corresponding to banks, brokers, or exchanges |

| Regulation | Largely unregulated, although rising authorities scrutiny | Closely regulated by monetary authorities (SEC, FCA, and many others.) |

| Velocity of Transactions | Quick, particularly on Layer 2 options; is determined by blockchain efficiency | Could also be slower as a result of middleman approval and banking hours |

| Prices/Charges | Sometimes decrease, however fuel charges can fluctuate relying on community utilization | Usually larger, with charges for providers like buying and selling, withdrawals, and many others. |

| Safety | Code-based safety; dangers embrace good contract vulnerabilities | Establishment-based safety, together with insurance coverage however susceptible to hacks or insolvency |

| Anonymity | Pseudonymous (transactions are public however consumer identities are masked) | No |

| Liquidity | Low | Excessive |

| Yield/Curiosity Charges | Increased yields as a result of modern mechanisms (e.g., staking, liquidity mining) | Decrease yields, however usually extra secure and predictable |

Advantages of Utilizing DeFi

DeFi has a couple of advantages over conventional monetary providers:

- Accessibility: No matter location or monetary standing, anyone with a WiFi or web connection can use DeFi providers. This enables customers in distant areas or underbanked populations to entry monetary instruments that have been beforehand unavailable to them.

- Openness: All transactions are recorded on a public blockchain, offering unparalleled ranges of transparency. This transparency helps construct belief amongst customers, as anybody can confirm transactions and be sure that no hidden actions are going down.

- Interoperability: DeFi protocols can readily talk with each other, leading to new monetary services. This seamless integration encourages innovation and permits customers to create personalized monetary options tailor-made to their particular wants.

- Decrease prices: By eradicating intermediaries, DeFi might be able to present decrease monetary service charges. Customers can save on prices which might be usually levied by banks and different monetary organizations, making transactions extra cheap for everybody.

- Increased Yields: Many DeFi platforms provide lenders larger rates of interest than conventional banks. This may offer you higher returns in your investments, serving to you to develop your wealth extra successfully over time.

- Programmability: Sensible contracts allow the design of difficult monetary devices and automatic operations. This programmability can scale back the necessity for handbook intervention, resulting in sooner and extra environment friendly transaction processes.

- Innovation: The open-source nature of DeFi permits fast invention and experimentation. Builders can collaborate and construct on one another’s work, resulting in a speedy evolution of economic applied sciences and providers.

- Management: Customers have full management over their belongings and don’t depend on third-party custodians. This direct possession minimizes the chance of loss as a result of third-party failures and provides customers peace of thoughts relating to their investments.

Dangers of Utilizing DeFi

Whereas DeFi provides many advantages, you need to be conscious of the dangers concerned:

- Vulnerabilities in Sensible Contracts: You may lose your digital belongings if there are errors or flaws within the programming. Hackers can exploit these vulnerabilities, thus it’s essential to completely assessment any good contract earlier than using it.

- Regulatory Uncertainty: The principles round DeFi are nonetheless altering, which may have an effect on how platforms work sooner or later. As governments look to create laws, these modifications may impression your potential to make use of sure providers or their legality.

- Volatility: The cryptocurrencies utilized in DeFi can change in worth in a short time, that means you possibly can face important losses. This unpredictability makes it laborious to stay to a secure funding plan.

- Lack of Shopper Protections: In contrast to conventional finance, DeFi doesn’t have most of the protections that you simply may count on like insurance coverage funds. This lack of security measures means it’s essential be additional cautious to guard your investments.

- Scalability Points: Blockchain networks can get overloaded, inflicting larger transaction charges and slower processing instances. This may make it laborious so that you can make trades rapidly when market circumstances change.

- Impermanent Loss: This particular danger occurs while you present liquidity, and the worth of your belongings in a liquidity pool can go down in comparison with holding them individually. Figuring out this danger is vital, as it could possibly have an effect on your total returns.

- Oracle Failures: DeFi is determined by oracles to supply outdoors information, and if these techniques fail, it could possibly result in fallacious pricing and potential hacks. If an oracle provides incorrect data, it may drastically have an effect on your trades and investments.

What Is an Instance of DeFi?

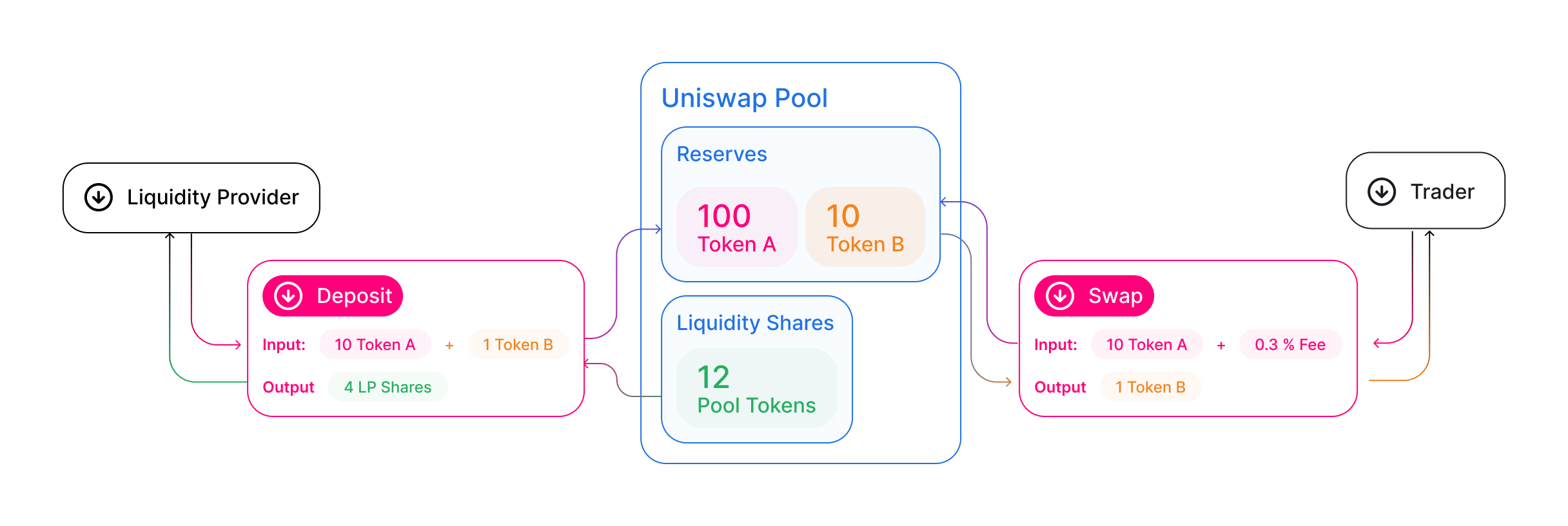

One of the crucial well-known examples of DeFi is Uniswap, a decentralized change (DEX) constructed on the Ethereum blockchain. Uniswap lets you commerce cryptocurrencies straight out of your pockets with no need a centralized intermediary.

Right here’s how Uniswap works:

- Liquidity Swimming pools: You may assist the platform by including crypto belongings like ETH to liquidity swimming pools. That is performed by depositing pairs of tokens like ETH/USDT, which give the required funds for buying and selling.

- Automated Market Making: Uniswap makes use of an automatic market maker (AMM) mannequin to set the change fee between tokens. This fee is set by the quantity of every token within the liquidity pool.

- Buying and selling: Different customers can commerce in opposition to these liquidity swimming pools. The change fee adjusts routinely primarily based on the dimensions of every commerce, making certain truthful pricing.

- Charges: Merchants who present liquidity earn charges from trades made on the platform. This rewards them for maintaining their belongings within the swimming pools and encourages extra participation.

Uniswap follows many vital DeFi ideas: it’s open to everybody, clear, and operates solely via good contracts. Consequently, it has grown to be one of many largest DeFi exchanges, dealing with billions of {dollars} in buying and selling quantity.

DeFi Use Circumstances and Functions

Decentralized Exchanges (DEXs)

Decentralized exchanges, or DEXs, corresponding to Uniswap, SushiSwap, and PancakeSwap, mean you can commerce cryptocurrencies straight out of your pockets. You do not want to depend on a government to make these trades.

These platforms use liquidity swimming pools and automatic market makers that can assist you commerce, which suggests you have got extra privateness and management over your transactions in comparison with conventional exchanges.

DEXs additionally usually have decrease charges and fewer restrictions, making them accessible to a wider viewers. By eradicating middlemen, DEXs can present a sooner and extra environment friendly buying and selling expertise.

Stablecoins

Stablecoins are digital currencies designed to keep up a secure worth. They’re usually pegged to a fiat forex (1:1) just like the US greenback. Stablecoins like DAI, USDC, and USDT are a couple of examples.

Stablecoins are essential to the DeFi ecosystem as a result of they provide a secure unit of account, which facilitates buying and selling amongst extra risky cryptocurrencies. You need to use them for transactions, financial savings, or as collateral for loans as a result of they decrease the risks introduced on by market modifications. Many customers within the DeFi area use them due to their stability.

Lending and Borrowing

Platforms corresponding to Aave, Compound, and MakerDAO allow you to lend your crypto belongings to others and earn curiosity or borrow belongings by placing up collateral.

You may usually discover higher rates of interest in comparison with typical lending establishments, and these platforms can be found 24/7, offering larger accessibility. This implies which you could handle your funds at any time with no need to satisfy particular necessities set by conventional banks.

With Aave, a lending and borrowing platform, you’ll be able to add cryptocurrency (like Ethereum) right into a pool and progressively earn curiosity. You can too use your ETH tokens as collateral. Then, borrow stablecoins like USDC for those who want funds rapidly.

Yield Farming

Yield farming is a method the place you present liquidity to totally different DeFi protocols to earn larger returns. By taking part in liquidity swimming pools or lending platforms, you’ll be able to earn extra tokens or charges as rewards.

Whereas yield farming will be very worthwhile, it’s also complicated and comes with dangers. It is advisable to fastidiously handle your investments and perceive how every protocol works to keep away from potential losses. Many yield farmers maintain monitor of market traits and modifications within the protocols to maximise their earnings, making it a extra lively type of funding.

Playing/Prediction Markets

DeFi has additionally enabled the event of decentralized prediction markets and playing platforms. Initiatives like Polymarket mean you can guess on the outcomes of real-world occasions with no need a central bookmaker.

These platforms use the knowledge of the gang to find out the probability of various outcomes, and so they routinely settle bets via good contracts.

This implies which you could place bets with confidence, realizing that the method is truthful and clear. These platforms have created new alternatives for individuals to interact in betting and hypothesis in a decentralized method.

NFTs

Whereas not usually seen as a part of DeFi, Non-Fungible Tokens (NFTs) have begun to combine with numerous DeFi protocols. Some new makes use of embrace NFT-collateralized loans, the place you’ll be able to borrow in opposition to the worth of your NFTs, and fractional possession, which permits a number of individuals to personal elements of high-value NFTs.

There are additionally NFT-based yield farming alternatives, which join distinctive digital belongings with decentralized finance. This mixing of NFTs and DeFi creates new potentialities for each digital artwork and finance.

Finest DeFi Platforms to Look For

Because the DeFi area retains rising, a number of platforms have develop into common and extensively used. Listed here are a few of the high Decentralized apps you’ll be able to take into account:

- Aave: Aave is a widely known decentralized platform the place you’ll be able to lend and borrow numerous cryptocurrencies. It provides distinctive options like flash loans, and its native token, AAVE, is used for governance and decision-making inside the platform.

- Uniswap: It’s the most important decentralized change. It’s easy to make use of, provides a variety of buying and selling pairings, and has its personal governance token, UNI, which permits customers to have a say in how the buying and selling platform operates.

- Compound Finance: Compound is one other main platform for lending and borrowing crypto belongings. It launched the thought of “yield farming” via its COMP token, and you may earn curiosity in your belongings by merely lending them.

- MakerDAO: MakerDAO is understood for creating the DAI stablecoin, which maintains a secure worth. You may create DAI by locking up different belongings as collateral, and it is likely one of the most trusted and established DeFi platforms.

- Curve Finance: Curve Finance focuses on stablecoin buying and selling and provides low-slippage trades. You can too earn charges and CRV tokens by offering liquidity to the platform, making it a well-liked alternative for stablecoin holders.

- Lido DAO: It’s a liquid staking platform. For instance, while you stake Ethereum, you obtain stETH, a token representing your staked ETH, which you’ll be able to nonetheless use in DeFi. With Lido, you earn staking rewards whereas sustaining liquidity, and the platform is ruled by its LDO token holders.

Get Concerned in DeFi?

Step 1: Set Up a Crypto Pockets

Create a pockets for cryptocurrencies that works with DeFi. You may set up well-known cryptocurrency wallets like Belief Pockets and MetaMask. These wallets function your entry level into the DeFi community. Maintain the restoration phrase of your crypto pockets in a safe location. Should you lose it, you lose entry to your saved funds.

Step 2: Purchase DeFi Cash

Buy cryptocurrency like Ethereum (ETH) from a centralized crypto change, corresponding to Binance or Coinbase. After you have purchased the crypto, switch it from the change to your pockets by getting into your pockets deal with. It will mean you can use the funds for DeFi actions.

Step 3: Join Pockets to DeFi Platform

Hyperlink your pockets to Compound, Uniswap, or Aave, amongst different DeFi platforms. The “Join Pockets” possibility on the vast majority of DeFi platforms makes it easy to attach your pockets to the service. You need to use your pockets to work together with the platform’s options after you’re linked.

Step 4: Use DeFi Providers

Begin exploring DeFi by taking part in actions corresponding to lending, borrowing, or offering liquidity. For instance, you’ll be able to lend your belongings on Aave to earn curiosity or present liquidity on Uniswap to obtain buying and selling charges. These actions mean you can earn rewards whereas contributing to the DeFi ecosystem.

Last Ideas

In a nutshell, DeFi is a giant change in how individuals use and handle monetary providers, offering a system that’s extra open, truthful, and cheaper.

Nevertheless, it additionally has its personal dangers, as it’s nonetheless new and never absolutely regulated. For individuals who are able to deal with the challenges and dangers, DeFi provides good alternatives, but it surely’s vital to watch out and do correct analysis.

FAQs

generate income with DeFi?

You can also make cash with DeFi by lending, staking, or exchanging cryptocurrencies. For instance, you’ll be able to lend your cryptocurrency to platforms like Aave and get curiosity, otherwise you can provide liquidity to exchanges like Uniswap and obtain a portion of the buying and selling charges. You can too get rewards for staking your tokens or taking part in yield farming. One other worthwhile technique is to commerce tokens primarily based on value actions.

Is DeFi protected?

Sure, DeFi is protected however there will be points like bugs in good contracts, excessive value swings in cryptocurrencies, and unclear laws. Additionally, in contrast to conventional banks, there are no insurances for you in DeFi. To remain safer, use well-known platforms with safety checks, begin with small quantities, and unfold your investments throughout totally different protocols.

Is Bitcoin a part of Decentralized Finance?

Sure, Bitcoin is a part of the world of Decentralized Finance (DeFi), but it surely’s not the identical as DeFi itself. It’s because its blockchain doesn’t assist in depth good contracts as Ethereum does.

Nevertheless, some initiatives purpose to incorporate Bitcoin in DeFi through the use of wrapped tokens, like Wrapped Bitcoin (WBTC), which will be traded on DeFi platforms. These tokens enable Bitcoin for use in DeFi techniques.

What are the highest Three DeFi cash?

The highest DeFi cash are Ethereum (ETH), Chainlink (LINK), and Uniswap (UNI). Ethereum is utilized by most DeFi initiatives, Chainlink supplies good contracts with exterior information, and Uniswap powers a significant decentralized change.

More NFT News

The 66 Greatest Motion pictures on Disney+ Proper Now (December 2024)

Simon’s Cat Token Debuts on Binance HODLer Airdrops

Botto, the Millionaire AI Artist, Is Getting a Character